NYC EXT 2024-2026

What is the NYC EXT

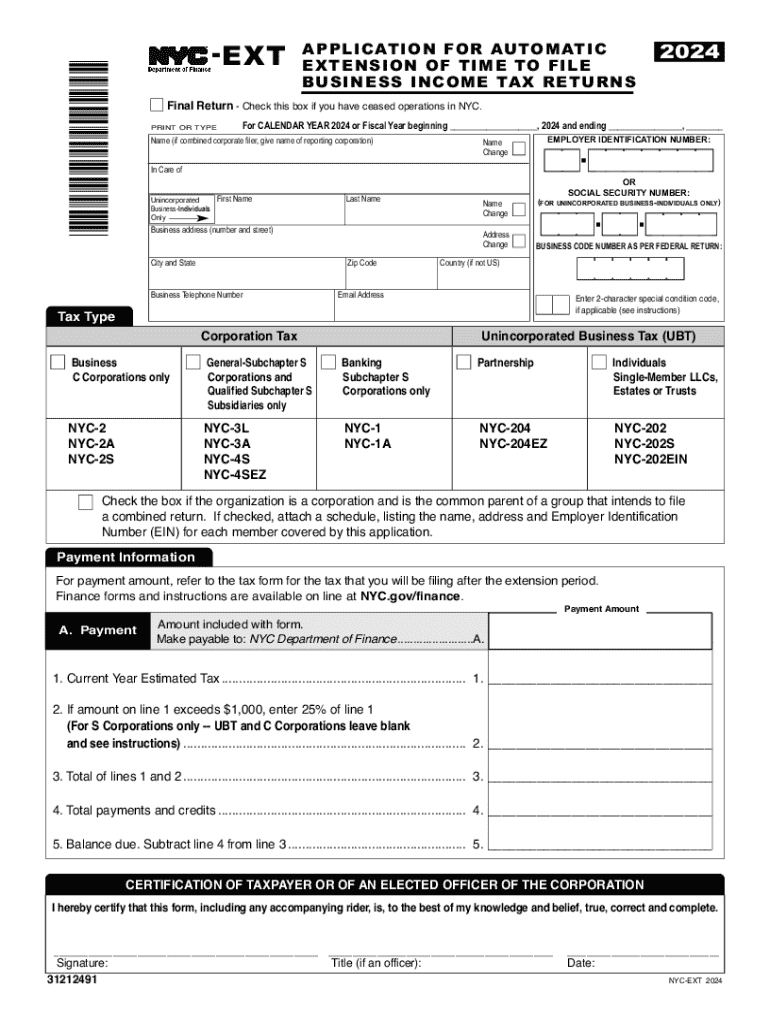

The NYC EXT, or New York City Extension, is a form used by taxpayers to request an extension for filing their income tax returns in New York City. This form allows individuals and businesses additional time to prepare their tax documents without incurring penalties for late filing. The extension typically provides an extra six months to submit the required tax return, ensuring that taxpayers have ample time to gather necessary information and complete their filings accurately.

How to use the NYC EXT

To use the NYC EXT, taxpayers must fill out the form accurately, providing essential information such as their name, address, and taxpayer identification number. Once completed, the form should be submitted to the appropriate tax authority, either electronically or via mail, depending on the taxpayer's preference. It is important to remember that while the NYC EXT grants an extension for filing, it does not extend the deadline for paying any taxes owed. Taxpayers should estimate their tax liability and pay any amount due by the original filing deadline to avoid penalties and interest.

Steps to complete the NYC EXT

Completing the NYC EXT involves several straightforward steps:

- Obtain the NYC EXT form from the official tax authority website or through authorized channels.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Estimate your tax liability for the year and include this information on the form.

- Sign and date the form to certify that the information provided is accurate.

- Submit the completed form either electronically or by mailing it to the designated tax office.

Filing Deadlines / Important Dates

Taxpayers should be aware of key deadlines associated with the NYC EXT. The original deadline for filing income tax returns typically falls on April fifteenth. If a taxpayer wishes to request an extension, the NYC EXT must be filed by this date. The extended deadline for submitting the tax return is generally six months later, allowing taxpayers until October fifteenth to file their returns. It is crucial to adhere to these deadlines to avoid penalties and maintain compliance with tax regulations.

Required Documents

When completing the NYC EXT, certain documents may be necessary to ensure accurate reporting and compliance. These documents can include:

- Previous year’s tax return for reference.

- Income statements, such as W-2s or 1099s.

- Records of any deductions or credits that may apply.

- Documentation of estimated tax payments made during the year.

Having these documents on hand can facilitate the completion of the form and help in estimating any taxes owed.

Penalties for Non-Compliance

Failing to file the NYC EXT by the deadline can result in penalties. Taxpayers may incur a late filing penalty, which is typically calculated as a percentage of the unpaid tax amount for each month the return is late. Additionally, interest may accrue on any unpaid taxes. It is essential for taxpayers to understand these consequences and ensure timely submission of the extension request to avoid unnecessary financial burdens.

Create this form in 5 minutes or less

Find and fill out the correct nyc ext

Create this form in 5 minutes!

How to create an eSignature for the nyc ext

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is NYC EXT and how does it benefit my business?

NYC EXT is an innovative feature of airSlate SignNow that streamlines the document signing process for businesses in New York City. It allows users to send and eSign documents quickly and securely, enhancing productivity and reducing turnaround times. By utilizing NYC EXT, businesses can improve their workflow and ensure compliance with local regulations.

-

How much does airSlate SignNow with NYC EXT cost?

The pricing for airSlate SignNow with NYC EXT is competitive and designed to fit various business budgets. We offer flexible subscription plans that cater to different needs, ensuring you only pay for what you use. For detailed pricing information, visit our website or contact our sales team.

-

What features are included in the NYC EXT package?

The NYC EXT package includes a range of features such as customizable templates, real-time tracking, and advanced security options. Additionally, users can integrate with popular applications to enhance their document management processes. These features make NYC EXT a comprehensive solution for businesses looking to optimize their eSigning experience.

-

Can I integrate NYC EXT with other software tools?

Yes, NYC EXT seamlessly integrates with various software tools, including CRM systems, cloud storage services, and productivity applications. This integration capability allows businesses to streamline their workflows and enhance collaboration. By using NYC EXT, you can connect your existing tools for a more efficient document management process.

-

Is NYC EXT suitable for small businesses?

Absolutely! NYC EXT is designed to cater to businesses of all sizes, including small enterprises. Its user-friendly interface and cost-effective pricing make it an ideal choice for small businesses looking to improve their document signing processes without breaking the bank.

-

How secure is the NYC EXT eSigning process?

The NYC EXT eSigning process is highly secure, utilizing advanced encryption and authentication methods to protect your documents. airSlate SignNow complies with industry standards and regulations to ensure that your sensitive information remains confidential. With NYC EXT, you can trust that your documents are safe throughout the signing process.

-

What are the benefits of using NYC EXT for document management?

Using NYC EXT for document management offers numerous benefits, including increased efficiency, reduced paper usage, and improved compliance. By digitizing your signing process, you can save time and resources while ensuring that your documents are easily accessible. NYC EXT empowers businesses to focus on what matters most—growing their operations.

Get more for NYC EXT

Find out other NYC EXT

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word