Form or 243, Claim to Refund Due a Deceased Person, 2022-2026

What is the Form OR 243, Claim To Refund Due A Deceased Person

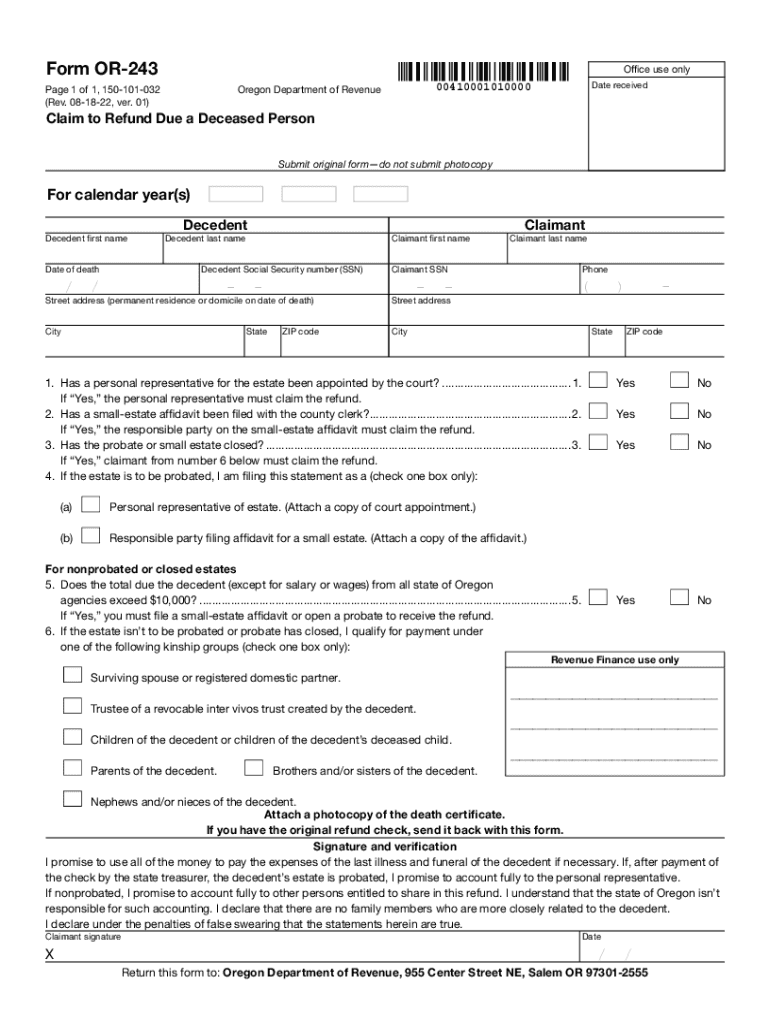

The Form OR 243 is a specific document used in the state of Oregon to claim a tax refund that is due to a deceased individual. This form is essential for the executor or administrator of the deceased's estate to recover any outstanding tax refunds that the individual was entitled to prior to their passing. The form ensures that the rightful beneficiaries can access these funds, facilitating the proper handling of the deceased's financial affairs.

How to use the Form OR 243, Claim To Refund Due A Deceased Person

To effectively use the Form OR 243, the executor or administrator must complete the document accurately, providing all necessary information regarding the deceased individual. This includes the deceased's full name, Social Security number, and details about the tax refund being claimed. Once the form is completed, it should be submitted to the Oregon Department of Revenue for processing. It is crucial to ensure that all information is correct to avoid delays in receiving the refund.

Steps to complete the Form OR 243, Claim To Refund Due A Deceased Person

Completing the Form OR 243 involves several key steps:

- Gather necessary documentation, including the deceased's tax records and identification.

- Fill out the form with accurate information, including the deceased's name, Social Security number, and the amount of the refund being claimed.

- Sign the form as the executor or administrator, certifying that the information provided is true and correct.

- Submit the completed form to the Oregon Department of Revenue, either by mail or electronically if applicable.

Required Documents for the Form OR 243, Claim To Refund Due A Deceased Person

When submitting the Form OR 243, it is important to include specific documents to support the claim. Required documents may include:

- A copy of the deceased's death certificate.

- Proof of the executor or administrator's authority, such as a court order or letters of administration.

- Documentation of the tax refund being claimed, such as previous tax returns or notices from the Oregon Department of Revenue.

Eligibility Criteria for the Form OR 243, Claim To Refund Due A Deceased Person

To be eligible to file the Form OR 243, the claimant must be the executor or administrator of the deceased person's estate. Additionally, the deceased must have had a tax refund due at the time of their passing. It is important to ensure that all eligibility criteria are met to facilitate a smooth claims process.

Form Submission Methods for the Form OR 243, Claim To Refund Due A Deceased Person

The Form OR 243 can be submitted through various methods to accommodate different preferences:

- By mail: Send the completed form and supporting documents to the Oregon Department of Revenue.

- Online: If available, utilize the state's electronic filing system for faster processing.

- In-person: Visit a local Oregon Department of Revenue office to submit the form directly.

Quick guide on how to complete form or 243 claim to refund due a deceased person

Effortlessly prepare Form OR 243, Claim To Refund Due A Deceased Person, on any device

The management of documents online has become increasingly favored by both businesses and individuals. It offers a perfect eco-friendly substitute for conventional printed and signed materials, allowing for easy access and secure storage of the necessary forms online. airSlate SignNow equips you with all the functionalities you require to swiftly create, modify, and electronically sign your documents without delays. Handle Form OR 243, Claim To Refund Due A Deceased Person, on any device through the airSlate SignNow Android or iOS applications and streamline your document-related processes today.

The simplest method to modify and electronically sign Form OR 243, Claim To Refund Due A Deceased Person, with ease

- Find Form OR 243, Claim To Refund Due A Deceased Person, and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize key sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device of your choice. Modify and electronically sign Form OR 243, Claim To Refund Due A Deceased Person, while ensuring excellent communication at every step of the form preparation procedure with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form or 243 claim to refund due a deceased person

Create this form in 5 minutes!

How to create an eSignature for the form or 243 claim to refund due a deceased person

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Oregon Form 243 and how can airSlate SignNow help with it?

Oregon Form 243 is a specific document used for various state regulations. By using airSlate SignNow, businesses can easily send, sign, and store this form digitally, ensuring compliance and efficiency. Our platform simplifies the entire process, making it quick and secure to manage your Oregon Form 243.

-

What are the pricing options for using airSlate SignNow for Oregon Form 243?

airSlate SignNow offers flexible pricing plans tailored to different business needs. Our plans are cost-effective, making it accessible for anyone needing to manage Oregon Form 243. To ensure you get the best fit, we recommend exploring our various options and selecting one that matches your usage.

-

What features does airSlate SignNow provide for handling Oregon Form 243?

With airSlate SignNow, you gain access to features such as eSigning, document templates, and real-time tracking for Oregon Form 243. This comprehensive set of tools allows for better workflow management and ensures all stakeholders can easily interact with the documentation process.

-

Can airSlate SignNow integrate with other applications for handling Oregon Form 243?

Yes, airSlate SignNow integrates seamlessly with various applications, enhancing your workflow when processing Oregon Form 243. Whether it's CRM, project management, or storage solutions, our integrations enable you to streamline your operations efficiently.

-

What are the benefits of using airSlate SignNow for Oregon Form 243?

Using airSlate SignNow for Oregon Form 243 provides numerous benefits, including reduced processing time and enhanced security. Additionally, you can access your documents anytime, anywhere, signNowly improving your operational efficiency and compliance with state regulations.

-

Is airSlate SignNow compliant with Oregon state laws regarding Form 243?

Absolutely! airSlate SignNow is designed to comply with all relevant regulations for documents like Oregon Form 243. We ensure that our eSigning process meets legal requirements, providing peace of mind for businesses and individuals alike.

-

How can I get started with airSlate SignNow for Oregon Form 243?

Getting started with airSlate SignNow for Oregon Form 243 is simple. Just sign up for an account, select your plan, and you can begin uploading and managing your forms right away. Our user-friendly interface will guide you through the process, ensuring a hassle-free experience.

Get more for Form OR 243, Claim To Refund Due A Deceased Person,

- Application for sublease rhode island form

- Inventory and condition of leased premises for pre lease and post lease rhode island form

- Letter from landlord to tenant with directions regarding cleaning and procedures for move out rhode island form

- Property manager agreement rhode island form

- Delayed rent payments 497325221 form

- Tenants maintenance repair request form rhode island

- Guaranty attachment to lease for guarantor or cosigner rhode island form

- Amendment to lease or rental agreement rhode island form

Find out other Form OR 243, Claim To Refund Due A Deceased Person,

- eSign Mississippi General Power of Attorney Template Free

- How Can I eSignature New Mexico Letter of Intent

- Can I eSign Colorado Startup Business Plan Template

- eSign Massachusetts Startup Business Plan Template Online

- eSign New Hampshire Startup Business Plan Template Online

- How To eSign New Jersey Startup Business Plan Template

- eSign New York Startup Business Plan Template Online

- eSign Colorado Income Statement Quarterly Mobile

- eSignature Nebraska Photo Licensing Agreement Online

- How To eSign Arizona Profit and Loss Statement

- How To eSign Hawaii Profit and Loss Statement

- How To eSign Illinois Profit and Loss Statement

- How To eSign New York Profit and Loss Statement

- How To eSign Ohio Profit and Loss Statement

- How Do I eSign Ohio Non-Compete Agreement

- eSign Utah Non-Compete Agreement Online

- eSign Tennessee General Partnership Agreement Mobile

- eSign Alaska LLC Operating Agreement Fast

- How Can I eSign Hawaii LLC Operating Agreement

- eSign Indiana LLC Operating Agreement Fast