Filing a State Income Tax Return Berkeley International Office 2022-2026

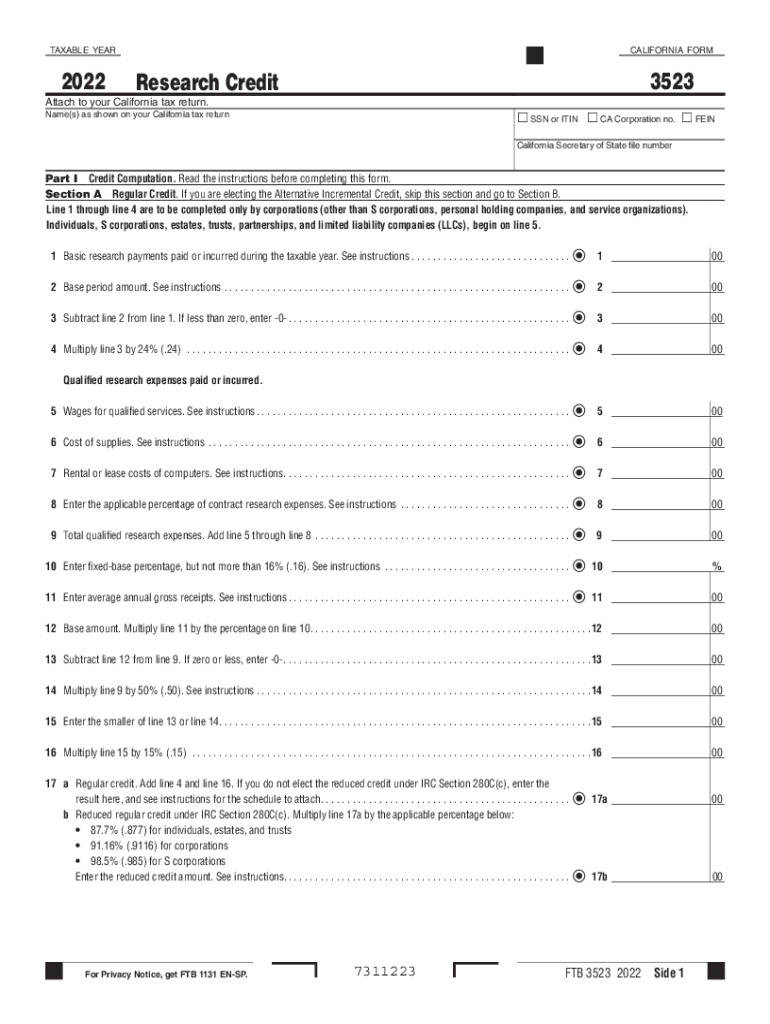

What is Form 3523?

Form 3523, also known as the California Research and Development (R&D) Credit form, is utilized by businesses in California to claim tax credits for qualified research activities. This form is specifically designed to help companies offset their tax liabilities by providing a financial incentive for investing in research and development. The credits are available to various business entities that engage in innovative activities aimed at improving their products or services.

Key Elements of Form 3523

Understanding the essential components of Form 3523 is crucial for accurate completion. Key elements include:

- Qualified Research Activities: Activities that meet specific criteria set by the California Franchise Tax Board.

- Qualified Research Expenses: Costs associated with the research activities, including wages, supplies, and contract research expenses.

- Credit Calculation: The formula used to determine the amount of credit available based on the qualified expenses incurred during the taxable year.

Steps to Complete Form 3523

Completing Form 3523 involves several steps to ensure accuracy and compliance:

- Gather documentation of all qualified research activities and expenses.

- Fill out the form, providing detailed information about your business and the research conducted.

- Calculate the credit by applying the appropriate formulas to your qualified expenses.

- Review the completed form for accuracy and completeness before submission.

Filing Deadlines for Form 3523

Timely submission of Form 3523 is essential to ensure eligibility for the tax credit. The filing deadline typically aligns with the due date of the California state income tax return. Businesses should be aware of any extensions that may apply and plan accordingly to avoid penalties.

Eligibility Criteria for Form 3523

To qualify for the R&D tax credit using Form 3523, businesses must meet specific eligibility criteria:

- The business must be engaged in qualified research activities as defined by California tax law.

- The expenses claimed must be directly related to the research activities performed.

- The business must have a valid California tax identification number.

Digital vs. Paper Version of Form 3523

Form 3523 can be filed either digitally or on paper. The digital version offers several advantages, including faster processing times and reduced likelihood of errors. Businesses are encouraged to use electronic filing methods to streamline their submission process and ensure compliance with state regulations.

Quick guide on how to complete filing a state income tax return berkeley international office

Complete Filing A State Income Tax Return Berkeley International Office with ease on any device

Managing documents online has become increasingly popular among businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Manage Filing A State Income Tax Return Berkeley International Office on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest way to edit and eSign Filing A State Income Tax Return Berkeley International Office effortlessly

- Obtain Filing A State Income Tax Return Berkeley International Office and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Mark important sections of the documents or redact sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature with the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Decide how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Forget about misplaced or lost documents, time-consuming form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Filing A State Income Tax Return Berkeley International Office and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct filing a state income tax return berkeley international office

Create this form in 5 minutes!

How to create an eSignature for the filing a state income tax return berkeley international office

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the cost of using airSlate SignNow for the 3523 solution?

The pricing for airSlate SignNow's 3523 solution is designed to be cost-effective, providing various plans to suit different business needs. You can choose from monthly or annual subscriptions, and the affordable pricing ensures that businesses of all sizes can take advantage of the powerful eSigning features.

-

What features does airSlate SignNow offer in relation to the 3523?

airSlate SignNow's 3523 features include a user-friendly interface, customizable templates, and robust security measures. These tools allow users to streamline their document management processes and enhance efficiency, making it an ideal choice for businesses looking to simplify eSigning.

-

How does airSlate SignNow enhance document security in the 3523 context?

With airSlate SignNow's 3523 solution, document security is a top priority. The platform implements advanced encryption standards and complies with industry regulations to safeguard your documents, ensuring that sensitive information remains protected throughout the signing process.

-

Can I integrate airSlate SignNow with other software using the 3523 option?

Yes, airSlate SignNow's 3523 option supports integrations with a variety of third-party applications, enhancing your workflow. This compatibility allows users to connect with CRM software, cloud storage services, and other productivity tools, making it easier to manage documents seamlessly.

-

What are the benefits of using airSlate SignNow's 3523 service for my business?

The benefits of choosing airSlate SignNow's 3523 service include increased productivity, reduced turnaround times, and improved compliance. By simplifying the eSigning process, businesses can focus on their core operations while ensuring that all documents are handled efficiently and securely.

-

How can I get started with airSlate SignNow's 3523 solution?

Getting started with airSlate SignNow's 3523 solution is easy. Simply visit our website, choose a plan that suits your needs, and sign up for an account. Once registered, you can start sending and eSigning documents right away, streamlining your workflow in no time.

-

Is there a mobile app for airSlate SignNow's 3523 service?

Absolutely! airSlate SignNow offers a mobile app for the 3523 service, allowing users to send, sign, and manage documents from anywhere. This flexibility ensures that you can handle important tasks on the go, making it easier to keep your business running smoothly.

Get more for Filing A State Income Tax Return Berkeley International Office

- South dakota notice 497326196 form

- South dakota law form

- Letter from tenant to landlord containing notice to landlord to withdraw improper rent increase due to violation of rent 497326198 form

- Letter from tenant to landlord about insufficient notice of rent increase south dakota form

- Letter from tenant to landlord containing notice to landlord to withdraw improper rent increase during lease south dakota form

- Letter from landlord to tenant about intent to increase rent and effective date of rental increase south dakota form

- Letter from landlord to tenant as notice to tenant to repair damage caused by tenant south dakota form

- Letter from tenant to landlord containing notice to landlord to withdraw retaliatory rent increase south dakota form

Find out other Filing A State Income Tax Return Berkeley International Office

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document