Form CT W4 Trumbull, CT 2022

What is the Form CT W4 Trumbull, CT

The Form CT W4 is a state-specific document used by employees in Trumbull, Connecticut, to determine the amount of state income tax to withhold from their paychecks. This form is essential for ensuring that the correct amount of tax is withheld based on an individual's personal and financial circumstances. The CT W4 allows employees to claim allowances, which can reduce the amount of tax withheld, helping to manage their take-home pay effectively.

How to use the Form CT W4 Trumbull, CT

To use the Form CT W4, employees should first complete the form accurately, providing necessary personal information such as their name, address, and Social Security number. Next, they need to calculate the number of allowances they are eligible to claim based on their personal situation, including dependents and other factors. Once completed, the form should be submitted to the employer's payroll department to ensure the correct withholding begins with the next paycheck.

Steps to complete the Form CT W4 Trumbull, CT

Completing the Form CT W4 involves several steps:

- Provide your personal information, including your name and Social Security number.

- Determine your filing status and the number of allowances you wish to claim.

- Consider any additional withholding amounts if necessary.

- Sign and date the form to certify that the information is accurate.

- Submit the completed form to your employer.

Legal use of the Form CT W4 Trumbull, CT

The legal use of the Form CT W4 is governed by state tax laws, which require employees to provide accurate information regarding their withholding allowances. Misrepresentation on the form can lead to penalties, including under-withholding or over-withholding of taxes. It is important for employees to review their allowances annually or when their financial situation changes to remain compliant with state regulations.

Filing Deadlines / Important Dates

Employees should be aware of key deadlines related to the Form CT W4. Typically, the form should be submitted to the employer when starting a new job or when there are changes in personal circumstances that affect tax withholding. It is advisable to review and potentially update the form at the beginning of each tax year or after significant life events, such as marriage or the birth of a child.

Required Documents

When completing the Form CT W4, employees may need to reference certain documents to accurately determine their allowances. These may include:

- Previous year’s tax return to assess income and deductions.

- Pay stubs to understand current withholding amounts.

- Documentation for dependents, if applicable.

Who Issues the Form

The Form CT W4 is issued by the Connecticut Department of Revenue Services. It is important for employees to ensure they are using the most current version of the form, as tax laws and regulations may change, affecting withholding requirements.

Quick guide on how to complete form ct w4 trumbull ct

Complete Form CT W4 Trumbull, CT effortlessly on any device

The management of online documents has gained popularity among enterprises and individuals. It offers an ideal eco-friendly option to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the resources required to create, modify, and electronically sign your documents quickly without delays. Handle Form CT W4 Trumbull, CT on any device using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

The easiest way to edit and electronically sign Form CT W4 Trumbull, CT with ease

- Locate Form CT W4 Trumbull, CT and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and has the same legal standing as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method of delivering your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious searches for forms, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign Form CT W4 Trumbull, CT while ensuring exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ct w4 trumbull ct

Create this form in 5 minutes!

How to create an eSignature for the form ct w4 trumbull ct

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

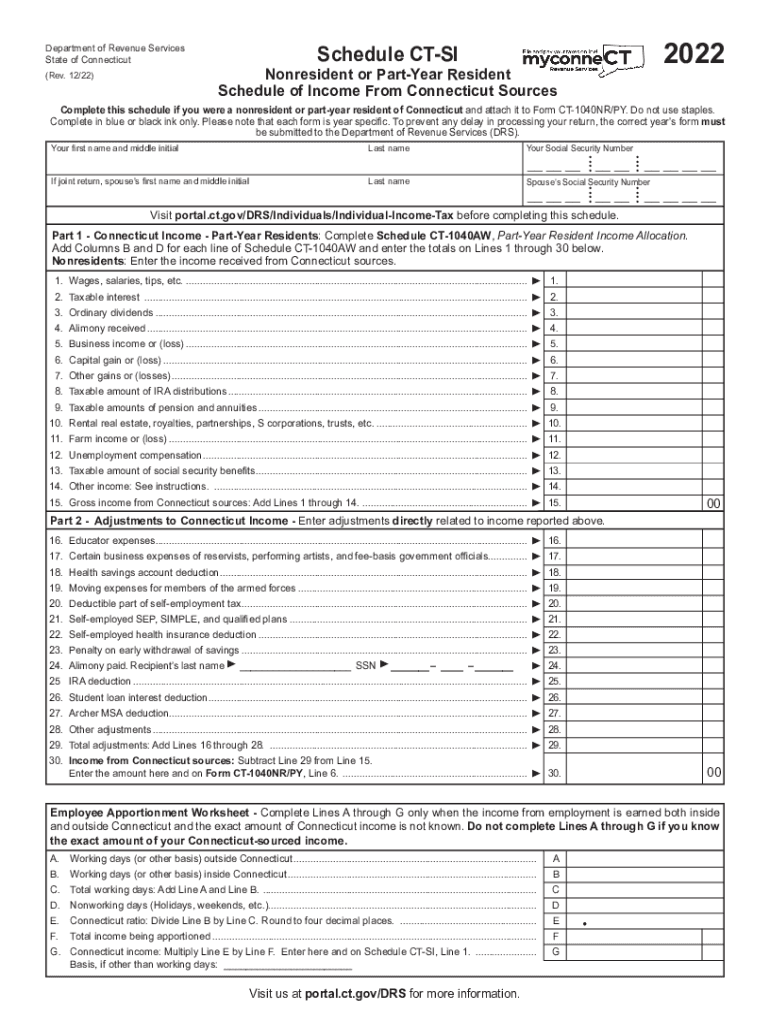

What is ct si in the context of airSlate SignNow?

Ct si refers to the streamlined process of sending and eSigning documents using airSlate SignNow. This solution simplifies paperwork and enhances productivity, making it easier for businesses to manage their documents efficiently.

-

How does airSlate SignNow support the ct si process?

AirSlate SignNow facilitates the ct si process by providing an intuitive platform that integrates electronic signatures and document management. Users can quickly send, sign, and track documents, reducing the time spent on manual processes.

-

What are the pricing options for airSlate SignNow?

AirSlate SignNow offers several pricing tiers, allowing businesses to choose a plan that best fits their needs and budget. Each plan supports the ct si approach, providing essential features such as document templates and advanced security.

-

What features does airSlate SignNow offer for ct si?

Key features of airSlate SignNow for ct si include customizable document templates, real-time tracking, and multi-user collaboration. These tools enhance the overall efficiency of document workflows and improve user experience.

-

Are there any benefits to using airSlate SignNow for ct si?

Yes, using airSlate SignNow for ct si provides numerous benefits, including faster document turnaround times, increased compliance, and reduced operational costs. It also enhances customer satisfaction by offering a seamless signing experience.

-

Can airSlate SignNow integrate with other applications?

Absolutely! AirSlate SignNow integrates with a wide variety of applications, allowing users to streamline their ct si processes. Popular integrations include CRM systems, project management tools, and cloud storage services.

-

How secure is the ct si process with airSlate SignNow?

AirSlate SignNow prioritizes security in the ct si process by using advanced encryption and authentication measures. Users can be confident that their documents are protected and that they comply with industry regulations.

Get more for Form CT W4 Trumbull, CT

- Commercial contractor package south dakota form

- Excavation contractor package south dakota form

- Renovation contractor package south dakota form

- Concrete mason contractor package south dakota form

- Demolition contractor package south dakota form

- Security contractor package south dakota form

- Insulation contractor package south dakota form

- Paving contractor package south dakota form

Find out other Form CT W4 Trumbull, CT

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now