Instructions for Form FTB 3587 Payment Voucher for LP, LLP, and REMIC E Filed Returns 2024-2026

Understanding the California FTB Payment Voucher for LP, LLP, and REMIC E Filed Returns

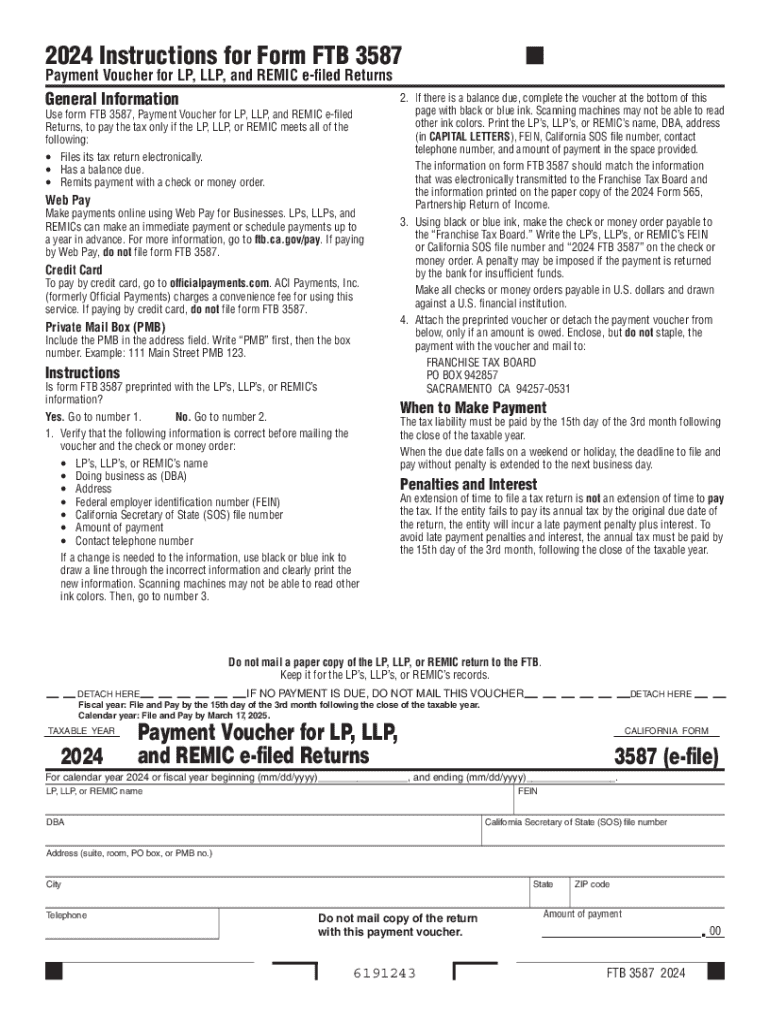

The California FTB payment voucher, specifically Form FTB 3587, is designed for Limited Partnerships (LP), Limited Liability Partnerships (LLP), and Real Estate Mortgage Investment Conduits (REMIC) that are filing their returns electronically. This form facilitates the payment of taxes owed to the California Franchise Tax Board (FTB) and ensures compliance with state tax regulations. It is crucial for entities to accurately complete this form to avoid penalties and ensure timely processing of their tax obligations.

Steps to Complete the California FTB Payment Voucher

Completing the California FTB payment voucher requires careful attention to detail. Here are the essential steps:

- Gather necessary information, including your entity's name, address, and identification number.

- Determine the amount of tax owed based on your filed return.

- Fill out the payment voucher, ensuring all fields are accurately completed.

- Double-check the information for any errors or omissions.

- Sign and date the voucher to validate the submission.

Following these steps will help ensure that your payment is processed without delays.

Legal Use of the California FTB Payment Voucher

The California FTB payment voucher serves a legal purpose in the tax filing process. It acts as a formal request for payment and must be submitted alongside your electronic return. Failure to use the voucher correctly can result in non-compliance with California tax laws, leading to potential penalties or interest on unpaid taxes. It is essential for LPs, LLPs, and REMICs to understand their obligations under California law to avoid legal complications.

Important Filing Deadlines for the California FTB Payment Voucher

Timely submission of the California FTB payment voucher is crucial. The due date typically aligns with the tax return filing deadline. For most entities, this is usually the fifteenth day of the fourth month following the close of the taxable year. For example, if your fiscal year ends on December 31, the payment voucher would be due by April 15 of the following year. Staying informed about these deadlines helps prevent late fees and ensures compliance.

Form Submission Methods for the California FTB Payment Voucher

Entities have several options for submitting the California FTB payment voucher. These methods include:

- Online Submission: Many businesses opt for electronic filing, which is efficient and allows for immediate confirmation of submission.

- Mail: The voucher can be mailed to the FTB office. Ensure it is sent well before the deadline to allow for processing time.

- In-Person: Some entities may choose to deliver the voucher directly to an FTB office for immediate processing.

Selecting the appropriate submission method can streamline the payment process and provide peace of mind.

Key Elements of the California FTB Payment Voucher

Understanding the key elements of the California FTB payment voucher is vital for successful completion. Important components include:

- Entity Information: Accurate identification of the entity filing the voucher.

- Payment Amount: The total amount owed as indicated on the tax return.

- Signature: The authorized representative must sign the voucher to validate the payment.

Ensuring all key elements are correctly filled out minimizes the risk of processing delays or rejections.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form ftb 3587 payment voucher for lp llp and remic e filed returns

Create this form in 5 minutes!

How to create an eSignature for the instructions for form ftb 3587 payment voucher for lp llp and remic e filed returns

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a California FTB payment voucher?

A California FTB payment voucher is a form used by taxpayers to submit payments to the California Franchise Tax Board. It helps ensure that your payments are properly credited to your account. Using airSlate SignNow, you can easily create and send this voucher electronically.

-

How can I obtain a California FTB payment voucher?

You can obtain a California FTB payment voucher directly from the California Franchise Tax Board's website or through airSlate SignNow. Our platform allows you to generate and customize the voucher quickly, ensuring you have the correct information for your payment.

-

What are the benefits of using airSlate SignNow for California FTB payment vouchers?

Using airSlate SignNow for California FTB payment vouchers streamlines the process of sending and signing documents. It offers a user-friendly interface, reduces paperwork, and ensures that your payments are submitted on time. Additionally, it provides tracking features for peace of mind.

-

Is there a cost associated with using airSlate SignNow for California FTB payment vouchers?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be cost-effective for businesses of all sizes. The pricing plans are flexible, allowing you to choose one that fits your needs while ensuring you can efficiently manage your California FTB payment vouchers.

-

Can I integrate airSlate SignNow with other software for managing California FTB payment vouchers?

Absolutely! airSlate SignNow offers integrations with various software applications, making it easy to manage your California FTB payment vouchers alongside your other business tools. This integration helps streamline your workflow and enhances productivity.

-

How secure is the process of sending California FTB payment vouchers through airSlate SignNow?

The security of your documents is a top priority at airSlate SignNow. We utilize advanced encryption and security protocols to ensure that your California FTB payment vouchers are sent safely and securely. You can trust that your sensitive information is protected.

-

Can I track the status of my California FTB payment voucher sent through airSlate SignNow?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your California FTB payment vouchers. You will receive notifications when your documents are viewed and signed, giving you complete visibility throughout the process.

Get more for Instructions For Form FTB 3587 Payment Voucher For LP, LLP, And REMIC E filed Returns

- Al form com 101

- Form x201 download

- Fedgov dnb webform

- Form 16 see rule 34 i

- Description oh it 4nr form

- California state university fullerton international student financial affidavit of support form

- Form i 9 employment eligibility verification christopher newport cnu

- Certified family life educator cfle work experie form

Find out other Instructions For Form FTB 3587 Payment Voucher For LP, LLP, And REMIC E filed Returns

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document