Close or End a Business Tax NY Gov 2023

What is the Close Or End A Business Tax NY gov

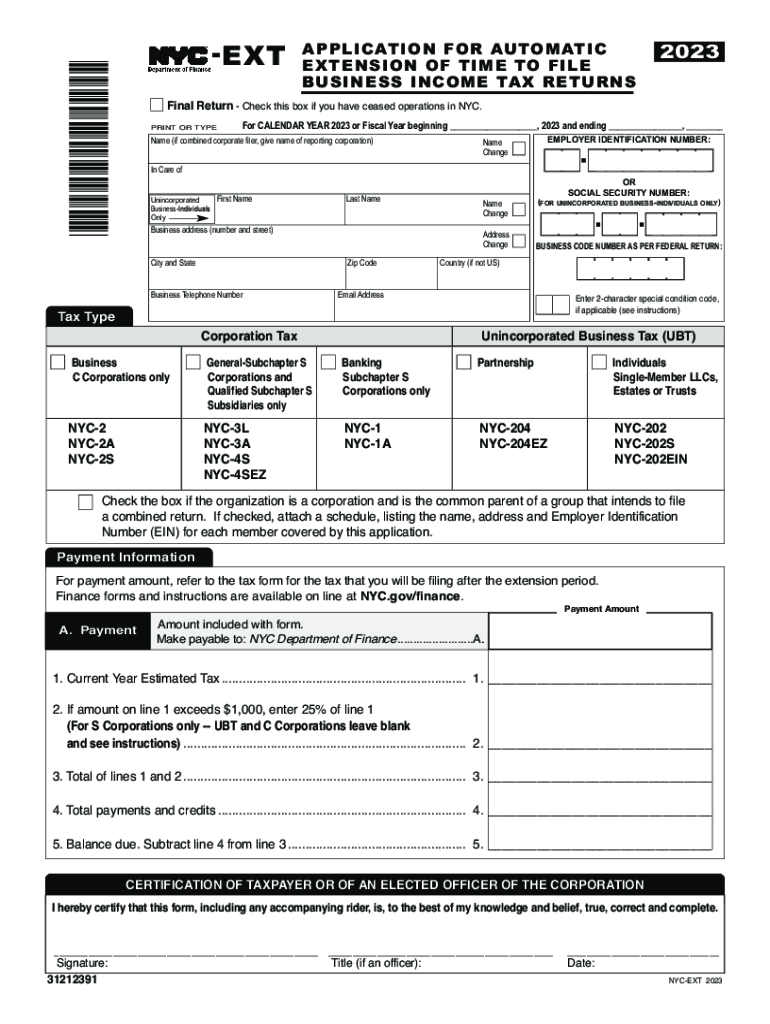

The Close Or End A Business Tax form is a crucial document for businesses in New York that are ceasing operations. This form notifies the New York State Department of Taxation and Finance of your intention to close your business and ensures that all tax obligations are settled. It is essential for compliance with state regulations and helps prevent any future tax liabilities or penalties. The form captures information about the business structure, such as whether it is a corporation, partnership, or sole proprietorship, and details regarding the final tax return.

Steps to complete the Close Or End A Business Tax NY gov

Completing the Close Or End A Business Tax form involves several important steps:

- Gather necessary information, including your business identification number and details regarding your business structure.

- Complete the form accurately, ensuring that all sections are filled out, including the final tax return information.

- Review the form for any errors or omissions to avoid delays in processing.

- Submit the form to the New York State Department of Taxation and Finance through the appropriate method, either online or by mail.

Required Documents

When preparing to submit the Close Or End A Business Tax form, certain documents are necessary:

- Your business identification number.

- Final tax returns for the relevant tax year.

- Any supporting documents that verify the closure of the business, such as dissolution papers if applicable.

- Records of any outstanding taxes or liabilities that need to be settled before closure.

Filing Deadlines / Important Dates

It is vital to be aware of the filing deadlines associated with the Close Or End A Business Tax form. Typically, the form should be submitted by the end of the tax year in which the business ceases operations. Failure to meet this deadline may result in penalties or additional tax liabilities. Keeping track of important dates, such as the final day for submitting the final tax return, is essential for compliance.

Form Submission Methods

The Close Or End A Business Tax form can be submitted through various methods:

- Online: Use the New York State Department of Taxation and Finance's online services for a quicker submission process.

- By Mail: Complete the form and send it to the designated address provided on the form.

- In-Person: You may also visit a local office of the Department of Taxation and Finance to submit the form directly.

Penalties for Non-Compliance

Failing to file the Close Or End A Business Tax form can result in significant penalties. Businesses may face fines, interest on unpaid taxes, and potential legal action from the state. It is important to ensure that all tax obligations are met and that the form is submitted in a timely manner to avoid these consequences. Understanding the implications of non-compliance can help business owners make informed decisions during the closure process.

Create this form in 5 minutes or less

Find and fill out the correct close or end a business tax ny gov

Create this form in 5 minutes!

How to create an eSignature for the close or end a business tax ny gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What steps do I need to take to Close Or End A Business Tax NY gov?

To Close Or End A Business Tax NY gov, you must first file the appropriate dissolution documents with the New York Department of State. Additionally, ensure that all tax obligations are settled and any final tax returns are submitted. It's advisable to consult with a tax professional to ensure compliance with all regulations.

-

How can airSlate SignNow help with the process of closing my business?

airSlate SignNow provides a streamlined solution for sending and eSigning necessary documents required to Close Or End A Business Tax NY gov. With our user-friendly platform, you can easily manage all paperwork digitally, ensuring a hassle-free experience. This saves time and reduces the risk of errors in your documentation.

-

What are the costs associated with using airSlate SignNow for business closure?

airSlate SignNow offers competitive pricing plans that cater to various business needs, making it a cost-effective solution for those looking to Close Or End A Business Tax NY gov. You can choose from monthly or annual subscriptions, with options that include unlimited eSigning and document management features. This flexibility allows you to select a plan that fits your budget.

-

Are there any features that specifically assist with business dissolution?

Yes, airSlate SignNow includes features that are particularly beneficial for business dissolution, such as customizable templates for dissolution documents and automated reminders for filing deadlines. These tools help ensure that you have all necessary paperwork ready when you need to Close Or End A Business Tax NY gov. This minimizes the risk of missing important steps in the process.

-

Can I integrate airSlate SignNow with other software for my business closure?

Absolutely! airSlate SignNow offers integrations with various software solutions, including accounting and project management tools. This allows you to streamline your workflow and manage all aspects of your business closure efficiently, making it easier to Close Or End A Business Tax NY gov without any hassle.

-

What benefits does airSlate SignNow provide for businesses in New York?

Using airSlate SignNow provides numerous benefits for businesses in New York, especially when looking to Close Or End A Business Tax NY gov. Our platform enhances efficiency by allowing you to manage documents electronically, reducing the time spent on paperwork. Additionally, our secure eSigning feature ensures that your documents are legally binding and compliant with state regulations.

-

Is airSlate SignNow secure for handling sensitive business documents?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling sensitive documents related to your business closure. We utilize advanced encryption and security protocols to protect your data, ensuring that your information remains confidential while you Close Or End A Business Tax NY gov. Trust in our platform to keep your documents secure.

Get more for Close Or End A Business Tax NY gov

Find out other Close Or End A Business Tax NY gov

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT