New Rules and Limitations for Depreciation and Expensing 2022

Understanding the New Rules and Limitations for Depreciation and Expensing

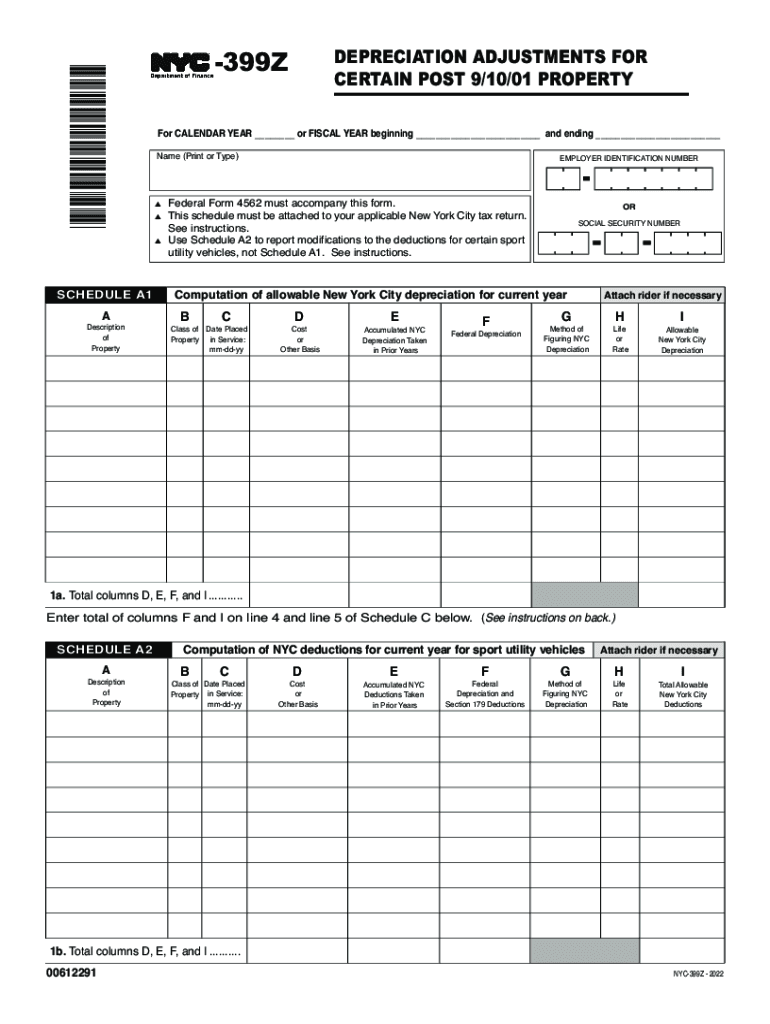

The new rules for depreciation and expensing significantly impact how property owners manage their assets. Under the Tax Cuts and Jobs Act, changes were made to the depreciation schedule for certain property types, including the NYC 399Z depreciation property. The most notable changes include increased bonus depreciation and altered limits on expensing. Property owners can now deduct a larger portion of their capital investments in the first year, enhancing cash flow and tax efficiency. However, these benefits come with specific limitations and requirements that must be understood to ensure compliance.

Steps to Complete the NYC 399Z Depreciation Property Form

Completing the NYC 399Z depreciation property form involves several key steps. First, gather all necessary financial documents related to the property, including purchase agreements, prior year tax returns, and any records of improvements made. Next, accurately fill out the form by providing details about the property, including its location, type, and the cost basis. Ensure all calculations for depreciation are correct, as errors can lead to delays or penalties. Finally, review the form for completeness and accuracy before submission, ensuring that all required signatures are included.

IRS Guidelines for Depreciation and Expensing

The IRS provides specific guidelines regarding the depreciation and expensing of property. These guidelines outline the eligibility criteria for different types of property, including residential and commercial real estate. The IRS distinguishes between Section 179 expensing and bonus depreciation, each having its own set of rules and limitations. Understanding these guidelines is crucial for property owners to maximize their tax benefits while remaining compliant with federal tax laws. It is advisable to consult the IRS publications or a tax professional for detailed information on these guidelines.

Required Documents for NYC 399Z Depreciation Property

To successfully complete the NYC 399Z depreciation property form, certain documents are required. These include proof of ownership, such as a deed or title, purchase invoices for any improvements made, and prior tax returns that reflect the property's depreciation history. Additionally, any supporting documentation that validates the cost basis of the property should be included. Having these documents organized and readily available will facilitate a smoother filing process and help avoid potential issues with the tax authorities.

Filing Deadlines for the NYC 399Z Depreciation Property

Filing deadlines for the NYC 399Z depreciation property form are critical for compliance. Generally, the form must be submitted along with your annual tax return. It is important to be aware of the specific due dates, which can vary depending on whether you file as an individual or a business entity. Missing these deadlines can result in penalties or the loss of certain tax benefits. Keeping a calendar of important tax dates and deadlines can help ensure timely submission.

Penalties for Non-Compliance with Depreciation Rules

Non-compliance with depreciation rules can lead to significant penalties for property owners. These penalties may include fines, interest on unpaid taxes, and disallowance of deductions that were improperly claimed. It is essential to understand the implications of incorrectly reporting depreciation and to maintain accurate records to support your claims. Regularly reviewing your compliance with IRS guidelines can help mitigate the risk of penalties.

Quick guide on how to complete new rules and limitations for depreciation and expensing

Easily Prepare New Rules And Limitations For Depreciation And Expensing on Any Device

Digital document management has become increasingly popular among both businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly and without hassle. Handle New Rules And Limitations For Depreciation And Expensing on any device using airSlate SignNow's Android or iOS applications and streamline any document-related workflow today.

How to Edit and Electronically Sign New Rules And Limitations For Depreciation And Expensing Effortlessly

- Locate New Rules And Limitations For Depreciation And Expensing and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize key parts of your documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for this purpose.

- Generate your signature using the Sign feature, which takes just moments and holds the same legal validity as a conventional wet ink signature.

- Verify all details and click the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, cumbersome form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and electronically sign New Rules And Limitations For Depreciation And Expensing to ensure excellent communication at each step of your form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct new rules and limitations for depreciation and expensing

Create this form in 5 minutes!

How to create an eSignature for the new rules and limitations for depreciation and expensing

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is NYC 399Z depreciation property?

NYC 399Z depreciation property refers to a specific category of property that allows owners to claim depreciation benefits under the New York City tax code. This tax incentive is aimed at encouraging property investment and development in certain sectors. Understanding this can help you maximize your tax benefits and investment returns.

-

How does airSlate SignNow assist with NYC 399Z depreciation property documentation?

airSlate SignNow streamlines the process of signing and sending documents related to NYC 399Z depreciation property. With our easy-to-use eSigning platform, you can ensure that all necessary paperwork is completed quickly and securely. This reduces delays and helps you stay organized throughout your investment process.

-

What are the pricing options for using airSlate SignNow with NYC 399Z depreciation property?

airSlate SignNow offers various pricing plans that cater to businesses dealing with NYC 399Z depreciation property. With competitive rates, you can choose a plan that best suits your document signing needs without incurring unnecessary costs. Check our pricing page for detailed options and find the perfect fit for your budget.

-

What features does airSlate SignNow provide for managing NYC 399Z depreciation property documents?

With airSlate SignNow, you gain access to features like customizable templates, in-app real-time collaboration, and automated reminders specifically designed for documents related to NYC 399Z depreciation property. These features simplify document management and enhance communication, making it easier to keep track of your investments.

-

Can I integrate airSlate SignNow with other applications for NYC 399Z depreciation property management?

Absolutely! airSlate SignNow offers seamless integrations with numerous applications popular in the real estate and finance industries. Whether you use CRM tools or accounting software, integrating these applications can streamline your workflow related to NYC 399Z depreciation property management.

-

What are the benefits of using airSlate SignNow for NYC 399Z depreciation property transactions?

Utilizing airSlate SignNow for transactions involving NYC 399Z depreciation property promotes efficiency and security. The platform ensures that all documents are signed and stored securely while providing easy access anytime. This helps simplify regulatory compliance and improves transaction speed.

-

Is airSlate SignNow compliant with NYC 399Z depreciation property regulations?

Yes, airSlate SignNow is designed to meet various legal and compliance requirements, including those related to NYC 399Z depreciation property. Our team stays updated on industry standards and regulations to ensure that your documents are legally binding and compliant with local laws.

Get more for New Rules And Limitations For Depreciation And Expensing

- Minnesota legal documents form

- Essential legal life documents for new parents minnesota form

- General power of attorney for care and custody of child or children minnesota form

- Business accounting package form

- Mn guardian 497312797 form

- Company employment policies and procedures package minnesota form

- Revocation power attorney 497312799 form

- Designated caregiver agreement statutory form minnesota

Find out other New Rules And Limitations For Depreciation And Expensing

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself