1099 InformationKansas Department of Administration 2022-2026

Understanding the 1099 Information

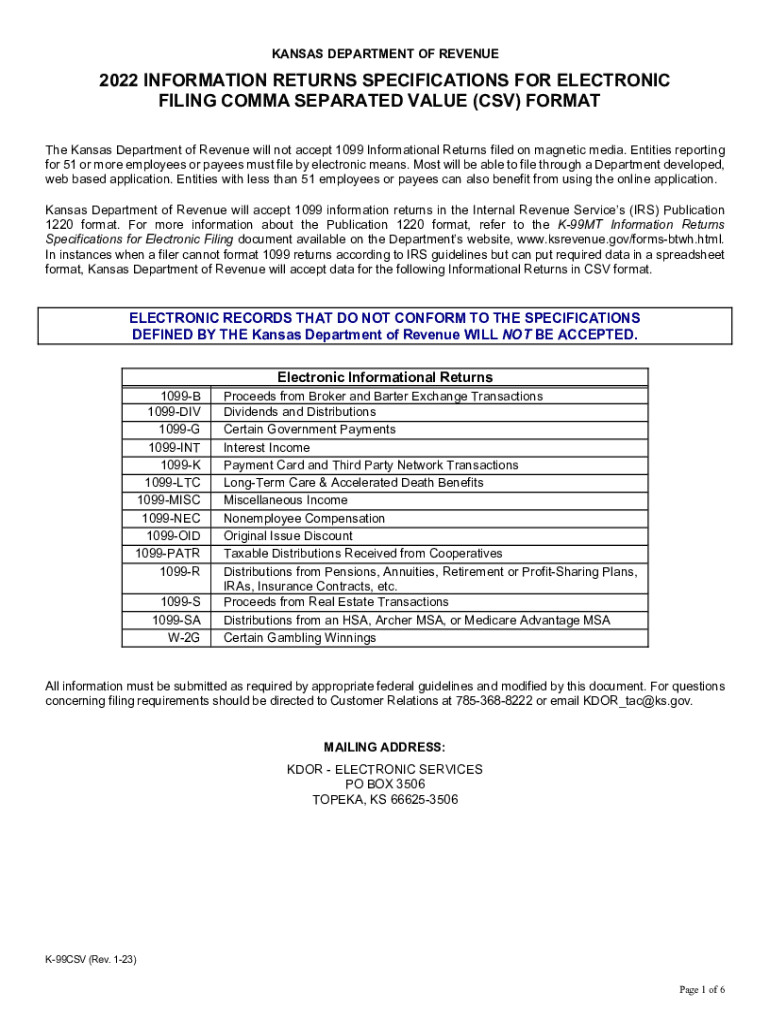

The 1099 Information form is essential for reporting various types of income that are not classified as wages. This includes income from self-employment, interest, dividends, and other sources. The Kansas Department of Administration oversees the proper use and submission of this form. It is crucial for both individuals and businesses to understand the requirements to ensure compliance with state and federal regulations.

Steps to Complete the 1099 Information

Completing the 1099 Information form involves several key steps:

- Gather all necessary financial documents, including records of payments made to contractors or other income sources.

- Fill out the form accurately, ensuring that all amounts are reported correctly to avoid penalties.

- Include the taxpayer identification number (TIN) for both the payer and the recipient.

- Review the form for any errors before submission to ensure compliance with IRS guidelines.

Legal Use of the 1099 Information

The legal use of the 1099 Information form is governed by IRS regulations. It is required to report income to the IRS and must be provided to recipients by January 31 of the following tax year. Failure to file this form correctly can result in penalties, making it essential to adhere to the guidelines set forth by both the IRS and the Kansas Department of Administration.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the 1099 Information form is critical to avoid penalties. The form must be submitted to the IRS by February 28 if filed by mail, or by March 31 if filed electronically. Recipients must receive their copies by January 31. Keeping track of these dates helps ensure compliance and smooth processing of tax documents.

Required Documents for Submission

When preparing to submit the 1099 Information form, it is important to have the following documents ready:

- Records of payments made to contractors or other income sources.

- Taxpayer identification numbers for both the payer and recipient.

- Any supporting documentation that verifies the amounts reported on the form.

Penalties for Non-Compliance

Non-compliance with the filing requirements for the 1099 Information form can lead to significant penalties. The IRS imposes fines for late filings, incorrect information, and failure to provide copies to recipients. It is advisable to familiarize yourself with these penalties to avoid unnecessary costs.

Quick guide on how to complete 1099 informationkansas department of administration

Craft 1099 InformationKansas Department Of Administration effortlessly on any gadget

Virtual document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed files, allowing you to locate the appropriate template and securely store it online. airSlate SignNow equips you with all the tools necessary to generate, alter, and eSign your documents swiftly and without holdups. Handle 1099 InformationKansas Department Of Administration on any device using airSlate SignNow's Android or iOS applications, and streamline any document-related task today.

How to modify and eSign 1099 InformationKansas Department Of Administration with ease

- Locate 1099 InformationKansas Department Of Administration and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive details with tools specifically designed by airSlate SignNow for this purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Verify the information and then press the Done button to save your modifications.

- Select your preferred method for delivering the form, whether by email, text message (SMS), or shareable link, or download it to your computer.

No more worrying about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and eSign 1099 InformationKansas Department Of Administration while ensuring effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1099 informationkansas department of administration

Create this form in 5 minutes!

How to create an eSignature for the 1099 informationkansas department of administration

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ks specifications format pdf and how is it used?

The ks specifications format pdf is a standardized way to structure documents for easy understanding and sharing. It is particularly useful for businesses that need to present specifications clearly and professionally. By using this format, you can ensure your documents are accessible and meet industry standards.

-

How can airSlate SignNow support my use of ks specifications format pdf?

airSlate SignNow is designed to streamline the process of sending and signing documents, including those in ks specifications format pdf. Our platform allows you to upload, eSign, and manage these documents efficiently, ensuring you maintain compliance and enhance productivity.

-

What are the pricing options for using airSlate SignNow with ks specifications format pdf?

We offer various pricing plans tailored to different business needs, making it affordable to utilize airSlate SignNow for your ks specifications format pdf documents. You can choose a plan that fits your size and usage, and each plan provides access to all essential features necessary for document management.

-

Can I integrate airSlate SignNow with other tools while using ks specifications format pdf?

Yes, airSlate SignNow offers seamless integration with various software tools, making it easy to manage your ks specifications format pdf documents alongside other business applications. Whether it's CRM systems or document storage solutions, our integrations enhance your workflow efficiency.

-

Are there any templates available for ks specifications format pdf within airSlate SignNow?

Yes, airSlate SignNow provides a range of customizable templates for documents in ks specifications format pdf. These templates help you get started quickly, ensuring that your specifications are well-structured and easy to fill out, saving you time and effort.

-

What benefits does airSlate SignNow provide for managing ks specifications format pdf documents?

Utilizing airSlate SignNow for your ks specifications format pdf documents offers numerous benefits, including enhanced security, ease of access, and streamlined collaboration. You can track document progress in real-time and ensure that all signatures are gathered efficiently, improving your overall document workflow.

-

Is airSlate SignNow secure for handling ks specifications format pdf?

Absolutely! airSlate SignNow prioritizes security, incorporating advanced encryption protocols to protect your ks specifications format pdf documents. Our platform is compliant with industry standards to ensure that your sensitive information remains secure throughout the signing process.

Get more for 1099 InformationKansas Department Of Administration

Find out other 1099 InformationKansas Department Of Administration

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe