Form it 204 1 New York Corporate Partners Schedule K Tax Year 2022

What is the Form IT 2041 New York Corporate Partners’ Schedule K Tax Year

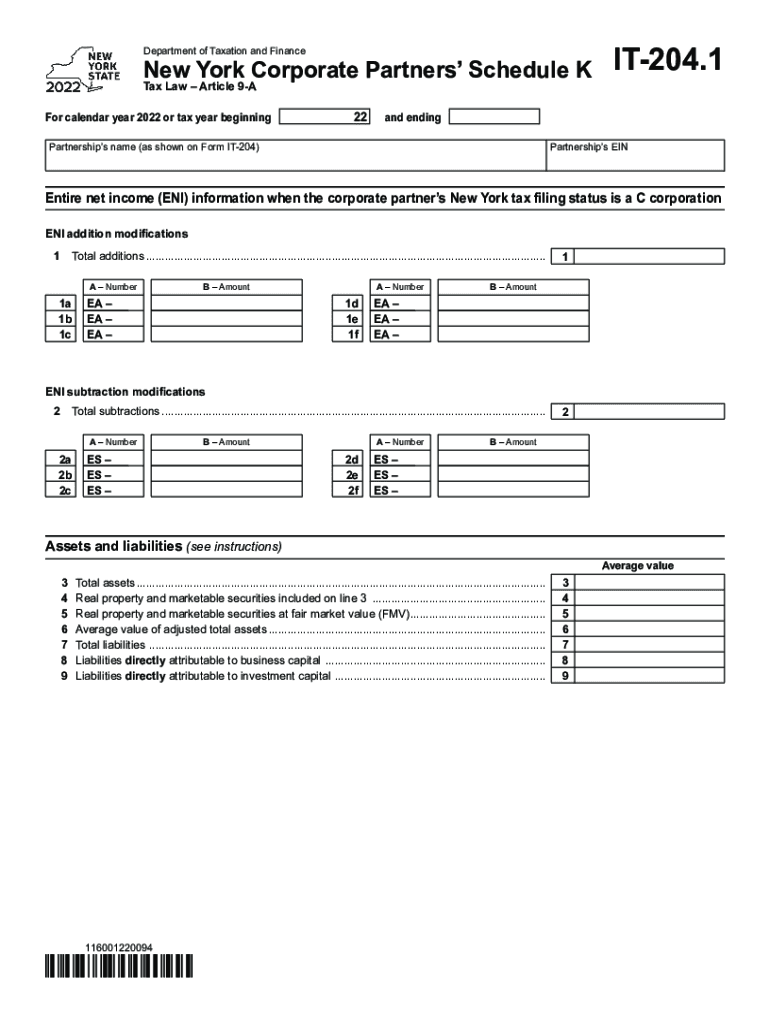

The Form IT 2041 is a tax document used in New York, specifically designed for corporate partners to report income, deductions, and credits related to partnerships. This form is essential for ensuring compliance with state tax regulations and allows corporate partners to accurately report their share of partnership income. The form captures vital information that affects the overall tax liability of the partners involved, making it a critical component of the tax filing process for businesses operating in New York.

Steps to Complete the Form IT 2041 New York Corporate Partners’ Schedule K Tax Year

Completing the Form IT 2041 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents related to the partnership, including income statements and expense reports. Next, fill out the form by providing information such as the partnership's name, identification number, and the specific tax year. It's important to accurately report your share of income, deductions, and credits as outlined in the partnership agreement. After completing the form, review all entries for accuracy before submitting it to the appropriate state tax authority.

Legal Use of the Form IT 2041 New York Corporate Partners’ Schedule K Tax Year

The legal use of the Form IT 2041 is governed by New York tax laws, which require corporate partners to report their share of partnership income accurately. To be considered legally valid, the form must be completed in accordance with state regulations, and all information provided must be truthful and complete. The use of electronic signatures through reliable platforms can further enhance the legal standing of the submitted document, ensuring compliance with eSignature laws such as ESIGN and UETA.

Filing Deadlines / Important Dates

Filing deadlines for the Form IT 2041 are typically aligned with the overall tax filing deadlines set by New York State. Generally, corporate partners must submit their forms by the 15th day of the fourth month following the end of the tax year. For partnerships operating on a calendar year basis, this means the form is due by April 15. It is crucial for corporate partners to be aware of these deadlines to avoid penalties and ensure timely compliance with state tax obligations.

Required Documents

To complete the Form IT 2041, several documents are necessary to ensure accurate reporting. These include:

- Partnership agreement outlining the distribution of income and expenses.

- Income statements detailing the partnership's earnings for the tax year.

- Expense reports that list all deductible costs incurred during the year.

- Prior year tax returns for reference and consistency.

Having these documents readily available will facilitate a smoother completion process and help ensure that all necessary information is accurately reported.

Form Submission Methods

The Form IT 2041 can be submitted through various methods, including online submission, mail, or in-person delivery. Online submission is often the most efficient method, allowing for quicker processing and confirmation of receipt. For those opting to mail the form, it is advisable to use certified mail to track the submission. In-person submissions can be made at designated state tax offices, ensuring that the form is delivered directly to the appropriate authorities.

Quick guide on how to complete form it 2041 new york corporate partners schedule k tax year 2022

Complete Form IT 204 1 New York Corporate Partners Schedule K Tax Year seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed papers, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with everything required to create, modify, and eSign your documents promptly without delays. Manage Form IT 204 1 New York Corporate Partners Schedule K Tax Year on any device using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

How to modify and eSign Form IT 204 1 New York Corporate Partners Schedule K Tax Year effortlessly

- Obtain Form IT 204 1 New York Corporate Partners Schedule K Tax Year and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive details with tools designed specifically for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method for submitting your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing more document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and eSign Form IT 204 1 New York Corporate Partners Schedule K Tax Year to ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 2041 new york corporate partners schedule k tax year 2022

Create this form in 5 minutes!

How to create an eSignature for the form it 2041 new york corporate partners schedule k tax year 2022

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is it 2041 and how does it relate to airSlate SignNow?

It 2041 refers to a future-oriented vision for document signing and collaboration. With airSlate SignNow, this vision is already being realized through advanced electronic signature solutions that empower businesses to seamlessly sign documents, ensuring security and compliance.

-

How much does airSlate SignNow cost for businesses looking at it 2041?

The pricing for airSlate SignNow is competitive and designed to cater to various business needs, even with the evolving landscape of document management by 2041. Different plans are available, allowing businesses to choose the one that best suits their volume and feature requirements, while maintaining cost-effectiveness.

-

What features does airSlate SignNow offer to support the it 2041 initiative?

AirSlate SignNow includes features like customizable templates, multi-party signing, and mobile accessibility, which are essential by 2041 for efficient document management. These features enhance collaboration and streamline workflows, ensuring your business stays ahead in a digital-first environment.

-

How does airSlate SignNow improve business efficiency with it 2041?

By automating the document signing process with airSlate SignNow, businesses can signNowly cut down on turnaround times and reduce operational costs. The platform's user-friendly interface and robust features align perfectly with the goals of efficiency highlighted in the it 2041 vision.

-

Can airSlate SignNow integrate with other tools for an it 2041 compliant workflow?

Yes, airSlate SignNow integrates with various third-party applications such as CRM systems, project management tools, and cloud storage services. These integrations are pivotal for creating a seamless workflow that supports the future-focused capabilities expected from an it 2041 initiative.

-

What are the security features of airSlate SignNow related to it 2041?

Security is a cornerstone of airSlate SignNow, employing encryption and compliance with global regulations to safeguard sensitive information. This level of security is essential as document-handling paradigms evolve towards 2041, ensuring peace of mind for both businesses and their clients.

-

How can businesses improve customer experience using airSlate SignNow with it 2041?

By leveraging airSlate SignNow's quick and reliable eSignature capabilities, businesses can enhance customer experience through faster transactions and reduced friction. Adapting to client expectations in the it 2041 landscape means providing seamless, user-friendly interactions that lead to higher satisfaction.

Get more for Form IT 204 1 New York Corporate Partners Schedule K Tax Year

- Quitclaim deed by two individuals to husband and wife tennessee form

- Warranty deed from two individuals to husband and wife tennessee form

- Quitclaim deed real form 497326685

- Quitclaim deed from an individual to a trust tennessee form

- Quitclaim deed form

- Tn time share form

- Tennessee quitclaim deed 497326689 form

- Tn husband wife 497326690 form

Find out other Form IT 204 1 New York Corporate Partners Schedule K Tax Year

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT