Department of Revenue Home 2022-2026

What is the Department of Revenue Home?

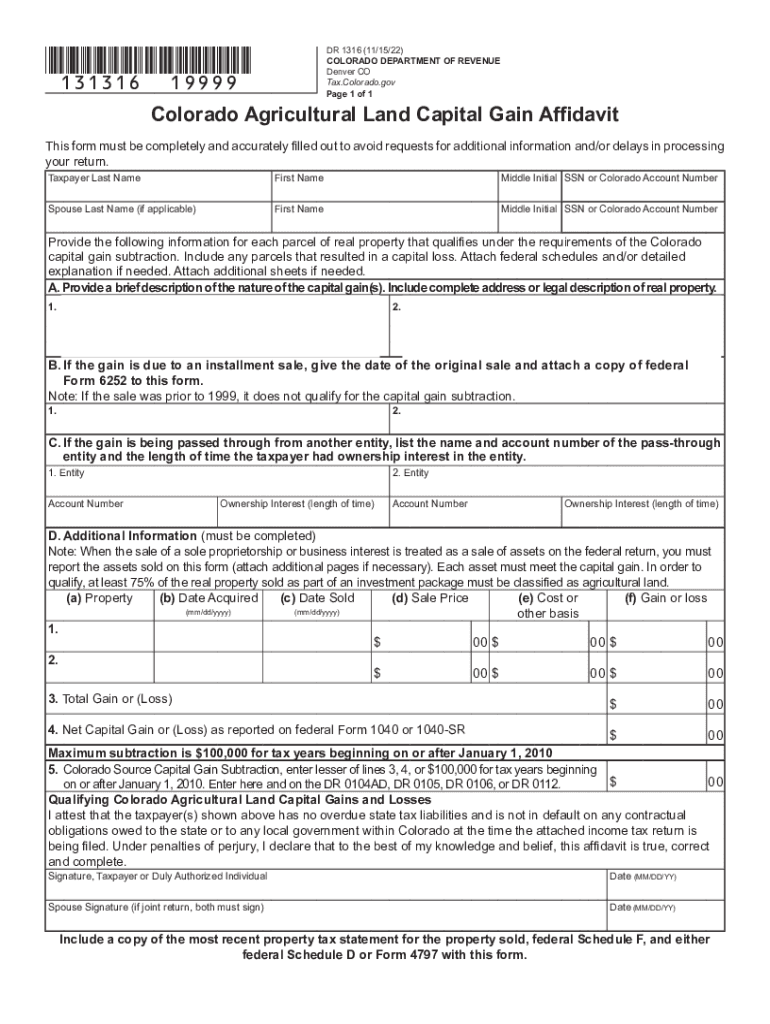

The Department of Revenue Home serves as the central hub for tax-related resources and services provided by the state. This department oversees various tax forms, including the Colorado capital gain affidavit and other essential documents. It is responsible for ensuring compliance with state tax laws and providing guidance to taxpayers on their obligations. The Department also offers online services to facilitate easier access to forms and information, making it simpler for individuals and businesses to manage their tax responsibilities.

Steps to complete the Department of Revenue Home

Completing the necessary forms through the Department of Revenue Home involves several key steps. First, identify the specific form required, such as the CO 1316 or the 2022 Colorado DR 1316. Next, gather all relevant information and documentation needed for the form. This may include financial records, identification, and any supporting documents related to capital gains. Once you have all the information, you can fill out the form electronically or print it for manual completion. Ensure that all fields are accurately filled to avoid delays in processing.

Required Documents

When preparing to submit forms related to capital gains, certain documents are typically required. These may include:

- Proof of income or financial statements

- Identification documents, such as a driver’s license or Social Security number

- Any previous tax returns related to the property or asset

- Supporting documents for deductions or credits claimed

Having these documents ready will streamline the process and help ensure compliance with state regulations.

Form Submission Methods (Online / Mail / In-Person)

The Department of Revenue Home offers multiple submission methods for tax forms. Taxpayers can choose to submit forms online through the department's website, which is often the quickest and most efficient option. Alternatively, forms can be mailed to the appropriate address provided on the form itself. For those who prefer face-to-face interaction, in-person submissions are also accepted at designated Department of Revenue offices. Each method has its own processing times, so it is advisable to choose the one that best fits your needs.

Penalties for Non-Compliance

Failure to comply with the requirements set forth by the Department of Revenue can result in various penalties. These may include fines, interest on unpaid taxes, or additional legal action. It is crucial for taxpayers to understand their obligations and ensure timely submission of forms, such as the 2021 Colorado gain affidavit, to avoid these consequences. Staying informed about deadlines and requirements can help mitigate the risk of non-compliance.

Eligibility Criteria

Eligibility criteria for submitting forms related to capital gains can vary based on individual circumstances. Generally, individuals must have realized a capital gain from the sale of property or assets within the tax year. Specific guidelines may apply depending on the type of asset sold, the duration of ownership, and any applicable exemptions. It is important to review the eligibility requirements outlined by the Department of Revenue to ensure proper compliance.

Quick guide on how to complete department of revenue home

Finish Department Of Revenue Home effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources you need to create, modify, and eSign your documents quickly without delays. Handle Department Of Revenue Home on any device using airSlate SignNow’s Android or iOS applications and streamline any document-related process today.

The easiest way to adjust and eSign Department Of Revenue Home with ease

- Locate Department Of Revenue Home and click on Get Form to begin.

- Use the tools we offer to fill out your form.

- Highlight important sections of the documents or obscure sensitive information with tools specially provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to send your form, either by email, SMS, or invitation link, or download it to your computer.

Put aside concerns about lost or misplaced documents, cumbersome form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Department Of Revenue Home and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct department of revenue home

Create this form in 5 minutes!

How to create an eSignature for the department of revenue home

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to colorado capital?

airSlate SignNow is an eSigning solution designed for businesses to easily manage document workflows. When seeking financing options in colorado capital, utilizing airSlate SignNow can streamline the signing and approval process, helping businesses secure the required funds efficiently.

-

How much does airSlate SignNow cost for businesses in colorado capital?

airSlate SignNow offers a range of pricing plans suitable for different business sizes, including those in colorado capital. By providing cost-effective solutions, businesses can choose a plan that best fits their budget while still accessing essential features needed for document management.

-

What features does airSlate SignNow offer for users in colorado capital?

airSlate SignNow includes numerous features such as customizable templates, in-person signing, and secure cloud storage. These tools are invaluable for businesses in colorado capital, ensuring that document security and efficiency are prioritized throughout the signing process.

-

Can airSlate SignNow integrate with other applications popular in colorado capital?

Yes, airSlate SignNow integrates seamlessly with various applications to enhance productivity and workflow. Businesses in colorado capital can link it with their favorite tools, making it easier to manage documents alongside existing software they use for finance, customer relationship management, and more.

-

How can airSlate SignNow benefit businesses seeking growth in colorado capital?

For businesses looking to grow in colorado capital, airSlate SignNow can accelerate transaction times and simplify contract management. This efficiency not only saves time but also fosters better client relationships, crucial for sustaining growth and gaining competitive advantage.

-

Is airSlate SignNow compliant with legal requirements in colorado capital?

Yes, airSlate SignNow complies with legal requirements governing eSignatures in colorado capital and other regions. This ensures that documents signed using the platform are legally binding, providing peace of mind for businesses engaging in contracts and agreements.

-

What types of documents can be signed using airSlate SignNow for colorado capital clients?

airSlate SignNow facilitates the signing of various document types, including contracts, NDAs, and forms critical for businesses in colorado capital. The versatility of the platform ensures that organizations can manage and automate all necessary paperwork efficiently.

Get more for Department Of Revenue Home

- Texas demand payment 497327303 form

- Special warranty deed texas form

- Texas demand payment 497327305 form

- Demand for affidavit of payment of subcontractors materialmen etc by original contractor individual texas form

- Quitclaim deed individual to individual and trust texas form

- Texas grant deed 497327308 form

- Texas appointment disposition form

- Texas waiver of form

Find out other Department Of Revenue Home

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple