State Tax Form Software Updates 2023-2026

Understanding the 2020 NY IT-196 Form

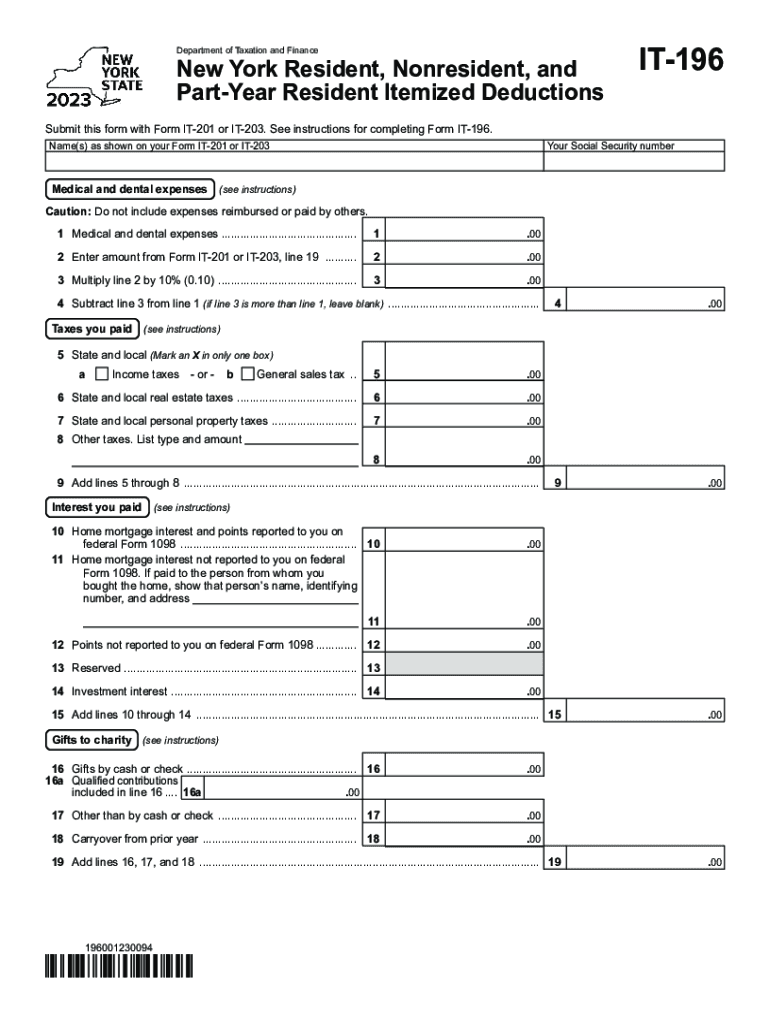

The 2020 NY IT-196 form is a state tax form used by nonresidents and part-year residents of New York to claim a credit for taxes paid to other jurisdictions. This form is essential for individuals who need to report their income earned outside of New York while ensuring they are not taxed twice on the same income. It is crucial to understand the specific requirements and instructions associated with this form to ensure accurate filing.

Steps to Complete the 2020 NY IT-196 Form

Completing the 2020 NY IT-196 form involves several key steps:

- Gather necessary documentation, including income statements and proof of taxes paid to other states.

- Fill out the personal information section accurately, including your name, address, and Social Security number.

- Report your total income earned in New York and the income earned in other jurisdictions.

- Calculate the credit for taxes paid to other states and provide the necessary details.

- Review the form for accuracy before submission.

Required Documents for the 2020 NY IT-196 Form

When filing the 2020 NY IT-196 form, it is important to have the following documents ready:

- W-2 forms or 1099 forms showing income earned.

- Tax returns from other states where income was earned.

- Proof of taxes paid to those states, such as payment receipts or tax return copies.

Filing Methods for the 2020 NY IT-196 Form

The 2020 NY IT-196 form can be submitted through various methods:

- Online filing through the New York State Department of Taxation and Finance website.

- Mailing the completed form to the appropriate address specified in the form instructions.

- In-person submission at designated tax offices, if applicable.

Important Deadlines for the 2020 NY IT-196 Form

It is essential to be aware of the filing deadlines associated with the 2020 NY IT-196 form to avoid penalties:

- The form is typically due on or before April fifteenth of the year following the tax year.

- Extensions may be available, but it is crucial to file any requests for extensions before the original due date.

Legal Use of the 2020 NY IT-196 Form

The 2020 NY IT-196 form is legally recognized for claiming tax credits and ensuring compliance with New York tax laws. Accurate completion of this form is necessary to avoid potential legal issues, including audits or penalties for incorrect filings. It is advisable to consult with a tax professional if there are any uncertainties regarding the form's use or requirements.

Quick guide on how to complete state tax form software updates

Prepare State Tax Form Software Updates effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal environmentally-friendly substitute for conventional printed and signed documents, as you can locate the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage State Tax Form Software Updates on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign State Tax Form Software Updates with ease

- Locate State Tax Form Software Updates and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of the documents or obscure sensitive information with the tools specifically provided by airSlate SignNow for this purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from your chosen device. Edit and eSign State Tax Form Software Updates and ensure excellent communication at every stage of the form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct state tax form software updates

Create this form in 5 minutes!

How to create an eSignature for the state tax form software updates

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2020 NY IT196 form?

The 2020 NY IT196 form is a tax form used by New York residents to claim the state standard deduction. Completing this form accurately is essential for ensuring you receive the correct tax benefits. Using airSlate SignNow can simplify the process of filling out and eSigning your 2020 NY IT196.

-

How can airSlate SignNow help with the 2020 NY IT196?

AirSlate SignNow streamlines the process of completing and submitting the 2020 NY IT196 by providing an easy-to-use platform for eSigning documents. You can quickly fill out the necessary fields, sign the form electronically, and share it securely with tax professionals or relevant authorities. This ensures efficiency and compliance.

-

Is there a cost associated with using airSlate SignNow for the 2020 NY IT196?

Yes, airSlate SignNow offers competitive pricing plans that can fit various business needs. You can choose a plan that provides the features necessary for efficiently managing documents like the 2020 NY IT196. The investment often pays off by saving you time and resources in the tax preparation process.

-

What features does airSlate SignNow offer for managing the 2020 NY IT196?

AirSlate SignNow offers features such as customizable templates, secure eSignature capabilities, and document sharing options that are particularly useful for managing the 2020 NY IT196. These tools help ensure that your tax forms are filled out correctly, signed, and submitted on time.

-

Can I integrate airSlate SignNow with other applications for the 2020 NY IT196?

Yes, airSlate SignNow offers seamless integrations with a variety of applications that can complement your workflow for the 2020 NY IT196 form. By integrating with tools such as cloud storage and accounting software, you can manage your documents efficiently and keep everything organized.

-

What are the benefits of using airSlate SignNow for eSigning the 2020 NY IT196?

Using airSlate SignNow for eSigning the 2020 NY IT196 comes with numerous benefits, such as speed, security, and ease of use. Electronic signatures reduce the hassle of printing and scanning documents while ensuring that your forms are legally binding and securely stored.

-

How does airSlate SignNow ensure the security of the 2020 NY IT196?

AirSlate SignNow prioritizes security by employing advanced encryption protocols to protect your documents, including the 2020 NY IT196. With secure access controls and audit trails, you can rest assured that your sensitive information remains safe throughout the signing process.

Get more for State Tax Form Software Updates

- Insectplant idproblem form iowa state university extension and

- Natural selection of the carmel origami bird indiana form

- November 20 2007 actors federal credit union form

- 5 year old informal language sample checklist

- Project pride application form

- Petl funding form

- Petl funding 502429138 form

- T shirt order form team rosters columbia youth football

Find out other State Tax Form Software Updates

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF

- How Can I Electronic signature Michigan Car Dealer Document