California Form 540 Schedule G 1 Tax on Lump Sum 2020

What is the California Form 540 Schedule G 1 Tax On Lump Sum

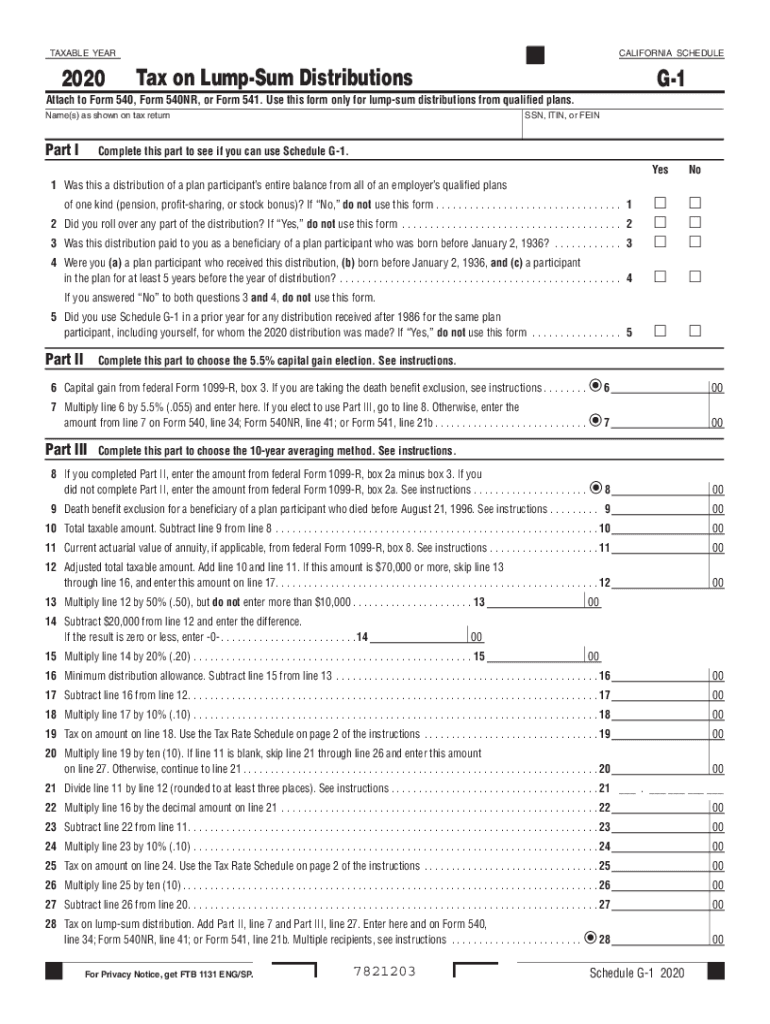

The California Form 540 Schedule G 1 is a tax form used to report tax on lump-sum distributions received from retirement plans or other qualified plans. This form is specifically designed for individuals who have received a one-time payment that may be subject to special tax treatment. Understanding this form is essential for ensuring compliance with California tax laws and accurately reporting income.

How to use the California Form 540 Schedule G 1 Tax On Lump Sum

Using the California Form 540 Schedule G 1 involves several steps. First, gather all necessary documents related to your lump-sum distribution, including the original plan documents and any tax statements. Next, complete the form by accurately entering the amount of the distribution and any applicable tax rates. It is crucial to follow the instructions carefully to ensure that your filing is correct and complete.

Steps to complete the California Form 540 Schedule G 1 Tax On Lump Sum

Completing the California Form 540 Schedule G 1 requires attention to detail. Start by filling out your personal information at the top of the form. Then, report the total amount of your lump-sum distribution in the designated section. Make sure to calculate the tax owed based on the specific rates applicable to your situation. Finally, review the form for accuracy before submitting it to the California Franchise Tax Board.

Legal use of the California Form 540 Schedule G 1 Tax On Lump Sum

The legal use of the California Form 540 Schedule G 1 is governed by state tax laws. This form must be used correctly to report any lump-sum distributions to avoid penalties or legal issues. It is essential to ensure that all information provided is accurate and that the form is submitted by the appropriate deadline to maintain compliance with California tax regulations.

Key elements of the California Form 540 Schedule G 1 Tax On Lump Sum

Key elements of the California Form 540 Schedule G 1 include personal identification information, the total amount of the lump-sum distribution, and the calculation of tax owed. Additionally, the form requires specific details about the source of the distribution and any deductions or credits that may apply. Ensuring that all these elements are correctly filled out is vital for a successful filing.

Filing Deadlines / Important Dates

Filing deadlines for the California Form 540 Schedule G 1 typically align with the general tax filing deadlines in California. It is essential to be aware of these dates to avoid late filing penalties. Generally, the deadline for submitting your state tax return is April 15, unless extended due to weekends or holidays. Always check for any updates or changes to these deadlines each tax year.

Quick guide on how to complete california form 540 schedule g 1 tax on lump sum

Complete California Form 540 Schedule G 1 Tax On Lump Sum effortlessly on any device

Digital document management has gained traction with businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides all the essential tools to create, modify, and eSign your documents quickly without delays. Manage California Form 540 Schedule G 1 Tax On Lump Sum on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to modify and eSign California Form 540 Schedule G 1 Tax On Lump Sum with ease

- Locate California Form 540 Schedule G 1 Tax On Lump Sum and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of the documents or obscure sensitive information with the tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form: via email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign California Form 540 Schedule G 1 Tax On Lump Sum and guarantee excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct california form 540 schedule g 1 tax on lump sum

Create this form in 5 minutes!

How to create an eSignature for the california form 540 schedule g 1 tax on lump sum

The best way to create an electronic signature for your PDF document online

The best way to create an electronic signature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The best way to generate an electronic signature right from your smart phone

The way to create an electronic signature for a PDF document on iOS

The best way to generate an electronic signature for a PDF on Android OS

People also ask

-

What is Schedule G 1 in relation to airSlate SignNow?

Schedule G 1 refers to a specific form used for reporting certain information related to eSigning and document management. With airSlate SignNow, users can easily prepare and send documents that may require Schedule G 1, streamlining the compliance process.

-

How can airSlate SignNow help me efficiently complete Schedule G 1?

airSlate SignNow offers a user-friendly interface that allows you to quickly fill out and eSign Schedule G 1 forms. Our platform simplifies the entire process, ensuring that you can focus on completing your tasks without the hassle of manual paperwork.

-

Is there a cost associated with using airSlate SignNow for Schedule G 1?

Yes, airSlate SignNow provides various pricing plans tailored to meet your needs, including options for businesses that frequently manage Schedule G 1 forms. Contact our sales team to find the best plan that covers your eSigning requirements at an affordable rate.

-

What features does airSlate SignNow offer for managing Schedule G 1?

Our platform includes features like document templates, signature tracking, and integration capabilities that help you manage Schedule G 1 forms effectively. You can customize your documents and streamline the signing process, ensuring compliance and efficiency.

-

Can I integrate airSlate SignNow with other software to manage Schedule G 1?

Absolutely! airSlate SignNow integrates seamlessly with various software solutions, enhancing your workflow while managing Schedule G 1 forms. This allows you to synchronize your documents and expedite your signing processes within your existing systems.

-

What are the benefits of using airSlate SignNow for Schedule G 1 over traditional paper methods?

Using airSlate SignNow for Schedule G 1 signNowly reduces the time and effort needed for document management. The digital solution not only enhances collaboration but also eliminates the risks associated with paper documents, such as loss or damage.

-

Is it easy to share Schedule G 1 documents with clients using airSlate SignNow?

Yes, sharing Schedule G 1 documents with clients is simple using airSlate SignNow. You can send documents directly through our platform, enabling easy access for recipients and allowing them to review and eSign quickly.

Get more for California Form 540 Schedule G 1 Tax On Lump Sum

- Certificate origin trade agreement form

- T1178 form

- Fin 360 international fuel tax agreement ifta use this form to file your ifta return and make a payment

- Id990a form

- Sbi outward remittance form

- Bajaj allianz insurance proposal form

- First of its kind certificate course on cardiovascular form

- Certificate course in cardiovascular disease and stroke cccs form

Find out other California Form 540 Schedule G 1 Tax On Lump Sum

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now