Form MO 1040 Individual Income Tax Return Long Form 2022

What is the Form MO 1040 Individual Income Tax Return Long Form

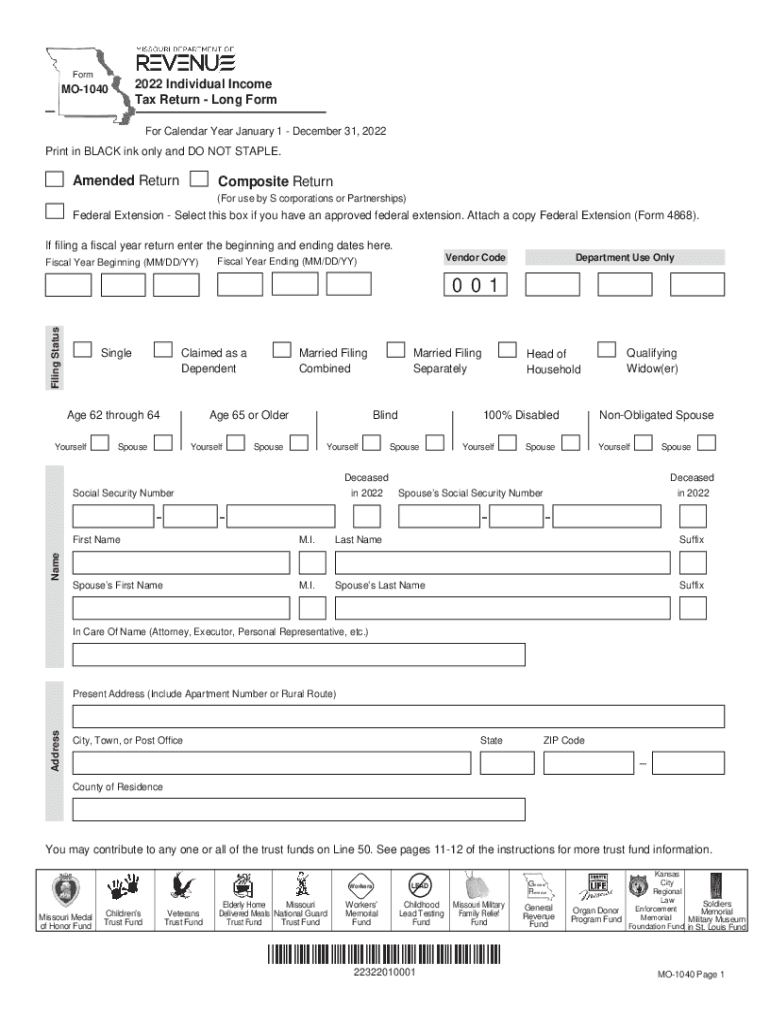

The Form MO 1040 is the official document used by residents of Missouri to report their individual income tax to the state. This long form is specifically designed for taxpayers who have more complex financial situations, such as multiple sources of income, various deductions, and credits. It allows for detailed reporting, ensuring that all income is accounted for and appropriate deductions are claimed. The form must be completed accurately to ensure compliance with Missouri tax laws.

Steps to complete the Form MO 1040 Individual Income Tax Return Long Form

Completing the Form MO 1040 involves several key steps:

- Gather all necessary financial documents, including W-2s, 1099s, and records of other income.

- Determine your filing status, which may affect your tax rate and eligibility for certain deductions.

- Fill out the personal information section at the top of the form, including your name, address, and Social Security number.

- Report all sources of income, including wages, dividends, and interest, in the appropriate sections.

- Claim deductions and credits that apply to your situation, ensuring you have documentation to support your claims.

- Calculate your total tax liability and any payments made or refunds due.

- Review the form for accuracy before signing and dating it.

Legal use of the Form MO 1040 Individual Income Tax Return Long Form

The Form MO 1040 is legally binding once it is signed and submitted to the Missouri Department of Revenue. It is essential to ensure that all information provided is truthful and complete, as inaccuracies can lead to penalties or audits. The form must be filed by the designated deadline to avoid late fees. Utilizing an electronic signature through a compliant platform can enhance the security and validity of the submission.

Required Documents

To complete the Form MO 1040 accurately, you will need several documents:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Records of other income, such as interest or dividends

- Documentation for deductions, including receipts for medical expenses, mortgage interest statements, and property tax records

- Any prior year tax returns that may provide relevant information

Filing Deadlines / Important Dates

The filing deadline for the Form MO 1040 typically aligns with the federal tax deadline, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. It is crucial to stay informed about any changes to the filing schedule, as well as any potential extensions that may be available for specific circumstances.

Form Submission Methods (Online / Mail / In-Person)

The Form MO 1040 can be submitted in various ways:

- Online through the Missouri Department of Revenue’s e-filing system, which is often the fastest method.

- By mail, sending the completed form to the appropriate address listed on the form.

- In-person at designated tax offices, which may provide additional assistance for complex filings.

Quick guide on how to complete form mo 1040 2022 individual income tax return long form

Complete Form MO 1040 Individual Income Tax Return Long Form effortlessly on any device

Digital document management has gained traction among organizations and individuals alike. It offers an ideal eco-friendly substitute to traditional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to craft, alter, and eSign your documents quickly and seamlessly. Manage Form MO 1040 Individual Income Tax Return Long Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

The simplest method to adjust and eSign Form MO 1040 Individual Income Tax Return Long Form without any hassle

- Locate Form MO 1040 Individual Income Tax Return Long Form and click on Get Form to initiate.

- Utilize the tools provided to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information with features available from airSlate SignNow designed specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious searches for forms, or errors that require reprinting new copies. airSlate SignNow meets your document management needs within a few clicks from any device you select. Modify and eSign Form MO 1040 Individual Income Tax Return Long Form, ensuring exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form mo 1040 2022 individual income tax return long form

Create this form in 5 minutes!

How to create an eSignature for the form mo 1040 2022 individual income tax return long form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the mo 1040 form 2023 and why do I need it?

The mo 1040 form 2023 is a state income tax return form used by residents of Missouri to report their income and calculate taxes owed. Completing this form is essential for compliance with state tax laws and to avoid penalties. airSlate SignNow simplifies the eSigning process for your mo 1040 form 2023, ensuring you can file your taxes quickly and efficiently.

-

How does airSlate SignNow help with completing the mo 1040 form 2023?

airSlate SignNow streamlines the completion of your mo 1040 form 2023 by allowing you to fill out and eSign documents in a secure, user-friendly environment. You can easily import your tax documents and send them for signatures, all while ensuring compliance with Missouri state regulations. This feature helps save time and reduces errors in the filing process.

-

Is there a cost associated with using airSlate SignNow for the mo 1040 form 2023?

Yes, airSlate SignNow offers various pricing plans to cater to different needs. Our plans are designed to be cost-effective, making it accessible for individuals and businesses to manage their mo 1040 form 2023 and other documents. You can choose a plan that fits your budget while leveraging our features for an efficient signing process.

-

Can I use airSlate SignNow to collaborate with others on my mo 1040 form 2023?

Absolutely! airSlate SignNow provides robust collaboration features that allow multiple users to review and sign the mo 1040 form 2023 simultaneously. This enhances the efficiency of the process as you can communicate directly within the platform and ensure all necessary parties are involved in the filing of your state taxes.

-

What are the key benefits of using airSlate SignNow for my mo 1040 form 2023?

Using airSlate SignNow for your mo 1040 form 2023 streamlines the filing process by offering a secure, efficient platform for completing and signing your documents. Our integration capabilities allow you to connect with various applications for seamless workflow management. Ultimately, this saves you time and reduces stress during tax season.

-

Does airSlate SignNow offer integrations for handling the mo 1040 form 2023?

Yes, airSlate SignNow integrates with numerous business applications, making it easy to manage your mo 1040 form 2023 alongside your other workflows. These integrations allow you to import data directly from accounting software and send documents for eSigning without leaving the platform. This helps streamline the entire tax filing process.

-

Is airSlate SignNow compliant with state regulations for the mo 1040 form 2023?

Yes, airSlate SignNow is designed to comply with all state regulations, including those related to the mo 1040 form 2023. Our platform utilizes secure technology to protect your sensitive information and ensure that all signatures are legally binding. You can trust that your tax documents will meet state compliance requirements.

Get more for Form MO 1040 Individual Income Tax Return Long Form

- Sellers information for appraiser provided to buyer texas

- Handbook real estate 497327197 form

- Subcontractors agreement texas form

- Texas prenuptial premarital agreement uniform premarital agreement act with financial statements texas

- Texas prenuptial premarital agreement without financial statements texas form

- Texas premarital agreement form

- Financial statements only in connection with prenuptial premarital agreement texas form

- Premarital prenuptial agreement 497327203 form

Find out other Form MO 1040 Individual Income Tax Return Long Form

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document