3587 E File Form Fillable Payment Voucher for LP, LLP, and 2021

What is the 2021 form FTB?

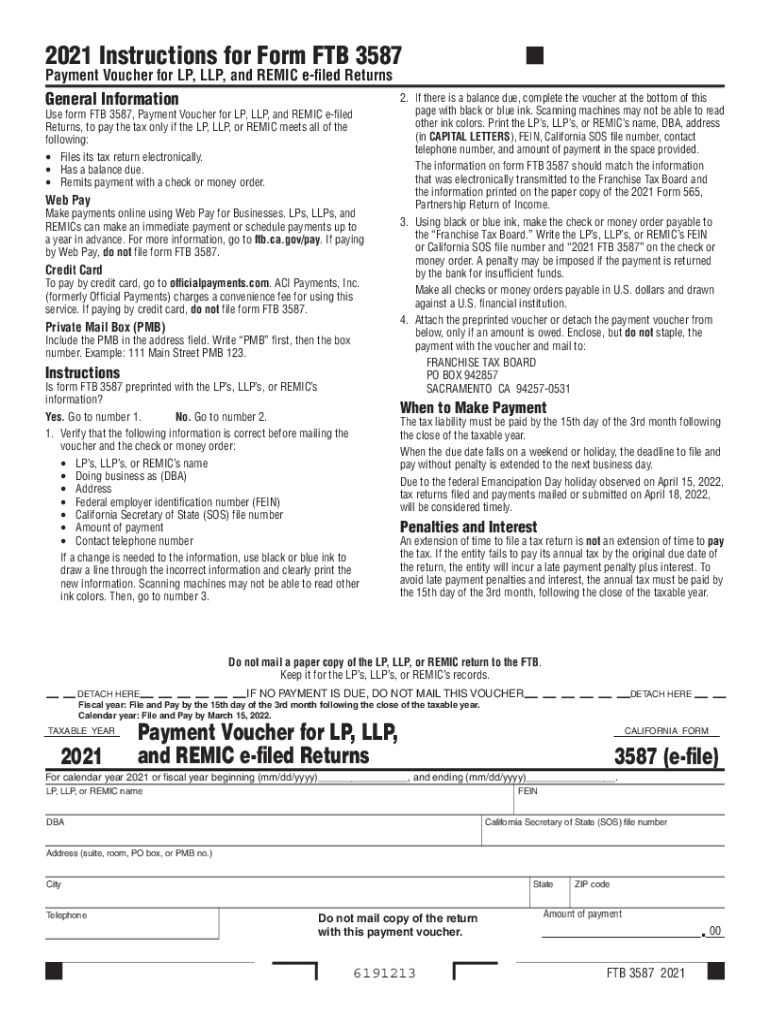

The 2021 form FTB, specifically known as the California FTB payment voucher, is a document used by limited partnerships (LP) and limited liability partnerships (LLP) to report and pay their state taxes. This form is crucial for ensuring compliance with California tax regulations. It serves as a payment voucher for the Franchise Tax Board (FTB) and is part of the broader tax filing process for businesses operating in California.

Steps to complete the 2021 form FTB

Completing the 2021 form FTB involves several key steps to ensure accuracy and compliance. First, gather all necessary financial information related to your partnership's income and expenses. Next, accurately fill in the required fields on the form, including your partnership's name, address, and tax identification number. It is important to calculate the correct payment amount based on your taxable income and any applicable credits. After completing the form, review it thoroughly for any errors before submission.

How to obtain the 2021 form FTB

The 2021 form FTB can be easily obtained online through the California Franchise Tax Board's official website. Users can download a fillable PDF version of the form, which allows for easy electronic completion. Additionally, physical copies may be available at local tax offices or through request from the FTB. Ensure that you are using the correct version of the form for the 2021 tax year to avoid any complications during filing.

Legal use of the 2021 form FTB

The 2021 form FTB is legally binding when filled out correctly and submitted in accordance with California tax laws. It is essential to adhere to all regulations set forth by the Franchise Tax Board to ensure that the form is accepted. This includes providing accurate information and making timely payments. Using a reliable eSignature solution can further enhance the legal validity of the document by ensuring secure and compliant electronic submissions.

Filing deadlines for the 2021 form FTB

Filing deadlines for the 2021 form FTB are critical for compliance. Typically, the due date for submitting the payment voucher aligns with the partnership's tax return deadline. For most partnerships, this is the 15th day of the fourth month following the close of the tax year. It is important to check specific deadlines for your partnership type and ensure that all forms and payments are submitted on time to avoid penalties.

Form Submission Methods for the 2021 form FTB

The 2021 form FTB can be submitted through various methods, including online filing, mail, or in-person submission. Electronic filing is often the most efficient method, allowing for quicker processing and confirmation of receipt. For those opting to mail the form, ensure that it is sent to the correct address provided by the FTB and that it is postmarked by the filing deadline. In-person submissions can be made at designated FTB offices, which may offer additional assistance if needed.

Key elements of the 2021 form FTB

Key elements of the 2021 form FTB include essential information such as the partnership's name, address, and federal employer identification number (EIN). The form also requires details about the total income, deductions, and the resulting tax liability. Additionally, it includes a section for calculating any payments made or credits applied. Understanding these elements is vital for accurate completion and submission of the form.

Quick guide on how to complete 3587 e file form fillable payment voucher for lp llp and

Prepare 3587 e File Form Fillable Payment Voucher For LP, LLP, And seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely keep it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents rapidly without delays. Manage 3587 e File Form Fillable Payment Voucher For LP, LLP, And on any platform using airSlate SignNow applications for Android or iOS and simplify your document-based processes today.

How to modify and eSign 3587 e File Form Fillable Payment Voucher For LP, LLP, And with ease

- Locate 3587 e File Form Fillable Payment Voucher For LP, LLP, And and click Get Form to begin.

- Use the tools provided to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools offered by airSlate SignNow for that specific purpose.

- Create your signature using the Sign tool, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to preserve your updates.

- Choose your preferred method to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors requiring the printing of new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and eSign 3587 e File Form Fillable Payment Voucher For LP, LLP, And and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 3587 e file form fillable payment voucher for lp llp and

Create this form in 5 minutes!

How to create an eSignature for the 3587 e file form fillable payment voucher for lp llp and

The way to generate an electronic signature for your PDF document in the online mode

The way to generate an electronic signature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

The way to create an electronic signature straight from your mobile device

The best way to make an electronic signature for a PDF document on iOS devices

The way to create an electronic signature for a PDF document on Android devices

People also ask

-

What is the 2021 form ftb and why do I need it?

The 2021 form ftb is a crucial tax document used for filing state income tax returns in California. It helps you report your income, deductions, and credits accurately. Ensuring you have the correct form is essential for compliance and to avoid delays in processing your tax return.

-

How can airSlate SignNow assist with the completion of the 2021 form ftb?

airSlate SignNow simplifies the process of filling out the 2021 form ftb by providing templates that are easy to use. With its eSigning capabilities, you can securely sign and send your form directly from the platform. This streamlines your workflow and ensures that your documents are always accessible.

-

What are the pricing options for using airSlate SignNow for the 2021 form ftb?

airSlate SignNow offers flexible pricing plans designed to meet various business needs. Whether you're a small business or a large enterprise, there’s a plan suitable for your requirements. Each plan includes access to features that help you efficiently complete and manage the 2021 form ftb.

-

Is airSlate SignNow secure for handling sensitive documents like the 2021 form ftb?

Yes, airSlate SignNow prioritizes the security of your documents. It employs robust encryption methods and industry-standard security protocols. This ensures that your 2021 form ftb and other sensitive information are protected throughout the eSigning process.

-

Can I integrate airSlate SignNow with other tools when working with the 2021 form ftb?

Yes, airSlate SignNow offers seamless integrations with various platforms such as Google Drive, Dropbox, and more. This allows you to easily access, manage, and share your 2021 form ftb along with other documents across different applications. Integrations enhance your productivity and workflow.

-

What features does airSlate SignNow provide for completing the 2021 form ftb?

airSlate SignNow includes features like customizable templates, a user-friendly interface, and advanced eSignature options geared towards completing the 2021 form ftb. You can also track document status, set reminders, and automate workflows to enhance efficiency. These features make the task of completing tax forms much simpler.

-

Why should I choose airSlate SignNow for my 2021 form ftb over other solutions?

Choosing airSlate SignNow means opting for a cost-effective and user-friendly solution that empowers you to manage the 2021 form ftb with ease. Its comprehensive features and secure environment set it apart from other platforms. Plus, the ability to streamline document processes saves you valuable time and reduces stress during tax season.

Get more for 3587 e File Form Fillable Payment Voucher For LP, LLP, And

- Louisiana western district bankruptcy guide and forms package for chapters 7 or 13 louisiana

- Bill of sale with warranty by individual seller louisiana form

- Bill of sale with warranty for corporate seller louisiana form

- Bill of sale without warranty by individual seller louisiana form

- Bill of sale without warranty by corporate seller louisiana form

- Motion valuation form

- Louisiana notice form 497309238

- Reaffirmation agreement louisiana form

Find out other 3587 e File Form Fillable Payment Voucher For LP, LLP, And

- eSign Missouri Work Order Computer

- eSign Hawaii Electrical Services Contract Safe

- eSign Texas Profit Sharing Agreement Template Safe

- eSign Iowa Amendment to an LLC Operating Agreement Myself

- eSign Kentucky Amendment to an LLC Operating Agreement Safe

- eSign Minnesota Affidavit of Identity Now

- eSign North Dakota Affidavit of Identity Free

- Help Me With eSign Illinois Affidavit of Service

- eSign North Dakota Affidavit of Identity Simple

- eSign Maryland Affidavit of Service Now

- How To eSign Hawaii Affidavit of Title

- How Do I eSign New Mexico Affidavit of Service

- How To eSign Texas Affidavit of Title

- How Do I eSign Texas Affidavit of Service

- eSign California Cease and Desist Letter Online

- eSign Colorado Cease and Desist Letter Free

- How Do I eSign Alabama Hold Harmless (Indemnity) Agreement

- eSign Connecticut Hold Harmless (Indemnity) Agreement Mobile

- eSign Hawaii Hold Harmless (Indemnity) Agreement Mobile

- Help Me With eSign Hawaii Hold Harmless (Indemnity) Agreement