Form or 243, Claim to Refund Due a Deceased Person 2021

What is the Form OR 243, Claim To Refund Due A Deceased Person

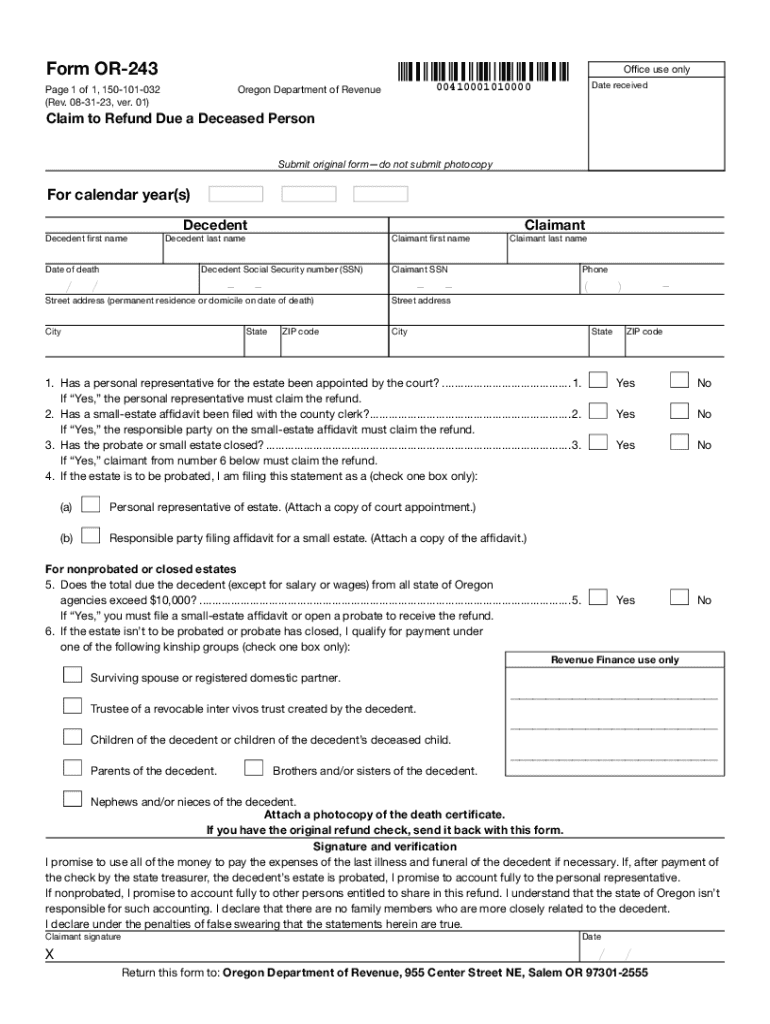

The Form OR 243, Claim To Refund Due A Deceased Person, is a legal document used in the state of Oregon. It allows individuals or entities to claim a refund that is owed to a deceased person. This form is particularly relevant when the deceased individual had overpaid taxes or is entitled to a refund from the state. The form must be filled out accurately to ensure that the rightful beneficiary receives the funds owed.

How to use the Form OR 243, Claim To Refund Due A Deceased Person

Using the Form OR 243 involves several steps to ensure proper completion and submission. First, gather all necessary information about the deceased person, including their full name, Social Security number, and details regarding the refund. Next, complete the form by providing the required information accurately. Ensure that you sign the form as the claimant, affirming your relationship to the deceased. Finally, submit the form to the appropriate state agency for processing.

Steps to complete the Form OR 243, Claim To Refund Due A Deceased Person

Completing the Form OR 243 requires careful attention to detail. Follow these steps:

- Obtain the form from a reliable source, such as the Oregon Department of Revenue website.

- Fill in the deceased person's information, including their name, address, and Social Security number.

- Provide your own information as the claimant, including your relationship to the deceased.

- Detail the reason for the refund claim, specifying any relevant tax years.

- Sign and date the form, confirming that the information is accurate and complete.

Required Documents

When submitting the Form OR 243, certain documents may be required to support the claim. These typically include:

- A copy of the deceased person's death certificate.

- Proof of your relationship to the deceased, such as a marriage certificate or birth certificate.

- Any relevant tax documents that indicate the refund amount owed.

Form Submission Methods

The Form OR 243 can be submitted through various methods. Claimants have the option to file the form by mail, ensuring it is sent to the appropriate address provided by the state. Some agencies may also allow in-person submissions, where you can deliver the form directly. It is important to verify the submission methods available to ensure timely processing.

Eligibility Criteria

To be eligible to use the Form OR 243, the claimant must be an individual or entity with a legitimate claim to the deceased person's refund. This typically includes immediate family members or legal representatives. Additionally, the claim must be based on valid grounds, such as overpayment of taxes or unclaimed refunds from the state. Understanding these criteria is essential for a successful claim.

Quick guide on how to complete form or 243 claim to refund due a deceased person

Effortlessly prepare Form OR 243, Claim To Refund Due A Deceased Person on any device

Digital document management has gained popularity among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily find the right form and securely store it online. airSlate SignNow provides you with all the tools you require to create, modify, and eSign your documents swiftly without any hold-ups. Manage Form OR 243, Claim To Refund Due A Deceased Person on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to adjust and eSign Form OR 243, Claim To Refund Due A Deceased Person without any hassle

- Locate Form OR 243, Claim To Refund Due A Deceased Person and click on Get Form to initiate the process.

- Utilize the tools we provide to complete your form.

- Emphasize important parts of your documents or redact sensitive information using tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you would like to share your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from a device of your preference. Modify and eSign Form OR 243, Claim To Refund Due A Deceased Person to ensure excellent communication at any point in the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form or 243 claim to refund due a deceased person

Create this form in 5 minutes!

How to create an eSignature for the form or 243 claim to refund due a deceased person

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form OR 243, Claim To Refund Due A Deceased Person?

Form OR 243, Claim To Refund Due A Deceased Person, is a legal document used by individuals or estates to request a refund from the state for any overpayment of taxes owed by a deceased individual. This form is crucial for ensuring that rightful funds are returned to heirs or estate administrators following a person's death. airSlate SignNow can help streamline the signing and submission process for this important document.

-

How can airSlate SignNow assist with Form OR 243?

airSlate SignNow provides a user-friendly experience to eSign and manage Form OR 243, Claim To Refund Due A Deceased Person. With its easy-to-use interface, users can quickly fill out the form electronically, ensuring that all necessary details are accurately captured. Our platform also allows for tracking and secure storage of your documents.

-

What are the pricing options for using airSlate SignNow for Form OR 243?

airSlate SignNow offers various pricing plans to accommodate different needs, including options specifically tailored for individuals needing to file Form OR 243, Claim To Refund Due A Deceased Person. The pricing is competitive, providing a cost-effective solution for businesses and private users alike. You can choose a plan that fits your volume of document signing to maximize value.

-

Is eSigning Form OR 243 legally valid?

Yes, eSigning Form OR 243, Claim To Refund Due A Deceased Person is legally valid in many jurisdictions, including those that accept electronic signatures. airSlate SignNow complies with e-signature laws, such as the ESIGN Act and UETA, ensuring that your electronically signed documents are enforceable in court. This makes the process not only convenient but also legally sound.

-

Can I integrate airSlate SignNow with other tools for processing Form OR 243?

Absolutely! airSlate SignNow offers integrations with several popular applications, allowing you to easily manage Form OR 243, Claim To Refund Due A Deceased Person within your existing workflow. Whether you use CRM systems, cloud storage solutions, or other productivity tools, our platform ensures a seamless integration for enhanced efficiency.

-

What features should I look for in airSlate SignNow when handling Form OR 243?

When using airSlate SignNow for Form OR 243, Claim To Refund Due A Deceased Person, you should look for features such as document templates, customizable fields, workflow automation, and audit trails. These functionalities enhance both the user experience and ensure accuracy in completing the form. Additionally, easy-sharing capabilities can help you collaborate with other stakeholders.

-

How secure is the process of eSigning Form OR 243 with airSlate SignNow?

Security is a top priority for airSlate SignNow, especially when dealing with sensitive documents like Form OR 243, Claim To Refund Due A Deceased Person. Our platform employs advanced encryption methods and follows strict compliance protocols to protect your data. You can trust that your documents remain confidential and secure throughout the signing process.

Get more for Form OR 243, Claim To Refund Due A Deceased Person

- Editorial outline frankenstein english 11 bwikispacesb form

- United independent school district national junior honor hpwebserver2 uisd form

- Characteristics of living organisms worksheet form

- Middle permission form

- Mswo data sheet form

- Academic renewal vvc form

- Gsp practice test form

- Van doren scholarship form

Find out other Form OR 243, Claim To Refund Due A Deceased Person

- How Can I eSign Iowa House rental lease agreement

- eSign Florida Land lease agreement Fast

- eSign Louisiana Land lease agreement Secure

- How Do I eSign Mississippi Land lease agreement

- eSign Connecticut Landlord tenant lease agreement Now

- eSign Georgia Landlord tenant lease agreement Safe

- Can I eSign Utah Landlord lease agreement

- How Do I eSign Kansas Landlord tenant lease agreement

- How Can I eSign Massachusetts Landlord tenant lease agreement

- eSign Missouri Landlord tenant lease agreement Secure

- eSign Rhode Island Landlord tenant lease agreement Later

- How Can I eSign North Carolina lease agreement

- eSign Montana Lease agreement form Computer

- Can I eSign New Hampshire Lease agreement form

- How To eSign West Virginia Lease agreement contract

- Help Me With eSign New Mexico Lease agreement form

- Can I eSign Utah Lease agreement form

- Can I eSign Washington lease agreement

- Can I eSign Alabama Non disclosure agreement sample

- eSign California Non disclosure agreement sample Now