Form it 398 New York State Depreciation Schedule for IRC 2022

What is the Form IT 398 New York State Depreciation Schedule For IRC

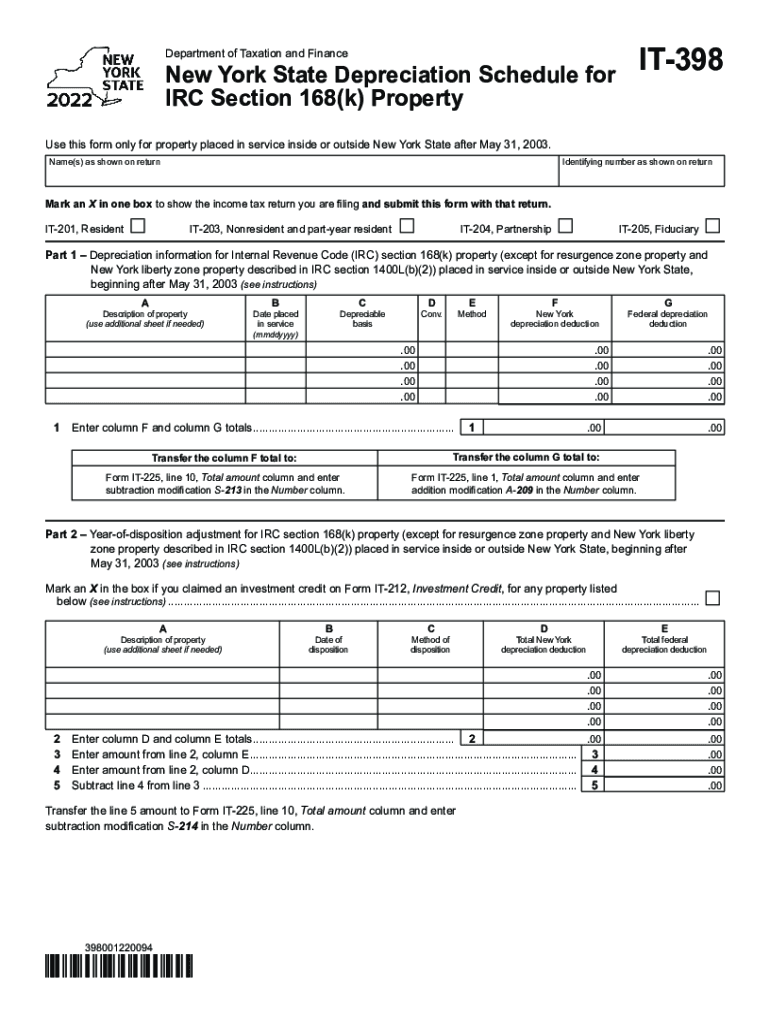

The Form IT 398 is a crucial document for New York State taxpayers who need to report depreciation for property under the Internal Revenue Code (IRC) Section 168. This form allows businesses and individuals to calculate and claim depreciation deductions on eligible assets. It is particularly relevant for those who own property that qualifies under New York's tax regulations. Understanding this form is essential for accurate tax reporting and maximizing potential deductions.

Steps to complete the Form IT 398 New York State Depreciation Schedule For IRC

Completing the Form IT 398 involves several key steps to ensure accuracy and compliance with New York State tax laws. Begin by gathering all necessary information regarding the property you are depreciating, including its purchase date, cost, and useful life. Follow these steps:

- Fill out your personal or business information at the top of the form.

- List each asset you are claiming depreciation for, including details such as the date placed in service and the cost basis.

- Calculate the depreciation for each asset using the appropriate method, typically the Modified Accelerated Cost Recovery System (MACRS).

- Transfer the total depreciation amounts to the appropriate sections of your tax return.

Ensure that all calculations are accurate and that you retain supporting documentation for your records.

Key elements of the Form IT 398 New York State Depreciation Schedule For IRC

The Form IT 398 contains several key components that are essential for accurate reporting. These include:

- Asset Description: A clear description of the property being depreciated.

- Cost Basis: The initial cost of the asset, which is necessary for calculating depreciation.

- Date Placed in Service: The date the asset was first used in your business or for income-producing purposes.

- Depreciation Method: The method used to calculate depreciation, such as straight-line or declining balance.

- Total Depreciation: The total amount of depreciation claimed for the tax year.

Understanding these elements helps ensure that the form is completed accurately and in compliance with tax regulations.

Legal use of the Form IT 398 New York State Depreciation Schedule For IRC

The legal use of Form IT 398 is governed by New York State tax laws and the IRC. To be valid, the form must be filled out completely and accurately, reflecting all applicable depreciation calculations. It is essential to maintain compliance with both state and federal regulations to avoid penalties. Proper documentation supporting the depreciation claims should be kept on file in case of an audit. This includes invoices, purchase agreements, and any other relevant records.

Filing Deadlines / Important Dates

Filing deadlines for the Form IT 398 align with the overall New York State tax filing schedule. Typically, this form must be submitted with your annual tax return, which is due on April fifteenth for most taxpayers. If you are unable to file by this date, you may request an extension, but it is important to check specific deadlines each year as they may vary. Staying informed about these dates helps ensure compliance and avoids unnecessary penalties.

IRS Guidelines

The IRS provides guidelines for the depreciation of property under Section 168, which are essential for completing Form IT 398. These guidelines outline the methods allowed for calculating depreciation, the types of property that qualify, and the necessary documentation required. Familiarizing yourself with these guidelines ensures that you are using the correct methods and calculations, which can significantly impact your tax liability.

Quick guide on how to complete form it 398 new york state depreciation schedule for irc

Prepare Form IT 398 New York State Depreciation Schedule For IRC effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely keep it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage Form IT 398 New York State Depreciation Schedule For IRC on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to alter and eSign Form IT 398 New York State Depreciation Schedule For IRC with ease

- Find Form IT 398 New York State Depreciation Schedule For IRC and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to submit your form, via email, text message (SMS), or invitation link, or download it to your computer.

Put aside concerns about lost or misplaced documents, tedious form searches, or errors that require new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your choice. Modify and eSign Form IT 398 New York State Depreciation Schedule For IRC and guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 398 new york state depreciation schedule for irc

Create this form in 5 minutes!

How to create an eSignature for the form it 398 new york state depreciation schedule for irc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is new york depreciation and how does it affect my business?

New York depreciation refers to the decline in value of an asset over time, specifically within New York's regulatory environment. Understanding this concept is crucial for businesses to manage their taxes effectively. Properly accounting for new york depreciation can lead to signNow tax savings and improved financial reporting.

-

How can airSlate SignNow assist with documents related to new york depreciation?

AirSlate SignNow provides a streamlined way to generate, send, and eSign documents associated with new york depreciation. This includes tax forms and asset valuation statements. With our platform, you can ensure that all documents are compliant and securely handled, facilitating easier audits and compliance.

-

What are the pricing options for airSlate SignNow when dealing with new york depreciation?

AirSlate SignNow offers a range of pricing plans tailored for various business needs, including those dealing with new york depreciation-related documents. Our plans are designed to be cost-effective, ensuring you can manage your documentation without breaking the bank. You can choose the plan that best suits your volume of eSigning and document management needs.

-

Does airSlate SignNow provide templates for new york depreciation-related documents?

Yes, airSlate SignNow provides customizable templates specifically for new york depreciation-related documents. These templates ensure you have a reliable starting point for your asset documentation. Whether it’s for tax submissions or internal records, our templates make compliance easier.

-

Can I integrate airSlate SignNow with my accounting software for new york depreciation calculations?

Absolutely! AirSlate SignNow offers seamless integrations with popular accounting software, making it easy to handle new york depreciation calculations. By connecting your tools, you can automate workflows and ensure that all your financial documentation is in sync, saving time and reducing errors.

-

What are the benefits of using airSlate SignNow for new york depreciation processes?

Using airSlate SignNow for your new york depreciation processes simplifies document management and enhances compliance. Our platform ensures secure electronic signatures and accelerates the approval process. Additionally, the ease of use allows teams to focus more on strategic tasks rather than paperwork.

-

How secure is airSlate SignNow when handling sensitive new york depreciation documents?

AirSlate SignNow prioritizes security, employing industry-standard encryption for all documents, including those related to new york depreciation. We understand the sensitivity of financial data and have implemented numerous security features to protect your documents from unauthorized access or bsignNowes.

Get more for Form IT 398 New York State Depreciation Schedule For IRC

- Tennessee landlord form

- Guaranty or guarantee of payment of rent tennessee form

- Letter from landlord to tenant as notice of default on commercial lease tennessee form

- Residential or rental lease extension agreement tennessee form

- Commercial rental lease application questionnaire tennessee form

- Apartment lease rental application questionnaire tennessee form

- Residential rental lease application tennessee form

- Salary verification form for potential lease tennessee

Find out other Form IT 398 New York State Depreciation Schedule For IRC

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online