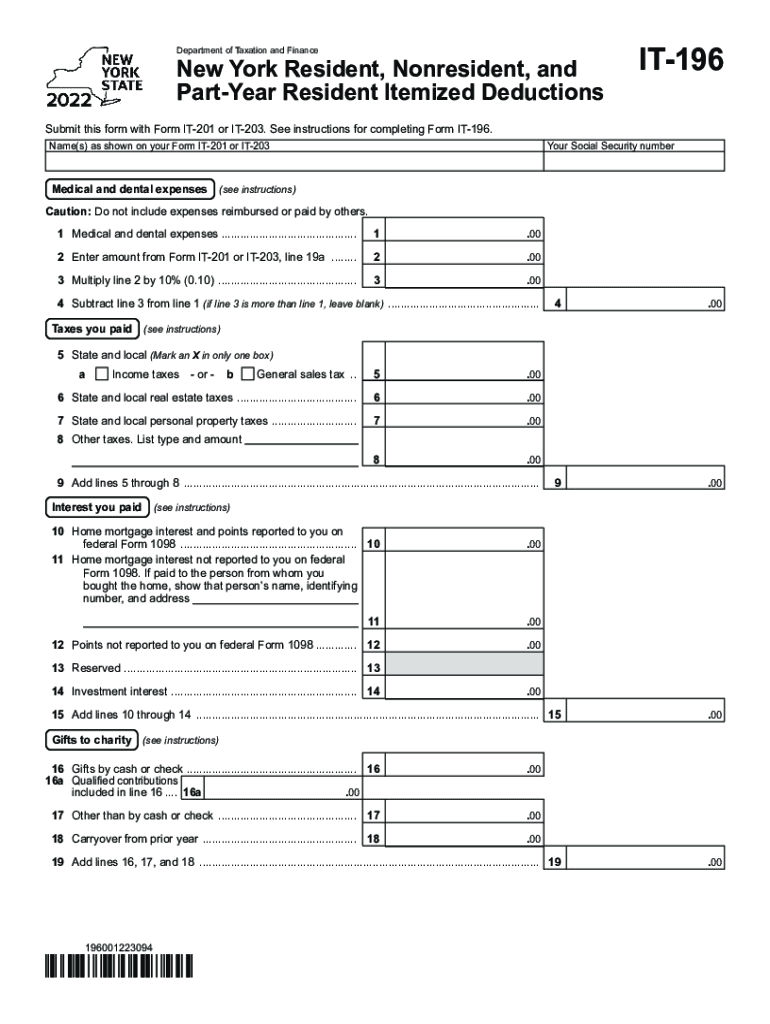

Form it 196New York Resident, Nonresident, and Part Year 2022

What is the Form IT 196?

The Form IT 196 is a tax form used by New York residents, nonresidents, and part-year residents to claim a credit for taxes paid to other jurisdictions. This form is essential for individuals who have income sourced from outside New York and wish to avoid double taxation. By completing the Form IT 196, taxpayers can report their income accurately and ensure compliance with New York State tax laws. It is particularly relevant for those who have worked or earned income in multiple states during the tax year.

How to Obtain the Form IT 196

The Form IT 196 can be easily obtained through the New York State Department of Taxation and Finance website. Taxpayers can download the form in PDF format, making it accessible for printing and filling out. Additionally, physical copies may be available at local tax offices or libraries. It is advisable to ensure that you are using the most current version of the form to comply with any recent changes in tax regulations.

Steps to Complete the Form IT 196

Completing the Form IT 196 involves several key steps:

- Gather all necessary documentation, including income statements from other jurisdictions.

- Fill out personal information, including your name, address, and Social Security number.

- Report the income earned in other states and the taxes paid to those jurisdictions.

- Calculate the credit amount you are eligible for based on the taxes paid.

- Review the form for accuracy and completeness before submission.

Legal Use of the Form IT 196

The Form IT 196 is legally binding when completed accurately and submitted according to New York State regulations. It is essential to provide truthful information, as any discrepancies can lead to penalties or audits. The form must be filed by the designated deadline to ensure that taxpayers receive the appropriate credits and avoid issues with tax compliance.

Filing Deadlines / Important Dates

Taxpayers should be aware of the filing deadlines associated with the Form IT 196. Typically, the form must be submitted by the same deadline as the federal tax return, which is usually April fifteenth. However, if you are requesting an extension, it is important to file the form by the extended deadline to maintain eligibility for the credit.

Key Elements of the Form IT 196

The Form IT 196 includes several key elements that are crucial for accurate completion:

- Taxpayer identification information, including name and Social Security number.

- Details of income earned in other states.

- Documentation of taxes paid to other jurisdictions.

- Calculation of the credit amount based on the provided information.

Quick guide on how to complete form it 1962018new york resident nonresident and part year

Effortlessly prepare Form IT 196New York Resident, Nonresident, And Part Year on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed paperwork, as you can easily find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Form IT 196New York Resident, Nonresident, And Part Year on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

How to edit and eSign Form IT 196New York Resident, Nonresident, And Part Year with ease

- Find Form IT 196New York Resident, Nonresident, And Part Year and then click Get Form to start.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal value as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you wish to share your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that require new printed copies. airSlate SignNow addresses your document management needs in just a few clicks from any preferred device. Edit and eSign Form IT 196New York Resident, Nonresident, And Part Year while ensuring excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 1962018new york resident nonresident and part year

Create this form in 5 minutes!

People also ask

-

What is 'form it 196' and how does it work?

'Form it 196' is a specific form template offered by airSlate SignNow designed to streamline the document signing process. It allows users to create, manage, and eSign documents efficiently while ensuring compliance with legal standards. With intuitive features, businesses can easily customize and distribute the form.

-

How can I access the 'form it 196' template?

Accessing the 'form it 196' template is simple with airSlate SignNow. Once you sign up for our service, you can easily find the template in our library of forms. You can customize it according to your specific needs and start using it for your document transactions.

-

What are the pricing options for using 'form it 196'?

airSlate SignNow offers various pricing plans to accommodate different business needs, including access to 'form it 196.' You can choose a plan that fits your budget, whether you require individual use or team collaboration. Our affordable pricing ensures you get maximum value for your document signing tasks.

-

What features does 'form it 196' offer?

'Form it 196' comes with several powerful features, including customizable fields, automated workflows, and real-time tracking. Additionally, you can customize reminders and notifications, streamline approvals, and ensure secure document sharing. These features make document management seamless and effective.

-

Can I integrate 'form it 196' with other applications?

Yes, airSlate SignNow allows you to integrate 'form it 196' with various applications for enhanced functionality. You can connect it with CRMs, project management tools, and cloud storage solutions to streamline your workflow. This integration results in a cohesive working environment, improving overall efficiency.

-

What are the benefits of using 'form it 196'?

Using 'form it 196' offers numerous benefits, including increased efficiency in document handling and enhanced compliance. It helps reduce turnaround times and minimizes the chances of errors, improving accuracy in your processes. Your team can easily collaborate and manage documents from anywhere.

-

Is 'form it 196' suitable for small businesses?

Absolutely! 'Form it 196' is designed to cater to businesses of all sizes, including small businesses. Our user-friendly interface and cost-effective pricing make it accessible for small teams looking to enhance their document management without overwhelming complexity or expense.

Get more for Form IT 196New York Resident, Nonresident, And Part Year

- Bill of sale without warranty by corporate seller oklahoma form

- Reaffirmation agreement oklahoma form

- Verification of matrix and certification of matrix on disk by attorney oklahoma form

- Verification of creditors matrix oklahoma form

- Verification of creditors matrix oklahoma 497323219 form

- Correction statement and agreement oklahoma form

- Oklahoma closing 497323221 form

- Flood zone statement and authorization oklahoma form

Find out other Form IT 196New York Resident, Nonresident, And Part Year

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter