State of CT Income Tax Filing RequirementsIt's Your Yale 2023-2026

Understanding Connecticut Income Tax Filing Requirements

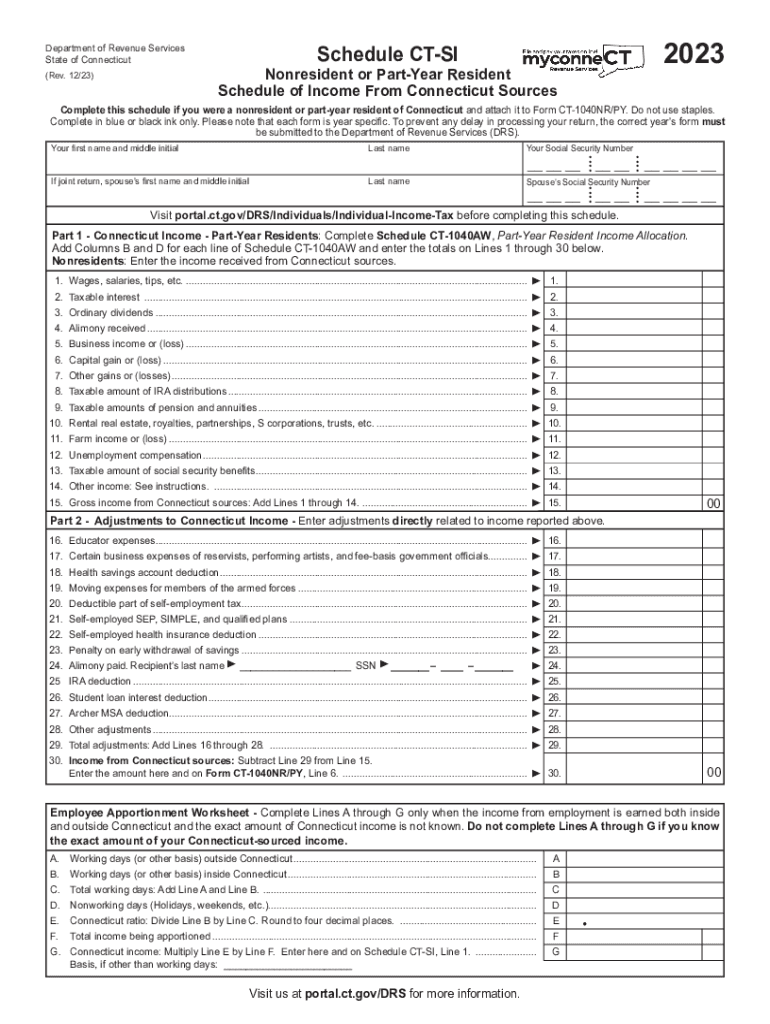

The State of Connecticut has specific income tax filing requirements that residents must adhere to. Generally, individuals must file a Connecticut income tax return if their income exceeds certain thresholds. For the tax year 2023, the filing requirements vary based on residency status, age, and income type. Residents, part-year residents, and non-residents each have distinct criteria that determine whether they need to file. It is essential for taxpayers to familiarize themselves with these requirements to ensure compliance and avoid penalties.

Steps to Complete the Connecticut Income Tax Filing Process

Filing your Connecticut income tax return involves several steps. First, gather all necessary documents, including W-2 forms, 1099 forms, and any other income statements. Next, determine your filing status, which can influence your tax rate and deductions. After that, complete the appropriate forms, such as the CT-1040 for residents or the CT-1040NR for non-residents. Review your completed return for accuracy before submitting it. Finally, file your return either online or by mail, ensuring you meet the deadline to avoid penalties.

Required Documents for Filing Connecticut Taxes

When preparing to file your Connecticut income tax return, certain documents are essential. These typically include:

- W-2 forms from employers

- 1099 forms for other income sources

- Records of any deductions or credits you plan to claim

- Proof of residency if filing as a part-year resident

- Any other relevant financial documents

Having these documents organized will streamline the filing process and help ensure that all income is accurately reported.

Filing Deadlines and Important Dates

Taxpayers in Connecticut should be aware of key deadlines related to income tax filing. For most individuals, the deadline to file your state income tax return is April 15. If this date falls on a weekend or holiday, the deadline may be extended. Additionally, taxpayers should keep in mind that extensions can be requested, but any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Penalties for Non-Compliance with Connecticut Tax Laws

Failure to comply with Connecticut's tax filing requirements can result in significant penalties. These may include fines for late filing or underpayment of taxes. Interest may also accrue on any unpaid taxes from the due date until payment is made. It is crucial for taxpayers to file on time and ensure that all information is accurate to avoid these consequences.

Eligibility Criteria for Filing in Connecticut

Eligibility to file a Connecticut income tax return depends on various factors, including residency status and income level. Residents must file if their income exceeds the state's minimum threshold, while part-year residents and non-residents have different criteria based on the income earned within Connecticut. Understanding these eligibility requirements is vital for ensuring proper compliance with state tax laws.

Form Submission Methods for Connecticut Taxes

Connecticut taxpayers have multiple options for submitting their income tax returns. These methods include:

- Online filing through the Connecticut Department of Revenue Services website

- Mailing paper forms to the appropriate address

- In-person submission at designated tax offices

Choosing the right submission method can help ensure a smooth filing process and timely receipt of any refunds.

Quick guide on how to complete state of ct income tax filing requirementsits your yale

Complete State Of CT Income Tax Filing RequirementsIt's Your Yale effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It serves as an excellent environmentally friendly alternative to traditional printed and signed papers, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without any delays. Manage State Of CT Income Tax Filing RequirementsIt's Your Yale on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented workflow today.

The easiest way to modify and eSign State Of CT Income Tax Filing RequirementsIt's Your Yale effortlessly

- Obtain State Of CT Income Tax Filing RequirementsIt's Your Yale and click on Get Form to begin.

- Take advantage of the tools we provide to complete your document.

- Highlight important sections of the documents or redact sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to deliver your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign State Of CT Income Tax Filing RequirementsIt's Your Yale and guarantee exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct state of ct income tax filing requirementsits your yale

Create this form in 5 minutes!

How to create an eSignature for the state of ct income tax filing requirementsits your yale

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a CT schedule and how does it relate to airSlate SignNow?

A CT schedule, or controlled transaction schedule, is an essential planning tool for businesses. With airSlate SignNow, you can easily manage documents related to your CT schedule, ensuring timely and efficient communication. This streamlines your workflow, allowing you to focus on your core operations without the hassle of paper-based processes.

-

How does pricing for airSlate SignNow work for managing my CT schedule?

Pricing for airSlate SignNow is flexible and designed to accommodate various business sizes. Depending on your needs, you can choose from different plans that offer features suitable for managing your CT schedule. Each plan ensures that you have the tools necessary to streamline document signing and management effectively.

-

What features does airSlate SignNow offer for optimizing my CT schedule?

airSlate SignNow includes features such as document templates, custom branding, and real-time tracking. These tools help you optimize your CT schedule by automating workflows, ensuring that each step in the signing process is as efficient as possible. You can also integrate reminders to keep everyone informed about deadlines.

-

Can airSlate SignNow help with compliance-related documents in my CT schedule?

Yes, airSlate SignNow aids in ensuring compliance with various regulatory standards necessary for your CT schedule. The platform offers secure eSigning options and audit trails, helping you maintain valid records for compliance inspections. This feature is invaluable for businesses looking to uphold industry regulations.

-

Does airSlate SignNow integrate with other tools I use for my CT schedule?

Yes, airSlate SignNow offers seamless integrations with a variety of tools, including CRM systems, project management software, and email services. This ability allows you to incorporate eSigning capabilities directly into your existing workflows associated with the CT schedule, enhancing efficiency and productivity.

-

What benefits will airSlate SignNow provide for managing my CT schedule?

By utilizing airSlate SignNow, businesses can experience increased efficiency, cost savings, and improved collaboration when managing their CT schedule. The platform reduces the time spent on document processing and eliminates the risk of errors associated with manual handling. This lets you focus on your business priorities and boost productivity.

-

How can I get started with airSlate SignNow for my CT schedule?

Getting started with airSlate SignNow for your CT schedule is easy. Simply sign up for a free trial to explore the platform's features and capabilities. Once you're ready, you can select a pricing plan that fits your business needs and begin integrating eSigning into your document workflows.

Get more for State Of CT Income Tax Filing RequirementsIt's Your Yale

- Abc checklist form

- Ho chunk nation k 12 application form

- Thelma rae self music scholarship form

- Cput application closing date form

- Austin high school librarys reading challenge form

- Dance audition form template

- Chicago state university transcripts form

- Asip application form new england college of optometry neco

Find out other State Of CT Income Tax Filing RequirementsIt's Your Yale

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy