CA FTB 3587 Fill Out Tax Template Online 2022

What is the California FTB 3587 Payment Voucher?

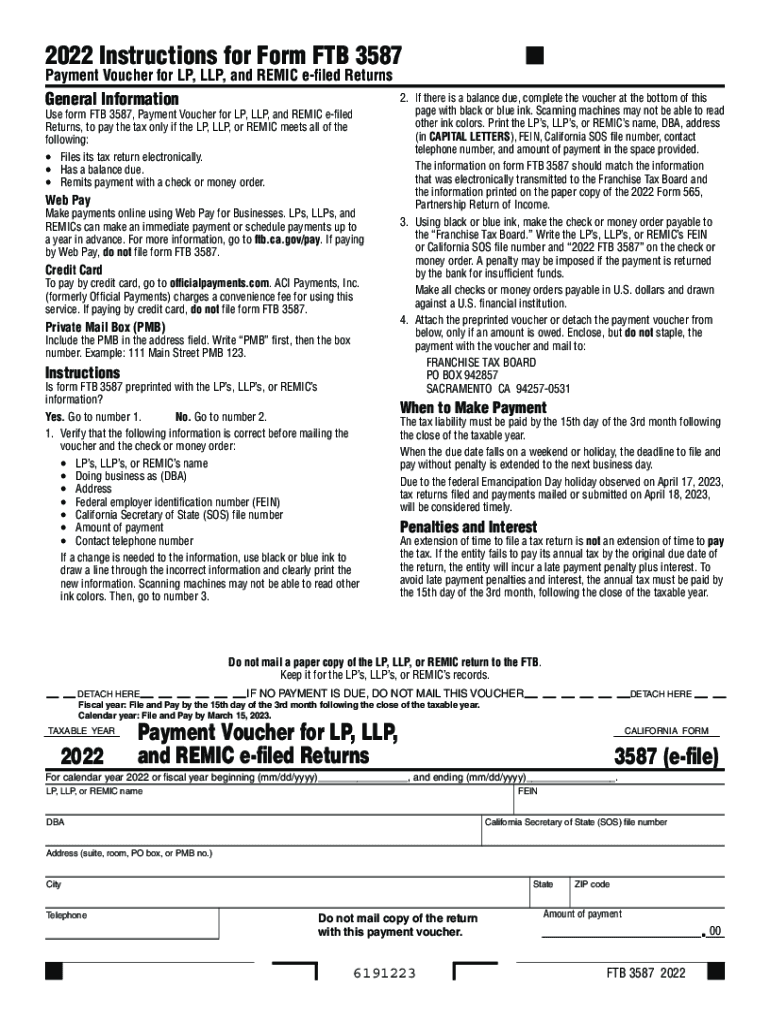

The California FTB 3587 payment voucher is a form used by taxpayers to submit payments for their state taxes. This form is particularly relevant for individuals and businesses who owe taxes to the California Franchise Tax Board (FTB). The voucher serves as a record of payment and is essential for ensuring that payments are properly credited to the taxpayer's account. Understanding the purpose and function of the California payment voucher is crucial for maintaining compliance with state tax obligations.

Steps to Complete the California FTB 3587 Payment Voucher Online

Completing the California FTB 3587 payment voucher online involves several straightforward steps:

- Access the form through a reliable digital platform.

- Enter your personal information, including your name, address, and Social Security number or taxpayer identification number.

- Specify the tax year for which you are making the payment.

- Indicate the amount you are paying and any relevant payment details.

- Review the information for accuracy before submitting the form.

Using an electronic signature tool can enhance the process, ensuring that your submission is secure and legally binding.

Legal Use of the California FTB 3587 Payment Voucher

The California FTB 3587 payment voucher is legally recognized when filled out correctly and submitted according to state guidelines. Compliance with the Electronic Signatures in Global and National Commerce (ESIGN) Act ensures that electronic signatures are valid and enforceable. Utilizing a trusted eSignature solution can help meet these legal requirements, providing a secure method for signing and submitting your payment voucher.

Required Documents for the California FTB 3587 Payment Voucher

When preparing to complete the California FTB 3587 payment voucher, it is essential to have the following documents on hand:

- Your most recent tax return for reference.

- Any notices or correspondence from the California Franchise Tax Board regarding your tax obligations.

- Payment information, such as bank account details if paying electronically.

Having these documents ready will streamline the process and help ensure accurate completion of the voucher.

Filing Deadlines for the California FTB 3587 Payment Voucher

Timeliness is crucial when submitting the California FTB 3587 payment voucher. Payments are typically due on the same date as your tax return, which is generally April 15 for individuals. However, if you are filing for an extension, it is important to check the specific deadlines for submitting your payment voucher to avoid penalties and interest. Staying informed about these dates will help you maintain compliance with state tax regulations.

Form Submission Methods for the California FTB 3587 Payment Voucher

The California FTB 3587 payment voucher can be submitted through various methods:

- Online submission via the California Franchise Tax Board's website.

- Mailing the completed voucher to the designated address provided on the form.

- In-person delivery at local FTB offices, if applicable.

Choosing the most convenient submission method can help ensure that your payment is processed promptly and accurately.

Quick guide on how to complete ca ftb 3587 2020 2022 fill out tax template online

Complete CA FTB 3587 Fill Out Tax Template Online effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily locate the necessary form and securely keep it online. airSlate SignNow provides all the tools you require to create, amend, and electronically sign your documents quickly without delays. Manage CA FTB 3587 Fill Out Tax Template Online on any device with airSlate SignNow Android or iOS applications and enhance any document-focused procedure today.

How to amend and electronically sign CA FTB 3587 Fill Out Tax Template Online with ease

- Locate CA FTB 3587 Fill Out Tax Template Online and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight necessary sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes moments and holds the same legal significance as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your requirements in document management in just a few clicks from any device you prefer. Edit and electronically sign CA FTB 3587 Fill Out Tax Template Online and ensure excellent communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ca ftb 3587 2020 2022 fill out tax template online

Create this form in 5 minutes!

How to create an eSignature for the ca ftb 3587 2020 2022 fill out tax template online

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a payment voucher for California state tax?

A payment voucher for California state tax is a form used by taxpayers to submit their tax payments to the California Franchise Tax Board. This voucher ensures that your payment is appropriately credited to your account, helping you avoid penalties and interest on late payments. Understanding how to fill out and submit this voucher is crucial for maintaining compliance with California tax laws.

-

How can I create a payment voucher for California state tax using airSlate SignNow?

With airSlate SignNow, you can easily create a payment voucher for California state tax by accessing customizable templates that expedite the process. Our user-friendly interface allows for seamless document preparation, enabling you to fill in necessary information quickly. Plus, eSigning capabilities streamline your preparation process, making it hassle-free.

-

What are the benefits of using airSlate SignNow for my payment voucher for California state tax?

Using airSlate SignNow for your payment voucher for California state tax offers several benefits, including easy document management, quick e-signature capabilities, and enhanced security features. This solution not only saves you time but also ensures accuracy in your submissions, helping you avoid future tax issues. Moreover, our platform is designed to meet the needs of both individuals and businesses.

-

Is there a cost associated with generating a payment voucher for California state tax on airSlate SignNow?

Yes, there is a subscription cost associated with using airSlate SignNow to generate a payment voucher for California state tax. However, considering the time saved and potential penalties avoided through accurate submissions, the investment is usually well worth it. We offer various pricing plans to fit different budget needs, making our solution accessible to all users.

-

Can I integrate airSlate SignNow with my accounting software for managing payment vouchers?

Absolutely! airSlate SignNow offers integrations with popular accounting software like QuickBooks and Xero, allowing you to manage your payment voucher for California state tax seamlessly. This integration helps you streamline your tax process and keep track of payments in one consolidated platform, ensuring greater efficiency in your financial management.

-

How secure is the information I submit for my payment voucher for California state tax?

At airSlate SignNow, we prioritize your data security and employ robust encryption measures to protect your information, including details on your payment voucher for California state tax. Our compliance with industry standards ensures that all documents are stored securely and accessed only by authorized users. You can trust us to keep your sensitive information safe.

-

What support does airSlate SignNow offer for questions related to payment vouchers for California state tax?

airSlate SignNow provides comprehensive customer support for any questions you might have regarding your payment voucher for California state tax. Our knowledgeable support team is available via chat, email, or phone to assist you with any inquiries or technical issues. We are dedicated to ensuring you have a smooth experience using our platform.

Get more for CA FTB 3587 Fill Out Tax Template Online

- South dakota individual form

- Warranty deed from husband and wife to corporation south dakota form

- Sd divorce 497326156 form

- Sd llc form

- Commence suit 497326159 form

- Quitclaim deed from husband and wife to llc south dakota form

- Warranty deed from husband and wife to llc south dakota form

- Sd judgment form

Find out other CA FTB 3587 Fill Out Tax Template Online

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament