Form or 40 N, Oregon Individual Income Tax Return for 2020

What is the Form OR 40 N, Oregon Individual Income Tax Return For

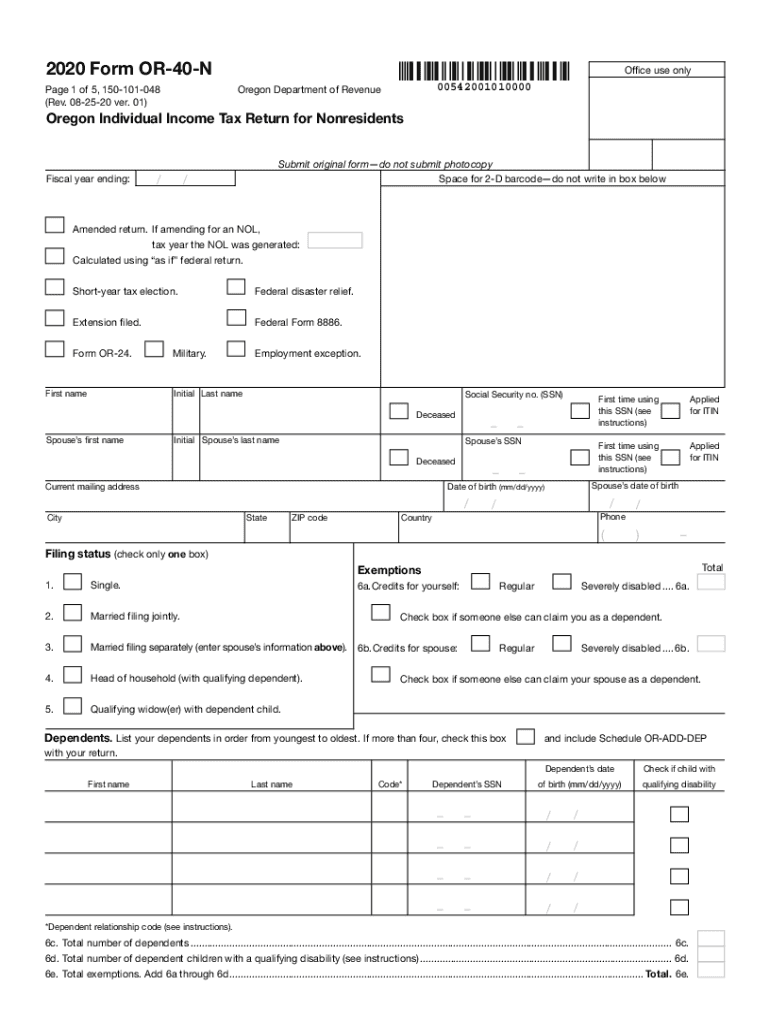

The Form OR 40 N is the official document used by residents of Oregon to file their individual income tax returns. This form is specifically designed for individuals who do not meet the requirements to file the standard Form OR 40. It is essential for reporting income, calculating tax liability, and ensuring compliance with Oregon tax laws. Understanding the purpose of this form helps taxpayers fulfill their obligations accurately and on time.

Steps to complete the Form OR 40 N, Oregon Individual Income Tax Return For

Completing the Form OR 40 N involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, fill out personal information, including your name, address, and Social Security number. Then, report your total income, deductions, and credits as applicable. It is crucial to double-check your calculations and ensure all information is correctly entered. Finally, sign and date the form before submitting it to the Oregon Department of Revenue.

Legal use of the Form OR 40 N, Oregon Individual Income Tax Return For

The Form OR 40 N is legally recognized as a valid method for filing income taxes in Oregon. To ensure its legal standing, taxpayers must adhere to specific guidelines set forth by the Oregon Department of Revenue. This includes accurately reporting income and claiming eligible deductions and credits. Additionally, electronic submissions through authorized e-filing services are accepted, provided they comply with state regulations. Understanding the legal implications of using this form is vital for avoiding potential penalties or issues with tax compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Form OR 40 N are crucial for taxpayers to observe. Generally, the deadline for submitting the form is April 15 of the tax year unless it falls on a weekend or holiday, in which case the deadline may be extended. Taxpayers should also be aware of any extensions available for filing, as well as the deadlines for making estimated tax payments. Keeping track of these important dates helps ensure timely compliance and avoids unnecessary penalties.

Required Documents

To complete the Form OR 40 N, several documents are required. Taxpayers should gather their W-2 forms, 1099 forms, and any other relevant income documentation. Additionally, records of deductions, such as receipts for medical expenses, mortgage interest statements, and property tax bills, should be included. Having all necessary documents on hand facilitates a smoother filing process and ensures that all income and deductions are accurately reported.

Who Issues the Form

The Form OR 40 N is issued by the Oregon Department of Revenue. This state agency is responsible for the administration of tax laws and the collection of taxes in Oregon. Taxpayers can obtain the form directly from the department's website or through authorized tax preparation services. Understanding the issuing authority helps ensure that taxpayers are using the most current version of the form and following the correct procedures for submission.

Quick guide on how to complete 2020 form or 40 n oregon individual income tax return for

Complete Form OR 40 N, Oregon Individual Income Tax Return For effortlessly on any device

Web-based document management has become increasingly prevalent among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily find the appropriate form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents quickly without any delays. Manage Form OR 40 N, Oregon Individual Income Tax Return For on any device with the airSlate SignNow Android or iOS applications and enhance any document-focused process today.

How to alter and eSign Form OR 40 N, Oregon Individual Income Tax Return For without hassle

- Locate Form OR 40 N, Oregon Individual Income Tax Return For and select Get Form to initiate the process.

- Take advantage of the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new copies of documents. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form OR 40 N, Oregon Individual Income Tax Return For and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form or 40 n oregon individual income tax return for

Create this form in 5 minutes!

How to create an eSignature for the 2020 form or 40 n oregon individual income tax return for

How to generate an eSignature for a PDF file online

How to generate an eSignature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

How to make an eSignature right from your mobile device

The best way to create an eSignature for a PDF file on iOS

How to make an eSignature for a PDF on Android devices

People also ask

-

What is the pricing structure for airSlate SignNow with or 40n?

The pricing for airSlate SignNow with or 40n is designed to accommodate businesses of all sizes. It offers flexible plans that cater to different user needs, ensuring that you get the most value for your investment. You can visit our pricing page to view options and choose the one that suits your requirements.

-

How does airSlate SignNow's eSigning process work with or 40n?

The eSigning process on airSlate SignNow with or 40n is streamlined for user convenience. You can upload documents, send them to signers, and track their status in real-time, all from one platform. The intuitive interface ensures that anyone can complete the signing process quickly and efficiently.

-

What features are included in airSlate SignNow when using or 40n?

airSlate SignNow with or 40n includes features such as customizable templates, automated workflows, and secure storage. These tools help enhance your document management process, making it easier to get documents signed and stored safely. The platform also supports multiple file formats to suit all your needs.

-

Can airSlate SignNow integrate with other applications for or 40n?

Yes, airSlate SignNow with or 40n seamlessly integrates with various applications, enhancing its functionality. You can connect it to CRMs, project management tools, and cloud storage services to streamline your workflows. This allows you to manage documents across multiple platforms smoothly.

-

What are the benefits of using airSlate SignNow for businesses with or 40n?

Using airSlate SignNow with or 40n provides businesses with a cost-effective and efficient solution for document management. It signNowly reduces turnaround times for contract signing and improves collaboration among teams. Additionally, the platform's compliance features ensure that your documents are handled securely.

-

Is airSlate SignNow secure for sensitive documents when using or 40n?

Absolutely, airSlate SignNow with or 40n prioritizes security. The platform utilizes industry-standard encryption and compliance with data protection regulations to ensure your sensitive documents are safe. You can confidently send and eSign documents knowing that they are protected.

-

How can I get started with airSlate SignNow and or 40n?

Getting started with airSlate SignNow and or 40n is simple. You can sign up for a free trial to explore the features and see how it fits your needs. Once you're ready, choose a pricing plan that works for you, and you can start sending documents for eSigning right away.

Get more for Form OR 40 N, Oregon Individual Income Tax Return For

- Crd93 100065675 form

- Fillable home inspection reports with pictures form

- Orea form 120 pdf

- Direct deposit form in spanish

- 956a form sample filled

- Letter of responsibility template form

- Application for the purpose of residence of 39study39 recognised ind form

- Application form for the purpose of residence of exchange au

Find out other Form OR 40 N, Oregon Individual Income Tax Return For

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile

- Can I Sign Alabama Healthcare / Medical Quitclaim Deed

- Sign Utah Government Month To Month Lease Myself

- Can I Sign Texas Government Limited Power Of Attorney

- Sign Arkansas Healthcare / Medical Living Will Free

- Sign Arkansas Healthcare / Medical Bill Of Lading Later

- Sign California Healthcare / Medical Arbitration Agreement Free

- Help Me With Sign California Healthcare / Medical Lease Agreement Form

- Sign Connecticut Healthcare / Medical Business Plan Template Free

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile

- Sign Wyoming Government Quitclaim Deed Free

- How To Sign Nebraska Healthcare / Medical Living Will