Income 15 Colorado Capital Gain SubtractionDenver, CO 80217 0087 Request for Copy of Tax Returns See HomeDepartment of Revenue 2020

Understanding the Colorado DR 1316 Form

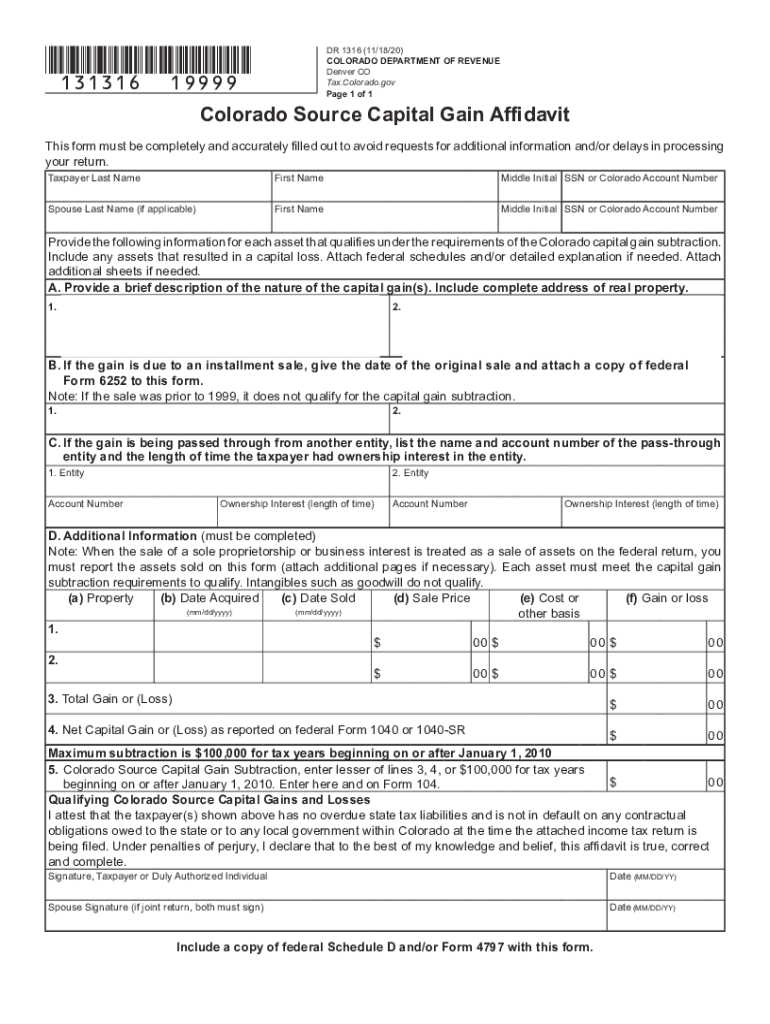

The Colorado DR 1316 form, also known as the Income 15 Colorado Capital Gain Subtraction, is a crucial document for taxpayers in Colorado who wish to claim a subtraction from their taxable income for capital gains. This form is specifically designed to help individuals and businesses reduce their tax liabilities by allowing them to subtract eligible capital gains from their income. Understanding the purpose and requirements of this form is essential for effective tax planning and compliance.

Steps to Complete the Colorado DR 1316 Form

Filling out the Colorado DR 1316 form involves several key steps to ensure accuracy and compliance with state tax regulations. First, gather all necessary documentation, including details of the capital gains you wish to report. Next, accurately fill out the form by providing your personal information, including your Social Security number and the amount of capital gain you are claiming. It is important to double-check all entries for accuracy before submission. Finally, submit the completed form along with your state tax return by the designated deadline.

Eligibility Criteria for the Colorado DR 1316 Form

To qualify for the Colorado DR 1316 form, taxpayers must meet specific eligibility criteria. This includes having realized capital gains from the sale of certain assets, such as stocks, bonds, or real estate, that are subject to Colorado state tax regulations. Additionally, the taxpayer must be a resident of Colorado and must have held the asset for the required duration to qualify for the capital gain subtraction. Understanding these criteria is essential to ensure that you can successfully claim the benefits of this form.

Legal Use of the Colorado DR 1316 Form

The Colorado DR 1316 form is legally binding and must be completed in accordance with state tax laws. It is essential to ensure that all information provided is truthful and accurate, as any discrepancies may lead to penalties or audits by the Colorado Department of Revenue. Utilizing electronic signature solutions, such as those offered by signNow, can enhance the security and legality of submitting this form, ensuring compliance with eSignature regulations.

Required Documents for the Colorado DR 1316 Form

When preparing to complete the Colorado DR 1316 form, several documents are necessary to support your claims. These may include proof of capital gains transactions, such as brokerage statements or closing documents for real estate sales. Additionally, any prior tax returns or documentation related to the assets sold may be required to substantiate your claims. Having these documents on hand will facilitate a smoother filing process and help ensure compliance with all legal requirements.

Potential Penalties for Non-Compliance

Failing to comply with the requirements associated with the Colorado DR 1316 form can result in significant penalties. Taxpayers may face fines, interest on unpaid taxes, or even audits by the Colorado Department of Revenue. It is crucial to ensure that all information is accurate and submitted on time to avoid these consequences. Understanding the implications of non-compliance can help motivate taxpayers to adhere to all filing requirements diligently.

Quick guide on how to complete income 15 colorado capital gain subtractiondenver co 80217 0087 request for copy of tax returns see homedepartment of revenue

Effortlessly Prepare Income 15 Colorado Capital Gain SubtractionDenver, CO 80217 0087 Request For Copy Of Tax Returns See HomeDepartment Of Revenue on Any Device

The management of online documents has gained traction among businesses and individuals alike. It offers an ideal environmentally-friendly substitute to traditional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow provides all the resources required to create, alter, and electronically sign your documents quickly without delays. Manage Income 15 Colorado Capital Gain SubtractionDenver, CO 80217 0087 Request For Copy Of Tax Returns See HomeDepartment Of Revenue on any device with airSlate SignNow apps for Android or iOS and streamline any document-related workflow today.

How to Edit and Electronically Sign Income 15 Colorado Capital Gain SubtractionDenver, CO 80217 0087 Request For Copy Of Tax Returns See HomeDepartment Of Revenue with Ease

- Find Income 15 Colorado Capital Gain SubtractionDenver, CO 80217 0087 Request For Copy Of Tax Returns See HomeDepartment Of Revenue and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your electronic signature with the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or corrections that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any chosen device. Modify and electronically sign Income 15 Colorado Capital Gain SubtractionDenver, CO 80217 0087 Request For Copy Of Tax Returns See HomeDepartment Of Revenue and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct income 15 colorado capital gain subtractiondenver co 80217 0087 request for copy of tax returns see homedepartment of revenue

Create this form in 5 minutes!

How to create an eSignature for the income 15 colorado capital gain subtractiondenver co 80217 0087 request for copy of tax returns see homedepartment of revenue

The best way to create an electronic signature for a PDF document in the online mode

The best way to create an electronic signature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

The best way to generate an eSignature from your mobile device

The way to create an eSignature for a PDF document on iOS devices

The best way to generate an eSignature for a PDF file on Android devices

People also ask

-

What is dr 1316 and how does it relate to airSlate SignNow?

dr 1316 is a unique identifier used to categorize and streamline specific document types within airSlate SignNow. This feature allows users to efficiently manage and track their electronically signed documents, ensuring compliance and organization.

-

What are the pricing plans available for using airSlate SignNow with dr 1316?

airSlate SignNow offers various pricing plans that cater to different business needs, all of which can effectively utilize the dr 1316 feature. Each plan provides access to essential eSigning capabilities, user-friendly interfaces, and advanced document management options at competitive prices.

-

Can I integrate dr 1316 functionality with other applications?

Absolutely! airSlate SignNow offers seamless integrations with popular applications to enhance the dr 1316 functionality. Users can connect it with tools like Salesforce, Google Drive, and Microsoft Office to streamline workflows and improve productivity.

-

What are the key benefits of using dr 1316 in airSlate SignNow?

Using dr 1316 in airSlate SignNow provides numerous benefits, including increased efficiency in document management and enhanced compliance tracking. It helps businesses streamline their operations while ensuring security and easy access to signed documents.

-

Is it easy to use dr 1316 in airSlate SignNow for beginners?

Yes, airSlate SignNow is designed for ease of use, making the dr 1316 feature accessible even to beginners. The intuitive interface allows users to navigate through eSigning and document management processes effortlessly, reducing the learning curve.

-

What types of documents can I manage using dr 1316?

With dr 1316, users can manage a wide range of documents, including contracts, agreements, and consent forms within airSlate SignNow. This flexibility ensures that all essential business documents are easily accessible and securely signed.

-

How does dr 1316 enhance document security in airSlate SignNow?

dr 1316 enhances document security by providing advanced encryption and authentication features within airSlate SignNow. This ensures that all signed documents are protected from unauthorized access and tampering, giving users peace of mind.

Get more for Income 15 Colorado Capital Gain SubtractionDenver, CO 80217 0087 Request For Copy Of Tax Returns See HomeDepartment Of Revenue

- Cms 1541b form

- Small business international travel resource travel planner form

- Head start oral health form children eclkc ohs acf hhs

- Form phs 6379 supplemental medical history record required of applicants to the public health service commissioned corps

- Hhs 26 form

- Guidance for health system contingency planning during form

- California request application staftrack form

- Office visits to dermatologists cdc form

Find out other Income 15 Colorado Capital Gain SubtractionDenver, CO 80217 0087 Request For Copy Of Tax Returns See HomeDepartment Of Revenue

- eSign Utah Plumbing Notice To Quit Secure

- eSign Alabama Real Estate Quitclaim Deed Mobile

- eSign Alabama Real Estate Affidavit Of Heirship Simple

- eSign California Real Estate Business Plan Template Free

- How Can I eSign Arkansas Real Estate Promissory Note Template

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online

- eSign Delaware Real Estate Quitclaim Deed Easy

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple

- eSign Florida Real Estate Limited Power Of Attorney Online

- eSign Hawaii Sports RFP Safe

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template