OIC Individual Doubtful Collectibility Package Offer in Compromise Individual Doubtful Collectibility Package 2022-2026

What is the OIC Individual Doubtful Collectibility Package Offer In Compromise Individual Doubtful Collectibility Package

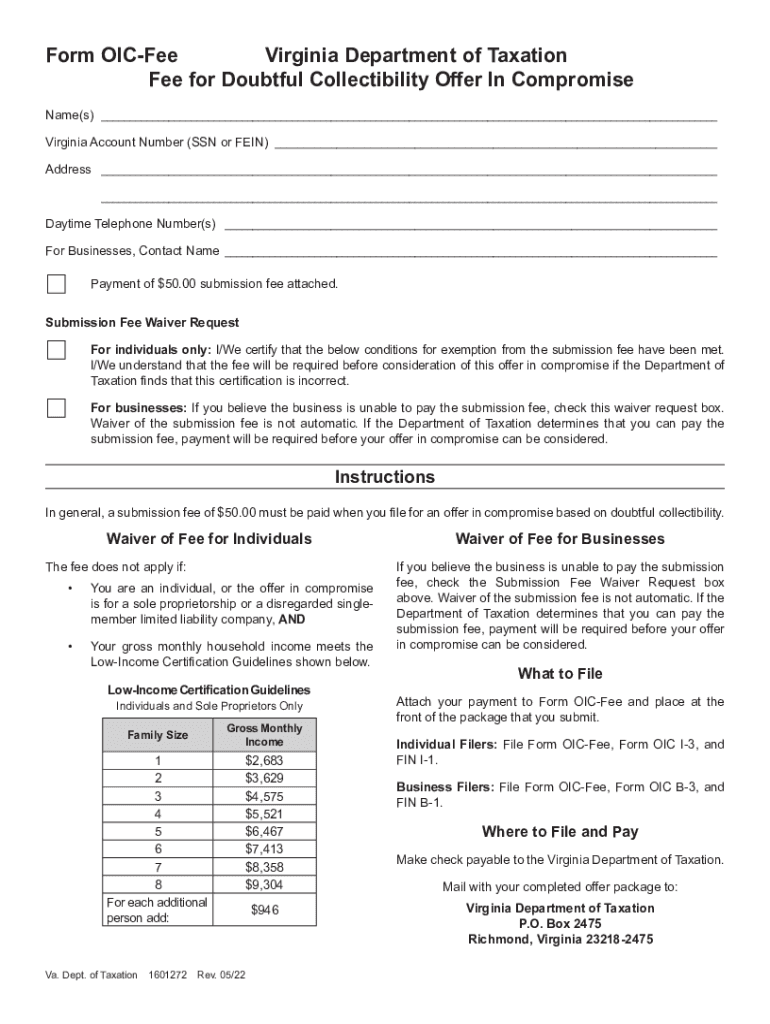

The OIC Individual Doubtful Collectibility Package Offer In Compromise Individual Doubtful Collectibility Package is a specialized form designed for individuals who are unable to pay their tax liabilities due to financial hardship. This package allows taxpayers to negotiate a settlement with the IRS, potentially reducing the total amount owed. It is particularly relevant for those whose financial situations indicate they cannot meet their tax obligations in full. By submitting this package, individuals can seek relief from their tax debts while adhering to IRS guidelines.

How to obtain the OIC Individual Doubtful Collectibility Package Offer In Compromise Individual Doubtful Collectibility Package

To obtain the OIC Individual Doubtful Collectibility Package, taxpayers can visit the official IRS website or contact their local IRS office. The package is available as a downloadable form, which can be printed and filled out. Additionally, taxpayers may seek assistance from tax professionals who can provide guidance on completing the package accurately. It is essential to ensure that all necessary documentation is included when submitting the package to avoid delays in processing.

Steps to complete the OIC Individual Doubtful Collectibility Package Offer In Compromise Individual Doubtful Collectibility Package

Completing the OIC Individual Doubtful Collectibility Package involves several critical steps:

- Gather financial information, including income, expenses, and assets.

- Fill out the required forms accurately, ensuring all information is complete.

- Provide supporting documentation that substantiates claims of financial hardship.

- Review the package for accuracy before submission.

- Submit the completed package to the IRS, either electronically or via mail.

Key elements of the OIC Individual Doubtful Collectibility Package Offer In Compromise Individual Doubtful Collectibility Package

Key elements of the OIC Individual Doubtful Collectibility Package include:

- Detailed financial disclosure, including income and expenses.

- Documentation of assets and liabilities.

- Proof of inability to pay tax debts in full.

- Signed declaration affirming the truthfulness of the information provided.

Eligibility Criteria

Eligibility for the OIC Individual Doubtful Collectibility Package is determined by several factors:

- Taxpayers must demonstrate that they cannot afford to pay their tax liabilities.

- Applicants should have filed all required tax returns.

- Taxpayers must not be in an active bankruptcy proceeding.

Form Submission Methods (Online / Mail / In-Person)

The OIC Individual Doubtful Collectibility Package can be submitted through various methods:

- Electronically via the IRS website, if applicable.

- By mail to the designated IRS address for Offers in Compromise.

- In-person submissions may be arranged through local IRS offices, though appointments are often required.

Quick guide on how to complete oic individual doubtful collectibility package offer in compromise individual doubtful collectibility package 625515001

Finish OIC Individual Doubtful Collectibility Package Offer In Compromise Individual Doubtful Collectibility Package seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers a superb eco-friendly substitute for conventional printed and signed documents, allowing you to locate the necessary form and securely save it online. airSlate SignNow equips you with all the tools you need to generate, alter, and electronically sign your documents quickly and efficiently. Manage OIC Individual Doubtful Collectibility Package Offer In Compromise Individual Doubtful Collectibility Package on any platform with the airSlate SignNow applications for Android or iOS and simplify your document-based processes today.

The easiest way to modify and eSign OIC Individual Doubtful Collectibility Package Offer In Compromise Individual Doubtful Collectibility Package effortlessly

- Obtain OIC Individual Doubtful Collectibility Package Offer In Compromise Individual Doubtful Collectibility Package and select Get Form to begin.

- Utilize the tools we provide to fill in your document.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to submit your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow streamlines all your document management needs in a few clicks from any device you select. Modify and eSign OIC Individual Doubtful Collectibility Package Offer In Compromise Individual Doubtful Collectibility Package and ensure outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct oic individual doubtful collectibility package offer in compromise individual doubtful collectibility package 625515001

Create this form in 5 minutes!

People also ask

-

What is the OIC Individual Doubtful Collectibility Package Offer In Compromise Individual Doubtful Collectibility Package?

The OIC Individual Doubtful Collectibility Package Offer In Compromise Individual Doubtful Collectibility Package is a structured solution designed for individuals facing tax liabilities that they cannot realistically pay. This package helps in negotiating a settlement with the IRS, allowing qualified individuals to reduce their tax debt.

-

Who qualifies for the OIC Individual Doubtful Collectibility Package Offer In Compromise Individual Doubtful Collectibility Package?

Individuals who can demonstrate that paying their full tax liability would create signNow financial hardship may qualify for the OIC Individual Doubtful Collectibility Package Offer In Compromise Individual Doubtful Collectibility Package. An assessment of your financial situation will be conducted to determine eligibility.

-

What are the benefits of the OIC Individual Doubtful Collectibility Package Offer In Compromise Individual Doubtful Collectibility Package?

The main benefits of the OIC Individual Doubtful Collectibility Package Offer In Compromise Individual Doubtful Collectibility Package include the potential to signNowly reduce your tax obligations and prevent aggressive IRS collection actions. It also offers peace of mind by providing a viable path to resolve tax debts.

-

How much does the OIC Individual Doubtful Collectibility Package Offer In Compromise Individual Doubtful Collectibility Package cost?

The cost of the OIC Individual Doubtful Collectibility Package Offer In Compromise Individual Doubtful Collectibility Package can vary based on individual circumstances and the level of service required. Typically, a flat fee is charged, which can be discussed in detail during an initial consultation.

-

What documents are needed for the OIC Individual Doubtful Collectibility Package Offer In Compromise Individual Doubtful Collectibility Package?

To initiate the OIC Individual Doubtful Collectibility Package Offer In Compromise Individual Doubtful Collectibility Package, you will need to provide various financial documents including income statements, asset information, and liabilities. This helps in constructing a robust case for your offer.

-

How does the application process work for the OIC Individual Doubtful Collectibility Package Offer In Compromise Individual Doubtful Collectibility Package?

The application process for the OIC Individual Doubtful Collectibility Package Offer In Compromise Individual Doubtful Collectibility Package involves several steps, including evaluating your financial situation, gathering necessary documents, and submitting the official IRS forms. Expert assistance can streamline this process.

-

Can I use airSlate SignNow to manage documents for the OIC Individual Doubtful Collectibility Package Offer In Compromise Individual Doubtful Collectibility Package?

Absolutely! airSlate SignNow facilitates the secure sending and eSigning of all necessary documents related to the OIC Individual Doubtful Collectibility Package Offer In Compromise Individual Doubtful Collectibility Package. This can enhance the efficiency and convenience of managing your tax settlement paperwork.

Get more for OIC Individual Doubtful Collectibility Package Offer In Compromise Individual Doubtful Collectibility Package

Find out other OIC Individual Doubtful Collectibility Package Offer In Compromise Individual Doubtful Collectibility Package

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later