Fill, Print & Go New Mexico Taxation and Revenue Department 2022-2026

Understanding the Oregon Revenue Department

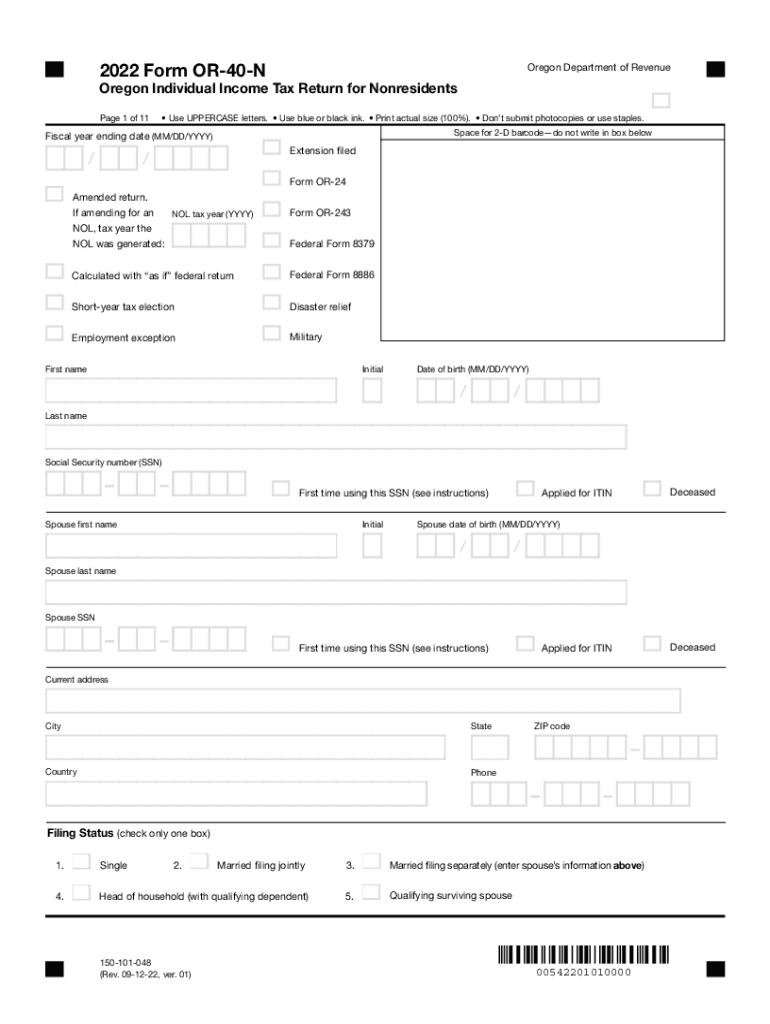

The Oregon Revenue Department is responsible for administering the state's tax laws, including the collection of income taxes and the management of various tax-related forms. This department plays a crucial role in ensuring that residents comply with state tax regulations and that the state's revenue needs are met. The department oversees the processing of forms such as the Oregon Form 40P and the Oregon Form 40N, which are essential for filing personal income taxes.

Steps to Complete the Oregon Tax Forms

Completing your Oregon tax forms requires careful attention to detail. Here are the steps to follow:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Determine which form to use based on your residency status and income type. Nonresidents typically use the Oregon Form 40N, while residents use the Oregon Form 40P.

- Fill out the chosen form accurately, ensuring all information is complete and correct.

- Review the form for any errors or omissions before submission.

- Submit the form electronically through a trusted eSignature platform or by mailing it to the Oregon Revenue Department.

Required Documents for Oregon Tax Filing

When filing your taxes with the Oregon Revenue Department, certain documents are essential. These include:

- W-2 forms from employers, detailing your annual income.

- 1099 forms for any freelance or contract work.

- Records of any other income, such as rental income or dividends.

- Documentation for deductions, including receipts for medical expenses or charitable contributions.

Filing Deadlines for Oregon Tax Returns

It is important to be aware of the filing deadlines for Oregon tax returns to avoid penalties. Typically, the deadline for filing personal income tax returns is April 15. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Additionally, if you need more time, you can file for an extension, but this does not extend the time to pay any taxes owed.

Penalties for Non-Compliance with Oregon Tax Laws

Failure to comply with Oregon tax laws can result in penalties. Common penalties include:

- Late filing penalties, which may be a percentage of the taxes owed.

- Interest on unpaid taxes, accruing from the original due date.

- Potential legal action for continued non-compliance, which could result in liens or garnishments.

Digital vs. Paper Version of Oregon Tax Forms

Both digital and paper versions of Oregon tax forms are available. The digital version allows for easier completion and submission through secure eSignature platforms, ensuring compliance with legal standards. The paper version can be downloaded and printed, but it requires mailing to the Oregon Revenue Department, which may delay processing. Choosing the digital option can enhance efficiency and provide a more streamlined filing experience.

Quick guide on how to complete fill print ampamp go new mexico taxation and revenue department

Complete Fill, Print & Go New Mexico Taxation And Revenue Department effortlessly on any device

The management of online documents has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute to conventional printed and signed documents, allowing you to acquire the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents swiftly without delays. Handle Fill, Print & Go New Mexico Taxation And Revenue Department on any platform with airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

How to modify and electronically sign Fill, Print & Go New Mexico Taxation And Revenue Department easily

- Obtain Fill, Print & Go New Mexico Taxation And Revenue Department and click Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes moments and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to preserve your changes.

- Select your preferred method for delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Fill, Print & Go New Mexico Taxation And Revenue Department and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fill print ampamp go new mexico taxation and revenue department

Create this form in 5 minutes!

How to create an eSignature for the fill print ampamp go new mexico taxation and revenue department

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What services does the Oregon Revenue Department offer for document signing?

The Oregon Revenue Department provides various services to assist businesses in managing their tax obligations, including electronic document signing. By utilizing airSlate SignNow, businesses can easily send and eSign necessary documents, ensuring compliance with state regulations.

-

How can airSlate SignNow help with compliance related to the Oregon Revenue Department?

airSlate SignNow empowers businesses to maintain compliance with the Oregon Revenue Department by streamlining the document eSigning process. This solution ensures that all signed documents are securely stored and readily accessible for audits or inquiries from the department.

-

What are the key features of airSlate SignNow that benefit users interacting with the Oregon Revenue Department?

Key features of airSlate SignNow include customizable templates, advanced authentication, and real-time tracking of document progress. These features enhance the user experience and help ensure that documents sent to the Oregon Revenue Department are timely and correctly completed.

-

Is there a cost associated with using airSlate SignNow for dealings with the Oregon Revenue Department?

Yes, airSlate SignNow offers various pricing plans to fit the needs of businesses working with the Oregon Revenue Department. These plans are designed to be cost-effective, allowing for unlimited sending and eSigning of documents without breaking the bank.

-

Can airSlate SignNow integrate with other tools I use to manage Oregon Revenue Department documents?

Absolutely! airSlate SignNow offers integrations with popular tools such as Google Drive, Salesforce, and Dropbox, making it easy to manage all documents related to the Oregon Revenue Department efficiently. This seamless integration enhances productivity while keeping your documents organized.

-

What benefits can my business expect from using airSlate SignNow for Oregon Revenue Department interactions?

Using airSlate SignNow provides numerous benefits, including faster processing of documents and enhanced security for sensitive information. This ensures that your business effectively meets its obligations to the Oregon Revenue Department without delays.

-

How secure is the document signing process with airSlate SignNow for the Oregon Revenue Department?

The document signing process with airSlate SignNow is highly secure, incorporating encryption and advanced authentication mechanisms. This level of security is crucial when dealing with documents submitted to the Oregon Revenue Department, ensuring that your information remains confidential.

Get more for Fill, Print & Go New Mexico Taxation And Revenue Department

- Quitclaim deed from husband and wife to llc rhode island form

- Warranty deed from husband and wife to llc rhode island form

- Rhode island judgment form

- Assignment of mechanics lien corporation or llc rhode island form

- Rhode island notice 497325093 form

- Rhode island tenant form

- Letter from tenant to landlord containing notice that premises in uninhabitable in violation of law and demand immediate repair 497325095 form

- Letter from tenant to landlord containing notice that premises leaks during rain and demand for repair rhode island form

Find out other Fill, Print & Go New Mexico Taxation And Revenue Department

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU