Non Taxable Transaction Certificates NTTCForms & Publications Taxation and Revenue New MexicoNon Taxable Transaction Cer

Understanding Non Taxable Transaction Certificates

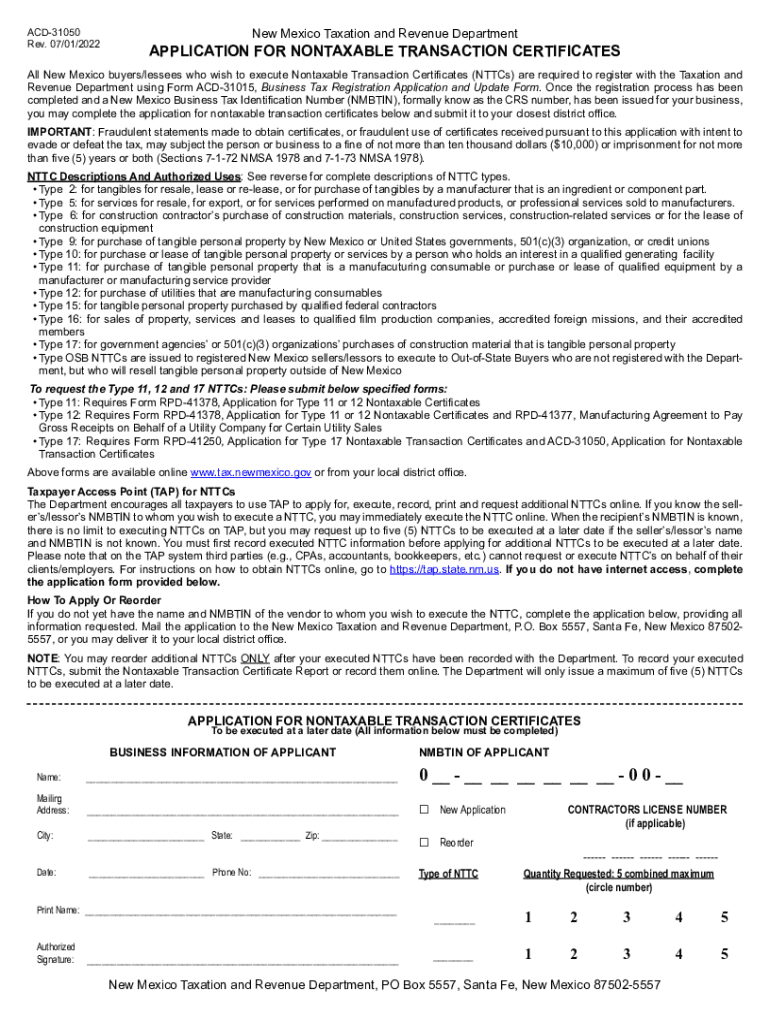

The Non Taxable Transaction Certificate (NTTC) is a crucial document used in New Mexico for tax purposes. It serves as proof that a transaction is exempt from gross receipts tax. Businesses and individuals utilize this certificate to ensure compliance with state tax regulations when engaging in non-taxable transactions. The NTTC allows for specific exemptions, such as sales to certain governmental entities or sales of certain goods and services. Understanding the legal framework surrounding this certificate is essential for both buyers and sellers to avoid potential tax liabilities.

Steps to Complete the Non Taxable Transaction Certificate

Completing the Non Taxable Transaction Certificate involves several key steps to ensure accuracy and compliance. First, gather all necessary information related to the transaction, including the seller's and buyer's details, the nature of the goods or services provided, and the reason for the tax exemption. Next, accurately fill out the certificate, ensuring that all required fields are completed. It's important to double-check the information for any errors before submission. Finally, both parties should sign and date the certificate to validate it, as this step is crucial for it to be recognized by the New Mexico taxation authorities.

Obtaining Non Taxable Transaction Certificates

To obtain a Non Taxable Transaction Certificate in New Mexico, businesses can typically download the form from the New Mexico Taxation and Revenue Department's website. Alternatively, businesses may request a copy directly from the department or through authorized tax professionals. It is advisable to familiarize oneself with the specific requirements and conditions under which the NTTC can be issued, as these can vary based on the type of transaction and the parties involved. Keeping a supply of NTTC forms on hand can facilitate smoother transactions and ensure compliance during sales.

Legal Use of Non Taxable Transaction Certificates

The legal use of Non Taxable Transaction Certificates is governed by New Mexico tax law. These certificates must be used in accordance with state regulations to ensure that transactions are properly documented and exempt from gross receipts tax. Misuse of the NTTC, such as using it for taxable transactions, can result in penalties or fines. Therefore, it is essential for businesses to understand the specific conditions under which the NTTC is applicable and to maintain accurate records of all transactions where the certificate is utilized.

Key Elements of the Non Taxable Transaction Certificate

Several key elements must be included in a Non Taxable Transaction Certificate to ensure its validity. These elements include the names and addresses of both the buyer and seller, a detailed description of the goods or services being provided, and the specific reason for the tax exemption. Additionally, the certificate should include the date of the transaction and any relevant identification numbers, such as the buyer's tax identification number. Ensuring that all of these details are accurately captured will help in maintaining compliance with tax regulations.

Examples of Using Non Taxable Transaction Certificates

Non Taxable Transaction Certificates can be utilized in various scenarios. For instance, a government agency purchasing office supplies may present an NTTC to exempt the transaction from gross receipts tax. Similarly, a non-profit organization acquiring services for community events can also use the certificate to avoid tax liabilities. These examples illustrate the importance of the NTTC in facilitating tax-exempt transactions and highlight the need for both buyers and sellers to understand when and how to use the certificate effectively.

Quick guide on how to complete non taxable transaction certificates nttcforms ampamp publications taxation and revenue new mexiconon taxable transaction

Complete Non Taxable Transaction Certificates NTTCForms & Publications Taxation And Revenue New MexicoNon Taxable Transaction Cer seamlessly on any device

Managing documents online has gained immense traction among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Handle Non Taxable Transaction Certificates NTTCForms & Publications Taxation And Revenue New MexicoNon Taxable Transaction Cer on any device using airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign Non Taxable Transaction Certificates NTTCForms & Publications Taxation And Revenue New MexicoNon Taxable Transaction Cer effortlessly

- Obtain Non Taxable Transaction Certificates NTTCForms & Publications Taxation And Revenue New MexicoNon Taxable Transaction Cer and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize essential sections of your documents or cover sensitive information with tools specifically provided by airSlate SignNow.

- Generate your signature using the Sign tool, which takes moments and holds the same legal validity as a standard wet ink signature.

- Review all information and click on the Done button to save your modifications.

- Choose how you wish to share your form via email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Modify and eSign Non Taxable Transaction Certificates NTTCForms & Publications Taxation And Revenue New MexicoNon Taxable Transaction Cer and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the acd form 31050 and how is it used?

The acd form 31050 is a crucial document used for specific administrative purposes in various industries. airSlate SignNow simplifies the process of completing and signing the acd form 31050 by offering a user-friendly electronic signature solution, making it easier for businesses to manage their paperwork efficiently.

-

How does airSlate SignNow secure my acd form 31050?

Security is a top priority for airSlate SignNow, especially for sensitive documents like the acd form 31050. We employ advanced encryption protocols and multi-factor authentication to ensure that your documents are safe and accessible only to authorized users, enhancing your overall security.

-

Can I integrate airSlate SignNow with other software for managing the acd form 31050?

Yes, airSlate SignNow offers seamless integrations with popular business applications, allowing you to manage the acd form 31050 alongside your existing workflows. This connectivity streamlines your document processes and enhances productivity by ensuring you have all necessary tools at your fingertips.

-

What are the pricing options for using airSlate SignNow for the acd form 31050?

airSlate SignNow provides flexible pricing plans tailored to various business needs, including options specifically designed for those frequently using the acd form 31050. Our cost-effective solution ensures that you can access powerful document management features without breaking the bank.

-

What features does airSlate SignNow offer for the acd form 31050?

airSlate SignNow includes an array of features to enhance the handling of the acd form 31050, such as customizable templates, real-time tracking, and automated reminders. These tools are designed to streamline your signing process and improve overall efficiency.

-

Is it easy to modify the acd form 31050 with airSlate SignNow?

Absolutely! airSlate SignNow allows users to easily edit and customize the acd form 31050 as needed. The intuitive interface makes it simple for anyone to make changes and ensure that the document meets their specific requirements before sending it out.

-

How can airSlate SignNow benefit my business when processing the acd form 31050?

Using airSlate SignNow for the acd form 31050 can signNowly streamline your document workflows, saving time and reducing the likelihood of errors. Our solution empowers businesses to eSign documents quickly, facilitating faster transactions and improved communication.

Get more for Non Taxable Transaction Certificates NTTCForms & Publications Taxation And Revenue New MexicoNon Taxable Transaction Cer

- Oregon reimbursement form

- Worker leasing notice oregon form

- Application for oregon worker leasing license oregon form

- Oregon tax compliance form

- Oregon workers compensation claim form

- Request release records for form

- Vocational closure report oregon form

- Notice of closure worksheet injury prior to january 1 2005 oregon form

Find out other Non Taxable Transaction Certificates NTTCForms & Publications Taxation And Revenue New MexicoNon Taxable Transaction Cer

- Can I Electronic signature Pennsylvania Co-Branding Agreement

- Can I Electronic signature South Dakota Engineering Proposal Template

- How Do I Electronic signature Arizona Proforma Invoice Template

- Electronic signature California Proforma Invoice Template Now

- Electronic signature New York Equipment Purchase Proposal Now

- How Do I Electronic signature New York Proforma Invoice Template

- How Can I Electronic signature Oklahoma Equipment Purchase Proposal

- Can I Electronic signature New Jersey Agreement

- How To Electronic signature Wisconsin Agreement

- Electronic signature Tennessee Agreement contract template Mobile

- How To Electronic signature Florida Basic rental agreement or residential lease

- Electronic signature California Business partnership agreement Myself

- Electronic signature Wisconsin Business associate agreement Computer

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement