Income Taxable 2011

What is the Income Taxable

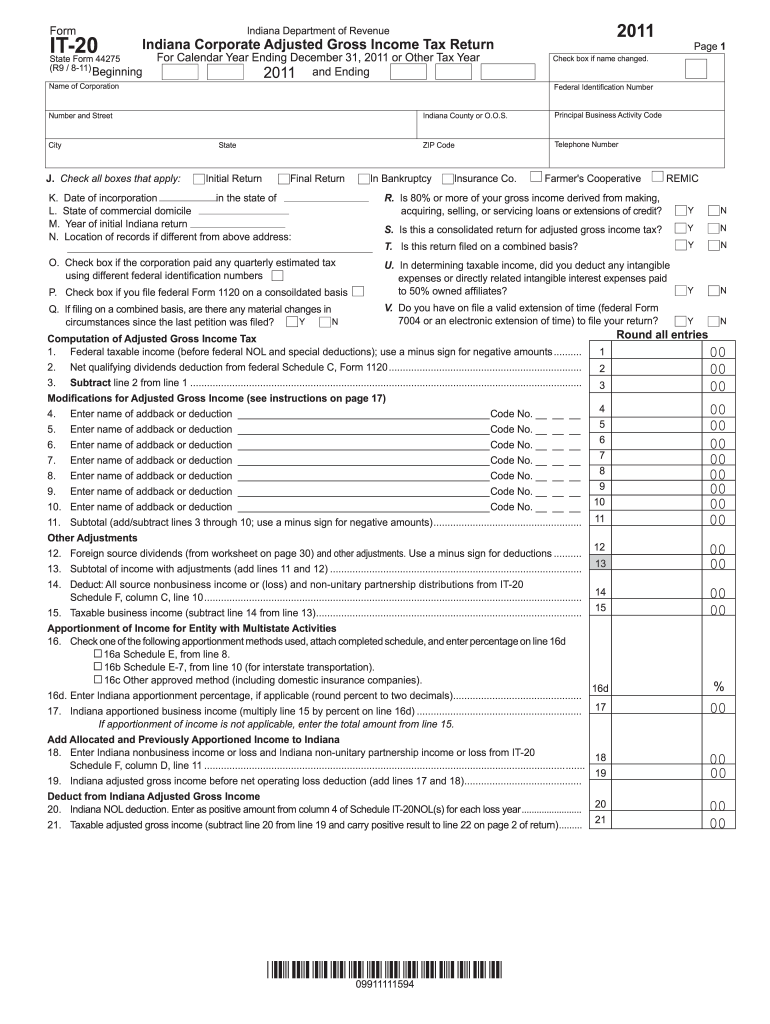

The term "income taxable" refers to income that is subject to taxation by federal, state, or local governments. Generally, this includes wages, salaries, bonuses, and other forms of compensation received for services rendered. Additionally, it encompasses interest, dividends, rental income, and capital gains. Understanding what constitutes taxable income is crucial for accurate tax filing and compliance with IRS regulations.

Steps to complete the Income Taxable

Completing the income taxable section on your tax return involves several key steps. First, gather all relevant income documents, such as W-2s, 1099s, and any other records of income received. Next, calculate your total income by adding all sources of taxable income. Once you have the total, you can proceed to fill out the appropriate forms, ensuring that you report each income source accurately. Finally, review your entries for accuracy before submitting your tax return to avoid potential issues with the IRS.

IRS Guidelines

The IRS provides specific guidelines regarding what income is taxable and how it should be reported. According to IRS rules, nearly all income received in the form of money, goods, property, or services is taxable unless specifically exempted by law. Taxpayers should refer to IRS Publication 525, which details the types of income that must be reported and offers clarity on various exemptions and deductions available. Following these guidelines helps ensure compliance and minimizes the risk of audits or penalties.

Required Documents

To accurately report income taxable, certain documents are essential. Key documents include:

- W-2 Forms: Issued by employers, detailing annual wages and withheld taxes.

- 1099 Forms: Used to report various types of income, including freelance work and interest.

- Bank Statements: To verify interest income and other deposits.

- Investment Statements: For reporting dividends and capital gains.

Having these documents organized and accessible will streamline the tax filing process.

Filing Deadlines / Important Dates

Understanding filing deadlines is crucial for timely submission of your tax return. In the United States, the typical deadline for filing individual income tax returns is April 15. If this date falls on a weekend or holiday, the deadline may be extended. Additionally, taxpayers can request an extension, allowing for an extra six months to file, but any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Penalties for Non-Compliance

Failure to report income taxable or submit a tax return on time can result in significant penalties. The IRS imposes a failure-to-file penalty, which is typically five percent of the unpaid tax for each month the return is late, up to a maximum of 25 percent. Additionally, failing to pay taxes owed can incur a failure-to-pay penalty, which is usually one-half of one percent of the unpaid tax for each month it remains unpaid. Understanding these penalties highlights the importance of timely and accurate tax filing.

Quick guide on how to complete income taxable

Effortlessly prepare Income Taxable on any device

The management of online documents has gained popularity among organizations and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any delays. Manage Income Taxable across any platform with the airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to modify and electronically sign Income Taxable with ease

- Obtain Income Taxable and click on Get Form to initiate.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information using tools specifically provided by airSlate SignNow for this purpose.

- Create your electronic signature with the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Revise and electronically sign Income Taxable and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct income taxable

Create this form in 5 minutes!

People also ask

-

What is a taxable refund and how does it affect my business?

A taxable refund refers to funds you receive that may be considered taxable income by the IRS. If your business provides taxable refunds, it's essential to keep accurate records and understand how they impact your overall tax obligations. airSlate SignNow can help you streamline the documentation process for these transactions, ensuring compliance and efficiency.

-

How does airSlate SignNow support businesses with taxable refunds?

airSlate SignNow allows businesses to send and eSign documents related to taxable refunds quickly and securely. You can create templates for refund agreements, ensuring that all necessary information is captured accurately. This ease of use helps reduce errors and improve record-keeping for taxable refund processes.

-

What features does airSlate SignNow offer for managing taxable refunds?

airSlate SignNow comes equipped with features like customizable document templates, automated workflows, and secure eSignature options that are ideal for managing taxable refunds. These features help businesses ensure that all documents are completed correctly and comply with IRS regulations. Additionally, real-time tracking allows you to monitor the status of your documents easily.

-

Is there a pricing structure for airSlate SignNow that fits businesses dealing with taxable refunds?

Yes, airSlate SignNow offers flexible pricing plans that cater to the needs of businesses dealing with taxable refunds. Whether you are a small business or a large enterprise, you can choose a plan that suits your budget while still providing access to essential features for managing documents. Explore our various plans to find the one that best meets your requirements.

-

Can airSlate SignNow integrate with accounting software for taxable refunds?

Absolutely! airSlate SignNow seamlessly integrates with various accounting software solutions that can help in managing taxable refunds. This integration allows for automatic updates to your financial records, making it easier to track and report taxable income. Simplifying these processes reduces the burden of data entry and enhances accuracy.

-

What are the benefits of using airSlate SignNow for taxable refunds compared to traditional methods?

Using airSlate SignNow for managing taxable refunds can signNowly reduce processing time compared to traditional paper-based methods. The electronic signature functionality enables faster approvals and document retrieval, minimizing delays. Additionally, enhanced security features protect sensitive information associated with taxable refunds.

-

How does airSlate SignNow ensure the security of documents related to taxable refunds?

airSlate SignNow prioritizes the security of documents, especially those linked to taxable refunds, with industry-standard encryption and secure storage solutions. Access controls allow you to determine who can view or edit your documents, adding an extra layer of protection. Our platform complies with international security standards to keep your information safe.

Get more for Income Taxable

- Warning of default on residential lease illinois form

- Landlord tenant closing statement to reconcile security deposit illinois form

- Name change notification package for brides court ordered name change divorced marriage for illinois illinois form

- Name change notification form illinois

- Illinois commercial lease form

- Illinois relative caretaker legal documents package illinois form

- Il guardian form

- Illinois northern district bankruptcy guide and forms package for chapters 7 or 13 illinois

Find out other Income Taxable

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free

- How To Send Sign PDF