Form it 360 1 Change of City Resident Status Tax Year 2024-2026

Understanding the IT 360 1 Form for Change of City Resident Status

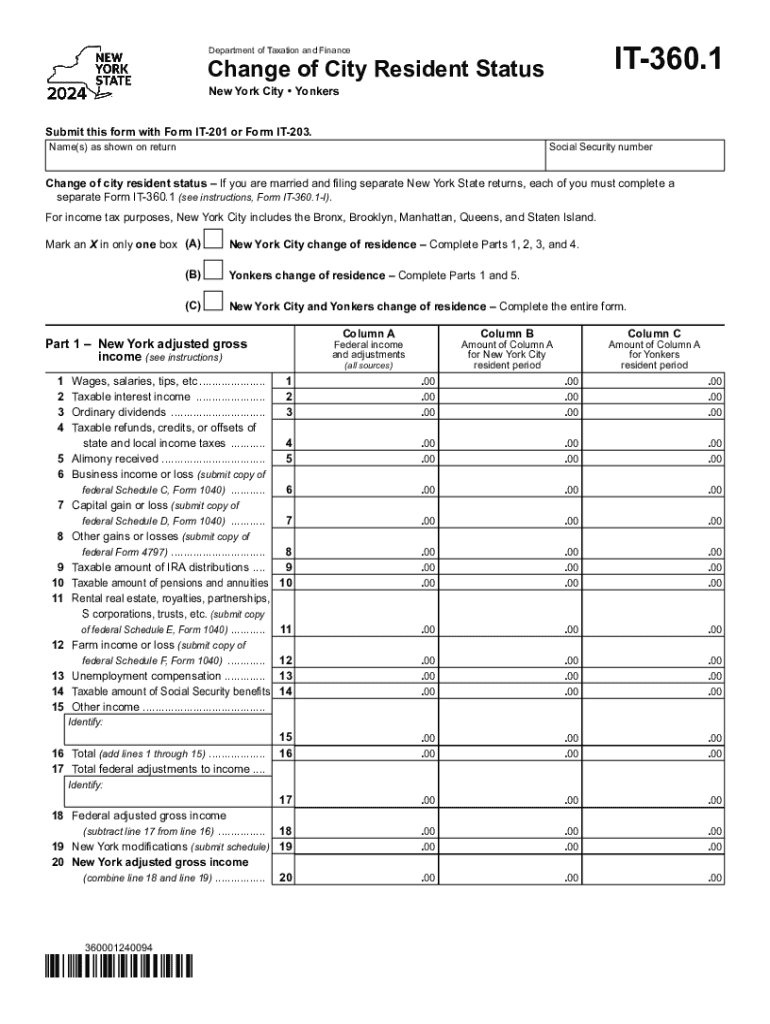

The IT 360 1 form is a crucial document for individuals who are changing their city resident status in the United States. This form is primarily used to notify the appropriate tax authorities about a change in residency, which can affect local tax obligations. It is important for city residents to understand the implications of this form, as it ensures compliance with local tax laws and helps avoid potential penalties.

Steps to Complete the IT 360 1 Form

Completing the IT 360 1 form involves several key steps:

- Gather necessary information, including your current address, previous address, and the effective date of the residency change.

- Fill out the form accurately, ensuring that all personal information is correct.

- Review the completed form for any errors or omissions.

- Submit the form to the appropriate tax authority, either online or by mail, based on your preference and the options available.

Obtaining the IT 360 1 Form

The IT 360 1 form can be obtained from the official tax authority website or local government offices. It is typically available in both digital and paper formats, allowing taxpayers to choose the most convenient method for their needs. Ensure you have the latest version of the form to avoid any issues during submission.

Legal Use of the IT 360 1 Form

This form serves a legal purpose by officially notifying tax authorities of a change in residency status. Proper use of the IT 360 1 form is essential for maintaining compliance with local tax regulations. Failing to submit this form when required can lead to complications, including potential fines or back taxes owed.

Filing Deadlines and Important Dates

Timeliness is critical when submitting the IT 360 1 form. Be aware of specific filing deadlines that may apply based on your residency change. Missing these deadlines can result in penalties or delays in processing your change of status. It is advisable to check the local tax authority's website for the most accurate and up-to-date information regarding important dates.

Key Elements of the IT 360 1 Form

The IT 360 1 form includes several important sections that must be completed. Key elements typically include:

- Your personal identification information, such as name and Social Security number.

- Details of your previous and new addresses.

- The effective date of the residency change.

- Signature and date to certify the information provided.

Create this form in 5 minutes or less

Find and fill out the correct form it 360 1 change of city resident status tax year 772088717

Create this form in 5 minutes!

How to create an eSignature for the form it 360 1 change of city resident status tax year 772088717

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the it 360 1 form and how does it work?

The it 360 1 form is a digital document that allows users to easily collect and manage information electronically. With airSlate SignNow, you can create, send, and eSign the it 360 1 form seamlessly, ensuring a smooth workflow for your business.

-

What are the key features of the it 360 1 form?

The it 360 1 form includes features such as customizable templates, electronic signatures, and real-time tracking. These features enhance efficiency and ensure that your documents are processed quickly and securely.

-

How much does it cost to use the it 360 1 form with airSlate SignNow?

Pricing for using the it 360 1 form with airSlate SignNow varies based on the plan you choose. We offer flexible pricing options that cater to businesses of all sizes, ensuring you get the best value for your investment.

-

Can I integrate the it 360 1 form with other applications?

Yes, the it 360 1 form can be easily integrated with various applications such as CRM systems, cloud storage, and project management tools. This integration allows for a more streamlined workflow and enhances productivity.

-

What are the benefits of using the it 360 1 form for my business?

Using the it 360 1 form can signNowly reduce paperwork and improve efficiency in your business processes. It allows for faster document turnaround times and enhances collaboration among team members.

-

Is the it 360 1 form secure for sensitive information?

Absolutely! The it 360 1 form is designed with security in mind, featuring encryption and compliance with industry standards. This ensures that your sensitive information is protected throughout the signing process.

-

How can I get started with the it 360 1 form on airSlate SignNow?

Getting started with the it 360 1 form on airSlate SignNow is easy. Simply sign up for an account, choose the it 360 1 form template, and customize it to fit your needs. You'll be able to send and eSign documents in no time.

Get more for Form IT 360 1 Change Of City Resident Status Tax Year

- Wallace state transcripts form

- Unofficial transcript william and mary form

- California income tax return form 6164537

- Application for master plumber examination state of michigan michigan form

- 4 form va us copyright office copyright

- Application for a copy of a north carolina nc vital records north vitalrecords nc form

- Crime incident report form 6276560

- Liu transcript request form

Find out other Form IT 360 1 Change Of City Resident Status Tax Year

- Electronic signature South Carolina Partnership agreements Online

- How Can I Electronic signature Florida Rental house lease agreement

- How Can I Electronic signature Texas Rental house lease agreement

- eSignature Alabama Trademark License Agreement Secure

- Electronic signature Maryland Rental agreement lease Myself

- How To Electronic signature Kentucky Rental lease agreement

- Can I Electronic signature New Hampshire Rental lease agreement forms

- Can I Electronic signature New Mexico Rental lease agreement forms

- How Can I Electronic signature Minnesota Rental lease agreement

- Electronic signature Arkansas Rental lease agreement template Computer

- Can I Electronic signature Mississippi Rental lease agreement

- Can I Electronic signature Missouri Rental lease contract

- Electronic signature New Jersey Rental lease agreement template Free

- Electronic signature New Jersey Rental lease agreement template Secure

- Electronic signature Vermont Rental lease agreement Mobile

- Electronic signature Maine Residential lease agreement Online

- Electronic signature Minnesota Residential lease agreement Easy

- Electronic signature Wyoming Rental lease agreement template Simple

- Electronic signature Rhode Island Residential lease agreement Online

- Electronic signature Florida Rental property lease agreement Free