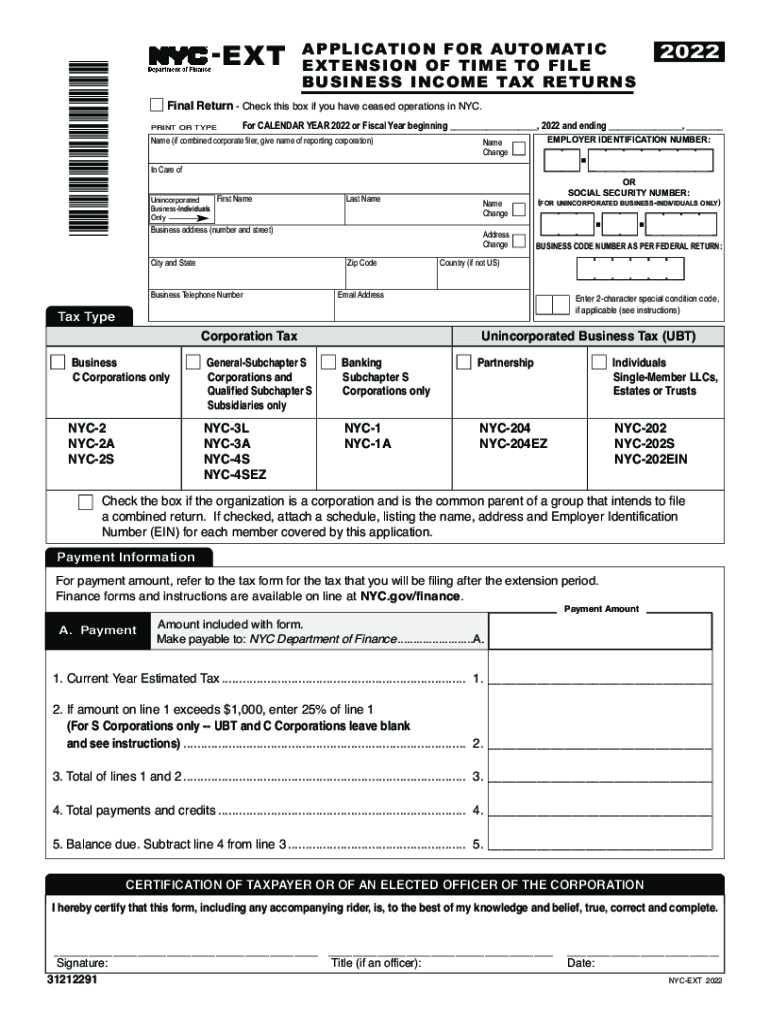

Income Tax Applications for Filing Extensions Tax NY Gov 2022

What is the Income Tax Applications For Filing Extensions Tax NY gov

The Income Tax Applications for Filing Extensions is a crucial form for taxpayers in New York who require additional time to file their income tax returns. This application allows individuals and businesses to extend their filing deadline, ensuring compliance with state tax regulations. It is particularly useful for those who may need extra time to gather necessary documentation or complete their tax returns accurately. By submitting this application, taxpayers can avoid penalties associated with late filings while still fulfilling their tax obligations.

Steps to complete the Income Tax Applications For Filing Extensions Tax NY gov

Completing the Income Tax Applications for Filing Extensions involves several straightforward steps. First, taxpayers should gather all relevant personal and financial information, including income details and deductions. Next, they need to access the application form, which can typically be found on the New York State Department of Taxation and Finance website. After filling out the required fields, including personal identification and the reason for the extension, the form can be submitted electronically or via mail. It is essential to ensure that the application is submitted before the original filing deadline to avoid any penalties.

Required Documents

When applying for an extension using the Income Tax Applications for Filing Extensions, certain documents may be necessary to support the application. Taxpayers should have their previous year’s tax return on hand, as it provides a reference for income and deductions. Additionally, any W-2 forms, 1099s, or other income statements should be collected to ensure accurate reporting. If applicable, documentation justifying the need for an extension, such as medical records or proof of travel, can also be helpful in the event of an inquiry.

Filing Deadlines / Important Dates

Understanding the filing deadlines associated with the Income Tax Applications for Filing Extensions is vital for compliance. Typically, the application must be submitted by the original due date of the tax return, which is usually April fifteenth for individual taxpayers. If the application is approved, the extension grants an additional six months to file the return, pushing the deadline to October fifteenth. It is important to note that while the extension allows more time to file, any taxes owed must still be paid by the original deadline to avoid interest and penalties.

IRS Guidelines

The IRS provides specific guidelines regarding the use of extensions for filing income tax returns. Taxpayers should be aware that while an extension allows for additional time to file, it does not extend the time to pay any taxes owed. Therefore, it is crucial to estimate the tax liability accurately and remit any payments by the original due date. Additionally, the IRS requires that taxpayers file their returns by the extended deadline to maintain compliance and avoid penalties.

Eligibility Criteria

Eligibility for the Income Tax Applications for Filing Extensions generally includes any individual or business that needs more time to file their income tax return. This includes self-employed individuals, small business owners, and those with complex financial situations. However, it is important to note that not all taxpayers may qualify for an extension based on their specific circumstances, such as those who have outstanding tax obligations from previous years. Understanding the eligibility criteria ensures that taxpayers can effectively navigate the extension process.

Quick guide on how to complete income tax applications for filing extensions taxnygov

Complete Income Tax Applications For Filing Extensions Tax NY gov effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to find the correct form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents promptly without any delays. Manage Income Tax Applications For Filing Extensions Tax NY gov on any device using airSlate SignNow's Android or iOS applications and streamline any document-centric process today.

The easiest way to alter and eSign Income Tax Applications For Filing Extensions Tax NY gov without hassle

- Find Income Tax Applications For Filing Extensions Tax NY gov and click on Get Form to begin.

- Make use of the available tools to complete your form.

- Emphasize pertinent sections of the documents or obscure confidential information with tools that airSlate SignNow offers specifically for that use.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a standard wet signature.

- Review the information and click the Done button to finalize your changes.

- Select how you'd like to share your form, through email, SMS, or invitation link, or save it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require reprinting new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and eSign Income Tax Applications For Filing Extensions Tax NY gov and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct income tax applications for filing extensions taxnygov

Create this form in 5 minutes!

How to create an eSignature for the income tax applications for filing extensions taxnygov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to nyc ext 2023?

airSlate SignNow is a powerful solution that empowers businesses in 2023, including those in NYC, to send and eSign documents easily. With features designed to streamline the signing process, airSlate SignNow ensures that your workflows are efficient and secure, making it an ideal choice for companies looking to modernize their approach this year.

-

What pricing plans does airSlate SignNow offer for 2023?

For 2023, airSlate SignNow provides flexible pricing plans to fit the needs of any business size in NYC and beyond. Our plans include essential features that promote efficient document management, allowing you to choose a package that aligns with your budget and requirements for this year.

-

What are the key features of airSlate SignNow for nyc ext 2023?

The key features of airSlate SignNow include robust eSignature capabilities, document templates, and a seamless user interface. These features enhance productivity for businesses in NYC and across the globe in 2023, allowing teams to collaborate and finalize documents faster than ever.

-

How can airSlate SignNow benefit my business in NYC in 2023?

In 2023, airSlate SignNow offers numerous benefits to businesses in NYC, such as reducing turnaround time for documents and mitigating delays. This empowers your team to focus on core activities rather than chasing signatures, ultimately improving overall operational efficiency.

-

Does airSlate SignNow integrate with other applications in 2023?

Yes, airSlate SignNow in 2023 integrates seamlessly with numerous applications like Google Drive, Dropbox, and CRM systems. This integration capability allows you to streamline your document workflows and manage all your files from one convenient location, enhancing productivity.

-

Is airSlate SignNow secure for sensitive documents in nyc ext 2023?

Absolutely! airSlate SignNow prioritizes security and utilizes top-tier encryption methods to protect sensitive documents in 2023. Compliance with industry standards ensures that your data remains safe and secure, particularly important for businesses operating in NYC.

-

How easy is it to use airSlate SignNow for new users in 2023?

New users can quickly adapt to airSlate SignNow in 2023 due to its intuitive interface and user-friendly design. With comprehensive tutorials and support available, businesses in NYC can start sending and eSigning documents without a steep learning curve.

Get more for Income Tax Applications For Filing Extensions Tax NY gov

- Notice of breach of written lease for violating specific provisions of lease with no right to cure for residential property 497327601 form

- Tx provisions form

- Tx application form

- Motion to dismiss traffic ticket form

- Individual credit application texas form

- Interrogatories to plaintiff for motor vehicle occurrence texas form

- Tx accident 497327612 form

- Llc notices resolutions and other operations forms package texas

Find out other Income Tax Applications For Filing Extensions Tax NY gov

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer