Form it 398 New York State Depreciation Schedule for IRC Section 168k Property Tax Year 2023-2026

What is the Form IT 398 New York State Depreciation Schedule For IRC Section 168k Property Tax Year

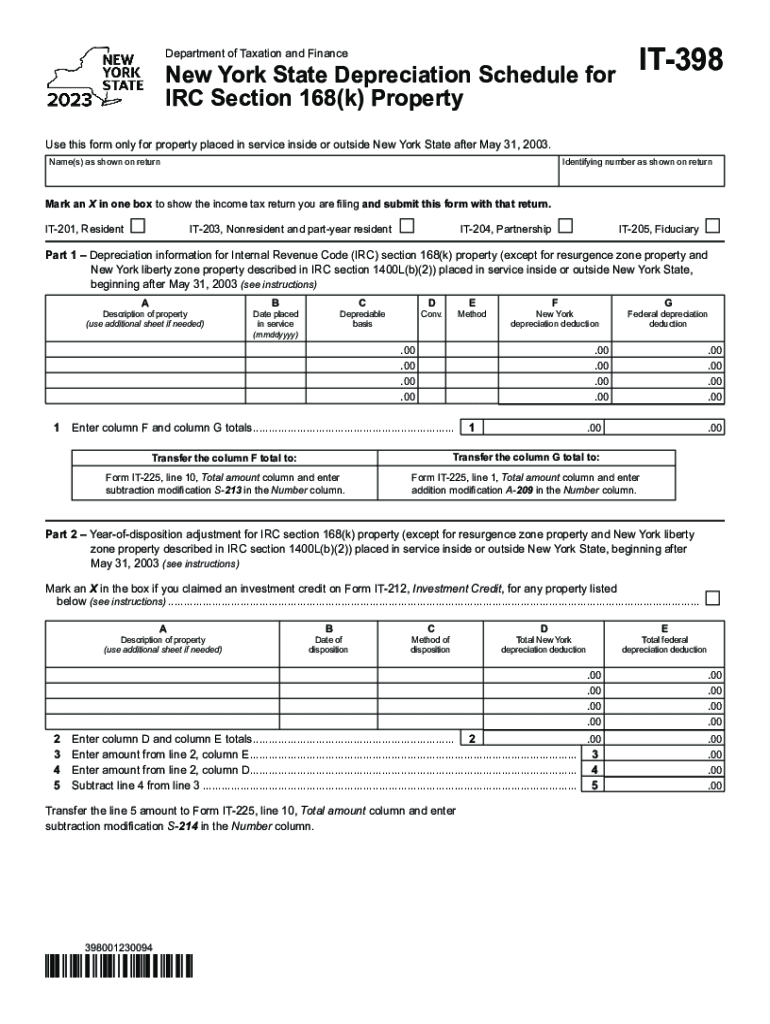

The Form IT 398 is a crucial document for New York State taxpayers who are claiming depreciation on property under IRC Section 168k. This form is specifically designed to report the depreciation of qualified property, which includes tangible assets such as machinery, equipment, and certain types of real estate. The depreciation schedule allows taxpayers to recover the cost of these assets over a specified period, thereby reducing taxable income. Understanding the details of this form is essential for accurate tax reporting and compliance with state regulations.

Steps to Complete the Form IT 398 New York State Depreciation Schedule For IRC Section 168k Property Tax Year

Completing the Form IT 398 involves several key steps:

- Gather necessary information about the property, including acquisition date, cost, and type of property.

- Determine the applicable depreciation method under IRC Section 168k, which may include bonus depreciation or modified accelerated cost recovery system (MACRS).

- Fill out the form by entering the required details in the appropriate sections, ensuring accuracy in calculations.

- Review the completed form for any errors or omissions before submission.

It is advisable to consult with a tax professional if there are any uncertainties regarding the completion of the form.

Key Elements of the Form IT 398 New York State Depreciation Schedule For IRC Section 168k Property Tax Year

The Form IT 398 includes several key elements that taxpayers must understand:

- Taxpayer Information: This section requires the taxpayer's name, address, and identification number.

- Property Details: Taxpayers must provide specific information about the property, including its classification and acquisition cost.

- Depreciation Calculation: This section outlines the method used for calculating depreciation, including the applicable rates and periods.

- Signature and Date: The form must be signed and dated by the taxpayer or an authorized representative.

State-Specific Rules for the Form IT 398 New York State Depreciation Schedule For IRC Section 168k Property Tax Year

New York State has specific rules that govern the use of Form IT 398. Taxpayers must adhere to state regulations regarding the types of property eligible for depreciation under IRC Section 168k. Additionally, New York may have unique guidelines for determining the useful life of assets and the applicable depreciation rates. It is essential for taxpayers to familiarize themselves with these state-specific rules to ensure compliance and optimize their tax benefits.

Examples of Using the Form IT 398 New York State Depreciation Schedule For IRC Section 168k Property Tax Year

Examples of using Form IT 398 can clarify how to apply the depreciation schedule effectively:

- A business purchases new machinery for $100,000. Using the IT 398, the business can report the depreciation over the asset's useful life, potentially reducing taxable income significantly.

- A real estate investor acquires a commercial property for $500,000. By completing the IT 398, the investor can claim depreciation on the property, which can lead to substantial tax savings.

These examples illustrate how the form can be utilized to maximize tax benefits for various types of property investments.

Filing Deadlines / Important Dates

Filing deadlines for Form IT 398 are aligned with the overall tax filing deadlines for New York State. Generally, taxpayers must submit the form along with their annual tax return by April fifteenth of each year. However, if an extension is filed, the deadline may be extended to October fifteenth. It is important for taxpayers to be aware of these dates to avoid penalties and ensure timely submission of their depreciation claims.

Quick guide on how to complete form it 398 new york state depreciation schedule for irc section 168k property tax year

Complete Form IT 398 New York State Depreciation Schedule For IRC Section 168k Property Tax Year effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed forms, allowing you to locate the correct document and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Manage Form IT 398 New York State Depreciation Schedule For IRC Section 168k Property Tax Year on any platform using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

The easiest way to modify and eSign Form IT 398 New York State Depreciation Schedule For IRC Section 168k Property Tax Year without hassle

- Acquire Form IT 398 New York State Depreciation Schedule For IRC Section 168k Property Tax Year and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight necessary sections of the documents or redact sensitive information with the tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method for delivering your document, by email, text message (SMS), an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing additional document copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Edit and eSign Form IT 398 New York State Depreciation Schedule For IRC Section 168k Property Tax Year to ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 398 new york state depreciation schedule for irc section 168k property tax year

Create this form in 5 minutes!

How to create an eSignature for the form it 398 new york state depreciation schedule for irc section 168k property tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is NY IT depreciation and how does it affect my business?

NY IT depreciation refers to the reduction in value of IT assets over time in New York State. It is essential for businesses to understand this concept as it can affect their tax liabilities and financial reporting. By effectively managing NY IT depreciation, organizations can optimize their IT budgeting and ensure compliance with state tax regulations.

-

How does airSlate SignNow help in managing NY IT depreciation documentation?

With airSlate SignNow, managing documents related to NY IT depreciation becomes streamlined. Businesses can easily create, send, and eSign necessary forms and tax documentation, ensuring that all information is properly recorded and approved. This minimizes errors and helps maintain a clear audit trail for financial evaluations.

-

What are the pricing options for airSlate SignNow in relation to NY IT depreciation?

airSlate SignNow offers a variety of pricing plans that can accommodate businesses looking to manage their NY IT depreciation documentation efficiently. The cost-effective solutions are designed to provide value for organizations of all sizes, emphasizing features that simplify document workflows associated with IT assets. You can choose a plan that best fits your budget and specific needs.

-

Can I integrate airSlate SignNow with my existing accounting software for tracking NY IT depreciation?

Yes, airSlate SignNow can integrate seamlessly with various accounting software, allowing for efficient tracking of NY IT depreciation. This integration ensures that your asset management and financial reporting systems are synchronized, making it easier to manage depreciation schedules. It enhances workflow efficiency by reducing manual data entry.

-

What features of airSlate SignNow assist in calculating NY IT depreciation?

AirSlate SignNow includes features that allow users to manage and track the lifecycle of their IT assets, making it easier to calculate NY IT depreciation. The platform offers customizable templates and workflows that can incorporate depreciation schedules and asset tracking. This aids businesses in ensuring accuracy and compliance in their financial documentation.

-

How does airSlate SignNow ensure compliance with NY IT depreciation regulations?

AirSlate SignNow stays updated with New York State regulations regarding NY IT depreciation, ensuring that businesses remain compliant. The platform facilitates the easy gathering of necessary approvals and signatures for tax documents, mitigating the risks of audits or penalties. Users can rest assured that their documentation meets state requirements with the tools provided.

-

What security measures does airSlate SignNow have in place for sensitive documents related to NY IT depreciation?

AirSlate SignNow employs robust security measures to protect sensitive documents associated with NY IT depreciation. This includes encryption, secure cloud storage, and strict access controls to ensure that only authorized personnel can view or manage crucial financial information. Our commitment to security gives businesses peace of mind when handling important documents.

Get more for Form IT 398 New York State Depreciation Schedule For IRC Section 168k Property Tax Year

- Parts return form

- Salary reduction letter form

- Authorization for cremation and disposition the neptune society of form

- Kentucky irp apportioned operational lease agreement form

- General internal medicine clinic referral form st michaelamp39s hospital

- Highmark therapy treatment plan form fillable

- El tutorial form

- Temporary id template download form

Find out other Form IT 398 New York State Depreciation Schedule For IRC Section 168k Property Tax Year

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure