Tax Colorado Gov Sites TaxColorado Source Capital Gain Affidavit DR 1316 2021

Understanding the Colorado Source Capital Gain Affidavit DR 1316

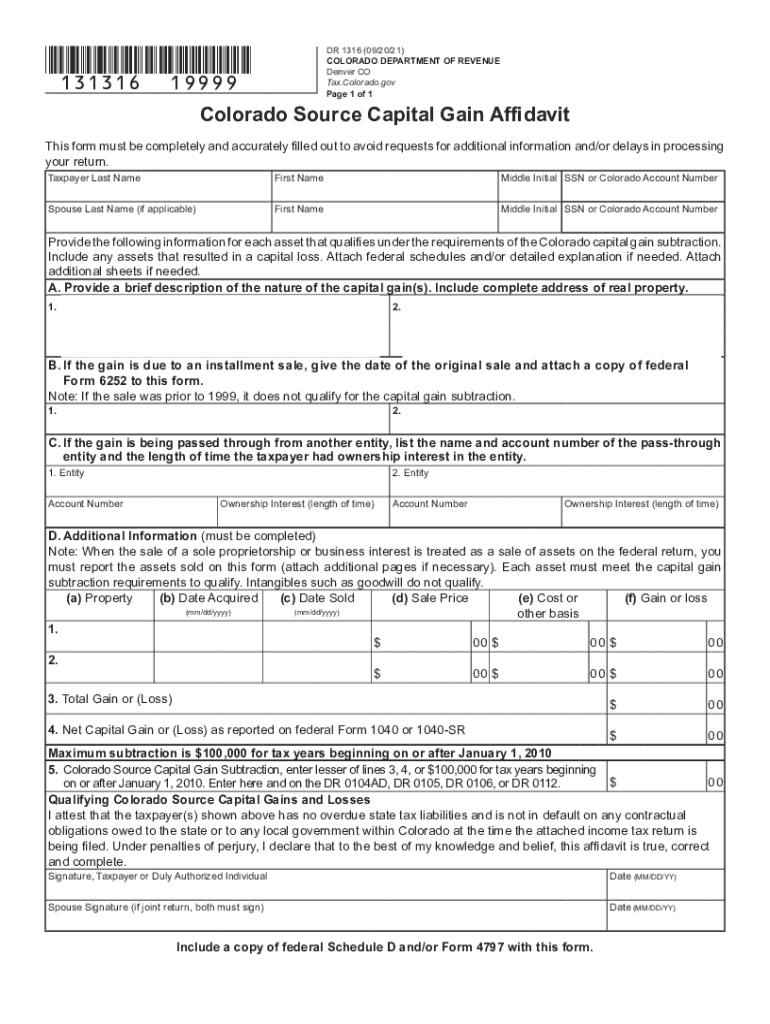

The Colorado Source Capital Gain Affidavit, commonly referred to as the DR 1316, is a crucial document for individuals and entities reporting capital gains from the sale of property in Colorado. This form is specifically designed to assist taxpayers in declaring their capital gains accurately, ensuring compliance with state tax regulations. It is essential for documenting the source of capital gains and verifying eligibility for any applicable tax benefits or exemptions.

Steps to Complete the Colorado DR 1316 Form

Completing the Colorado DR 1316 form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information regarding the property sold, including purchase and sale dates, sale price, and any adjustments to the basis. Next, fill out the form by providing detailed information about the transaction, including the nature of the capital gain. Ensure that all calculations are precise to avoid any discrepancies. Finally, review the completed form for accuracy before submission.

Legal Use of the Colorado DR 1316 Form

The Colorado DR 1316 form is legally binding when completed and submitted in accordance with state regulations. It serves as an official record of capital gains, which may be subject to taxation under Colorado law. To ensure the legal validity of the form, it must be signed by the taxpayer or an authorized representative. Additionally, the form must be submitted within the designated filing deadlines to avoid penalties.

Required Documents for the Colorado DR 1316

When filing the Colorado DR 1316, certain documents are required to substantiate the claims made on the form. These may include:

- Proof of purchase and sale agreements

- Closing statements from the sale

- Documentation of any improvements made to the property

- Records of any prior depreciation taken on the property

Having these documents ready will facilitate a smoother filing process and support the information provided on the form.

Filing Deadlines for the Colorado DR 1316

It is important to adhere to the filing deadlines associated with the Colorado DR 1316 form to avoid penalties. Typically, the form must be submitted along with the state income tax return by the due date of the return. Taxpayers should be aware of any changes to deadlines that may occur due to legislative updates or special circumstances.

Examples of Using the Colorado DR 1316 Form

The Colorado DR 1316 form is commonly used in various scenarios involving capital gains. For instance, if an individual sells a residential property and realizes a profit, they must report this gain using the DR 1316. Similarly, businesses that sell assets or properties must also utilize this form to accurately report their capital gains. Understanding these examples can help taxpayers recognize when the DR 1316 is applicable.

Quick guide on how to complete taxcoloradogov sites taxcolorado source capital gain affidavit dr 1316

Complete Tax colorado gov Sites TaxColorado Source Capital Gain Affidavit DR 1316 effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely preserve it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Tax colorado gov Sites TaxColorado Source Capital Gain Affidavit DR 1316 on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Tax colorado gov Sites TaxColorado Source Capital Gain Affidavit DR 1316 with ease

- Find Tax colorado gov Sites TaxColorado Source Capital Gain Affidavit DR 1316 and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious document searches, or errors that necessitate reprinting new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Tax colorado gov Sites TaxColorado Source Capital Gain Affidavit DR 1316 to ensure excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct taxcoloradogov sites taxcolorado source capital gain affidavit dr 1316

Create this form in 5 minutes!

How to create an eSignature for the taxcoloradogov sites taxcolorado source capital gain affidavit dr 1316

The way to make an e-signature for a PDF in the online mode

The way to make an e-signature for a PDF in Chrome

The way to create an e-signature for putting it on PDFs in Gmail

The best way to make an e-signature straight from your smart phone

The way to make an e-signature for a PDF on iOS devices

The best way to make an e-signature for a PDF document on Android OS

People also ask

-

What is Colorado 1316 in relation to airSlate SignNow?

Colorado 1316 refers to the specific features and compliance aspects of airSlate SignNow tailored for businesses in Colorado. This designation ensures that our eSignature solution meets local legislative requirements, providing peace of mind for users in the region.

-

How much does airSlate SignNow cost for Colorado 1316 users?

Pricing for Colorado 1316 users of airSlate SignNow varies based on the subscription plan chosen. We offer flexible pricing tiers that cater to different business sizes, ensuring an affordable solution for all Colorado users looking to leverage eSignatures.

-

What are the key features of airSlate SignNow for Colorado 1316?

AirSlate SignNow offers robust features for Colorado 1316, including document templates, advanced security options, and seamless integration capabilities. These features simplify the signing process, making it efficient and secure for users in Colorado.

-

What benefits does airSlate SignNow provide to Colorado 1316 customers?

For Colorado 1316 customers, airSlate SignNow enhances productivity by streamlining the signing process. Businesses can save time and reduce costs associated with paper-based documents, which is crucial for those operating within the Colorado jurisdiction.

-

Can airSlate SignNow integrate with other tools for Colorado 1316 users?

Yes, airSlate SignNow integrates seamlessly with various business tools commonly used in Colorado. This enhances user experience by allowing businesses to connect their workflows and utilize electronic signatures effectively within their existing systems.

-

Is airSlate SignNow compliant with Colorado 1316 regulations?

Absolutely, airSlate SignNow is fully compliant with Colorado 1316 regulations. Our solution adheres to local laws governing electronic signatures, which ensures that your documents are legally binding and secure.

-

What types of documents can I sign with airSlate SignNow in Colorado 1316?

In Colorado 1316, you can sign a wide range of documents using airSlate SignNow, including contracts, agreements, and forms. Our platform supports multiple document formats, making it versatile for all types of business needs.

Get more for Tax colorado gov Sites TaxColorado Source Capital Gain Affidavit DR 1316

- Residential landlord tenant rental lease forms and agreements package minnesota

- Mn issuance form

- Affidavit in support of order for publication and order for publication minnesota form

- Name change instructions and forms package for an adult minnesota

- Minnesota instructions for form

- Minnesota family 497312770 form

- Minnesota application name change form

- Minnesota criminal history check form

Find out other Tax colorado gov Sites TaxColorado Source Capital Gain Affidavit DR 1316

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free