MO 10402023 Individual Income Tax Return Long Form 2023

Understanding the MO 1040 Individual Income Tax Return Long Form

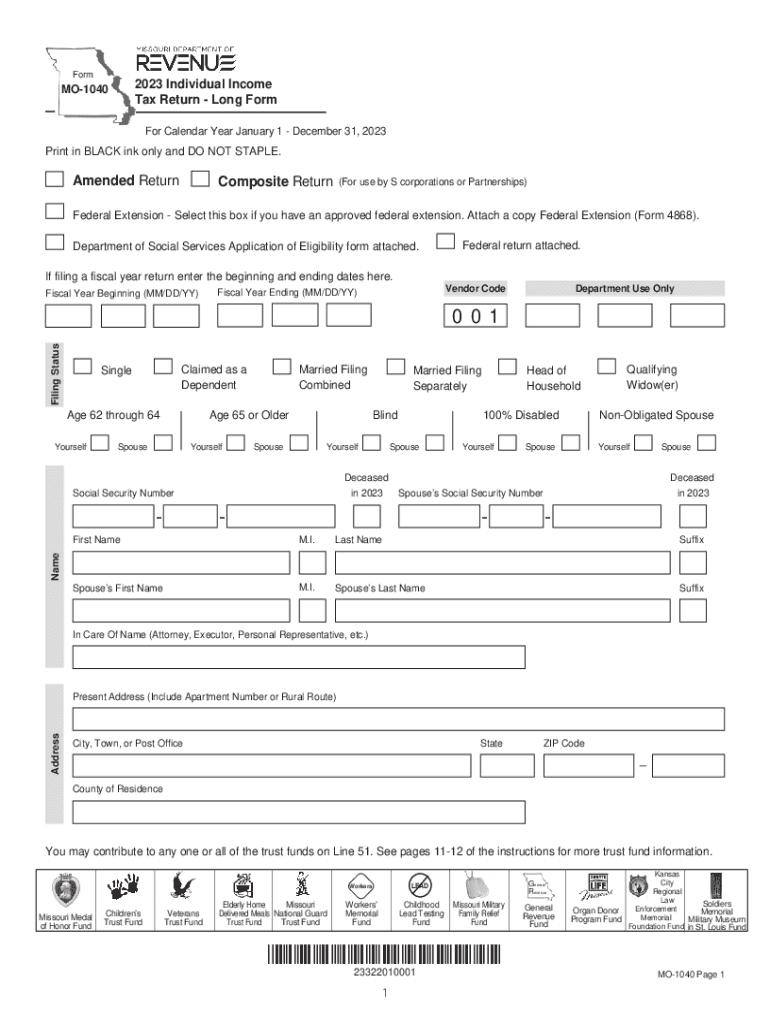

The MO 1040 is the official Individual Income Tax Return form for residents of Missouri. This form is used to report income, calculate taxes owed, and claim any applicable credits or deductions. The long form is designed for individuals with more complex tax situations, such as those with multiple sources of income, itemized deductions, or specific tax credits. Understanding the details of the MO 1040 is essential for accurate tax reporting and compliance with state tax laws.

Steps to Complete the MO 1040 Individual Income Tax Return Long Form

Completing the MO 1040 involves several key steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your total income from all sources, ensuring to include any taxable interest and dividends.

- Calculate your adjusted gross income (AGI) by applying any adjustments allowed by Missouri law.

- Determine your deductions. You can choose between the standard deduction and itemizing your deductions.

- Calculate your taxable income by subtracting your deductions from your AGI.

- Apply the appropriate tax rates to compute your total tax liability.

- Claim any credits you are eligible for, such as the Missouri Property Tax Credit or the Earned Income Tax Credit.

- Complete the form by signing and dating it, and ensure all information is accurate before submission.

Required Documents for the MO 1040 Individual Income Tax Return Long Form

To successfully complete the MO 1040, you will need several documents:

- W-2 forms from employers, which report your annual wages and taxes withheld.

- 1099 forms for any freelance or contract work, reporting non-employment income.

- Documentation of any other income sources, such as rental income or investment earnings.

- Records of deductible expenses, including receipts for medical expenses, charitable donations, and mortgage interest.

- Proof of eligibility for any tax credits, such as documentation for education expenses or childcare costs.

Filing Deadlines for the MO 1040 Individual Income Tax Return Long Form

Filing deadlines for the MO 1040 are crucial to avoid penalties:

- The standard deadline for filing your Missouri state tax return is April 15th of the following year.

- If April 15th falls on a weekend or holiday, the deadline is extended to the next business day.

- Extensions may be available, but any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Form Submission Methods for the MO 1040 Individual Income Tax Return Long Form

You have several options for submitting the MO 1040:

- Online submission through the Missouri Department of Revenue's e-filing system, which is secure and efficient.

- Mailing a paper copy of the completed form to the appropriate address provided in the instructions.

- In-person submission at local Department of Revenue offices, where assistance may be available.

State-Specific Rules for the MO 1040 Individual Income Tax Return Long Form

Missouri has specific rules that affect how you complete the MO 1040:

- Residents must report all income earned, regardless of where it was earned, while non-residents only report Missouri-source income.

- Missouri allows for certain deductions that may differ from federal guidelines, such as specific retirement contributions.

- Tax credits available to Missouri residents can significantly reduce tax liability, so it is essential to review eligibility criteria carefully.

Quick guide on how to complete mo 10402023 individual income tax return long form

Prepare MO 10402023 Individual Income Tax Return Long Form effortlessly on any device

Digital document management has gained traction with businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely archive it online. airSlate SignNow equips you with all the necessary tools to create, alter, and electronically sign your documents quickly and efficiently. Handle MO 10402023 Individual Income Tax Return Long Form on any platform with airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and electronically sign MO 10402023 Individual Income Tax Return Long Form effortlessly

- Find MO 10402023 Individual Income Tax Return Long Form and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important parts of your documents or conceal sensitive information with tools that airSlate SignNow specifically offers for that function.

- Create your signature using the Sign function, which takes just moments and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Choose how you would like to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign MO 10402023 Individual Income Tax Return Long Form and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct mo 10402023 individual income tax return long form

Create this form in 5 minutes!

How to create an eSignature for the mo 10402023 individual income tax return long form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the Missouri 1040 instructions for 2023?

The Missouri 1040 instructions for 2023 provide detailed guidance on how to complete your state income tax return. This includes information on the necessary forms, schedules, and documentation required. For accurate filing, it's crucial to follow these instructions closely to ensure compliance with state regulations.

-

How can I obtain the Missouri 1040 instructions for 2023?

You can obtain the Missouri 1040 instructions for 2023 from the official Missouri Department of Revenue website. They usually provide downloadable PDFs which include comprehensive details on filing your taxes. Additionally, many tax software solutions reference these instructions directly within their applications.

-

Are there any changes in the Missouri 1040 instructions for 2023 compared to previous years?

Yes, the Missouri 1040 instructions for 2023 may include updates concerning deductions, credits, and any changes in tax rates. It’s essential to review these changes to ensure you're aware of new opportunities or requirements. Staying informed can help taxpayers maximize their refunds or minimize their liabilities.

-

What features does airSlate SignNow offer for signing Missouri 1040 forms?

airSlate SignNow provides user-friendly features that allow you to electronically sign Missouri 1040 forms securely. You can easily upload, sign, and send your documents, simplifying the tax filing process. This efficiency ensures that your forms are submitted on time and with minimal hassle.

-

How much does airSlate SignNow cost and is it worth it for Missouri 1040 filings?

airSlate SignNow offers a range of pricing plans that cater to different business needs, making it a cost-effective solution for electronic signatures. Given the importance of timely and accurate filings, investing in SignNow can help streamline the submission of your Missouri 1040, saving you time and reducing errors.

-

Can airSlate SignNow integrate with tax software for Missouri 1040 filings?

Yes, airSlate SignNow integrates with various tax software applications, making it easy for you to incorporate eSignatures into your Missouri 1040 filing process. This integration helps you manage your documents more effectively, ensuring a smoother workflow when dealing with tax preparations.

-

What are the benefits of using airSlate SignNow for filing Missouri 1040 forms?

Using airSlate SignNow to file your Missouri 1040 offers numerous benefits, including improved efficiency and enhanced security for your sensitive documents. The platform’s user-friendly design allows for quick signing and sharing of forms, which can signNowly reduce the time spent on tax-related tasks and enhance compliance.

Get more for MO 10402023 Individual Income Tax Return Long Form

- Member in training application process idsog form

- Moaa claims form

- Endorsementsponsorshipinitiative requestosteoarthritis form

- American fidelity claim form

- Ofac faqs other sanctions programs treasury department form

- Tcc bacterial meningitis vaccination verification form

- Mychart child form

- Aetna reimbursement form 27117932

Find out other MO 10402023 Individual Income Tax Return Long Form

- How To Electronic signature Arkansas Construction Word

- How Do I Electronic signature Arkansas Construction Document

- Can I Electronic signature Delaware Construction PDF

- How Can I Electronic signature Ohio Business Operations Document

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF