PDF Instructions for Form it 205 Fiduciary Income Tax Return Tax Year 2021

Understanding the California Schedule G-1 Form

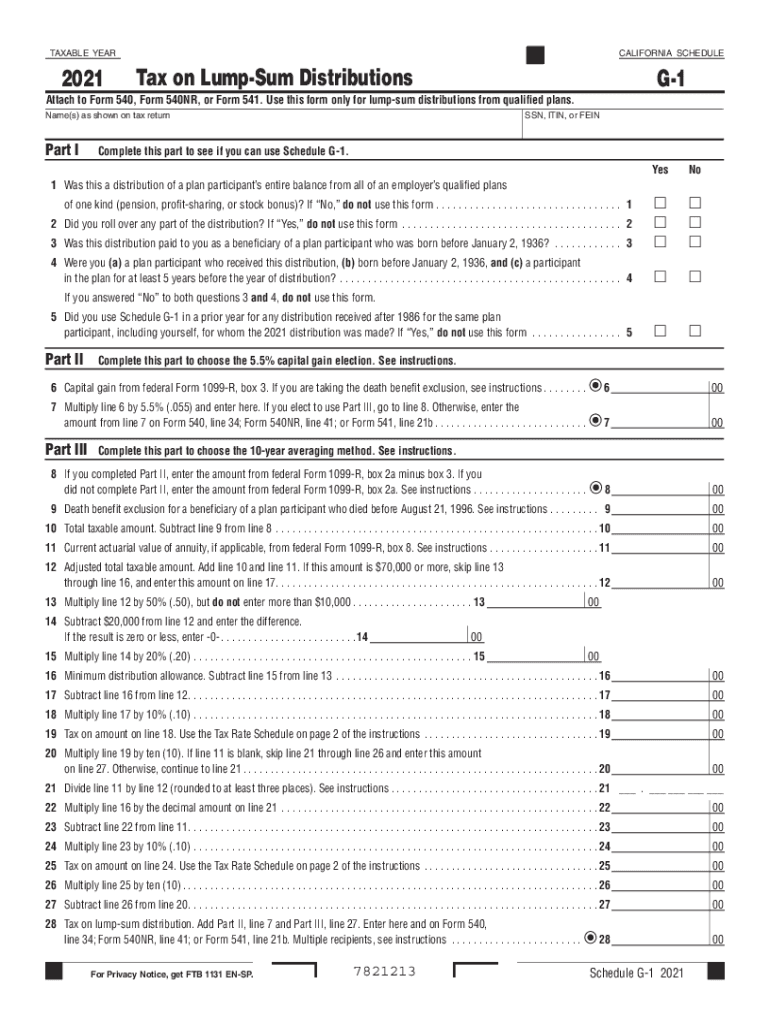

The California Schedule G-1 is a tax form used to report certain distributions from estates and trusts. This form is essential for fiduciaries who need to disclose income distributions to beneficiaries. Understanding its purpose and requirements is crucial for accurate tax reporting. The Schedule G-1 provides a detailed account of the distributions made during the tax year, ensuring compliance with California tax regulations.

Steps to Complete the California Schedule G-1

Completing the California Schedule G-1 involves several key steps:

- Gather necessary documents: Collect all relevant financial records, including trust or estate income statements and beneficiary information.

- Fill out the form: Input the required information, including the total distributions made during the year and the names of beneficiaries.

- Review for accuracy: Double-check all entries to ensure that the information is correct and complete.

- Submit the form: File the completed Schedule G-1 with your California tax return by the designated deadline.

Legal Use of the California Schedule G-1

The California Schedule G-1 is legally recognized as a binding document for tax reporting purposes. It must be filled out accurately to avoid penalties or complications with the California Franchise Tax Board. Proper completion of this form ensures that fiduciaries fulfill their legal obligations in reporting distributions and that beneficiaries receive the correct tax treatment for their income.

Filing Deadlines for the California Schedule G-1

Filing deadlines for the California Schedule G-1 align with the general tax return deadlines. Typically, fiduciaries must submit the form by April 15 of the following year, unless an extension has been granted. It is important to stay informed about any changes in deadlines to ensure timely submission and avoid late fees.

Required Documents for the California Schedule G-1

To complete the California Schedule G-1, certain documents are necessary:

- Trust or estate tax returns for the year.

- Statements detailing income distributions made to beneficiaries.

- Any relevant documentation supporting the amounts reported on the form.

Penalties for Non-Compliance with the California Schedule G-1

Failure to file the California Schedule G-1 accurately and on time can result in penalties. These may include fines imposed by the California Franchise Tax Board and potential interest on unpaid taxes. It is essential for fiduciaries to understand these consequences to ensure compliance and avoid unnecessary financial burdens.

Quick guide on how to complete pdf instructions for form it 205 fiduciary income tax return tax year

Effortlessly Prepare PDF Instructions For Form IT 205 Fiduciary Income Tax Return Tax Year on Any Device

Digital document management has gained signNow traction among companies and individuals alike. It presents an ideal environmentally friendly substitute for traditional printed and signed documents, as it allows you to locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to generate, alter, and electronically sign your documents swiftly without any hindrances. Manage PDF Instructions For Form IT 205 Fiduciary Income Tax Return Tax Year on any device with airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

The most effective way to edit and electronically sign PDF Instructions For Form IT 205 Fiduciary Income Tax Return Tax Year seamlessly

- Obtain PDF Instructions For Form IT 205 Fiduciary Income Tax Return Tax Year and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Select important sections of your documents or conceal sensitive information using tools designed specifically for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose your preferred method for sharing your form, such as email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new document versions. airSlate SignNow addresses your document management needs with just a few clicks from any device of your choice. Modify and eSign PDF Instructions For Form IT 205 Fiduciary Income Tax Return Tax Year to ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pdf instructions for form it 205 fiduciary income tax return tax year

Create this form in 5 minutes!

How to create an eSignature for the pdf instructions for form it 205 fiduciary income tax return tax year

How to generate an e-signature for your PDF document in the online mode

How to generate an e-signature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

How to make an electronic signature right from your mobile device

The best way to create an electronic signature for a PDF document on iOS devices

How to make an electronic signature for a PDF on Android devices

People also ask

-

What is the California Schedule G 1 form?

The California Schedule G 1 form is a tax form used for reporting specific income and deductions related to businesses in California. It is essential for ensuring compliance with California tax laws and accurately calculating tax liabilities.

-

How can airSlate SignNow help with the California Schedule G 1?

airSlate SignNow streamlines the process of preparing and signing the California Schedule G 1. With its intuitive interface, users can easily upload, fill out, and send this form for eSignature, saving time and reducing errors during tax season.

-

What are the pricing options available for using airSlate SignNow?

airSlate SignNow offers several pricing plans to accommodate different business needs. Depending on the level of features required, customers can choose from basic to premium plans, ensuring access to tools that simplify tasks like completing the California Schedule G 1.

-

Are there any features that specifically assist in the preparation of the California Schedule G 1?

Yes, airSlate SignNow provides features such as document templates, collaboration tools, and secure eSignature capabilities. These features are particularly useful for businesses looking to efficiently manage their California Schedule G 1 forms without compromising on accuracy or security.

-

What are the benefits of using airSlate SignNow for tax-related documents like the California Schedule G 1?

Using airSlate SignNow for the California Schedule G 1 offers numerous benefits, including faster processing times and enhanced security. Users can automate workflows and track document status, making the tax filing process much more manageable and efficient.

-

Can airSlate SignNow integrate with accounting software for managing the California Schedule G 1?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software options. This integration allows users to export data directly into their systems, ensuring a cohesive workflow when preparing the California Schedule G 1 and other documents.

-

Is it safe to eSign the California Schedule G 1 using airSlate SignNow?

Yes, eSigning the California Schedule G 1 using airSlate SignNow is completely safe. The platform employs advanced security features and encryption protocols to protect sensitive information, ensuring that all signed documents are secure and compliant with legal standards.

Get more for PDF Instructions For Form IT 205 Fiduciary Income Tax Return Tax Year

- Massachusetts bond form

- Massachusetts quitclaim deed 497309638 form

- Warranty deed from husband and wife to corporation massachusetts form

- Divorce worksheet and law summary for contested or uncontested case of over 25 pages ideal client interview form massachusetts

- Ma llc company form

- Bond for written contract individual massachusetts form

- Quitclaim deed from husband and wife to llc massachusetts form

- Warranty deed from husband and wife to llc massachusetts form

Find out other PDF Instructions For Form IT 205 Fiduciary Income Tax Return Tax Year

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe