Form it 360 1 Change of City Resident Status Tax Year 2023

What is the Form IT 360 1 Change Of City Resident Status Tax Year

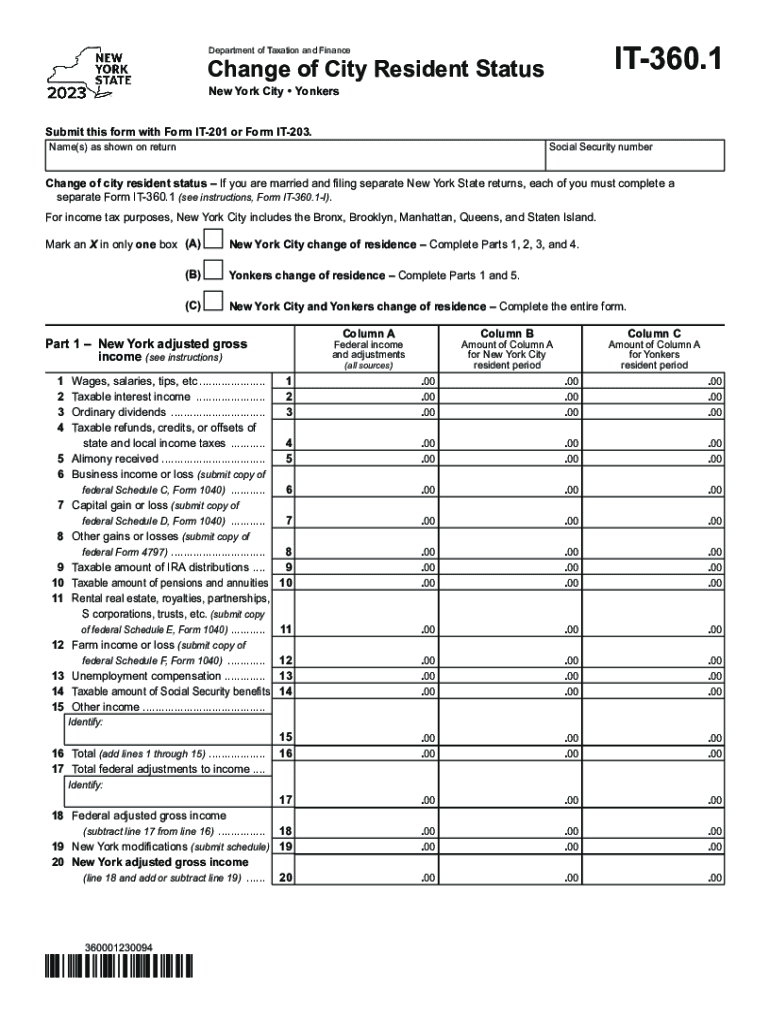

The IT 360 1 form is a tax document used by individuals who have changed their residency status in New York City during a tax year. This form allows taxpayers to report their change in residency status, which can affect their tax obligations. Specifically, it is designed for those who were part-year residents of New York City, enabling them to accurately calculate their city tax liability based on the time they resided within the city limits. Understanding this form is crucial for compliance with local tax laws.

How to use the Form IT 360 1 Change Of City Resident Status Tax Year

Using the IT 360 1 form involves several steps to ensure accurate completion. Taxpayers must provide personal information, including their name, address, and Social Security number. The form also requires details about the periods of residency and non-residency in New York City. It is important to follow the instructions carefully to avoid errors that could lead to penalties. Once completed, the form must be submitted along with the appropriate tax return for the year in which the residency change occurred.

Steps to complete the Form IT 360 1 Change Of City Resident Status Tax Year

Completing the IT 360 1 form requires a systematic approach. Start by gathering all necessary documentation, including prior tax returns and proof of residency. Follow these steps:

- Fill in your personal information at the top of the form.

- Indicate the dates of residency and non-residency in New York City.

- Complete the calculation sections to determine your tax liability.

- Review the form for accuracy and completeness.

- Sign and date the form before submission.

Ensure that all calculations are double-checked to prevent any discrepancies that may trigger an audit.

Legal use of the Form IT 360 1 Change Of City Resident Status Tax Year

The IT 360 1 form is legally mandated for individuals who change their residency status within a tax year. Proper use of this form ensures compliance with New York City tax regulations. Failure to submit the form when required can result in penalties, including fines or additional tax assessments. It is essential to understand the legal implications of the information provided on the form, as it directly impacts tax responsibilities.

Filing Deadlines / Important Dates

Timely filing of the IT 360 1 form is crucial to avoid penalties. The form must be submitted by the due date of your tax return for the year in which the residency change occurred. Typically, this deadline aligns with the federal tax filing deadline, which is April fifteenth. If additional time is needed, taxpayers may file for an extension, but it is important to check specific state guidelines regarding extensions for local tax forms.

Required Documents

To complete the IT 360 1 form accurately, several documents may be required. These include:

- Proof of residency, such as utility bills or lease agreements.

- Previous tax returns to verify income and residency periods.

- Any additional documentation that supports the residency change, such as employment records.

Having these documents on hand can streamline the process and help ensure that the form is filled out correctly.

Quick guide on how to complete form it 360 1 change of city resident status tax year

Complete Form IT 360 1 Change Of City Resident Status Tax Year seamlessly on any device

Managing documents online has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to access the necessary forms and securely save them online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents quickly without delays. Handle Form IT 360 1 Change Of City Resident Status Tax Year on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest method to modify and eSign Form IT 360 1 Change Of City Resident Status Tax Year effortlessly

- Find Form IT 360 1 Change Of City Resident Status Tax Year and click on Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize important sections of your documents or redact confidential information with tools specifically designed for this by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method of delivering your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, cumbersome form navigation, or mistakes that necessitate recreating document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign Form IT 360 1 Change Of City Resident Status Tax Year and ensure effective communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 360 1 change of city resident status tax year

Create this form in 5 minutes!

How to create an eSignature for the form it 360 1 change of city resident status tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the it 360 form and how does it function?

The it 360 form is a digital document designed for efficient data collection and electronic signatures. This form simplifies the process of gathering necessary information from various stakeholders while ensuring compliance and security in document handling. By using the it 360 form, businesses can streamline their operations and reduce paperwork.

-

How much does the it 360 form cost to implement?

Implementing the it 360 form through airSlate SignNow offers competitive pricing tailored to your business needs. Depending on your subscription plan, you can enjoy affordable rates with no hidden fees, making it a cost-effective solution for document signing and management. For detailed pricing, visit our pricing page.

-

What features does the it 360 form offer?

The it 360 form includes features such as customizable templates, real-time tracking, and automated workflows. Businesses can easily personalize their forms to meet specific requirements, ensuring a seamless experience for users. These features enhance productivity and minimize errors in document submission.

-

How does the it 360 form improve business efficiency?

The it 360 form signNowly improves business efficiency by minimizing time spent on manual documentation processes. With features like automated reminders and integrations with other systems, businesses can expedite the approval process. This leads to faster turnaround times and improved resource management.

-

Can the it 360 form be integrated with other software?

Yes, the it 360 form can be easily integrated with a variety of popular software applications. This allows businesses to connect their existing workflows, providing a seamless experience across platforms. Integrations with CRM systems, project management tools, and cloud storage services enhance the utility of the it 360 form.

-

Is the it 360 form secure for sensitive information?

Absolutely! The it 360 form employs industry-standard encryption and secure cloud storage to protect sensitive information. With advanced security measures, businesses can confidently collect and manage confidential data without compromising integrity or compliance. Your data safety is our top priority.

-

What benefits can I expect from using the it 360 form?

Using the it 360 form provides numerous benefits, including faster document processing and easier collaboration among team members. This leads to a more organized workflow, reduced chances of errors, and improved visibility of document status. Overall, businesses can enjoy enhanced performance and customer satisfaction.

Get more for Form IT 360 1 Change Of City Resident Status Tax Year

Find out other Form IT 360 1 Change Of City Resident Status Tax Year

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online