INDIANA it 20 CORPORATE E Form RS Login 2022

Understanding the Indiana IT 20 Corporate E Form RS Login

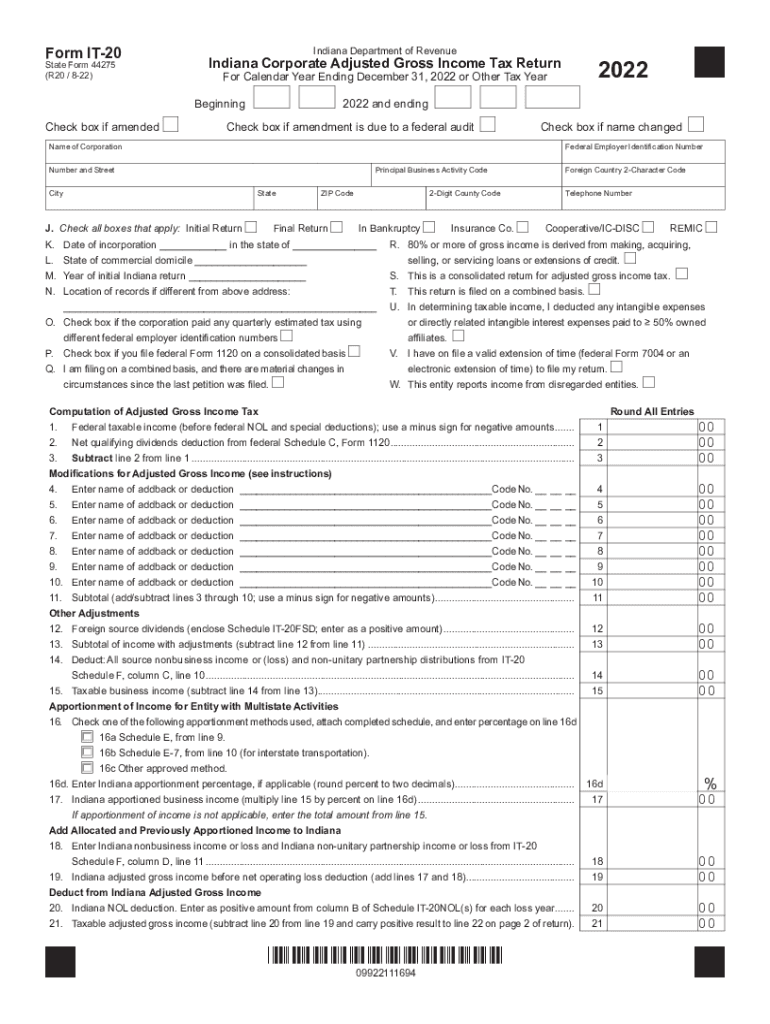

The Indiana IT 20 Corporate E Form RS Login is essential for corporations operating within the state. This form facilitates the electronic filing of corporate income tax returns. It is specifically designed for businesses to report their income and calculate their tax obligations accurately. Understanding this form is crucial for compliance with state tax laws and ensuring that corporations fulfill their tax responsibilities efficiently.

Steps to Complete the Indiana IT 20 Corporate E Form RS Login

Completing the Indiana IT 20 Corporate E Form RS Login involves several steps to ensure accuracy and compliance. First, businesses must gather all necessary financial documents, including income statements and expense reports. Next, access the login portal using secure credentials. Once logged in, follow the prompts to fill out the required fields, ensuring all information is accurate. After completing the form, review it for any errors before submitting it electronically. This process helps avoid delays and potential penalties associated with incorrect filings.

Filing Deadlines and Important Dates

Corporations must be aware of specific filing deadlines associated with the Indiana IT 20 Corporate E Form RS Login. Typically, corporate income tax returns are due on the fifteenth day of the fourth month following the end of the corporation's fiscal year. It is crucial to mark these dates on the calendar to avoid late fees and penalties. Additionally, understanding the timeline for any extensions or amendments can provide flexibility in managing tax obligations.

Required Documents for Filing

When preparing to file the Indiana IT 20 Corporate E Form RS Login, certain documents are necessary. Corporations should have their financial statements, including balance sheets and income statements, ready for reference. Other important documents include prior year tax returns, supporting schedules for deductions, and any relevant tax credits. Organizing these documents beforehand can streamline the filing process and ensure all required information is provided.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the Indiana IT 20 Corporate E Form RS Login can result in significant penalties. Corporations may face fines for late filings, inaccurate information, or failure to file altogether. Understanding these penalties emphasizes the importance of timely and accurate submissions. It is advisable for businesses to stay informed about compliance requirements to avoid unnecessary financial repercussions.

Legal Use of the Indiana IT 20 Corporate E Form RS Login

The Indiana IT 20 Corporate E Form RS Login serves a legal purpose in the context of corporate taxation. This form is recognized by the state as a valid means of reporting income and calculating tax liabilities. When completed correctly, it ensures that corporations meet their legal obligations under Indiana tax law. Utilizing this electronic form also aligns with the state's efforts to streamline tax processes and enhance efficiency in tax collection.

Quick guide on how to complete indiana it 20 corporate e form rs login

Complete INDIANA IT 20 CORPORATE E Form RS Login effortlessly on any device

Digital document management has gained popularity among organizations and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed documents, as you can easily access the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly without delays. Manage INDIANA IT 20 CORPORATE E Form RS Login on any device with airSlate SignNow's Android or iOS applications and streamline any document-based procedure today.

How to edit and electronically sign INDIANA IT 20 CORPORATE E Form RS Login with ease

- Obtain INDIANA IT 20 CORPORATE E Form RS Login and click on Get Form to initiate the process.

- Utilize the tools we offer to fill out your form.

- Mark signNow parts of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal authority as a conventional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your needs in document management in just a few clicks from any device you prefer. Edit and electronically sign INDIANA IT 20 CORPORATE E Form RS Login and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct indiana it 20 corporate e form rs login

Create this form in 5 minutes!

How to create an eSignature for the indiana it 20 corporate e form rs login

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for income file tax with airSlate SignNow?

The income file tax process with airSlate SignNow is streamlined and efficient. Users can easily prepare their documents, send them for eSignature, and track the status of each signature in real-time. This ensures that filing your income taxes is hassle-free and timely.

-

Is airSlate SignNow a cost-effective solution for managing income file tax documents?

Yes, airSlate SignNow offers a cost-effective solution for managing income file tax documents. The pricing plans are designed to fit various budgets while providing comprehensive features that enhance document management. You can save both time and money when filing your income taxes.

-

What features does airSlate SignNow offer for income file tax preparation?

airSlate SignNow provides several features for income file tax preparation, including eSigning, document templates, and automated workflows. These features allow users to create, edit, and send tax documents quickly, ensuring that all necessary signatures are obtained promptly.

-

Can I integrate airSlate SignNow with other tax preparation tools for income file tax?

Absolutely! airSlate SignNow integrates seamlessly with various tax preparation tools, making it easier to handle your income file tax documents. This interoperability allows users to enhance their workflows, combining the best features of both platforms for efficient tax management.

-

How does airSlate SignNow ensure the security of my income file tax documents?

Security is a top priority for airSlate SignNow. The platform implements robust encryption and authentication processes to protect your income file tax documents. You can confidently manage sensitive information, knowing that your documents are secure.

-

What are the benefits of using airSlate SignNow for income file tax filing?

Using airSlate SignNow for income file tax filing offers numerous benefits, including increased efficiency, reduced paperwork, and lower costs. The automated processes save time and improve accuracy, allowing you to focus on more important aspects of your business.

-

Is there customer support available for income file tax inquiries with airSlate SignNow?

Yes, airSlate SignNow offers robust customer support to assist users with any income file tax inquiries. You can signNow out to their support team via chat, email, or phone, ensuring that you receive assistance whenever you need it during the tax filing process.

Get more for INDIANA IT 20 CORPORATE E Form RS Login

Find out other INDIANA IT 20 CORPORATE E Form RS Login

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement

- Sign Hawaii Police Purchase Order Template Computer

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement