Form it 398 "New York State Depreciation Schedule for IRC 2021

What is the Form IT 398: New York State Depreciation Schedule for IRC

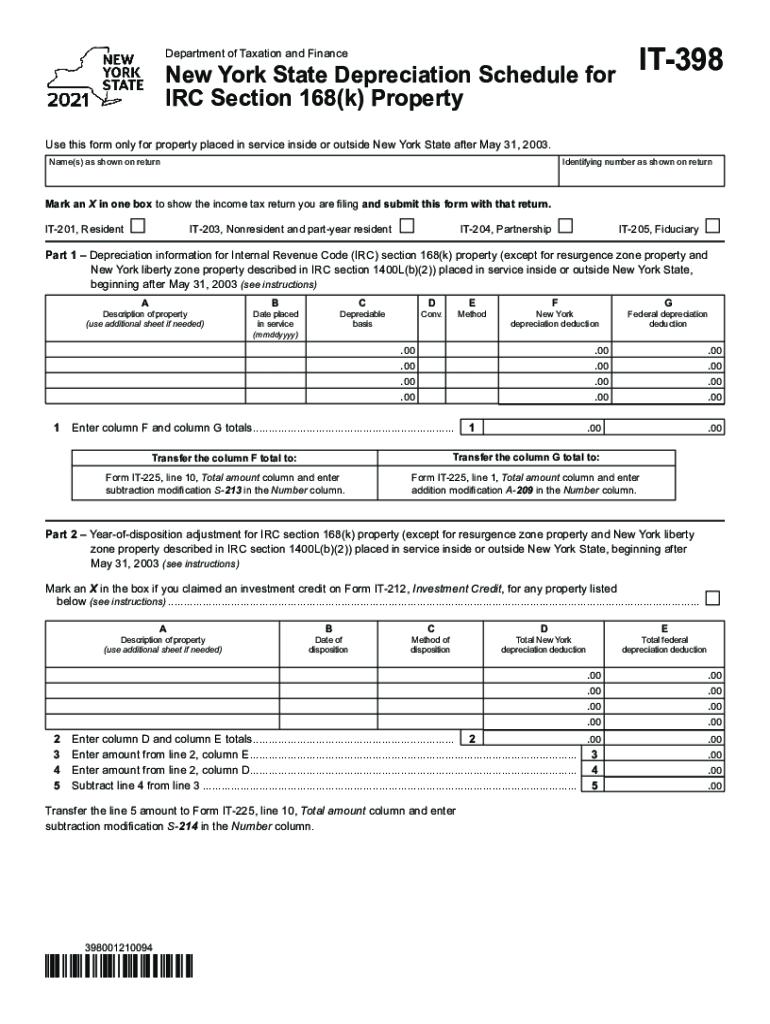

The Form IT 398 is a crucial document for taxpayers in New York who need to report depreciation for property under the Internal Revenue Code (IRC) Section 168. This form allows individuals and businesses to compute the depreciation deductions on qualified property, ensuring compliance with state tax laws. The IT 398 is specifically designed to align with federal depreciation schedules while accommodating state-specific regulations. Understanding this form is essential for accurate tax reporting and maximizing allowable deductions.

How to Use the Form IT 398

Using the Form IT 398 involves several key steps to ensure proper completion and submission. First, gather all necessary documentation related to the property being depreciated, including purchase invoices and previous tax returns. Next, fill out the form by entering relevant information such as the type of property, date placed in service, and the applicable depreciation method. It is important to follow the instructions carefully to avoid errors that could lead to delays or penalties. Once completed, the form should be submitted with your New York State tax return.

Steps to Complete the Form IT 398

Completing the Form IT 398 requires attention to detail. Begin by entering your personal information at the top of the form. Next, list each asset for which you are claiming depreciation. For each asset, provide the following:

- Asset description

- Date placed in service

- Cost or other basis

- Depreciation method used

After filling in the necessary details, calculate the total depreciation for each asset and ensure that all calculations are accurate. Finally, review the form for any discrepancies before submitting it along with your tax return.

Key Elements of the Form IT 398

The Form IT 398 includes several key elements that taxpayers must understand to ensure compliance. Important sections of the form include:

- Taxpayer Information: Personal details of the taxpayer or business entity.

- Asset Information: Detailed descriptions of the property being depreciated.

- Depreciation Calculations: Required calculations based on the chosen depreciation method.

- Signature and Date: Confirmation that the information provided is accurate and complete.

Understanding these elements is vital for successful completion and accurate reporting.

Legal Use of the Form IT 398

The legal use of the Form IT 398 is governed by New York State tax regulations and the Internal Revenue Code. To ensure that the form is legally binding, it must be completed accurately and submitted on time. Failure to comply with the requirements may result in penalties or disallowance of depreciation claims. It is advisable to keep copies of the completed form and supporting documents for your records, as they may be needed in case of an audit.

Filing Deadlines for the Form IT 398

Filing deadlines for the Form IT 398 coincide with the due date for your New York State tax return. Typically, individual taxpayers must file their returns by April fifteenth, while businesses may have different deadlines based on their entity structure. It is essential to be aware of these deadlines to avoid late fees and ensure that your depreciation claims are processed in a timely manner.

Quick guide on how to complete form it 398 ampquotnew york state depreciation schedule for irc

Complete Form IT 398 "New York State Depreciation Schedule For IRC effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Form IT 398 "New York State Depreciation Schedule For IRC on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to modify and eSign Form IT 398 "New York State Depreciation Schedule For IRC effortlessly

- Locate Form IT 398 "New York State Depreciation Schedule For IRC and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive information with the tools airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form navigation, or errors that require reprinting new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Alter and eSign Form IT 398 "New York State Depreciation Schedule For IRC and ensure excellent communication throughout any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 398 ampquotnew york state depreciation schedule for irc

Create this form in 5 minutes!

How to create an eSignature for the form it 398 ampquotnew york state depreciation schedule for irc

The best way to generate an electronic signature for a PDF in the online mode

The best way to generate an electronic signature for a PDF in Chrome

The way to create an e-signature for putting it on PDFs in Gmail

The best way to make an e-signature straight from your smart phone

The way to make an e-signature for a PDF on iOS devices

The best way to make an e-signature for a PDF document on Android OS

People also ask

-

What is the cost of using airSlate SignNow for the IT 398 application?

The pricing for airSlate SignNow varies based on the plan you choose. For the IT 398 application, you can expect competitive rates that provide a cost-effective solution for your eSignature needs. Plans typically include essential features that enhance productivity and streamline document management.

-

What features does airSlate SignNow offer for document management in IT 398?

airSlate SignNow offers a range of features specifically tailored for the IT 398 application. These include document templates, real-time editing, and secure eSigning capabilities that help ensure compliance and efficiency. With an intuitive interface, managing documents becomes seamless.

-

How does airSlate SignNow benefit organizations using IT 398?

For organizations leveraging the IT 398 application, airSlate SignNow enhances workflow efficiency by reducing the time needed for document approvals. The automated processes save time and minimize errors, allowing for quicker turnaround times. This boosts overall productivity and supports better communication within teams.

-

Is airSlate SignNow compatible with other applications for IT 398 users?

Yes, airSlate SignNow integrates smoothly with various applications essential for IT 398 users. This includes popular tools such as Google Workspace, Microsoft Office, and numerous CRM systems. These integrations help users centralize their workflows and enhance collaboration.

-

Can I customize documents when using airSlate SignNow for IT 398?

Absolutely! airSlate SignNow allows for extensive customization of documents used in the IT 398 framework. Users can create templates, add logos, and adjust fields to fit their specific requirements, ensuring that every document aligns with their brand and operational needs.

-

What types of documents can I sign with airSlate SignNow for IT 398?

With airSlate SignNow, you can sign a wide variety of documents relevant to the IT 398 application, including contracts, agreements, and compliance forms. The platform supports a multitude of formats, allowing for versatility and ease of use in document management. This flexibility ensures that all your signing needs are met.

-

Is there a mobile app for airSlate SignNow relevant to IT 398?

Yes, airSlate SignNow offers a user-friendly mobile app that enhances accessibility for users of the IT 398 application. This mobile solution enables you to send and sign documents on the go, ensuring that you can manage your documents anytime, anywhere. Stay productive regardless of your location!

Get more for Form IT 398 "New York State Depreciation Schedule For IRC

- Sellers information for appraiser provided to buyer colorado

- Legallife multistate guide and handbook for selling or buying real estate colorado form

- Colorado subcontractors form

- Option to purchase addendum to residential lease lease or rent to own colorado form

- Colorado prenuptial premarital agreement with financial statements colorado form

- Colorado prenuptial form

- Amendment to prenuptial or premarital agreement colorado form

- Financial statements only in connection with prenuptial premarital agreement colorado form

Find out other Form IT 398 "New York State Depreciation Schedule For IRC

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors