Form it 196 New York Resident, Nonresident, and Part YearForm it 196 New York Resident, Nonresident, and Part YearIt 196 Form Fi 2021

What is the Form IT-196?

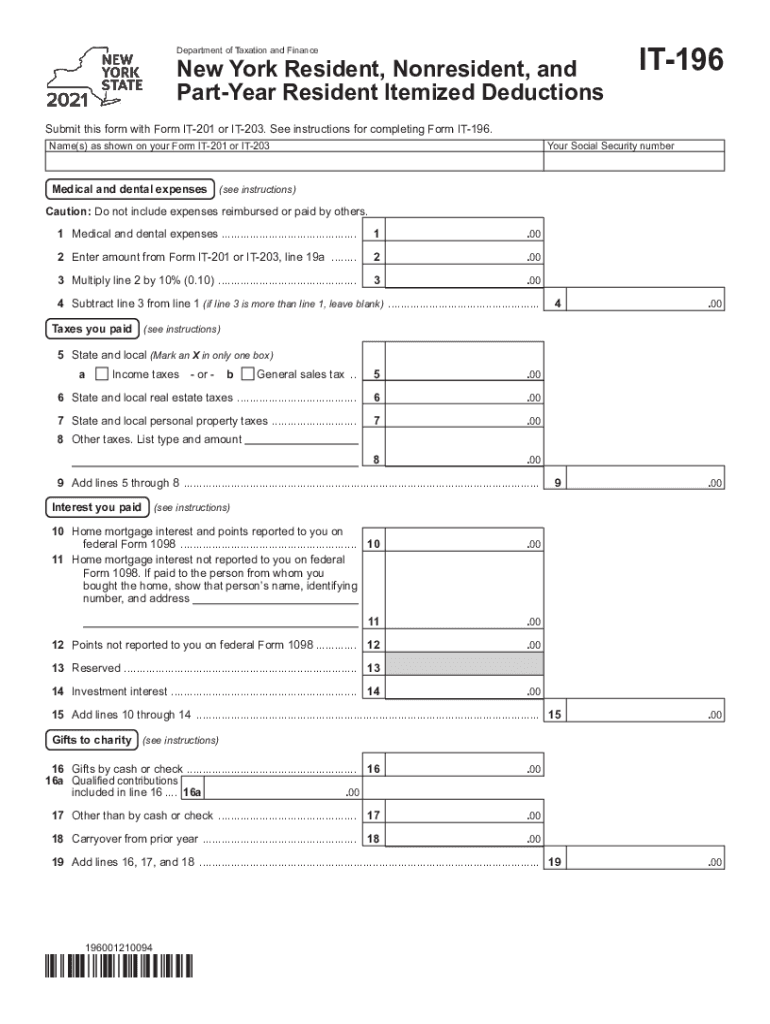

The Form IT-196 is a tax form used by New York residents, nonresidents, and part-year residents to claim itemized deductions on their state income tax returns. This form allows taxpayers to report various deductions that may reduce their taxable income, ultimately leading to a lower tax liability. It is essential for individuals who do not take the standard deduction and wish to maximize their tax benefits.

How to Obtain the Form IT-196

The Form IT-196 can be easily obtained from the New York State Department of Taxation and Finance website. Taxpayers can download a printable version of the form directly from the site. Additionally, many tax preparation software programs include the form, allowing users to complete it electronically. It is advisable to ensure that you have the most current version of the form to comply with any updates or changes in tax law.

Steps to Complete the Form IT-196

Completing the Form IT-196 involves several key steps:

- Gather necessary documentation, including records of all deductible expenses.

- Fill in your personal information, such as your name, address, and Social Security number.

- Detail each itemized deduction in the appropriate sections of the form, ensuring accuracy.

- Calculate the total deductions and ensure they align with your financial records.

- Review the completed form for any errors before submission.

Legal Use of the Form IT-196

The Form IT-196 is legally recognized for claiming itemized deductions on New York State income tax returns. To ensure its legal validity, taxpayers must adhere to the guidelines set forth by the New York State Department of Taxation and Finance. Proper completion and submission of the form are crucial, as inaccuracies can lead to penalties or denial of deductions.

Key Elements of the Form IT-196

Several key elements are essential when filling out the Form IT-196:

- Personal Information: Accurate details about the taxpayer, including name and address.

- Deduction Categories: Specific sections for different types of deductions, such as medical expenses, taxes paid, and charitable contributions.

- Total Deductions: A summary line that calculates the total amount of itemized deductions claimed.

Filing Deadlines for Form IT-196

It is important for taxpayers to be aware of the filing deadlines for the Form IT-196. Generally, the form must be submitted by the same deadline as the New York State income tax return, which is typically April fifteenth. If additional time is needed, taxpayers may file for an extension, but they should still pay any taxes owed by the original deadline to avoid penalties.

Quick guide on how to complete form it 196 new york resident nonresident and part yearform it 196 new york resident nonresident and part yearit 196 form 2019

Complete Form IT 196 New York Resident, Nonresident, And Part YearForm IT 196 New York Resident, Nonresident, And Part YearIt 196 Form Fi effortlessly on any device

Digital document management has become prevalent among companies and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, as you can access the right form and securely save it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents swiftly without delays. Manage Form IT 196 New York Resident, Nonresident, And Part YearForm IT 196 New York Resident, Nonresident, And Part YearIt 196 Form Fi on any platform using airSlate SignNow’s Android or iOS applications and simplify any document-related process today.

How to modify and eSign Form IT 196 New York Resident, Nonresident, And Part YearForm IT 196 New York Resident, Nonresident, And Part YearIt 196 Form Fi effortlessly

- Obtain Form IT 196 New York Resident, Nonresident, And Part YearForm IT 196 New York Resident, Nonresident, And Part YearIt 196 Form Fi and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to preserve your changes.

- Choose your preferred method of submitting your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you select. Modify and eSign Form IT 196 New York Resident, Nonresident, And Part YearForm IT 196 New York Resident, Nonresident, And Part YearIt 196 Form Fi and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 196 new york resident nonresident and part yearform it 196 new york resident nonresident and part yearit 196 form 2019

Create this form in 5 minutes!

People also ask

-

What is the Form IT 196 and why do I need it?

Form IT 196 is a crucial tax form for New York residents, nonresidents, and part-year residents to determine their tax obligations. By utilizing the Form IT 196 New York Resident, Nonresident, And Part YearForm, you can accurately report your income and claim any applicable deductions. Filling out this form correctly ensures compliance with New York's tax laws.

-

How can I fill and sign the Form IT 196 online?

You can easily fill and sign the Form IT 196 New York Resident, Nonresident, And Part YearForm using our printable template online. The airSlate SignNow platform offers a user-friendly interface that guides you through the filling process, enabling you to complete and eSign documents conveniently from anywhere.

-

Is there a cost associated with using airSlate SignNow for Form IT 196?

Yes, there is a subscription fee for using airSlate SignNow, which provides access to advanced features including eSigning and document management. The cost is competitive and provides a cost-effective solution to manage the Form IT 196 New York Resident, Nonresident, And Part Year efficiently. The investment ensures that you have a reliable service for all your document needs.

-

What features does airSlate SignNow offer for managing Form IT 196?

airSlate SignNow offers features such as easy document uploading, secure eSignature functionality, and real-time collaboration. These features streamline the process of handling the Form IT 196 New York Resident, Nonresident, And Part Year, ensuring efficiency and accuracy in your documentation.

-

Can I integrate airSlate SignNow with other software?

Yes, airSlate SignNow allows seamless integration with various third-party applications to enhance your workflow. By integrating our platform with your existing tools, you can easily manage Form IT 196 New York Resident, Nonresident, And Part Year documents without disrupting your current processes.

-

What are the benefits of using airSlate SignNow for tax forms?

Using airSlate SignNow for tax forms like Form IT 196 provides numerous benefits including ease of use, enhanced security, and faster processing times. The platform's ability to streamline document management allows you to focus on completing your taxes accurately and efficiently, ensuring compliance with New York regulations.

-

Is it secure to use airSlate SignNow for my tax documents?

Absolutely! airSlate SignNow prioritizes security with advanced encryption and compliance with legal standards. When you fill and sign the Form IT 196 New York Resident, Nonresident, And Part Year, you can trust that your sensitive information is protected and handled securely.

Get more for Form IT 196 New York Resident, Nonresident, And Part YearForm IT 196 New York Resident, Nonresident, And Part YearIt 196 Form Fi

- Physician authorization of supplemental disability oregon form

- Workers compensation irrevocable standby letter of credit form a oregon

- Workers compensation irrevocable standby letter of credit form b oregon

- Oregon disclosure form

- Workers compensation request for reimbursement of expenses oregon form

- Workers compensation request form

- Independent medical form

- Notice of dishonored check civil keywords bad check bounced check oregon form

Find out other Form IT 196 New York Resident, Nonresident, And Part YearForm IT 196 New York Resident, Nonresident, And Part YearIt 196 Form Fi

- eSign Hawaii Football Registration Form Secure

- eSign Hawaii Football Registration Form Fast

- eSignature Hawaii Affidavit of Domicile Fast

- Can I eSignature West Virginia Affidavit of Domicile

- eSignature Wyoming Affidavit of Domicile Online

- eSign Montana Safety Contract Safe

- How To eSign Arizona Course Evaluation Form

- How To eSign California Course Evaluation Form

- How To eSign Florida Course Evaluation Form

- How To eSign Hawaii Course Evaluation Form

- How To eSign Illinois Course Evaluation Form

- eSign Hawaii Application for University Free

- eSign Hawaii Application for University Secure

- eSign Hawaii Medical Power of Attorney Template Free

- eSign Washington Nanny Contract Template Free

- eSignature Ohio Guaranty Agreement Myself

- eSignature California Bank Loan Proposal Template Now

- Can I eSign Indiana Medical History

- eSign Idaho Emergency Contract Form Myself

- eSign Hawaii General Patient Information Fast