Iowa Alternative Minimum TaxIowa Department of Revenue 2022-2026

Understanding the Iowa Alternative Minimum Tax

The Iowa Alternative Minimum Tax (IAMT) is designed to ensure that taxpayers who benefit from certain deductions and credits still contribute a minimum amount of tax. This tax is particularly relevant for individuals and businesses with significant deductions that could otherwise reduce their tax liability to zero. Understanding the IAMT is crucial for accurate tax planning and compliance.

Steps to Complete the Iowa Minimum Tax Form

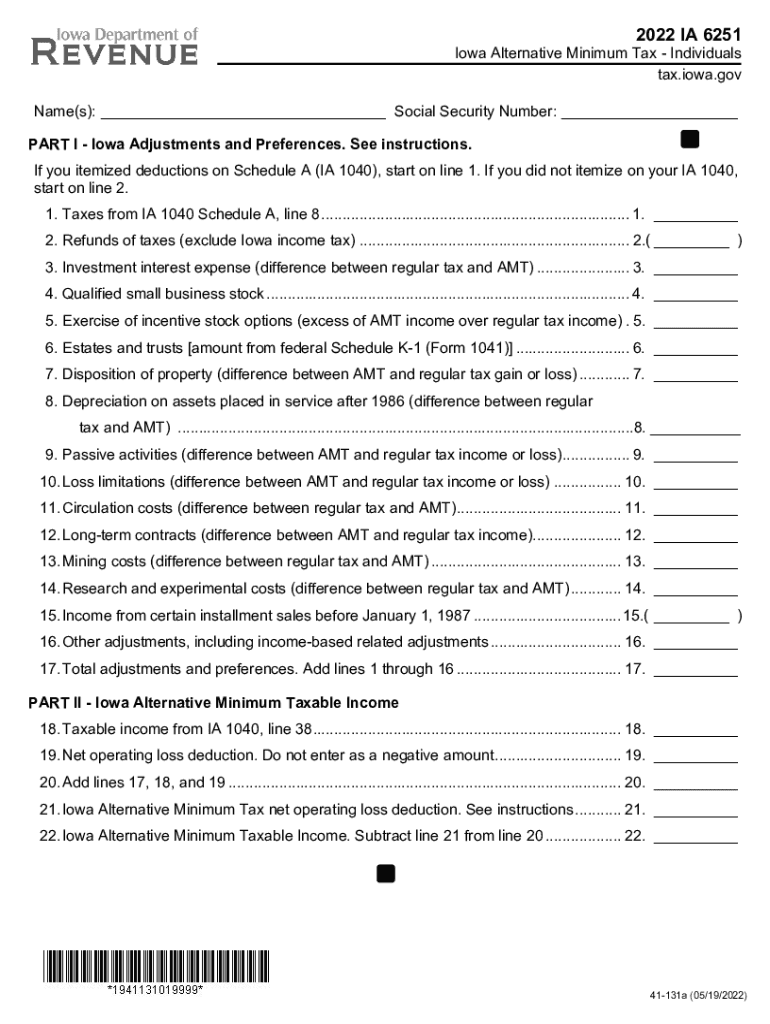

Completing the Iowa Minimum Tax form, specifically the Iowa 6251, involves several key steps:

- Gather necessary financial documents, including income statements and records of deductions.

- Calculate your regular Iowa tax liability to determine if you need to apply the alternative minimum tax.

- Complete the Iowa 6251 form, ensuring all income and deductions are accurately reported.

- Review the completed form for accuracy before submission.

- Submit the form either online or via mail, depending on your preference.

Legal Aspects of the Iowa Minimum Tax

The Iowa Minimum Tax is legally binding and must be filed according to state regulations. Compliance with the tax laws is essential to avoid penalties. The IAMT is governed by specific statutes that outline how it should be calculated and reported. Understanding these legal requirements helps ensure that taxpayers meet their obligations without issues.

Required Documents for Filing the Iowa Minimum Tax

To file the Iowa Minimum Tax, taxpayers should prepare the following documents:

- Income statements, including W-2s and 1099s.

- Documentation of deductions and credits claimed on your regular tax return.

- Previous tax returns for reference and accuracy.

- Any additional forms relevant to the IAMT calculations.

Filing Deadlines for the Iowa Minimum Tax

It is important to be aware of the filing deadlines for the Iowa Minimum Tax to avoid late fees and penalties. Typically, the deadline aligns with the standard Iowa income tax filing date. Taxpayers should verify the exact date each year, as it can vary, especially in response to changes in tax law or state regulations.

Penalties for Non-Compliance with the Iowa Minimum Tax

Failure to comply with the Iowa Minimum Tax requirements can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. Understanding the implications of non-compliance is essential for all taxpayers to ensure they meet their obligations and avoid unnecessary financial burdens.

Quick guide on how to complete iowa alternative minimum taxiowa department of revenue

Effortlessly Prepare Iowa Alternative Minimum TaxIowa Department Of Revenue on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to locate the necessary form and securely keep it online. airSlate SignNow provides all the tools you require to create, edit, and electronically sign your documents promptly without delays. Handle Iowa Alternative Minimum TaxIowa Department Of Revenue on any device using airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

How to Edit and eSign Iowa Alternative Minimum TaxIowa Department Of Revenue with Ease

- Obtain Iowa Alternative Minimum TaxIowa Department Of Revenue and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Select important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searching, or mistakes necessitating new copies. airSlate SignNow fulfills all your document management requirements in a few clicks from any device you choose. Edit and eSign Iowa Alternative Minimum TaxIowa Department Of Revenue and facilitate excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct iowa alternative minimum taxiowa department of revenue

Create this form in 5 minutes!

How to create an eSignature for the iowa alternative minimum taxiowa department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Iowa minimum tax?

The Iowa minimum tax is a tax provision that ensures businesses pay a minimum amount of state taxes. Understanding this tax is crucial for Iowa businesses to avoid penalties and compliance issues. Utilizing software like airSlate SignNow can help manage your tax documents efficiently.

-

How can airSlate SignNow assist with understanding the Iowa minimum tax?

airSlate SignNow offers seamless document management solutions that can help businesses in Iowa prepare and eSign necessary tax forms. By keeping your tax-related documents organized and accessible, you can better manage your responsibilities related to the Iowa minimum tax. This simplifies compliance and reduces the risk of errors.

-

What are the pricing options available for airSlate SignNow?

airSlate SignNow provides various pricing tiers to meet the needs of different businesses, ensuring access to features like document eSigning and management. Businesses in Iowa looking to understand the implications of the Iowa minimum tax can select a plan that fits their budget while gaining essential tools for tax document management.

-

What features does airSlate SignNow offer that relate to tax documentation?

airSlate SignNow offers features such as customizable templates, document tracking, and secure eSigning, all vital for managing tax documentation related to the Iowa minimum tax. These features streamline the process, ensuring all required documents are properly signed and stored, making tax season less stressful.

-

Can I integrate airSlate SignNow with my existing accounting software?

Yes, airSlate SignNow easily integrates with various accounting software systems, allowing for effective management of tax-related documentation related to the Iowa minimum tax. This integration ensures that you can maintain accurate records and simplify your workflow without the hassle of manual data entry.

-

How does airSlate SignNow ensure the security of my tax documents?

airSlate SignNow prioritizes document security with advanced encryption and secure storage options. This is particularly important for sensitive tax documents related to the Iowa minimum tax, helping businesses protect their data against unauthorized access while maintaining compliance with state regulations.

-

What benefits does eSigning offer for Iowa businesses handling taxes?

ESigning with airSlate SignNow provides signNow benefits for Iowa businesses, including faster processing times and reduced paperwork. This is especially useful for tax documents related to the Iowa minimum tax, allowing you to complete and submit filings more efficiently, ultimately saving time and resources.

Get more for Iowa Alternative Minimum TaxIowa Department Of Revenue

- Site work contractor package south dakota form

- Siding contractor package south dakota form

- Refrigeration contractor package south dakota form

- Drainage contractor package south dakota form

- Tax free exchange package south dakota form

- Landlord tenant sublease package south dakota form

- Buy sell agreement package south dakota form

- Option to purchase package south dakota form

Find out other Iowa Alternative Minimum TaxIowa Department Of Revenue

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy