Schedule S Other State Tax Credit EFile 2022

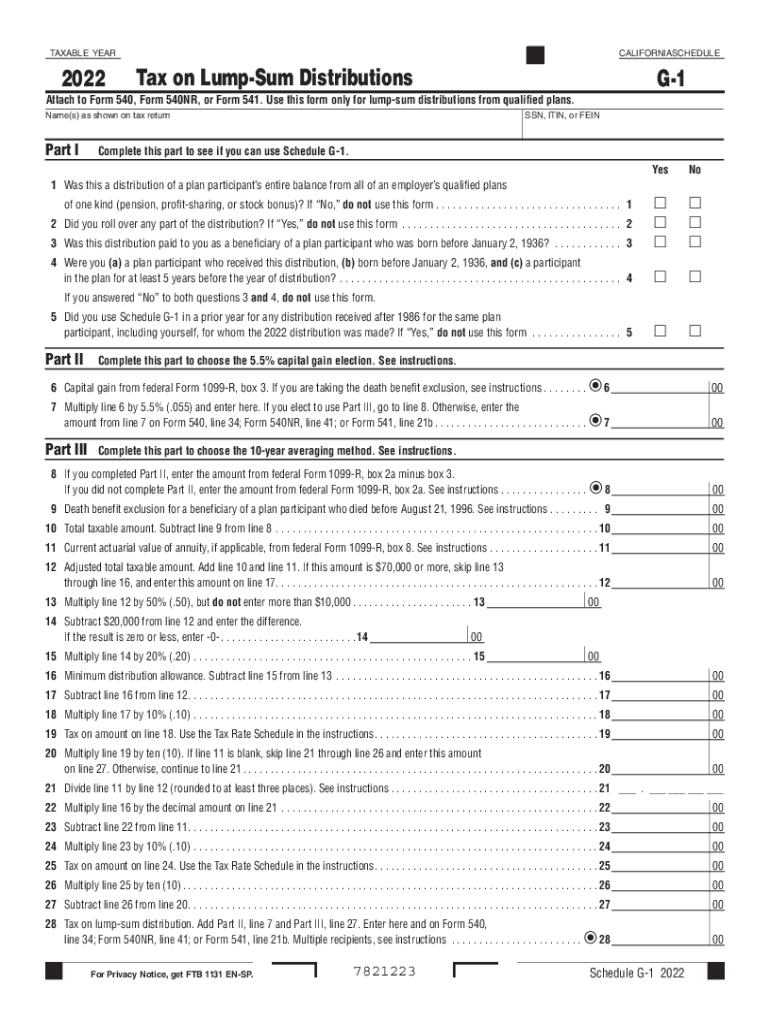

What is the Schedule G1?

The Schedule G1 is a tax form used in California for reporting lump-sum distributions from retirement plans. It is essential for individuals who have received distributions that may be subject to special tax treatment. The form helps taxpayers calculate the tax implications of such distributions, ensuring compliance with state tax laws. Understanding the Schedule G1 is crucial for accurate tax reporting and to avoid potential penalties.

Steps to Complete the Schedule G1

Filling out the Schedule G1 involves several key steps:

- Gather necessary documents, including your retirement plan statements and any prior tax returns that may provide relevant information.

- Determine the total amount of your lump-sum distribution, including any taxable and non-taxable portions.

- Complete the form by entering your personal information, such as your name, address, and Social Security number.

- Report the total distribution amount and calculate the taxable amount based on the applicable tax rules.

- Review the completed form for accuracy before submission.

Eligibility Criteria for Using the Schedule G1

To use the Schedule G1, taxpayers must meet specific eligibility criteria. This includes having received a lump-sum distribution from a qualified retirement plan, such as a 401(k) or pension plan. Additionally, the distribution must meet certain conditions outlined by the California Franchise Tax Board, including the timing and nature of the distribution. Understanding these criteria is vital to ensure proper use of the form.

Legal Use of the Schedule G1

The Schedule G1 is legally valid when completed accurately and submitted in compliance with California tax laws. Electronic signatures on the form are accepted, provided they meet the requirements set forth by the Electronic Signatures in Global and National Commerce (ESIGN) Act and other relevant regulations. Ensuring that the form is filled out correctly and submitted on time is essential to avoid legal complications.

Filing Deadlines for the Schedule G1

Filing deadlines for the Schedule G1 align with the general tax filing deadlines in California. Typically, taxpayers must submit their forms by April 15 of the tax year, unless an extension has been granted. It is important to stay informed about any changes to these deadlines, as failing to file on time can result in penalties and interest on unpaid taxes.

Required Documents for the Schedule G1

When completing the Schedule G1, taxpayers need to have several documents on hand, including:

- Retirement plan distribution statements detailing the amounts received.

- Previous tax returns for reference on taxable income.

- Any documentation related to the retirement plan that may affect the tax treatment of the distribution.

Examples of Using the Schedule G1

Examples of situations where the Schedule G1 is applicable include:

- A taxpayer who receives a lump-sum distribution from a 401(k) after retirement.

- An individual who withdraws funds from a pension plan due to financial hardship.

- A person who rolls over a portion of their retirement account into another qualified plan and needs to report the taxable portion.

Quick guide on how to complete 2020 schedule s other state tax credit efile

Complete Schedule S Other State Tax Credit EFile effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an optimal eco-friendly substitute for conventional printed and signed documents, as you can easily find the appropriate form and securely archive it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Schedule S Other State Tax Credit EFile on any platform with airSlate SignNow Android or iOS applications and enhance any document-related procedure today.

The simplest method to modify and eSign Schedule S Other State Tax Credit EFile without hassle

- Find Schedule S Other State Tax Credit EFile and then click Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight important sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes moments and has the same legal validity as a traditional handwritten signature.

- Review the information and then click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or mislaid files, cumbersome form searching, or errors that necessitate printing new document copies. airSlate SignNow manages all your requirements in document handling with just a few clicks from your chosen device. Modify and eSign Schedule S Other State Tax Credit EFile and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 schedule s other state tax credit efile

Create this form in 5 minutes!

How to create an eSignature for the 2020 schedule s other state tax credit efile

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the best way to schedule g1 using airSlate SignNow?

To schedule g1 with airSlate SignNow, simply log in to your account and navigate to the scheduling feature. You can set times for document signing and send reminders to recipients. This ensures that your documents are signed timely, enhancing overall workflow efficiency.

-

Is there a cost associated with scheduling g1 documents?

airSlate SignNow offers a range of pricing plans tailored to meet diverse business needs. The cost of scheduling g1 documents typically varies based on the features you choose. Check our pricing page for detailed information on plans that suit your budget.

-

What features does airSlate SignNow provide to optimize scheduling g1?

airSlate SignNow includes powerful features like automated reminders, customizable templates, and real-time tracking for scheduling g1. These tools streamline the signing process and help you manage your documents efficiently, providing a better experience for you and your clients.

-

Can I integrate airSlate SignNow with other applications to schedule g1?

Yes, airSlate SignNow seamlessly integrates with various applications like Google Drive, Salesforce, and Dropbox. This integration allows you to manage your schedules more effectively, ensuring that your g1 documents align with other business operations.

-

How can I track the status of my scheduled g1 documents?

You can easily track the status of your scheduled g1 documents through the airSlate SignNow dashboard. The platform provides real-time updates, so you know exactly when documents are viewed and signed, enabling you to follow up appropriately.

-

What benefits can businesses expect from scheduling g1 with airSlate SignNow?

By scheduling g1 with airSlate SignNow, businesses can expect improved efficiency, reduced turnaround time, and enhanced document management. The user-friendly interface allows for quick scheduling, which can lead to faster decision-making and increased productivity.

-

Is there a mobile app for scheduling g1 with airSlate SignNow?

Yes, airSlate SignNow offers a mobile app that allows you to schedule g1 documents on the go. With the app, you can easily send and sign documents from your mobile device, giving you the flexibility to manage your workflows anytime, anywhere.

Get more for Schedule S Other State Tax Credit EFile

- Residential rental lease agreement south dakota form

- Tenant welcome letter south dakota form

- Warning of default on commercial lease south dakota form

- Warning of default on residential lease south dakota form

- Landlord tenant closing statement to reconcile security deposit south dakota form

- South dakota marriage form

- Name change notification form south dakota

- Commercial building or space lease south dakota form

Find out other Schedule S Other State Tax Credit EFile

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document