Application of Net Operating Loss for Iowa E Form RS Login 2022-2026

Understanding the Application of Net Operating Loss for Iowa

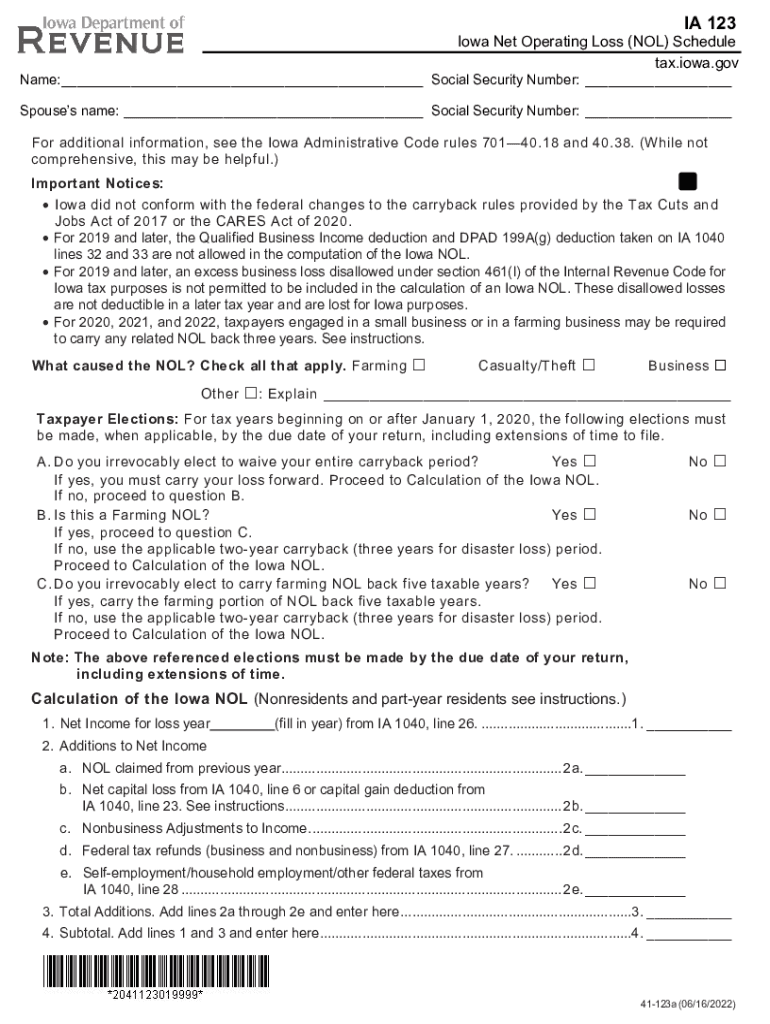

The Application of Net Operating Loss (NOL) for Iowa is a crucial tool for taxpayers who have incurred losses in their business operations. This form allows eligible individuals and businesses to offset taxable income in future years, effectively reducing their tax liability. By applying the NOL, taxpayers can carry forward losses to subsequent tax years, which can lead to significant tax savings. Understanding the specific rules and regulations governing the use of this form is essential for maximizing its benefits.

Steps to Complete the Application of Net Operating Loss for Iowa

Completing the Application of Net Operating Loss for Iowa involves several key steps:

- Gather necessary financial documents, including income statements and expense reports.

- Calculate the net operating loss by subtracting total expenses from total income for the applicable tax year.

- Fill out the form accurately, ensuring all relevant sections are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed application either online or by mail, depending on your preference.

Eligibility Criteria for the Application of Net Operating Loss for Iowa

To qualify for the Application of Net Operating Loss for Iowa, taxpayers must meet specific eligibility criteria. Generally, the applicant must be a business entity or individual who has experienced a net operating loss during the tax year. Additionally, the losses must be derived from business activities that are recognized under Iowa tax law. Understanding these criteria is vital to ensure that the application is valid and accepted by the state tax authority.

Required Documents for the Application of Net Operating Loss for Iowa

When applying for the Net Operating Loss in Iowa, several documents are required to support your application:

- Income statements for the years in question.

- Expense reports detailing all business-related costs.

- Previous tax returns, which may provide context for the losses claimed.

- Any additional documentation that substantiates the business activities and losses.

Legal Use of the Application of Net Operating Loss for Iowa

The legal use of the Application of Net Operating Loss for Iowa is governed by state tax laws. It is important for taxpayers to ensure compliance with these regulations to avoid penalties. The application must be filed within the designated timeframe and adhere to all guidelines set forth by the Iowa Department of Revenue. Understanding these legal parameters helps protect taxpayers from potential issues during the filing process.

Filing Deadlines for the Application of Net Operating Loss for Iowa

Filing deadlines for the Application of Net Operating Loss in Iowa are critical for ensuring timely submission. Generally, the application must be filed by the tax return due date for the year in which the loss was incurred. This is typically April 30 for individuals, but may vary for businesses based on their fiscal year. Staying informed about these deadlines is essential to avoid missing the opportunity to utilize the NOL.

Quick guide on how to complete application of net operating loss for iowa e form rs login

Complete Application Of Net Operating Loss For Iowa E Form RS Login effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect eco-conscious alternative to traditional printed and signed documents, as you can easily locate the right form and securely keep it online. airSlate SignNow provides all the resources you need to create, modify, and electronically sign your documents swiftly without delays. Handle Application Of Net Operating Loss For Iowa E Form RS Login on any platform with airSlate SignNow Android or iOS applications and enhance any document-related process today.

The simplest way to modify and electronically sign Application Of Net Operating Loss For Iowa E Form RS Login with ease

- Locate Application Of Net Operating Loss For Iowa E Form RS Login and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to secure your changes.

- Select how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of missing or lost documents, tedious form searches, or errors that necessitate reprinting document copies. airSlate SignNow meets your needs in document management in just a few clicks from any device you prefer. Alter and electronically sign Application Of Net Operating Loss For Iowa E Form RS Login and ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct application of net operating loss for iowa e form rs login

Create this form in 5 minutes!

How to create an eSignature for the application of net operating loss for iowa e form rs login

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ia 123 and how does it relate to airSlate SignNow?

ia 123 is a powerful feature within airSlate SignNow that streamlines the document signing process. By leveraging this functionality, businesses can easily send and manage documents for eSignature, enhancing productivity and efficiency. The integration of ia 123 ensures a seamless user experience for all signers.

-

How much does airSlate SignNow cost with the ia 123 feature?

airSlate SignNow offers competitive pricing plans that include the ia 123 feature. Depending on your business needs, you can choose a plan that fits your budget while gaining access to a wide range of eSignature tools. Visit our pricing page to find a plan that best suits your requirements.

-

What are the key features of airSlate SignNow's ia 123 functionality?

The ia 123 feature in airSlate SignNow includes advanced eSignature capabilities, document templates, and workflow automation. This allows users to efficiently create, send, and track documents while ensuring accuracy and compliance. The intuitive interface makes it easy for anyone to use, regardless of their technical background.

-

Can ia 123 be integrated with other tools and platforms?

Yes, ia 123 seamlessly integrates with various popular applications, enhancing your existing workflows. Whether you use CRM systems, cloud storage solutions, or project management tools, airSlate SignNow facilitates smooth integrations to streamline your document processes. This flexibility helps businesses maximize productivity.

-

What benefits does using ia 123 provide for businesses?

Utilizing ia 123 empowers businesses to enhance their document management processes by saving time and reducing errors. The automated workflows ensure that documents are delivered, signed, and filed in a timely manner, promoting efficiency in operations. Moreover, this feature supports remote work, making it easier for teams to collaborate.

-

Is airSlate SignNow secure and compliant when using ia 123?

Absolutely! airSlate SignNow complies with industry standards for data security and privacy while using the ia 123 feature. We employ advanced encryption and security protocols to protect your documents and signatures, ensuring compliance with regulations such as GDPR and HIPAA. Your data's integrity is our top priority.

-

How can I get started with airSlate SignNow and ia 123?

Getting started with airSlate SignNow and the ia 123 feature is simple. You can sign up for a free trial on our website to explore the platform's capabilities. Once registered, you can start creating, sending, and signing documents right away, experiencing firsthand how ia 123 simplifies your workflow.

Get more for Application Of Net Operating Loss For Iowa E Form RS Login

- Letter from tenant to landlord for failure of landlord to return all prepaid and unearned rent and security recoverable by 497326188 form

- Letter from tenant to landlord for failure of landlord to comply with building codes affecting health and safety or resulting 497326189 form

- Letter from landlord to tenant where tenant complaint was caused by the deliberate or negligent act of tenant or tenants guest 497326190 form

- Letter from landlord to tenant for failure to keep premises as clean and safe as condition of premises permits remedy or lease 497326191 form

- South dakota in rules form

- South dakota landlord form

- South dakota landlord 497326194 form

- Letter from landlord to tenant as notice to tenant of tenants disturbance of neighbors peaceful enjoyment to remedy or lease 497326195 form

Find out other Application Of Net Operating Loss For Iowa E Form RS Login

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form