State of Rhode Island Division of Taxation2023 RIS 2023

Understanding the State Of Rhode Island Division Of Taxation2023 RIS

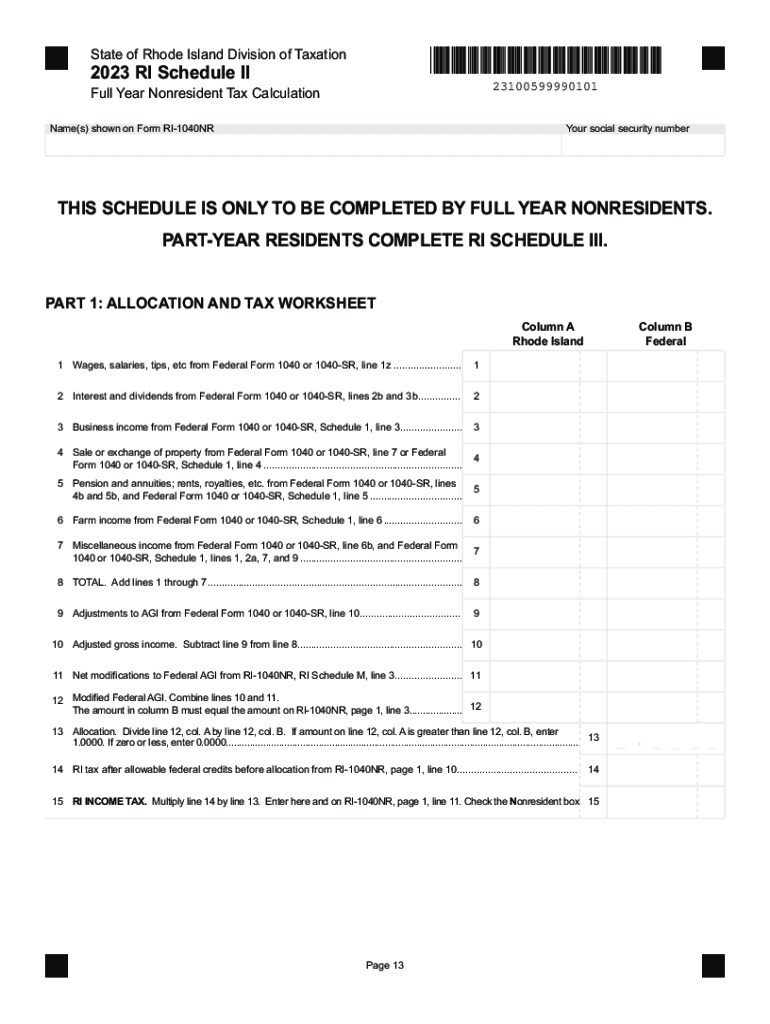

The State Of Rhode Island Division Of Taxation2023 RIS is a crucial document for individuals and businesses in Rhode Island. This form is primarily used for tax reporting and compliance purposes, ensuring that taxpayers meet their obligations under state law. It encompasses various tax-related information, including income, deductions, and credits, which are essential for accurate tax filings. Understanding this form is vital for maintaining compliance and avoiding potential penalties.

How to Complete the State Of Rhode Island Division Of Taxation2023 RIS

Completing the State Of Rhode Island Division Of Taxation2023 RIS involves several steps. First, gather all necessary financial documents, including income statements, previous tax returns, and any relevant deductions. Next, fill out the form with accurate information, ensuring that all figures are correct. It is important to double-check for any errors or omissions before submission. Once completed, the form can be submitted electronically or via mail, depending on your preference.

Obtaining the State Of Rhode Island Division Of Taxation2023 RIS

The State Of Rhode Island Division Of Taxation2023 RIS can be obtained from the Rhode Island Division of Taxation's official website or through their office. The form is typically available in both digital and paper formats, allowing taxpayers to choose the method that best suits their needs. For those who prefer digital access, downloading the form online is a straightforward process, ensuring that you have the most current version for your filings.

Key Elements of the State Of Rhode Island Division Of Taxation2023 RIS

Several key elements are essential to understand when working with the State Of Rhode Island Division Of Taxation2023 RIS. These include:

- Taxpayer Information: This section requires personal details such as name, address, and Social Security number.

- Income Reporting: Accurate reporting of all sources of income is necessary for compliance.

- Deductions and Credits: Taxpayers should be aware of available deductions and credits that can reduce their tax liability.

- Signature and Date: The form must be signed and dated by the taxpayer to validate the submission.

Filing Deadlines for the State Of Rhode Island Division Of Taxation2023 RIS

Filing deadlines for the State Of Rhode Island Division Of Taxation2023 RIS are critical for taxpayers to adhere to in order to avoid penalties. Typically, the deadline for submitting this form aligns with the federal tax filing deadline, which is usually April 15. However, it is advisable to check the Rhode Island Division of Taxation's website for any updates or changes to these deadlines, as they can vary from year to year.

Penalties for Non-Compliance with the State Of Rhode Island Division Of Taxation2023 RIS

Failure to comply with the requirements of the State Of Rhode Island Division Of Taxation2023 RIS can result in various penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is essential for taxpayers to understand these consequences and ensure timely and accurate submission of the form to avoid any negative repercussions.

Quick guide on how to complete state of rhode island division of taxation2023 ris

Complete State Of Rhode Island Division Of Taxation2023 RIS effortlessly on any device

Online document administration has become prevalent among companies and individuals. It offers an excellent environmentally friendly substitute for traditional printed and signed documents, as you can obtain the appropriate form and securely save it online. airSlate SignNow grants you all the resources required to create, modify, and electronically sign your documents rapidly without holdups. Manage State Of Rhode Island Division Of Taxation2023 RIS on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and electronically sign State Of Rhode Island Division Of Taxation2023 RIS effortlessly

- Obtain State Of Rhode Island Division Of Taxation2023 RIS and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight relevant sections of your documents or hide sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and has the same legal significance as a traditional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your needs in document management in just a few clicks from any device of your choice. Alter and electronically sign State Of Rhode Island Division Of Taxation2023 RIS and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct state of rhode island division of taxation2023 ris

Create this form in 5 minutes!

How to create an eSignature for the state of rhode island division of taxation2023 ris

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the State Of Rhode Island Division Of Taxation2023 RIS?

The State Of Rhode Island Division Of Taxation2023 RIS is an initiative aimed at modernizing tax collection and document management. It provides tools and resources for businesses to efficiently manage their tax obligations. By integrating airSlate SignNow, users can streamline document workflows related to taxation.

-

How can airSlate SignNow help with the State Of Rhode Island Division Of Taxation2023 RIS?

airSlate SignNow is designed to facilitate the signing and management of documents related to the State Of Rhode Island Division Of Taxation2023 RIS. With its e-signature capabilities, users can quickly send tax-related documents for approval, ensuring compliance with regulations while saving time.

-

What are the pricing options for airSlate SignNow?

AirSlate SignNow offers flexible pricing plans catered to various business needs, allowing firms to choose a plan that fits their requirements, especially in relation to the State Of Rhode Island Division Of Taxation2023 RIS. Users can opt for monthly or annual subscriptions, with costs typically decreasing with longer commitments.

-

What features does airSlate SignNow offer for tax-related documents?

airSlate SignNow includes features such as customizable templates, bulk sending, and automated reminders specifically beneficial for managing documents associated with the State Of Rhode Island Division Of Taxation2023 RIS. These tools enhance efficiency and ensure thoroughness in the tax filing process.

-

Can airSlate SignNow integrate with other platforms for tax management?

Yes, airSlate SignNow seamlessly integrates with various third-party applications that businesses may use for tax management. These integrations can enhance functionality and streamline processes related to the State Of Rhode Island Division Of Taxation2023 RIS, allowing for a more cohesive workflow.

-

How does airSlate SignNow ensure the security of tax documents?

AirSlate SignNow prioritizes security by employing advanced encryption and compliance with industry standards, making it a reliable choice for handling documents related to the State Of Rhode Island Division Of Taxation2023 RIS. This ensures that sensitive tax information remains protected throughout the signing process.

-

What are the benefits of using airSlate SignNow for businesses in Rhode Island?

Using airSlate SignNow provides businesses in Rhode Island with a cost-effective solution for e-signing and document management, particularly for the State Of Rhode Island Division Of Taxation2023 RIS. It enhances efficiency, reduces turnaround times, and helps businesses maintain compliance with tax regulations.

Get more for State Of Rhode Island Division Of Taxation2023 RIS

- Care options for children of incarcerated parents la court form

- Uccjea form

- Ch 100 info can a civil harassment restraining order help me civil harassment prevention judicial council forms

- Free alaska notarial certificate jurat pdf word form

- Alaska and shc 1124 form

- Alabama child support form cs 42

- Form 16 alabama judicial system

- Alabama child support forms 497230392

Find out other State Of Rhode Island Division Of Taxation2023 RIS

- eSignature Montana Real Estate Cease And Desist Letter Easy

- How Do I eSignature Nebraska Real Estate Lease Agreement

- eSignature Nebraska Real Estate Living Will Now

- Can I eSignature Michigan Police Credit Memo

- eSignature Kentucky Sports Lease Agreement Template Easy

- eSignature Minnesota Police Purchase Order Template Free

- eSignature Louisiana Sports Rental Application Free

- Help Me With eSignature Nevada Real Estate Business Associate Agreement

- How To eSignature Montana Police Last Will And Testament

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA