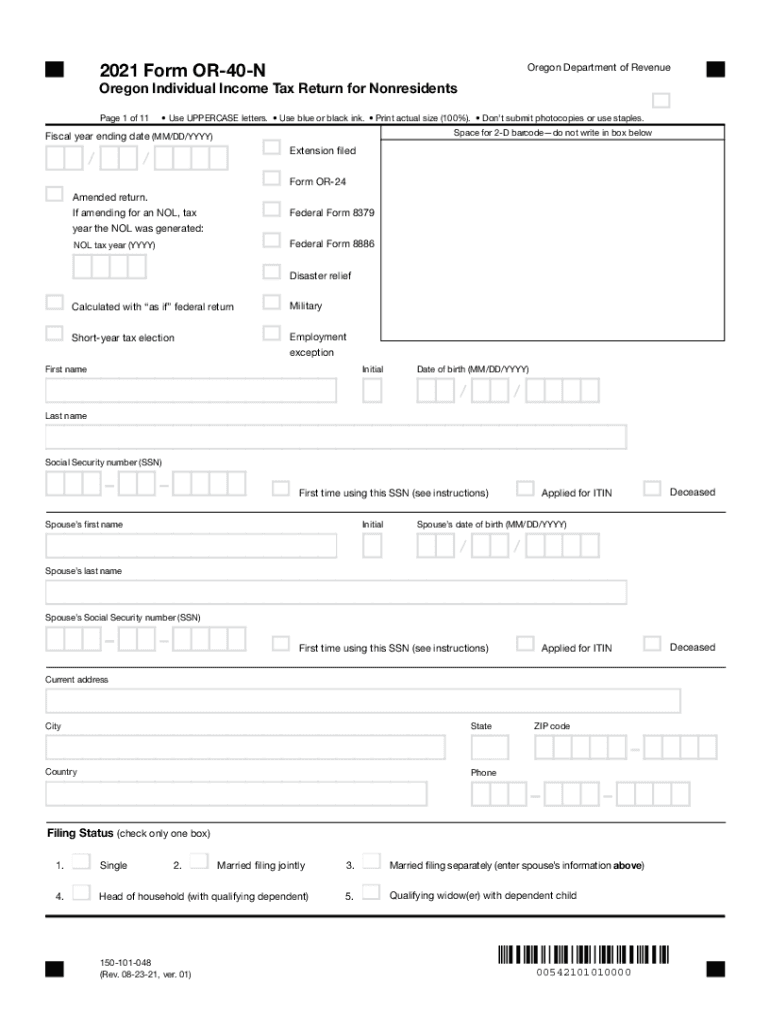

Fillable Online Oregon Clear Form OREGON Amended Return 2021

What is the Fillable Online Oregon Clear Form OREGON Amended Return

The Fillable Online Oregon Clear Form OREGON Amended Return is a specific tax form used by individuals and businesses in Oregon to amend previously filed tax returns. This form allows taxpayers to correct any errors or omissions in their original filings, ensuring compliance with state tax regulations. It is essential for those who need to adjust their reported income, deductions, or credits after the initial submission of their Oregon tax return.

Steps to complete the Fillable Online Oregon Clear Form OREGON Amended Return

Completing the Fillable Online Oregon Clear Form OREGON Amended Return involves several key steps:

- Gather necessary documents such as your original tax return, W-2s, and any other relevant income statements.

- Access the fillable form through the Oregon Department of Revenue website or designated platforms.

- Input the corrected information in the appropriate fields, ensuring accuracy in all entries.

- Review the completed form for any errors or missing information before submission.

- Submit the amended return electronically or print and mail it to the appropriate tax office.

Legal use of the Fillable Online Oregon Clear Form OREGON Amended Return

The Fillable Online Oregon Clear Form OREGON Amended Return is legally recognized when it meets specific criteria. To ensure its validity, the form must be filled out completely and accurately. Additionally, the taxpayer must sign and date the form, either electronically or manually, depending on the submission method. Compliance with Oregon tax laws is crucial, as any discrepancies could lead to penalties or additional scrutiny from tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Fillable Online Oregon Clear Form OREGON Amended Return are critical to avoid penalties. Generally, taxpayers must submit their amended returns within three years from the original due date of the return or within two years from the date the tax was paid, whichever is later. It is advisable to keep track of these deadlines to ensure timely compliance with state tax regulations.

Required Documents

When completing the Fillable Online Oregon Clear Form OREGON Amended Return, several documents are necessary to support the amendments being made. These may include:

- Your original tax return for reference.

- W-2 forms and 1099s that report income.

- Any documentation related to deductions or credits being claimed.

- Previous correspondence with the Oregon Department of Revenue, if applicable.

Eligibility Criteria

To use the Fillable Online Oregon Clear Form OREGON Amended Return, taxpayers must meet specific eligibility criteria. This form is intended for individuals and entities who have already filed an Oregon tax return and need to make corrections. It is applicable for various tax situations, including those involving changes in income, filing status, or deductions. Taxpayers must ensure they are amending a return that was filed within the allowable time frame to qualify for this process.

Quick guide on how to complete fillable online oregon clear form oregon amended return

Complete Fillable Online Oregon Clear Form OREGON Amended Return effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, edit, and electronically sign your documents swiftly without any holdups. Manage Fillable Online Oregon Clear Form OREGON Amended Return on any device using airSlate SignNow's Android or iOS applications, and streamline any document-related task today.

How to edit and electronically sign Fillable Online Oregon Clear Form OREGON Amended Return with ease

- Find Fillable Online Oregon Clear Form OREGON Amended Return and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Mark important sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign feature, which takes only seconds and carries the same legal significance as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method for submitting your form; options include email, text message (SMS), invitation link, or downloading it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, and errors that necessitate printing new copies of documents. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Fillable Online Oregon Clear Form OREGON Amended Return and ensure effective communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fillable online oregon clear form oregon amended return

Create this form in 5 minutes!

How to create an eSignature for the fillable online oregon clear form oregon amended return

The best way to generate an electronic signature for a PDF file in the online mode

The best way to generate an electronic signature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

How to make an electronic signature right from your smartphone

The way to make an e-signature for a PDF file on iOS devices

How to make an electronic signature for a PDF on Android

People also ask

-

What types of documents can I eSign to generate Oregon income from my business?

With airSlate SignNow, you can eSign a variety of documents, including contracts, agreements, and forms, all of which can contribute to your Oregon income from improved efficiency. This allows you to close deals faster and streamline your workflows, ensuring you maximize your revenue potential.

-

How can airSlate SignNow help increase my Oregon income from sales?

By utilizing airSlate SignNow's eSigning features, you can expedite the sales process and enhance customer satisfaction. Faster turnaround times on contracts and agreements mean you'll have more completed sales, ultimately increasing your Oregon income from effective business practices.

-

What are the pricing options available for airSlate SignNow to support my Oregon income from eSigning?

airSlate SignNow offers flexible pricing plans tailored to meet varying business needs, which can directly support your Oregon income from efficient document handling. Whether you're a small business or a large enterprise, there is a plan that can help you maximize your profits while minimizing costs.

-

Can I integrate airSlate SignNow with other tools to boost my Oregon income from digital workflows?

Yes, airSlate SignNow seamlessly integrates with various CRM and productivity tools, enhancing your ability to manage documents and workflows. These integrations ensure all aspects of your business work harmoniously, which can signNowly boost your Oregon income from optimized operations.

-

What security features does airSlate SignNow provide to protect my Oregon income from document fraud?

airSlate SignNow prioritizes document security with features like encryption and audit trails, ensuring your transactions are safe. Protecting your documents helps safeguard your Oregon income from potential fraud and liability, allowing you to conduct business with peace of mind.

-

How quickly can I start generating Oregon income from using airSlate SignNow?

You can start seeing benefits almost immediately after signing up for airSlate SignNow. With its user-friendly interface and quick onboarding process, you can efficiently eSign documents and begin enhancing your Oregon income from day one.

-

What are the benefits of using airSlate SignNow for my Oregon income from online transactions?

Using airSlate SignNow provides numerous benefits, including faster transaction times and reduced paper costs. By making the eSigning process more efficient, you can signNowly increase your Oregon income from online transactions overall.

Get more for Fillable Online Oregon Clear Form OREGON Amended Return

- Employment employee personnel file package indiana form

- Assignment of mortgage package indiana form

- Assignment of lease package indiana form

- Indiana purchase form

- Satisfaction cancellation or release of mortgage package indiana form

- Premarital agreements package indiana form

- Painting contractor package indiana form

- Framing contractor package indiana form

Find out other Fillable Online Oregon Clear Form OREGON Amended Return

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form

- How Do I eSign Hawaii Construction Form

- How To eSign Florida Doctors Form

- Help Me With eSign Hawaii Doctors Word

- How Can I eSign Hawaii Doctors Word

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document