Fillable Online Revenue Ky 72A135 12 07 DEPARTMENT USE ONLY Form

What is the Fillable Online Revenue Ky 72A135?

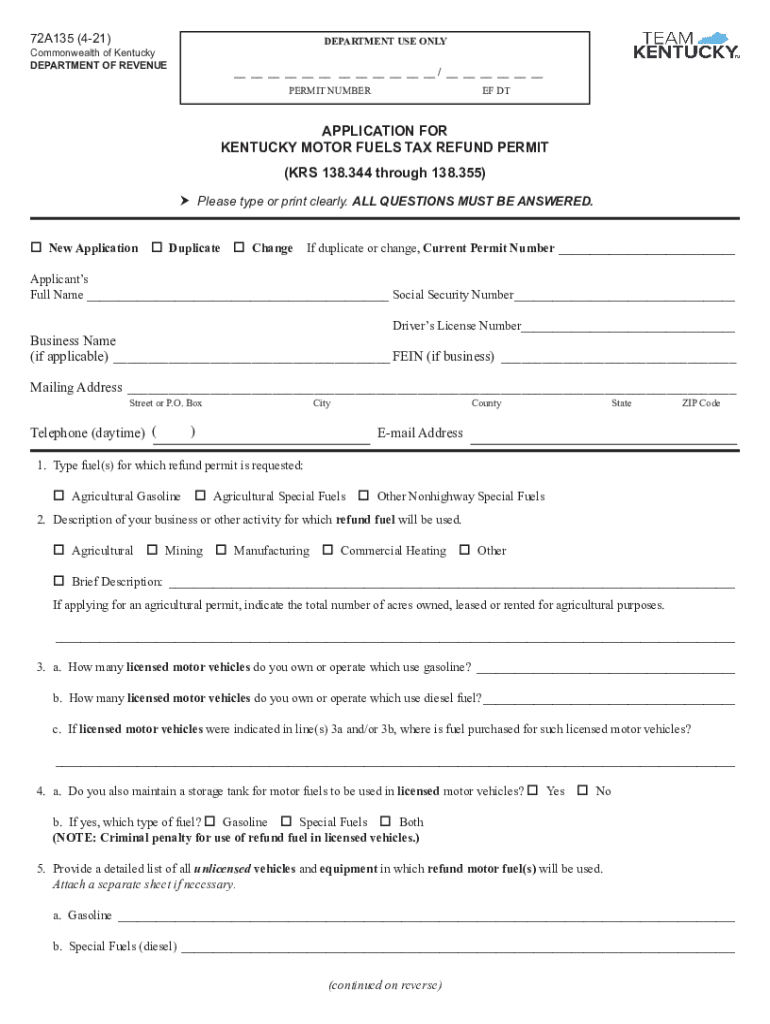

The Fillable Online Revenue Ky 72A135 is a form used by businesses and individuals in Kentucky to report and claim refunds for motor fuels taxes. This document is essential for those who have paid more tax than is owed or who qualify for specific exemptions. The form is designed to facilitate the process of obtaining refunds from the Kentucky Department of Revenue (DOR) for motor fuels taxes paid on gasoline and diesel fuel. It is crucial for taxpayers to understand the requirements and guidelines associated with this form to ensure compliance and successful submission.

Steps to Complete the Fillable Online Revenue Ky 72A135

Completing the Fillable Online Revenue Ky 72A135 involves several specific steps to ensure accuracy and compliance. Begin by gathering all necessary documentation, including receipts and records of fuel purchases. Next, access the online form and fill in the required fields, which include personal identification information, details about the fuel purchased, and the amount of tax paid. It is important to double-check all entries for accuracy before submission. Once completed, review the form for any errors, and submit it electronically through the designated platform provided by the Kentucky DOR.

Required Documents for the Fillable Online Revenue Ky 72A135

When filling out the Ky 72A135 form, certain documents are required to substantiate your claim for a refund. These documents typically include:

- Receipts for fuel purchases

- Records of tax payments made

- Any relevant permits or licenses related to fuel sales

- Proof of eligibility for any exemptions claimed

Having these documents readily available will streamline the completion process and help ensure that your refund request is processed without delays.

Form Submission Methods

The Fillable Online Revenue Ky 72A135 can be submitted through various methods to accommodate different preferences. The primary method is online submission via the Kentucky Department of Revenue's website, which allows for immediate processing. Alternatively, individuals may choose to print the completed form and submit it by mail. It is essential to follow the specific submission guidelines provided by the DOR to ensure that your form is received and processed correctly.

Eligibility Criteria for the Fillable Online Revenue Ky 72A135

Eligibility for filing the Ky 72A135 form is determined by several factors. Taxpayers must demonstrate that they have paid motor fuels taxes on fuel that was used in a manner that qualifies for a refund. This may include circumstances such as overpayment of taxes, fuel used for exempt purposes, or fuel purchased for specific types of vehicles. It is advisable to review the eligibility criteria outlined by the Kentucky DOR to ensure compliance and maximize the chances of a successful refund claim.

Penalties for Non-Compliance

Failure to comply with the regulations surrounding the Fillable Online Revenue Ky 72A135 can result in significant penalties. This may include fines, denial of refund claims, or additional tax liabilities. It is crucial for taxpayers to understand the importance of accurate reporting and timely submission of all required forms to avoid these consequences. Staying informed about the rules and regulations can help ensure that all submissions are compliant and reduce the risk of penalties.

Quick guide on how to complete fillable online revenue ky 72a135 12 07 department use only

Complete Fillable Online Revenue Ky 72A135 12 07 DEPARTMENT USE ONLY effortlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, as you can easily find the right form and securely save it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Fillable Online Revenue Ky 72A135 12 07 DEPARTMENT USE ONLY on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The simplest way to alter and electronically sign Fillable Online Revenue Ky 72A135 12 07 DEPARTMENT USE ONLY with ease

- Locate Fillable Online Revenue Ky 72A135 12 07 DEPARTMENT USE ONLY and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize signNow sections of the documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to preserve your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Alter and electronically sign Fillable Online Revenue Ky 72A135 12 07 DEPARTMENT USE ONLY and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Kentucky fuels tax and how does it affect my business?

The Kentucky fuels tax is a tax levied on the sale of fuel within the state, impacting businesses that rely on transportation. Understanding this tax is crucial for compliance and financial planning. Additionally, using software like airSlate SignNow can help streamline documentation related to fuels tax reporting.

-

How can airSlate SignNow assist with managing Kentucky fuels tax documents?

airSlate SignNow simplifies the process of managing documents related to the Kentucky fuels tax by allowing you to create, send, and eSign forms easily. With our user-friendly interface, you can ensure that all necessary paperwork is properly completed and submitted on time. This can save you time and reduce the risk of errors.

-

Are there any specific features in airSlate SignNow for handling taxes?

Yes, airSlate SignNow includes features tailored to tax management, such as templates and customizable forms that can be used for Kentucky fuels tax documentation. These features help ensure compliance and make it simpler to track submissions. This can enhance your overall tax management strategy.

-

What types of businesses can benefit from understanding Kentucky fuels tax?

Any business that operates in the transportation sector, including trucking companies and logistics firms, can greatly benefit from understanding the Kentucky fuels tax. Comprehensive knowledge about this tax can lead to better financial management and compliance. Utilizing airSlate SignNow can further streamline associated documentation.

-

How does the pricing of airSlate SignNow compare with other document management solutions?

airSlate SignNow offers competitive pricing designed to be cost-effective for businesses of all sizes. By employing our solution for handling tasks related to Kentucky fuels tax, businesses can save on administrative costs and avoid penalties. Explore our pricing options to find the best plan for your needs.

-

Does airSlate SignNow integrate with other accounting software to manage Kentucky fuels tax?

Yes, airSlate SignNow integrates seamlessly with various accounting and financial software platforms. This enables users to manage Kentucky fuels tax calculations more effectively and ensures that all necessary documentation is accessible in one place. Integration can enhance overall efficiency in tax preparation.

-

What benefits can I expect by using airSlate SignNow for my tax management?

By using airSlate SignNow, you can expect enhanced efficiency in document handling and improved accuracy in your Kentucky fuels tax submissions. The ease of eSigning and managing documents online will facilitate faster turnaround times. Overall, this can lead to reduced stress during tax season.

Get more for Fillable Online Revenue Ky 72A135 12 07 DEPARTMENT USE ONLY

- Notice of option for recording oklahoma form

- Oklahoma documents form

- General durable power of attorney for property and finances or financial effective upon disability oklahoma form

- Essential legal life documents for baby boomers oklahoma form

- Oklahoma general form

- Revocation of general durable power of attorney oklahoma form

- Essential legal life documents for newlyweds oklahoma form

- Essential legal life documents for military personnel oklahoma form

Find out other Fillable Online Revenue Ky 72A135 12 07 DEPARTMENT USE ONLY

- Sign Tennessee Car Insurance Quotation Form Online

- How Can I Sign Tennessee Car Insurance Quotation Form

- Sign North Dakota Business Insurance Quotation Form Online

- Sign West Virginia Car Insurance Quotation Form Online

- Sign Wisconsin Car Insurance Quotation Form Online

- Sign Alabama Life-Insurance Quote Form Free

- Sign California Apply for Lead Pastor Easy

- Sign Rhode Island Certeficate of Insurance Request Free

- Sign Hawaii Life-Insurance Quote Form Fast

- Sign Indiana Life-Insurance Quote Form Free

- Sign Maryland Church Donation Giving Form Later

- Can I Sign New Jersey Life-Insurance Quote Form

- Can I Sign Pennsylvania Church Donation Giving Form

- Sign Oklahoma Life-Insurance Quote Form Later

- Can I Sign Texas Life-Insurance Quote Form

- Sign Texas Life-Insurance Quote Form Fast

- How To Sign Washington Life-Insurance Quote Form

- Can I Sign Wisconsin Life-Insurance Quote Form

- eSign Missouri Work Order Computer

- eSign Hawaii Electrical Services Contract Safe