OIC Individual Doubtful Collectibility Package Offer in Compromise Individual Doubtful Collectibility Package 2018

What is the OIC Individual Doubtful Collectibility Package Offer In Compromise Individual Doubtful Collectibility Package

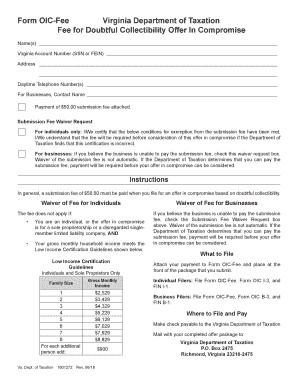

The OIC Individual Doubtful Collectibility Package Offer In Compromise Individual Doubtful Collectibility Package is a specific form used by individuals who are unable to pay their tax liabilities due to financial hardship. This package allows taxpayers to negotiate a settlement with the IRS, reducing their overall tax burden. The package is designed for those who can demonstrate that they have limited income and assets, making it unlikely that the IRS can collect the full amount owed. It is essential for individuals to understand the criteria and documentation required to qualify for this offer.

How to use the OIC Individual Doubtful Collectibility Package Offer In Compromise Individual Doubtful Collectibility Package

Utilizing the OIC Individual Doubtful Collectibility Package involves several steps. First, individuals should gather all necessary financial documents, including income statements, bank statements, and asset valuations. Next, complete the required forms accurately, ensuring that all information reflects your current financial situation. After filling out the forms, submit them to the IRS along with any supporting documentation. It is advisable to keep copies of everything submitted for your records. Understanding the process is crucial for successful negotiation with the IRS.

Steps to complete the OIC Individual Doubtful Collectibility Package Offer In Compromise Individual Doubtful Collectibility Package

Completing the OIC Individual Doubtful Collectibility Package requires a systematic approach:

- Gather financial documents, including proof of income, expenses, and assets.

- Fill out the required forms, ensuring accuracy and completeness.

- Review the forms for any errors or omissions before submission.

- Submit the forms and supporting documents to the IRS.

- Monitor the status of your application and respond to any IRS inquiries promptly.

Eligibility Criteria

To qualify for the OIC Individual Doubtful Collectibility Package, individuals must meet specific eligibility criteria. These include demonstrating that their income and assets are insufficient to pay off their tax liabilities. The IRS typically considers factors such as monthly income, necessary living expenses, and the value of assets when assessing eligibility. It is important for applicants to provide thorough documentation to support their claims of financial hardship.

Required Documents

Submitting the OIC Individual Doubtful Collectibility Package requires various documents to substantiate your financial situation. Key documents include:

- Proof of income (pay stubs, tax returns, etc.)

- Bank statements for all accounts

- Documentation of monthly expenses (bills, lease agreements, etc.)

- Asset valuations (property appraisals, vehicle titles, etc.)

Having these documents ready can streamline the application process and improve the chances of approval.

Legal use of the OIC Individual Doubtful Collectibility Package Offer In Compromise Individual Doubtful Collectibility Package

The legal use of the OIC Individual Doubtful Collectibility Package hinges on compliance with IRS regulations. This package is a formal request to settle tax debts and must be completed with accurate information. The IRS requires that all submissions adhere to the guidelines set forth in the Internal Revenue Code. Failure to provide truthful information or to comply with submission requirements may result in denial of the offer or further penalties.

Quick guide on how to complete oic individual doubtful collectibility package offer in compromise individual doubtful collectibility package

Effortlessly Prepare OIC Individual Doubtful Collectibility Package Offer In Compromise Individual Doubtful Collectibility Package on Any Device

The management of online documents has become increasingly favored by both enterprises and individuals. It offers an ideal environmentally-friendly substitute to conventional printed and signed documentation, allowing you to find the necessary form and securely keep it in the cloud. airSlate SignNow provides all the tools needed to create, modify, and eSign your documents swiftly without delays. Manage OIC Individual Doubtful Collectibility Package Offer In Compromise Individual Doubtful Collectibility Package on any device using the airSlate SignNow apps for Android or iOS, and enhance any document-related task today.

How to Alter and eSign OIC Individual Doubtful Collectibility Package Offer In Compromise Individual Doubtful Collectibility Package with Ease

- Find OIC Individual Doubtful Collectibility Package Offer In Compromise Individual Doubtful Collectibility Package and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and then click the Done button to save your modifications.

- Choose your preferred method to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Alter and eSign OIC Individual Doubtful Collectibility Package Offer In Compromise Individual Doubtful Collectibility Package and guarantee effective communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct oic individual doubtful collectibility package offer in compromise individual doubtful collectibility package

Create this form in 5 minutes!

People also ask

-

What is the OIC Individual Doubtful Collectibility Package Offer In Compromise Individual Doubtful Collectibility Package?

The OIC Individual Doubtful Collectibility Package Offer In Compromise Individual Doubtful Collectibility Package is a tailored solution designed for individuals facing signNow financial burdens. It allows eligible taxpayers to settle their tax debts for less than the full amount owed, provided they meet specific criteria regarding their financial situation.

-

How does the OIC Individual Doubtful Collectibility Package benefit me?

By using the OIC Individual Doubtful Collectibility Package Offer In Compromise Individual Doubtful Collectibility Package, you can signNowly reduce your tax liability, making it a practical financial relief option. This package helps alleviate the stress of tax debt, allowing you to focus on rebuilding your finances.

-

What are the costs associated with the OIC Individual Doubtful Collectibility Package?

The costs involved in the OIC Individual Doubtful Collectibility Package Offer In Compromise Individual Doubtful Collectibility Package vary based on the complexity of your financial situation. It typically includes a non-refundable application fee and any related processing fees, providing a cost-effective solution for eligible individuals.

-

Are there any eligibility requirements for the OIC Individual Doubtful Collectibility Package?

Yes, eligibility for the OIC Individual Doubtful Collectibility Package Offer In Compromise Individual Doubtful Collectibility Package requires you to demonstrate that you cannot pay your tax debt in full and proving your financial hardship. This includes providing detailed information about your income, expenses, and assets.

-

How do I apply for the OIC Individual Doubtful Collectibility Package?

To apply for the OIC Individual Doubtful Collectibility Package Offer In Compromise Individual Doubtful Collectibility Package, you must complete the necessary IRS forms and provide supporting financial documentation. Our platform simplifies this process, guiding you through each step to ensure a smooth application experience.

-

What features are included in the OIC Individual Doubtful Collectibility Package?

The OIC Individual Doubtful Collectibility Package Offer In Compromise Individual Doubtful Collectibility Package includes comprehensive features such as document preparation, assistance with IRS communication, and guidance through the negotiation process. These features are designed to make the OIC application process more manageable.

-

Can the OIC Individual Doubtful Collectibility Package be integrated with other systems?

Absolutely, the OIC Individual Doubtful Collectibility Package Offer In Compromise Individual Doubtful Collectibility Package can be integrated with various accounting and financial software. This integration streamlines your financial management processes, enhancing your overall experience.

Get more for OIC Individual Doubtful Collectibility Package Offer In Compromise Individual Doubtful Collectibility Package

Find out other OIC Individual Doubtful Collectibility Package Offer In Compromise Individual Doubtful Collectibility Package

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online