Indiana Form it 20 Corporate Adjusted Gross Income Tax 2023-2026

What is the Indiana Form IT 20 Corporate Adjusted Gross Income Tax

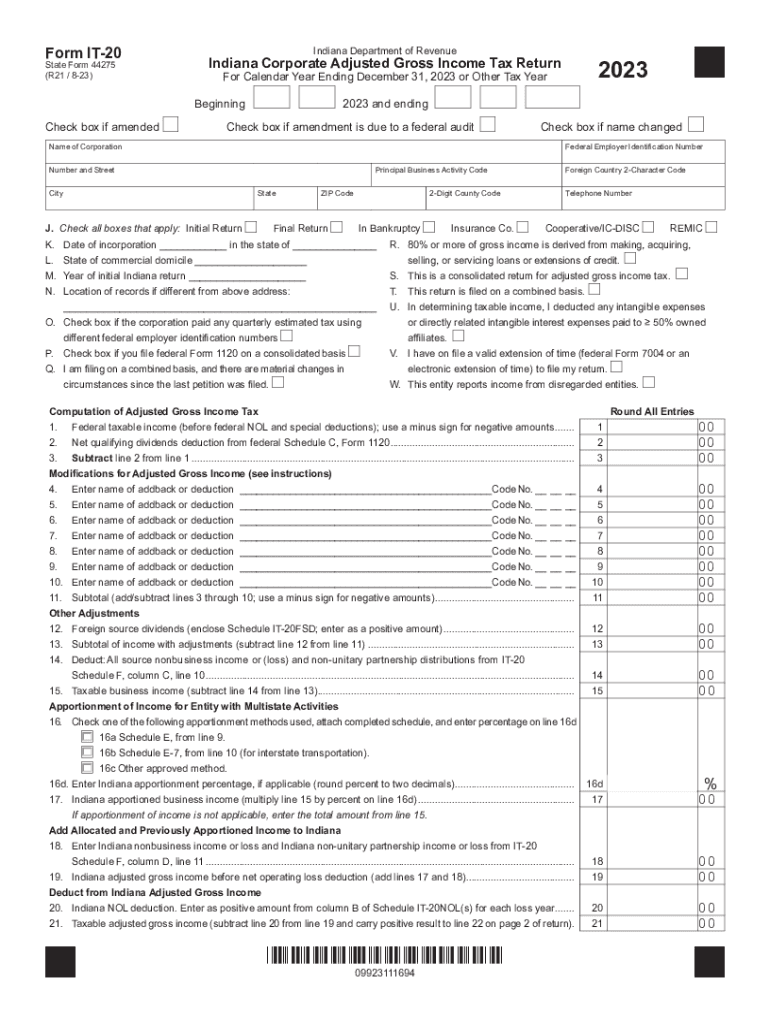

The Indiana Form IT 20 is a tax form used by corporations to report their adjusted gross income tax to the state of Indiana. This form is essential for corporations operating within the state, as it ensures compliance with state tax regulations. The IT 20 form captures various financial details, including income, deductions, and credits, which are necessary for calculating the corporation's tax liability.

Steps to complete the Indiana Form IT 20 Corporate Adjusted Gross Income Tax

Completing the Indiana Form IT 20 involves several key steps:

- Gather financial records: Collect all relevant financial documents, including income statements, balance sheets, and any previous tax returns.

- Calculate adjusted gross income: Determine your corporation's total income and make adjustments for any deductions or exemptions applicable under Indiana tax law.

- Fill out the form: Enter the calculated figures into the appropriate sections of the IT 20 form, ensuring accuracy and completeness.

- Review for errors: Double-check all entries for accuracy, as mistakes can lead to delays or penalties.

- Submit the form: File the completed IT 20 form with the Indiana Department of Revenue by the designated deadline.

Filing Deadlines / Important Dates

Corporations must be aware of specific deadlines when filing the Indiana Form IT 20. Typically, the form is due on the fifteenth day of the fourth month following the end of the corporation's fiscal year. For corporations operating on a calendar year, this means the form is due on April 15. It is crucial to adhere to these deadlines to avoid penalties and interest on unpaid taxes.

Required Documents

To successfully complete the Indiana Form IT 20, several documents are necessary:

- Financial statements, including income statements and balance sheets.

- Records of all income received during the tax year.

- Documentation for any deductions or credits claimed.

- Prior year tax returns for reference.

Who Issues the Form

The Indiana Form IT 20 is issued by the Indiana Department of Revenue. This state agency is responsible for administering tax laws and ensuring compliance among corporations operating within Indiana. The department provides resources and guidance to assist corporations in understanding their tax obligations.

Penalties for Non-Compliance

Failure to file the Indiana Form IT 20 on time can result in significant penalties. Corporations may face a late filing fee, which could increase the longer the form remains unfiled. Additionally, interest may accrue on any unpaid taxes, leading to a larger overall tax liability. It is essential for corporations to file accurately and on time to avoid these consequences.

Quick guide on how to complete indiana form it 20 corporate adjusted gross income tax

Complete Indiana Form IT 20 Corporate Adjusted Gross Income Tax effortlessly on any gadget

Digital document management has become a trend among companies and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed papers, as you can find the necessary form and securely archive it online. airSlate SignNow equips you with all the resources needed to generate, modify, and eSign your documents promptly without delays. Manage Indiana Form IT 20 Corporate Adjusted Gross Income Tax on any device with airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest method to revise and eSign Indiana Form IT 20 Corporate Adjusted Gross Income Tax with little effort

- Find Indiana Form IT 20 Corporate Adjusted Gross Income Tax and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark important sections of your documents or conceal sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a standard wet ink signature.

- Verify all details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tiring form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow addresses your needs in document management in just a few clicks from any device you prefer. Modify and eSign Indiana Form IT 20 Corporate Adjusted Gross Income Tax and assure effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct indiana form it 20 corporate adjusted gross income tax

Create this form in 5 minutes!

How to create an eSignature for the indiana form it 20 corporate adjusted gross income tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the Indiana Form IT-20 instructions for 2023?

The Indiana Form IT-20 instructions for 2023 provide detailed guidance on how to fill out and submit the form for individual income tax reporting. These instructions include information on required documentation, eligibility criteria, and filing deadlines to ensure compliance with state tax laws.

-

How can airSlate SignNow help with submitting the Indiana Form IT-20?

airSlate SignNow can streamline the process of preparing and submitting the Indiana Form IT-20 by allowing users to eSign documents securely online. This platform enhances efficiency by enabling easy collaboration, ensuring that all tax documents are signed and submitted on time with minimal hassle.

-

What features does airSlate SignNow offer for managing Indiana Form IT-20?

airSlate SignNow offers features such as customizable templates, automated reminders, and real-time tracking that are beneficial for managing the Indiana Form IT-20. These tools help users stay organized and ensure that all necessary steps are completed for timely and accurate submissions.

-

Is there a cost associated with using airSlate SignNow for Indiana Form IT-20?

Yes, airSlate SignNow offers various pricing plans to cater to different user needs, which include access to features that facilitate the completion of forms like the Indiana Form IT-20 instructions for 2023. While there may be a subscription fee, the cost-effective solution can save time and resources in the long run.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow allows for seamless integrations with popular accounting and tax preparation software, making it easier to manage the Indiana Form IT-20 instructions for 2023. This connectivity ensures a smoother workflow by allowing users to pull in relevant data and documents directly.

-

What are the benefits of using airSlate SignNow for tax document management?

The benefits of using airSlate SignNow for tax document management include enhanced security, easy access, and efficient tracking of the Indiana Form IT-20 instructions for 2023. With features designed to simplify document handling, users can focus more on their tax strategies rather than administrative burdens.

-

How can I ensure my Indiana Form IT-20 is submitted on time with airSlate SignNow?

By using airSlate SignNow's automated reminders and deadlines feature, you can ensure that your Indiana Form IT-20 is completed and submitted on time. The platform helps with scheduling and notifications, so you never miss an important date during the filing process.

Get more for Indiana Form IT 20 Corporate Adjusted Gross Income Tax

- Prior authorization medication exception request form

- Hca13 form

- Authorization for release of confidential hiv test results form

- Hiv results results form fillable

- Sleep study authorization form

- Hipaa forms west virginia department of health and

- Alaska native medical center anmcorg form

- Abuse of title or authority military what is abuse of form

Find out other Indiana Form IT 20 Corporate Adjusted Gross Income Tax

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe