for Faster Processing, File and Pay Sales and Use Tax Online at MyVTax 2020

Understanding the Vermont SUT 451 Form

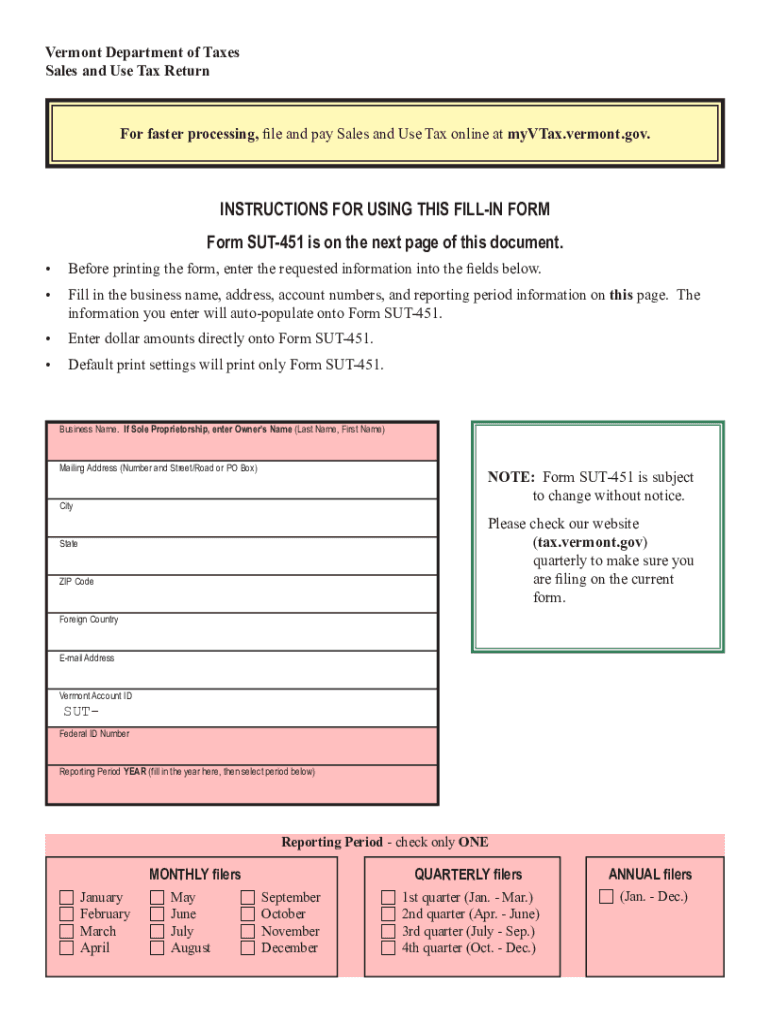

The Vermont SUT 451 form is essential for businesses operating within the state, as it is used to report and pay sales and use tax. This form is crucial for ensuring compliance with state tax laws and maintaining good standing with the Vermont Department of Taxes. Businesses must accurately complete this form to avoid penalties and ensure that they meet their tax obligations.

Steps to Complete the Vermont SUT 451 Form

Completing the Vermont SUT 451 form involves several key steps:

- Gather necessary financial documents, including sales records and previous tax filings.

- Accurately calculate the total sales and use tax owed for the reporting period.

- Fill out the SUT 451 form, ensuring all sections are completed accurately.

- Review the form for any errors or omissions before submission.

- Submit the form either online through MyVTax or by mailing it to the appropriate tax office.

Filing Deadlines for the Vermont SUT 451 Form

Timely filing of the Vermont SUT 451 form is critical. The due date for filing is typically the last day of the month following the end of the reporting period. For example, if you are reporting for the month of January, the form is due by February 28. Businesses should mark their calendars to ensure they meet these deadlines to avoid late fees and penalties.

Legal Use of the Vermont SUT 451 Form

The Vermont SUT 451 form is legally binding when completed and submitted according to state regulations. It is important to ensure that all information provided is truthful and accurate, as any discrepancies can lead to audits or penalties. The form serves as an official record of tax obligations and payments, making it essential for legal compliance.

Required Documents for Filing the Vermont SUT 451 Form

When filing the Vermont SUT 451 form, businesses should prepare the following documents:

- Sales records for the reporting period.

- Purchase invoices that include sales tax.

- Any previous tax returns filed.

- Proof of payment for any taxes previously submitted.

Penalties for Non-Compliance with the Vermont SUT 451 Form

Failure to file the Vermont SUT 451 form on time or inaccuracies in the submission can result in significant penalties. These may include late fees, interest on unpaid taxes, and potential legal action. It is advisable for businesses to stay informed about their tax obligations and ensure timely and accurate filings to avoid these consequences.

Quick guide on how to complete for faster processing file and pay sales and use tax online at myvtax

Effortlessly prepare For Faster Processing, File And Pay Sales And Use Tax Online At MyVTax on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools you require to create, edit, and eSign your documents quickly without delays. Manage For Faster Processing, File And Pay Sales And Use Tax Online At MyVTax on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign For Faster Processing, File And Pay Sales And Use Tax Online At MyVTax with ease

- Obtain For Faster Processing, File And Pay Sales And Use Tax Online At MyVTax and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign For Faster Processing, File And Pay Sales And Use Tax Online At MyVTax and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct for faster processing file and pay sales and use tax online at myvtax

Create this form in 5 minutes!

How to create an eSignature for the for faster processing file and pay sales and use tax online at myvtax

The way to create an electronic signature for your PDF online

The way to create an electronic signature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

How to make an eSignature straight from your smartphone

The best way to create an electronic signature for a PDF on iOS

How to make an eSignature for a PDF document on Android

People also ask

-

What is sut 451 and how does it benefit my business?

SUT 451 refers to a specific compliance standard that ensures secure and efficient electronic signatures. By integrating SUT 451, airSlate SignNow helps businesses streamline their document signing processes while maintaining compliance, ultimately improving productivity and reducing turnaround times.

-

How does airSlate SignNow ensure compliance with sut 451?

airSlate SignNow is designed with compliance in mind, adhering to the stipulations of sut 451. Our solution incorporates advanced security measures, including encryption and audit trails, to ensure that your electronically signed documents meet all compliance requirements.

-

What are the pricing options for using airSlate SignNow with sut 451 compliance?

We offer flexible pricing plans tailored to various business needs while ensuring compliance with sut 451. Our pricing structure is competitive, providing affordable solutions for individuals and enterprises looking for efficient eSigning capabilities without compromising on security.

-

Can I integrate airSlate SignNow with other tools while ensuring sut 451 compliance?

Yes, airSlate SignNow seamlessly integrates with a range of business applications, all while maintaining compliance with sut 451. By connecting with tools like CRM systems and cloud storage, you can enhance your workflow and ensure that every signed document adheres to compliance standards.

-

What features does airSlate SignNow offer to support sut 451 compliance?

AirSlate SignNow includes features such as electronic signatures, document templates, and compliance support to ensure adherence to sut 451. Additionally, our platform provides detailed insights and tracking for every document signed, helping businesses maintain accountability and transparency.

-

Is airSlate SignNow suitable for small businesses needing sut 451 compliance?

Absolutely! AirSlate SignNow is perfect for small businesses looking to achieve sut 451 compliance without the complexity. Our user-friendly interface and cost-effective pricing make it easy for any organization to implement secure electronic signature solutions.

-

What support resources does airSlate SignNow offer for sut 451 questions?

We provide comprehensive support resources for our users navigating sut 451 compliance. You can access our knowledge base, customer service team, and community forums, ensuring that you have the right information and assistance whenever you need it.

Get more for For Faster Processing, File And Pay Sales And Use Tax Online At MyVTax

Find out other For Faster Processing, File And Pay Sales And Use Tax Online At MyVTax

- Sign Connecticut Pet Addendum to Lease Agreement Now

- Sign Florida Pet Addendum to Lease Agreement Simple

- Can I Sign Hawaii Pet Addendum to Lease Agreement

- Sign Louisiana Pet Addendum to Lease Agreement Free

- Sign Pennsylvania Pet Addendum to Lease Agreement Computer

- Sign Rhode Island Vacation Rental Short Term Lease Agreement Safe

- Sign South Carolina Vacation Rental Short Term Lease Agreement Now

- How Do I Sign Georgia Escrow Agreement

- Can I Sign Georgia Assignment of Mortgage

- Sign Kentucky Escrow Agreement Simple

- How To Sign New Jersey Non-Disturbance Agreement

- How To Sign Illinois Sales Invoice Template

- How Do I Sign Indiana Sales Invoice Template

- Sign North Carolina Equipment Sales Agreement Online

- Sign South Dakota Sales Invoice Template Free

- How Can I Sign Nevada Sales Proposal Template

- Can I Sign Texas Confirmation Of Reservation Or Order

- How To Sign Illinois Product Defect Notice

- Sign New Mexico Refund Request Form Mobile

- Sign Alaska Sponsorship Agreement Safe