POWER of ATTORNEY Marylandtaxes Gov 2022

What is the Maryland Form 548P?

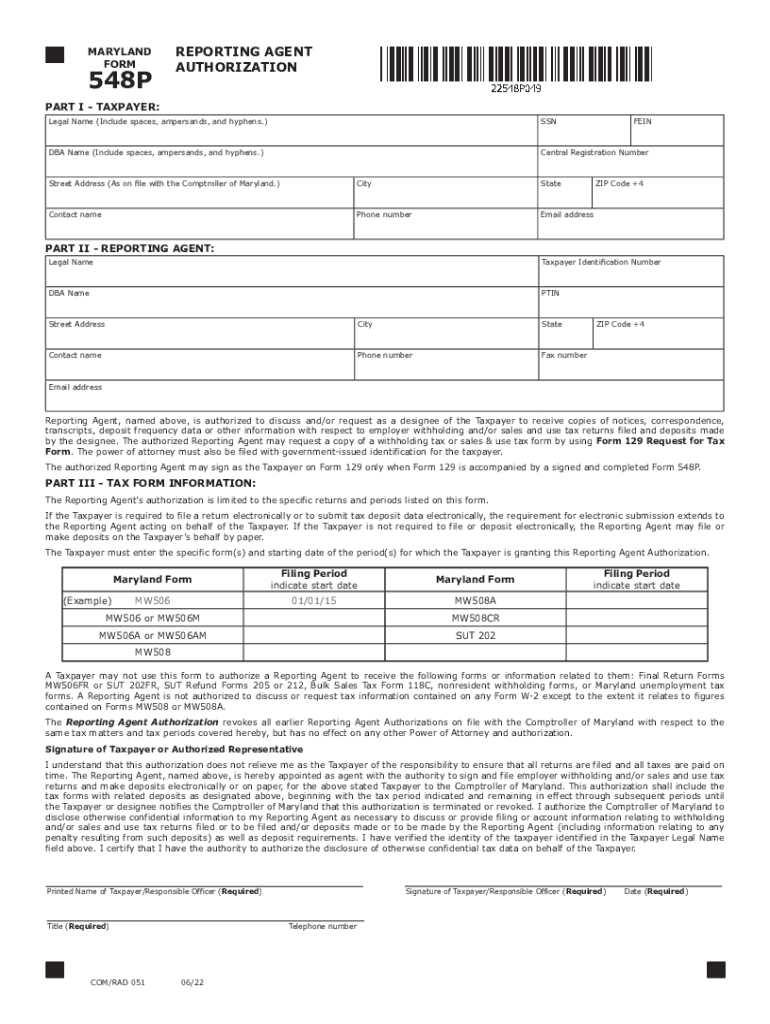

The Maryland Form 548P, also known as the Maryland Reporting Authorization, is a document that allows taxpayers to designate an individual or entity to act on their behalf regarding tax matters. This form is crucial for individuals who want to ensure that their tax information is managed properly, particularly when they are unable to handle their tax affairs directly. By completing this form, the taxpayer grants the designated agent the authority to receive tax information and represent them in communications with the Maryland Comptroller’s office.

Steps to Complete the Maryland Form 548P

Completing the Maryland Form 548P involves several straightforward steps:

- Obtain the Form: Access the Maryland Form 548P from the official Maryland taxes website or relevant tax offices.

- Fill in Taxpayer Information: Provide your name, address, Social Security number, and other identifying details in the designated sections.

- Designate an Agent: Enter the name, address, and contact information of the individual or entity you wish to authorize.

- Sign and Date: Ensure that you sign and date the form to validate it. This step is essential for the form to be considered legally binding.

- Submit the Form: Follow the submission guidelines, which may include mailing the form to the appropriate office or submitting it electronically if available.

Legal Use of the Maryland Form 548P

The Maryland Form 548P is legally binding, provided it is filled out correctly and signed by the taxpayer. This form complies with state regulations regarding power of attorney and authorization for tax matters. It allows the designated agent to access confidential tax information and represent the taxpayer in discussions with tax authorities. It is important to ensure that the agent understands their responsibilities and the extent of their authority as outlined in the form.

Required Documents for Maryland Form 548P

When completing the Maryland Form 548P, you may need to gather certain documents to ensure accurate information is provided:

- Identification: A government-issued ID for the taxpayer and the designated agent may be required.

- Tax Records: Previous tax returns or documentation that supports the taxpayer's identity and tax status.

- Contact Information: Ensure that all contact details for both the taxpayer and the agent are current and accurate.

Form Submission Methods for Maryland Form 548P

The Maryland Form 548P can be submitted through various methods, depending on the preferences of the taxpayer and the requirements of the Maryland Comptroller’s office:

- Mail: Print the completed form and send it to the designated address provided by the Maryland tax authorities.

- Online Submission: If available, utilize the online portal for electronic submission of the form, which may streamline the process.

- In-Person: Visit a local tax office to submit the form directly, ensuring that you have all necessary documentation with you.

Eligibility Criteria for Maryland Form 548P

To use the Maryland Form 548P, certain eligibility criteria must be met:

- Taxpayer Status: The individual completing the form must be a registered taxpayer in Maryland.

- Agent Qualification: The designated agent must be capable of handling tax matters and should be someone the taxpayer trusts.

- Legal Age: Both the taxpayer and the agent must be of legal age to enter into binding agreements.

Penalties for Non-Compliance with Maryland Form 548P

Failure to properly complete and submit the Maryland Form 548P can result in various penalties. Taxpayers may face delays in processing their tax matters, and unauthorized individuals may not be able to access necessary information. Additionally, non-compliance could lead to fines or other legal repercussions, depending on the nature of the oversight. It is essential to ensure that the form is accurately filled out and submitted in a timely manner to avoid these issues.

Quick guide on how to complete power of attorney marylandtaxesgov

Effortlessly Manage POWER OF ATTORNEY Marylandtaxes gov on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can easily locate the required form and securely archive it online. airSlate SignNow equips you with all the necessary tools to produce, modify, and electronically sign your documents quickly and without hassle. Handle POWER OF ATTORNEY Marylandtaxes gov on any device using the airSlate SignNow applications for Android or iOS and enhance your document-centric workflows today.

How to Alter and Electronically Sign POWER OF ATTORNEY Marylandtaxes gov Seamlessly

- Find POWER OF ATTORNEY Marylandtaxes gov and click on Obtain Form to begin.

- Make use of the tools at your disposal to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all information carefully and click on the Completed button to save your modifications.

- Choose how you wish to send your form—via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes necessitating the printing of new document copies. airSlate SignNow fulfills all your document management requirements with just a few clicks from any device you prefer. Modify and electronically sign POWER OF ATTORNEY Marylandtaxes gov and guarantee effective communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct power of attorney marylandtaxesgov

Create this form in 5 minutes!

How to create an eSignature for the power of attorney marylandtaxesgov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Maryland form 548p used for?

The Maryland form 548p is primarily used for reporting the completion of a payment plan for various local taxes. This form helps ensure compliance with state regulations and marks the end of the tax obligation, allowing businesses to maintain good standing with the state of Maryland.

-

How can airSlate SignNow assist with completing the Maryland form 548p?

AirSlate SignNow streamlines the process of completing the Maryland form 548p by offering eSignature capabilities and secure document management. With our easy-to-use platform, you can fill out, sign, and send the form electronically, which saves time and reduces paperwork.

-

Is there a cost associated with using airSlate SignNow for the Maryland form 548p?

Yes, there is a subscription cost associated with using airSlate SignNow, which varies based on the features you select. However, the investment is often worthwhile, as it simplifies your workflow and enhances efficiency when dealing with documents like the Maryland form 548p.

-

What features does airSlate SignNow offer for managing the Maryland form 548p?

AirSlate SignNow offers various features such as eSignature, document templates, and secure cloud storage specifically tailored for forms like the Maryland form 548p. These features enhance accessibility, streamline processes, and ensure that your documents are handled efficiently and securely.

-

Can airSlate SignNow integrate with other software I use for the Maryland form 548p?

Yes, airSlate SignNow provides integration capabilities with numerous software solutions, enabling seamless workflows for preparing and submitting the Maryland form 548p. This ensures that the signing process fits naturally into your existing systems, making compliance hassle-free.

-

What are the benefits of using airSlate SignNow for the Maryland form 548p?

Using airSlate SignNow for the Maryland form 548p offers several benefits, including quicker document turnaround, reduced paper usage, and enhanced security. Additionally, our platform allows for tracking and managing the signing process, ensuring nothing is overlooked.

-

Is training available for using airSlate SignNow with the Maryland form 548p?

Absolutely! AirSlate SignNow provides various resources and training modules to help users effectively navigate the platform, including tips specific to the Maryland form 548p. This training ensures that teams can fully leverage all features for a smooth experience.

Get more for POWER OF ATTORNEY Marylandtaxes gov

- Construction contract cost plus or fixed fee south dakota form

- Painting contract for contractor south dakota form

- Trim carpenter contract for contractor south dakota form

- Fencing contract for contractor south dakota form

- Hvac contract for contractor south dakota form

- Landscape contract for contractor south dakota form

- Commercial contract for contractor south dakota form

- Excavator contract for contractor south dakota form

Find out other POWER OF ATTORNEY Marylandtaxes gov

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple