Generating Form it 360 1 for NYC or Yonkers Part Year 2022

What is the IT 360 1 Form for NYC or Yonkers Part-Year Residents?

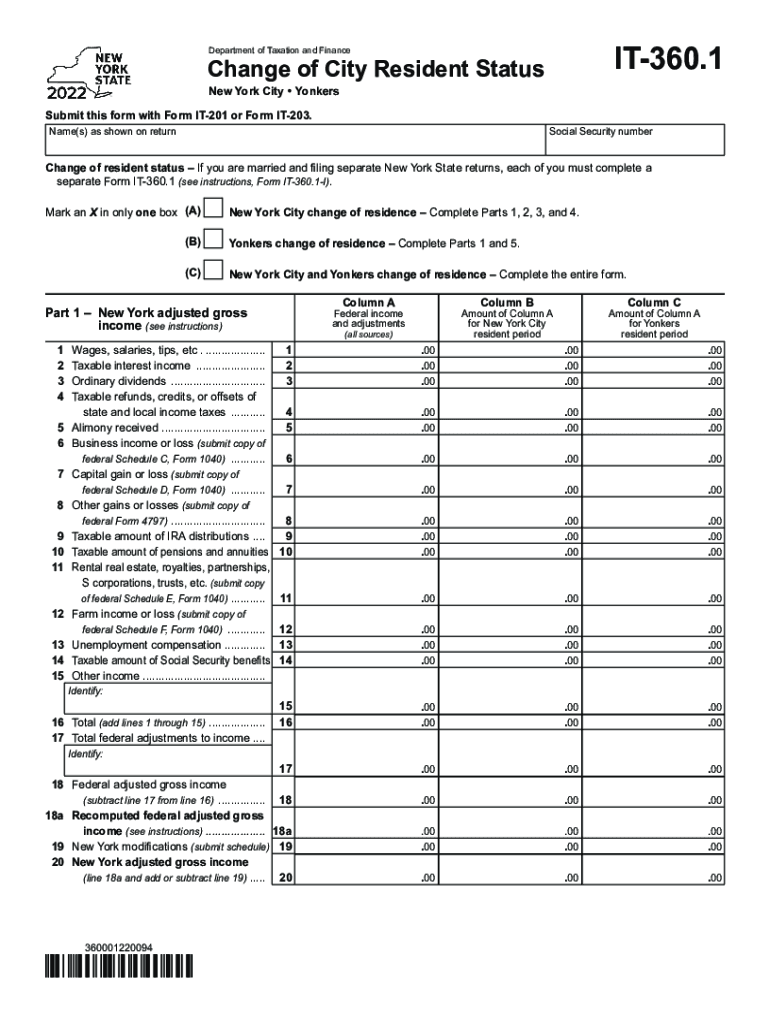

The IT 360 1 form is specifically designed for individuals who have changed their resident status in New York City or Yonkers during the tax year. This form allows part-year residents to report their income accurately and determine their tax obligations. It is essential for those who have lived in New York City or Yonkers for only part of the year, ensuring that they are taxed only on the income earned while residing in these areas. The form captures vital information regarding residency status, income sources, and applicable deductions, making it a critical component of the tax filing process for part-year residents.

Steps to Complete the IT 360 1 Form for NYC or Yonkers Part-Year Residents

Filling out the IT 360 1 form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documentation, including income statements and proof of residency. Follow these steps:

- Personal Information: Fill in your name, address, and Social Security number at the top of the form.

- Residency Dates: Clearly indicate the dates you were a resident of New York City or Yonkers during the tax year.

- Income Reporting: Report all income earned while a resident, including wages, self-employment income, and other sources.

- Deductions and Credits: Include any applicable deductions or credits that may reduce your taxable income.

- Signature: Sign and date the form to certify that the information provided is accurate.

Review the completed form for any errors before submission to ensure a smooth filing process.

How to Obtain the IT 360 1 Form for NYC or Yonkers Part-Year Residents

The IT 360 1 form can be easily obtained through several channels. The most convenient way is to visit the official New York State Department of Taxation and Finance website, where you can download the form directly. Additionally, you may request a physical copy by contacting the department via phone or visiting a local office. It is advisable to ensure you are using the most current version of the form to avoid any issues during the filing process.

Legal Use of the IT 360 1 Form for NYC or Yonkers Part-Year Residents

The IT 360 1 form serves a legal purpose in the tax system, allowing part-year residents to comply with state tax laws. Proper use of this form ensures that individuals are taxed fairly based on their residency status. It is crucial to complete the form accurately, as any discrepancies may lead to penalties or audits by the New York State Department of Taxation and Finance. Understanding the legal implications of the information provided on the form is essential for maintaining compliance with state tax regulations.

Key Elements of the IT 360 1 Form for NYC or Yonkers Part-Year Residents

Several key elements must be included when completing the IT 360 1 form. These include:

- Residency Information: Accurate dates of residency in New York City or Yonkers.

- Income Details: Comprehensive reporting of all income earned during the residency period.

- Deductions: Any deductions that apply to part-year residents, which can help reduce taxable income.

- Signature: A signed declaration confirming the accuracy of the information provided.

Each of these elements plays a vital role in ensuring that the form is completed correctly and in compliance with tax regulations.

Quick guide on how to complete generating form it 3601 for nyc or yonkers part year

Manage Generating Form IT 360 1 For NYC Or Yonkers Part year effortlessly on any device

Digital document management has gained popularity among organizations and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to easily locate the right form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without any holdups. Handle Generating Form IT 360 1 For NYC Or Yonkers Part year on any platform using the airSlate SignNow Android or iOS applications and enhance any document-related procedure today.

How to alter and electronically sign Generating Form IT 360 1 For NYC Or Yonkers Part year effortlessly

- Obtain Generating Form IT 360 1 For NYC Or Yonkers Part year and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of your documents or black out sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature using the Sign tool, which takes mere moments and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you would like to share your form, via email, text message (SMS), an invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Generating Form IT 360 1 For NYC Or Yonkers Part year and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct generating form it 3601 for nyc or yonkers part year

Create this form in 5 minutes!

How to create an eSignature for the generating form it 3601 for nyc or yonkers part year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the it 360 1 and how does it benefit my business?

The it 360 1 is a powerful document management and eSigning solution that streamlines your business processes. By allowing businesses to easily send and eSign documents, it signNowly reduces turnaround time and enhances operational efficiency, ultimately leading to cost savings.

-

How much does it cost to use the it 360 1 service?

The pricing for the it 360 1 is competitive and offers different tiers based on your business needs. You can choose from various plans that are designed to fit small businesses to larger enterprises, ensuring flexibility and value for money.

-

What features are included with the it 360 1?

The it 360 1 includes features such as customizable templates, automated workflows, and real-time tracking of document status. These tools work together to simplify your document management and enhance your eSigning experience.

-

Can the it 360 1 integrate with other software tools?

Yes, the it 360 1 offers seamless integrations with popular software applications such as CRM and project management tools. This allows for a smoother workflow and better collaboration across your business processes.

-

How secure is the it 360 1 for document signing?

The it 360 1 prioritizes security with robust encryption methods to protect your documents. Features such as audit trails and secure authentication ensure that your signed documents are safe and verifiable.

-

Is there a mobile app for the it 360 1?

Yes, the it 360 1 is equipped with a mobile app that enables users to manage and sign documents on-the-go. This flexibility ensures that you can complete business transactions anytime, anywhere, increasing productivity.

-

How does the it 360 1 improve workflow efficiency?

The it 360 1 enhances workflow efficiency by automating repetitive tasks and minimizing manual errors. With features like bulk sending and reminders, it ensures that your documents get signed faster and your team stays focused on core activities.

Get more for Generating Form IT 360 1 For NYC Or Yonkers Part year

- Salary verification form for potential lease michigan

- Michigan landlord tenant 497311521 form

- Notice of default on residential lease michigan form

- Landlord tenant lease co signer agreement michigan form

- Application for sublease michigan form

- Inventory and condition of leased premises for pre lease and post lease michigan form

- Letter from landlord to tenant with directions regarding cleaning and procedures for move out michigan form

- Property manager agreement michigan form

Find out other Generating Form IT 360 1 For NYC Or Yonkers Part year

- How Can I Electronic signature North Carolina Landlord tenant lease agreement

- Can I Electronic signature Vermont lease agreement

- Can I Electronic signature Michigan Lease agreement for house

- How To Electronic signature Wisconsin Landlord tenant lease agreement

- Can I Electronic signature Nebraska Lease agreement for house

- eSignature Nebraska Limited Power of Attorney Free

- eSignature Indiana Unlimited Power of Attorney Safe

- Electronic signature Maine Lease agreement template Later

- Electronic signature Arizona Month to month lease agreement Easy

- Can I Electronic signature Hawaii Loan agreement

- Electronic signature Idaho Loan agreement Now

- Electronic signature South Carolina Loan agreement Online

- Electronic signature Colorado Non disclosure agreement sample Computer

- Can I Electronic signature Illinois Non disclosure agreement sample

- Electronic signature Kentucky Non disclosure agreement sample Myself

- Help Me With Electronic signature Louisiana Non disclosure agreement sample

- How To Electronic signature North Carolina Non disclosure agreement sample

- Electronic signature Ohio Non disclosure agreement sample Online

- How Can I Electronic signature Oklahoma Non disclosure agreement sample

- How To Electronic signature Tennessee Non disclosure agreement sample