INFORMATION RETURNS SPECIFICATIONS for 2020

What is the INFORMATION RETURNS SPECIFICATIONS FOR

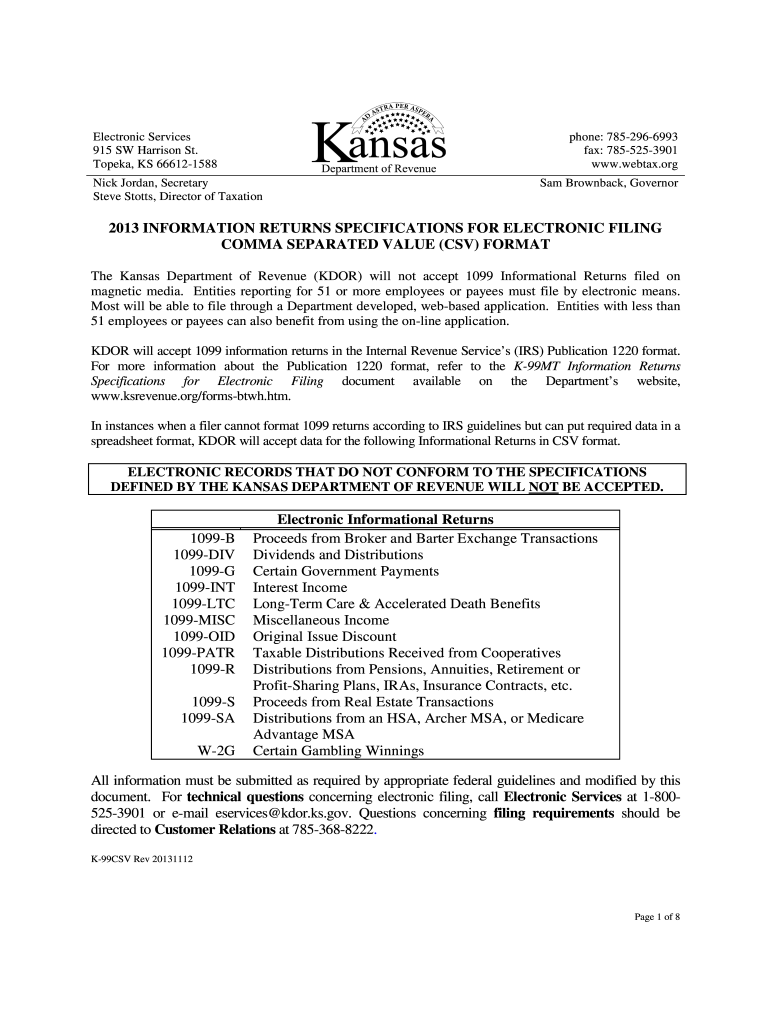

The INFORMATION RETURNS SPECIFICATIONS FOR refers to a set of guidelines established by the Internal Revenue Service (IRS) that outlines the requirements for filing information returns. These specifications ensure that businesses report various types of income and transactions accurately. Common forms associated with these specifications include the 1099 series, which is used to report payments made to non-employees, and other forms that document income, deductions, and credits. Understanding these specifications is crucial for compliance and to avoid potential penalties.

Steps to complete the INFORMATION RETURNS SPECIFICATIONS FOR

Completing the INFORMATION RETURNS SPECIFICATIONS FOR involves several key steps to ensure accuracy and compliance. First, identify the correct form based on the type of payment or transaction being reported. Next, gather all necessary information, including the recipient's name, taxpayer identification number, and the amount paid. Fill out the form carefully, ensuring that all details are accurate and complete. After completing the form, review it for any errors before submission. Finally, submit the form electronically or by mail, adhering to the IRS deadlines for filing.

Legal use of the INFORMATION RETURNS SPECIFICATIONS FOR

The legal use of the INFORMATION RETURNS SPECIFICATIONS FOR is essential for businesses to fulfill their tax obligations. These specifications provide a framework that ensures all income and transactions are reported to the IRS in a standardized manner. Compliance with these specifications helps businesses avoid legal issues, including audits and penalties. It is important to use the correct forms and follow the guidelines closely to maintain legal integrity in financial reporting.

Filing Deadlines / Important Dates

Filing deadlines for the INFORMATION RETURNS SPECIFICATIONS FOR vary depending on the specific form being submitted. Generally, most information returns must be filed by January thirty-first of the year following the tax year in question. If filing electronically, the deadline may extend to March thirty-first. It is crucial for businesses to be aware of these deadlines to avoid late filing penalties. Keeping a calendar of important tax dates can help ensure timely submissions.

Required Documents

To complete the INFORMATION RETURNS SPECIFICATIONS FOR, certain documents are required. These typically include the recipient's taxpayer identification number (TIN), which can be obtained using Form W-9, and any supporting documentation that verifies the payments made. Additionally, businesses may need to maintain records of the transactions being reported, such as invoices or contracts, to substantiate the amounts reported on the information returns.

Penalties for Non-Compliance

Failure to comply with the INFORMATION RETURNS SPECIFICATIONS FOR can result in significant penalties for businesses. The IRS imposes fines for late filings, incorrect information, and failure to file altogether. These penalties can vary based on the severity of the non-compliance and the length of time the issue persists. It is essential for businesses to understand these potential penalties and take proactive measures to ensure compliance with all filing requirements.

IRS Guidelines

The IRS provides detailed guidelines regarding the INFORMATION RETURNS SPECIFICATIONS FOR, which outline the requirements for various forms and the procedures for filing them. These guidelines include information on who must file, what constitutes reportable payments, and how to correct errors on filed forms. Staying updated with IRS guidelines is vital for businesses to ensure they are following the most current regulations and avoiding any compliance issues.

Quick guide on how to complete 2011 information returns specifications for

Prepare INFORMATION RETURNS SPECIFICATIONS FOR effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed paperwork, as you can obtain the necessary form and securely keep it online. airSlate SignNow provides you with all the resources you require to create, modify, and eSign your documents quickly and efficiently. Handle INFORMATION RETURNS SPECIFICATIONS FOR on any device using airSlate SignNow’s Android or iOS applications and enhance any document-focused procedure today.

The simplest method to modify and eSign INFORMATION RETURNS SPECIFICATIONS FOR with ease

- Obtain INFORMATION RETURNS SPECIFICATIONS FOR and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or redact sensitive information using tools that airSlate SignNow has specifically designed for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about misplaced or lost files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign INFORMATION RETURNS SPECIFICATIONS FOR and guarantee excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2011 information returns specifications for

Create this form in 5 minutes!

How to create an eSignature for the 2011 information returns specifications for

The best way to create an electronic signature for your PDF in the online mode

The best way to create an electronic signature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The way to generate an eSignature straight from your smart phone

The way to create an electronic signature for a PDF on iOS devices

The way to generate an eSignature for a PDF document on Android OS

People also ask

-

What are the INFORMATION RETURNS SPECIFICATIONS FOR using airSlate SignNow?

The INFORMATION RETURNS SPECIFICATIONS FOR airSlate SignNow outline the necessary guidelines for preparing and submitting electronic documents. This ensures that all compliance and regulatory requirements are met efficiently. By following these specifications, businesses can streamline their document processes while maintaining legal validity.

-

How does airSlate SignNow handle DOCUMENT SECURITY in accordance with INFORMATION RETURNS SPECIFICATIONS FOR?

airSlate SignNow prioritizes document security by adhering to rigorous INFORMATION RETURNS SPECIFICATIONS FOR. Our platform employs advanced encryption methods and secure access controls to protect sensitive information. This means your documents are safeguarded against unauthorized access while ensuring compliance with industry standards.

-

What pricing options does airSlate SignNow offer for services related to INFORMATION RETURNS SPECIFICATIONS FOR?

airSlate SignNow provides a flexible pricing model tailored to fit various business needs concerning INFORMATION RETURNS SPECIFICATIONS FOR. Pricing plans range from basic to premium, offering features that include eSignature, document tracking, and integrations with other platforms. You can choose the plan that best meets your operational requirements and budget.

-

What features of airSlate SignNow support INFORMATION RETURNS SPECIFICATIONS FOR?

airSlate SignNow includes multiple features such as customizable templates, audit trails, and compliance checks, which help support INFORMATION RETURNS SPECIFICATIONS FOR. These features enable businesses to prepare, send, and store their documents systematically while ensuring they meet necessary specifications. Furthermore, our user-friendly interface simplifies the document management process.

-

How can airSlate SignNow improve efficiency in managing INFORMATION RETURNS SPECIFICATIONS FOR?

Using airSlate SignNow can signNowly enhance efficiency in managing INFORMATION RETURNS SPECIFICATIONS FOR by automating document workflows. With signature requests and approvals streamlined, businesses can reduce turnaround times and minimize errors. This enables teams to focus on core tasks without being bogged down by manual processes.

-

Does airSlate SignNow integrate with other tools for INFORMATION RETURNS SPECIFICATIONS FOR?

Yes, airSlate SignNow offers seamless integrations with various software solutions to facilitate INFORMATION RETURNS SPECIFICATIONS FOR. This compatibility allows for smoother data transfer and improves workflow continuity. Users can connect with CRM systems, accounting platforms, and cloud storage services easily.

-

What are the benefits of using airSlate SignNow for INFORMATION RETURNS SPECIFICATIONS FOR?

The benefits of using airSlate SignNow for INFORMATION RETURNS SPECIFICATIONS FOR include enhanced compliance, cost savings, and improved collaboration. It simplifies the entire signing process, allowing teams to work together effectively regardless of their location. This leads to quicker completion of critical documents while ensuring adherence to specified requirements.

Get more for INFORMATION RETURNS SPECIFICATIONS FOR

- Form of option see rule 8 9

- Uia work search form

- Emotional stability questionnaire esq pdf form

- Kyc access bank form

- Borang permohonan visa malaysia form

- Flight ticket form

- Office of land surveys manual caltrans state of california form

- Dpd 3002 request for photographs maps as built plans or other form

Find out other INFORMATION RETURNS SPECIFICATIONS FOR

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney

- How To Sign Pennsylvania Car Dealer Quitclaim Deed

- How Can I Sign Pennsylvania Car Dealer Quitclaim Deed

- Sign Rhode Island Car Dealer Agreement Safe

- Sign South Dakota Car Dealer Limited Power Of Attorney Now

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast

- How To Sign Wisconsin Car Dealer Rental Lease Agreement

- How To Sign Wisconsin Car Dealer Quitclaim Deed

- How Do I Sign Wisconsin Car Dealer Quitclaim Deed