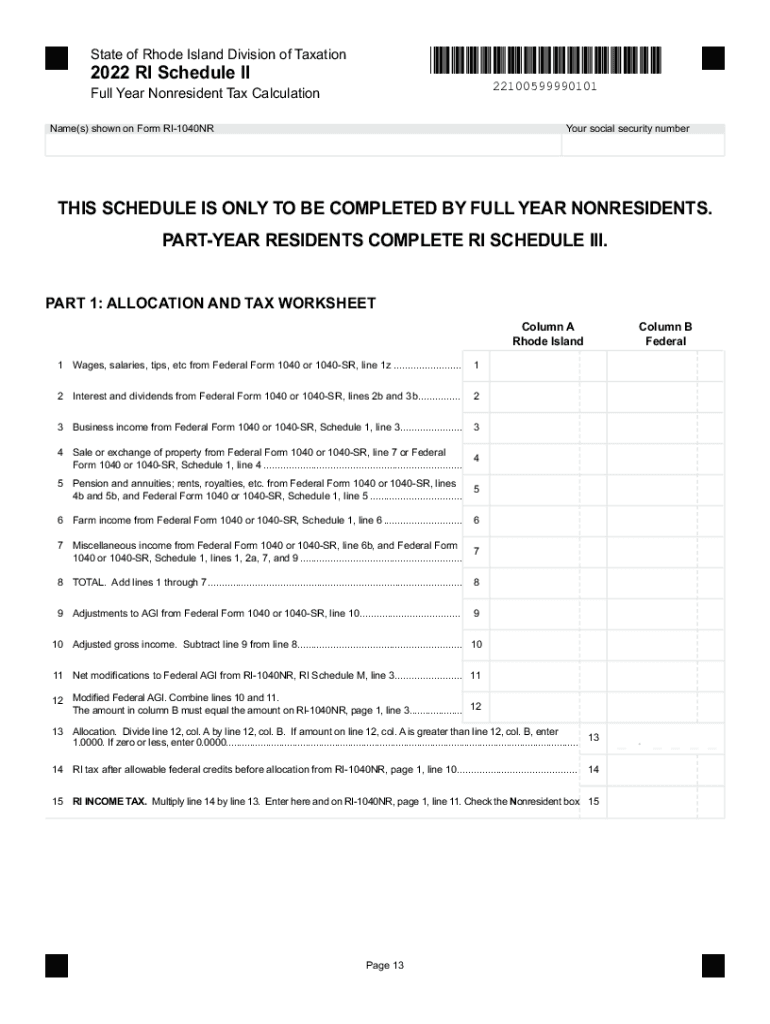

1 Wages, Salaries, Tips, Etc from Federal Form 1040 or 1040 SR, Line 1z 2022

What is the 1 Wages, Salaries, Tips, Etc From Federal Form 1040 Or 1040 SR, Line 1z

The 1 wages, salaries, tips, etc. from Federal Form 1040 or 1040 SR, Line 1z, represents the total income earned from employment and other sources that must be reported on your federal income tax return. This line captures various forms of compensation, including wages, salaries, bonuses, and tips received during the tax year. It is essential for determining your overall taxable income and plays a critical role in calculating your tax liability.

Steps to complete the 1 Wages, Salaries, Tips, Etc From Federal Form 1040 Or 1040 SR, Line 1z

To accurately complete Line 1z of the Federal Form 1040 or 1040 SR, follow these steps:

- Gather all relevant documents, including W-2 forms from employers and any 1099 forms for additional income.

- Sum up all wages, salaries, and tips received during the tax year from these documents.

- Enter the total amount on Line 1z of the form.

- Ensure that the total reflects all income sources accurately to avoid discrepancies.

How to obtain the 1 Wages, Salaries, Tips, Etc From Federal Form 1040 Or 1040 SR, Line 1z

To obtain the necessary information for filling out Line 1z, you will need to collect your W-2 forms from your employer, which detail your earnings and withheld taxes. If you have other income sources, such as freelance work or tips, you may need to gather 1099 forms or other documentation. These forms are typically provided by your employer or clients and can often be accessed through online payroll systems or directly requested from the issuer.

Legal use of the 1 Wages, Salaries, Tips, Etc From Federal Form 1040 Or 1040 SR, Line 1z

Line 1z must be completed accurately to comply with IRS regulations. This line is used to report your total income, which is subject to federal taxation. Failing to report income accurately can lead to penalties, interest, or audits by the IRS. It is crucial to maintain accurate records of all income sources and ensure that the information reported aligns with the documentation provided.

IRS Guidelines

The IRS provides specific guidelines regarding the reporting of wages, salaries, and tips on Form 1040 or 1040 SR. According to these guidelines, all income must be reported in the year it is received. The IRS also emphasizes the importance of accurate reporting to avoid issues during the tax filing process. Taxpayers should refer to the IRS instructions for Form 1040 for detailed information on how to report income correctly.

Filing Deadlines / Important Dates

Filing deadlines for the Federal Form 1040 or 1040 SR typically fall on April 15 of each year, unless it falls on a weekend or holiday. In such cases, the deadline may be extended to the next business day. It is important to keep track of these deadlines to avoid late fees or penalties. Additionally, if you require an extension, you must file Form 4868 to request additional time to submit your tax return.

Quick guide on how to complete 1 wages salaries tips etc from federal form 1040 or 1040 sr line 1z

Effortlessly Prepare 1 Wages, Salaries, Tips, Etc From Federal Form 1040 Or 1040 SR, Line 1z on Any Device

The management of online documents has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly substitute for traditional printed and signed papers, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly and without interruption. Manage 1 Wages, Salaries, Tips, Etc From Federal Form 1040 Or 1040 SR, Line 1z on any platform using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

The Easiest Way to Edit and Electronically Sign 1 Wages, Salaries, Tips, Etc From Federal Form 1040 Or 1040 SR, Line 1z with Ease

- Locate 1 Wages, Salaries, Tips, Etc From Federal Form 1040 Or 1040 SR, Line 1z and click on Get Form to commence.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that task.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to preserve your changes.

- Select how you would like to distribute your form: via email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign 1 Wages, Salaries, Tips, Etc From Federal Form 1040 Or 1040 SR, Line 1z to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1 wages salaries tips etc from federal form 1040 or 1040 sr line 1z

Create this form in 5 minutes!

How to create an eSignature for the 1 wages salaries tips etc from federal form 1040 or 1040 sr line 1z

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is included in 1 Wages, Salaries, Tips, Etc From Federal Form 1040 Or 1040 SR, Line 1z?

1 Wages, Salaries, Tips, Etc From Federal Form 1040 Or 1040 SR, Line 1z encompasses all forms of compensation received by an individual. This includes wages, salaries, tips, and any other source of income that is taxable. Understanding what qualifies can help in accurate tax reporting and compliance.

-

How can airSlate SignNow assist with Form 1040 and 1040 SR?

airSlate SignNow simplifies the document-signing process for Form 1040 and 1040 SR. With our user-friendly interface, you can easily prepare, send, and eSign documents related to 1 Wages, Salaries, Tips, Etc From Federal Form 1040 Or 1040 SR, Line 1z. This reduces handling time and streamlines your tax filing experience.

-

Is airSlate SignNow cost-effective for business owners?

Yes, airSlate SignNow offers a cost-effective solution for businesses looking to manage their documents. Our pricing plans are designed to cater to varying needs without compromising on features. Utilizing airSlate SignNow can save time and resources, especially when dealing with 1 Wages, Salaries, Tips, Etc From Federal Form 1040 Or 1040 SR, Line 1z.

-

What features does airSlate SignNow provide for document management?

airSlate SignNow provides comprehensive features, including customizable templates, secure eSigning, and real-time tracking. These features make it easy to manage and organize documentation related to 1 Wages, Salaries, Tips, Etc From Federal Form 1040 Or 1040 SR, Line 1z. This ensures that your tax documents are always in order and accessible.

-

Can I integrate airSlate SignNow with other software?

Yes, airSlate SignNow supports integrations with various software systems to enhance your workflow. By integrating with accounting and tax software, you can easily manage information related to 1 Wages, Salaries, Tips, Etc From Federal Form 1040 Or 1040 SR, Line 1z. This creates a seamless experience when preparing your tax returns.

-

What are the benefits of eSigning documents with airSlate SignNow?

The benefits of eSigning with airSlate SignNow include enhanced security, faster turnaround times, and improved efficiency. eSigning documents related to 1 Wages, Salaries, Tips, Etc From Federal Form 1040 Or 1040 SR, Line 1z eliminates the need for printing and scanning, allowing for quick and secure transactions.

-

How does airSlate SignNow ensure document security?

airSlate SignNow prioritizes document security by employing advanced encryption and compliance measures. All transactions and documents related to 1 Wages, Salaries, Tips, Etc From Federal Form 1040 Or 1040 SR, Line 1z are protected to prevent unauthorized access. You can trust that your sensitive information is safe with us.

Get more for 1 Wages, Salaries, Tips, Etc From Federal Form 1040 Or 1040 SR, Line 1z

- Painting contract for contractor rhode island form

- Trim carpenter contract for contractor rhode island form

- Fencing contract for contractor rhode island form

- Hvac contract for contractor rhode island form

- Landscape contract for contractor rhode island form

- Commercial contract for contractor rhode island form

- Excavator contract for contractor rhode island form

- Renovation contract for contractor rhode island form

Find out other 1 Wages, Salaries, Tips, Etc From Federal Form 1040 Or 1040 SR, Line 1z

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple