Form it 204 1 New York Corporate Partners Schedule K Tax Year 2020

What is the Form IT 204 1 New York Corporate Partners Schedule K Tax Year

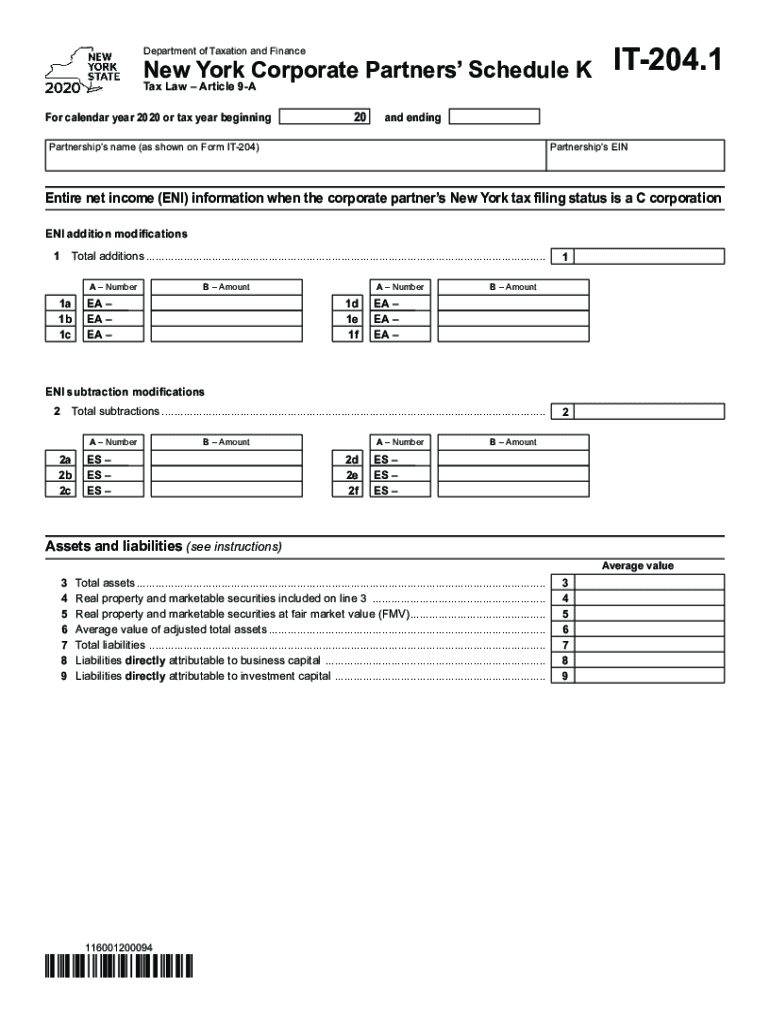

The Form IT 204 1 is a tax document used by corporate partners in New York to report income, deductions, and credits from partnerships. This form is essential for corporate entities that are partners in a partnership, as it provides a detailed account of their share of the partnership's income and losses for the specified tax year. The information reported on this form is crucial for accurately calculating state tax obligations and ensuring compliance with New York tax laws.

Steps to complete the Form IT 204 1 New York Corporate Partners Schedule K Tax Year

Completing the Form IT 204 1 requires careful attention to detail. Here are the general steps to follow:

- Gather all necessary financial documents, including partnership agreements and prior tax returns.

- Fill in the identification section with the corporate partner's name, address, and tax identification number.

- Report the partnership's income, deductions, and credits as outlined in the partnership's Schedule K-1.

- Ensure that all calculations are accurate and align with the partnership's financial statements.

- Review the completed form for any errors or omissions before submission.

Legal use of the Form IT 204 1 New York Corporate Partners Schedule K Tax Year

The Form IT 204 1 is legally recognized as a valid tax document when completed and submitted according to New York State regulations. To ensure its legal standing, it must be signed by an authorized representative of the corporate partner. Additionally, compliance with eSignature laws is crucial if the form is submitted electronically. The use of a reputable eSignature platform can enhance the legal validity of the document.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the Form IT 204 1. Typically, the form must be filed by the due date of the corporate partner's tax return. For most corporations, this is the fifteenth day of the third month following the end of the tax year. Failure to file by the deadline may result in penalties and interest on any taxes owed.

How to obtain the Form IT 204 1 New York Corporate Partners Schedule K Tax Year

The Form IT 204 1 can be obtained directly from the New York State Department of Taxation and Finance website. It is available as a downloadable PDF, which can be printed and filled out manually. Additionally, the form may also be accessible through various tax software programs that support New York state tax filings.

Key elements of the Form IT 204 1 New York Corporate Partners Schedule K Tax Year

Key elements of the Form IT 204 1 include:

- Identification information for the corporate partner and the partnership.

- Details of the partnership's income, losses, and deductions.

- Information on credits that the corporate partner may claim.

- Signature of an authorized representative to validate the form.

Quick guide on how to complete form it 2041 new york corporate partners schedule k tax year 2020

Effortlessly Prepare Form IT 204 1 New York Corporate Partners Schedule K Tax Year on Any Device

Managing documents online has gained traction among both businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the right format and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents promptly without any holdups. Process Form IT 204 1 New York Corporate Partners Schedule K Tax Year on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Alter and eSign Form IT 204 1 New York Corporate Partners Schedule K Tax Year with Ease

- Locate Form IT 204 1 New York Corporate Partners Schedule K Tax Year and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or obscure sensitive data with tools provided by airSlate SignNow specifically for that purpose.

- Create your signature with the Sign utility, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you would like to send your form: via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Modify and eSign Form IT 204 1 New York Corporate Partners Schedule K Tax Year while ensuring effective communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 2041 new york corporate partners schedule k tax year 2020

Create this form in 5 minutes!

How to create an eSignature for the form it 2041 new york corporate partners schedule k tax year 2020

The best way to make an electronic signature for your PDF online

The best way to make an electronic signature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The way to generate an eSignature right from your smartphone

How to generate an electronic signature for a PDF on iOS

The way to generate an eSignature for a PDF on Android

People also ask

-

What is the Form IT 204 1 New York Corporate Partners Schedule K Tax Year?

The Form IT 204 1 New York Corporate Partners Schedule K Tax Year is a state tax form used by corporate partners in New York to report their share of income, deductions, and credits. It provides a detailed view of each partner's financials for the tax year, ensuring compliance with New York tax laws. Understanding this form is crucial for accurate tax reporting and planning.

-

How can airSlate SignNow assist with Form IT 204 1 New York Corporate Partners Schedule K Tax Year?

airSlate SignNow offers a streamlined solution for electronically signing and managing documents, including the Form IT 204 1 New York Corporate Partners Schedule K Tax Year. Our platform allows users to fill out, sign, and send this form securely, enhancing efficiency and minimizing errors. This ensures that you can meet deadlines and stay compliant with state tax requirements.

-

Is airSlate SignNow affordable for businesses needing the Form IT 204 1 New York Corporate Partners Schedule K Tax Year?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes that need to complete the Form IT 204 1 New York Corporate Partners Schedule K Tax Year. Our competitive pricing models cater to different business needs, allowing you to choose a plan that suits your budget. By opting for our digital solution, you can also save on printing and mailing costs.

-

What features does airSlate SignNow provide to assist with filing the Form IT 204 1 New York Corporate Partners Schedule K Tax Year?

airSlate SignNow provides essential features such as templates for the Form IT 204 1 New York Corporate Partners Schedule K Tax Year, in-app collaboration, and secure document storage. Our user-friendly interface simplifies the preparation and digital signing process, minimizing the time spent on paperwork. These features ensure that you can efficiently manage your documents and regulatory compliance.

-

Can airSlate SignNow integrate with other accounting software for the Form IT 204 1 New York Corporate Partners Schedule K Tax Year?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, making it easier to manage financial documents related to the Form IT 204 1 New York Corporate Partners Schedule K Tax Year. This integration streamlines data transfer, reduces manual errors, and enhances overall operational efficiency. You can maintain a cohesive workflow while ensuring accurate reporting to tax authorities.

-

What benefits will I gain by using airSlate SignNow for the Form IT 204 1 New York Corporate Partners Schedule K Tax Year?

Using airSlate SignNow for the Form IT 204 1 New York Corporate Partners Schedule K Tax Year provides numerous benefits, including time savings, improved accuracy, and enhanced security. Our digital methods reduce the potential for errors commonly associated with manual data entry. Additionally, with our secure platform, your sensitive financial information remains protected during the signing process.

-

How secure is airSlate SignNow for submitting the Form IT 204 1 New York Corporate Partners Schedule K Tax Year?

Security is a priority at airSlate SignNow. We implement advanced encryption measures and maintain compliance with stringent data protection regulations to ensure that your Form IT 204 1 New York Corporate Partners Schedule K Tax Year and other sensitive documents are kept safe. This commitment to security helps you submit your forms confidently, knowing your information is protected from unauthorized access.

Get more for Form IT 204 1 New York Corporate Partners Schedule K Tax Year

Find out other Form IT 204 1 New York Corporate Partners Schedule K Tax Year

- Sign Colorado Plumbing Emergency Contact Form Now

- Sign Colorado Plumbing Emergency Contact Form Free

- How Can I Sign Connecticut Plumbing LLC Operating Agreement

- Sign Illinois Plumbing Business Plan Template Fast

- Sign Plumbing PPT Idaho Free

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding