Personal Income Tax Forms State of Rhode Island File Your Annual Report Rhode Island Nellie M GorbeaRhode Island Office of the G 2020

Understanding the Personal Income Tax Forms in Rhode Island

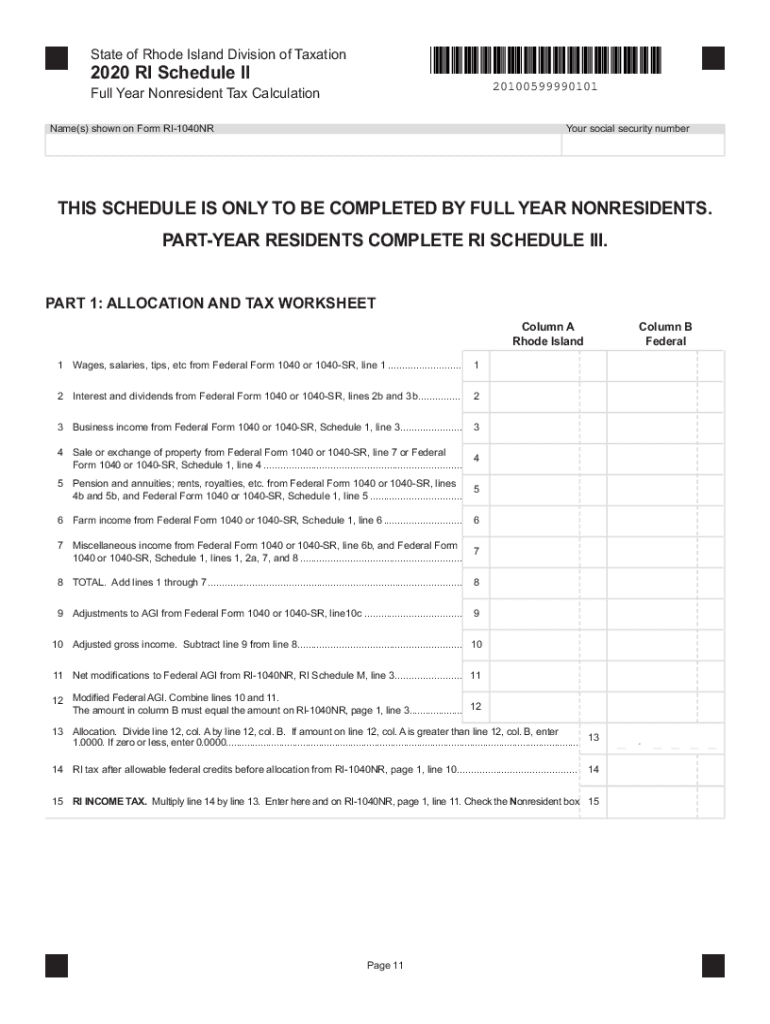

The Personal Income Tax Forms for the State of Rhode Island are essential documents that residents must complete to report their income and calculate their tax obligations. These forms are issued by the Rhode Island Office of the General Treasurer, led by Nellie M. Gorbea. It is crucial for taxpayers to understand the specific requirements and components of these forms to ensure accurate filing and compliance with state tax laws.

How to Obtain the Personal Income Tax Forms

Residents can obtain the Personal Income Tax Forms for Rhode Island through various methods. The forms are available online on the official Rhode Island government website. Additionally, taxpayers can request physical copies by contacting the Rhode Island Office of the General Treasurer directly. It is advisable to ensure that the most recent version of the forms is used, as tax regulations can change annually.

Steps to Complete the Personal Income Tax Forms

Completing the Personal Income Tax Forms involves several steps:

- Gather all necessary financial documents, including W-2s, 1099s, and any other income statements.

- Carefully read the instructions provided with the forms to understand what information is required.

- Fill out the forms accurately, ensuring that all income and deductions are reported correctly.

- Review the completed forms for any errors or omissions before submission.

- Sign and date the forms, as required, to validate the submission.

Legal Use of the Personal Income Tax Forms

The Personal Income Tax Forms are legally binding documents. When filled out and submitted, they represent a taxpayer's formal declaration of income and tax liability to the state. It is essential to comply with all legal requirements to avoid penalties or audits. Utilizing electronic signatures through secure platforms can enhance the legitimacy of the submitted forms.

Filing Deadlines and Important Dates

Taxpayers in Rhode Island must be aware of the filing deadlines for the Personal Income Tax Forms. Typically, the deadline for filing is April fifteenth of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important to stay informed about any changes to these dates to ensure timely submission and avoid late fees.

Required Documents for Filing

To complete the Personal Income Tax Forms, taxpayers must gather specific documents, including:

- W-2 forms from employers

- 1099 forms for other income sources

- Records of any deductions or credits claimed

- Previous year's tax return for reference

Having these documents ready can streamline the filing process and help ensure accuracy in reporting.

Quick guide on how to complete personal income tax forms state of rhode island file your annual report rhode island nellie m gorbearhode island office of the

Effortlessly Prepare Personal Income Tax Forms State Of Rhode Island File Your Annual Report Rhode Island Nellie M GorbeaRhode Island Office Of The G on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It presents an ideal eco-friendly substitute for conventional printed and signed documents, allowing users to access the necessary forms and securely store them online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly without any delays. Manage Personal Income Tax Forms State Of Rhode Island File Your Annual Report Rhode Island Nellie M GorbeaRhode Island Office Of The G on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The Simplest Method to Alter and eSign Personal Income Tax Forms State Of Rhode Island File Your Annual Report Rhode Island Nellie M GorbeaRhode Island Office Of The G with Ease

- Find Personal Income Tax Forms State Of Rhode Island File Your Annual Report Rhode Island Nellie M GorbeaRhode Island Office Of The G and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with specific tools offered by airSlate SignNow for this purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred delivery method for the form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious searches for forms, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Personal Income Tax Forms State Of Rhode Island File Your Annual Report Rhode Island Nellie M GorbeaRhode Island Office Of The G and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct personal income tax forms state of rhode island file your annual report rhode island nellie m gorbearhode island office of the

Create this form in 5 minutes!

How to create an eSignature for the personal income tax forms state of rhode island file your annual report rhode island nellie m gorbearhode island office of the

The way to generate an electronic signature for a PDF file in the online mode

The way to generate an electronic signature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

The best way to create an electronic signature right from your smartphone

The best way to make an e-signature for a PDF file on iOS devices

The best way to create an electronic signature for a PDF on Android

People also ask

-

What are Personal Income Tax Forms for the State of Rhode Island?

Personal Income Tax Forms for the State of Rhode Island are official documents required for individuals to report their annual income and calculate state tax liabilities. To legally file your annual report in Rhode Island, these forms must be accurately completed and submitted to the Rhode Island Office of the General Treasurer, headed by Nellie M. Gorbea.

-

How can I file my Personal Income Tax Forms in Rhode Island?

You can file your Personal Income Tax Forms in Rhode Island electronically or by mail. The Rhode Island Office of the General Treasurer provides online portals for easy submission, ensuring a smooth process for filing your annual report. To optimize your experience, consider using airSlate SignNow's eSignature features for document preparation.

-

What is the deadline to file Personal Income Tax Forms in Rhode Island?

The deadline to file your Personal Income Tax Forms in Rhode Island is typically April 15 each year. It's important to keep track of any extensions or changes announced by the Rhode Island Office of the General Treasurer, led by Nellie M. Gorbea, to avoid late fees.

-

Are there penalties for late filing of Personal Income Tax Forms in Rhode Island?

Yes, there are penalties for late filing of Personal Income Tax Forms in Rhode Island. If you miss the deadline, a late fee may be imposed, and interest can accrue on any unpaid taxes, making it crucial to file your annual report on time with accurate documents.

-

What support is available for filling out Personal Income Tax Forms in Rhode Island?

Support for filling out Personal Income Tax Forms in Rhode Island is available through the Rhode Island Office of the General Treasurer's website and customer service. Additionally, using airSlate SignNow can simplify document signing and enhance your overall filing experience.

-

Can I use airSlate SignNow to eSign my Personal Income Tax Forms?

Absolutely! You can use airSlate SignNow to eSign your Personal Income Tax Forms for the State of Rhode Island, making the process more efficient. This electronic solution allows you to complete your annual report with ease, all while meeting state compliance requirements.

-

What are the benefits of using airSlate SignNow for tax document management?

Using airSlate SignNow for tax document management offers numerous benefits, including ease of use, cost-effectiveness, and secure eSigning capabilities. By utilizing this platform, you can streamline the submission of Personal Income Tax Forms for the State of Rhode Island and simplify your interactions with the Rhode Island Office of the General Treasurer.

Get more for Personal Income Tax Forms State Of Rhode Island File Your Annual Report Rhode Island Nellie M GorbeaRhode Island Office Of The G

- Internal website search how to make content searchable on form

- Copyright all content on this web site such as text form

- 5 things you should know about email unsubscribe links before form

- Posting guidelines for the living in indonesia expat forum form

- Independent sales and marketing representative agreement form

- Please let me know where we are in concluding this matter form

- Victims of identity theft may lose job opportunities be refused loans for education housing or cars and even get arrested form

- Deferred improvement agreement with surety new kent county form

Find out other Personal Income Tax Forms State Of Rhode Island File Your Annual Report Rhode Island Nellie M GorbeaRhode Island Office Of The G

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document

- How Do I eSign Hawaii High Tech Document

- Can I eSign Hawaii High Tech Word

- How Can I eSign Hawaii High Tech Form

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF